Texas Service Sector Activity Stabilizes

Texas Service Sector Outlook Survey

September 1, 2020

Texas Service Sector Activity Stabilizes

What’s New This Month

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of COVID-19. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

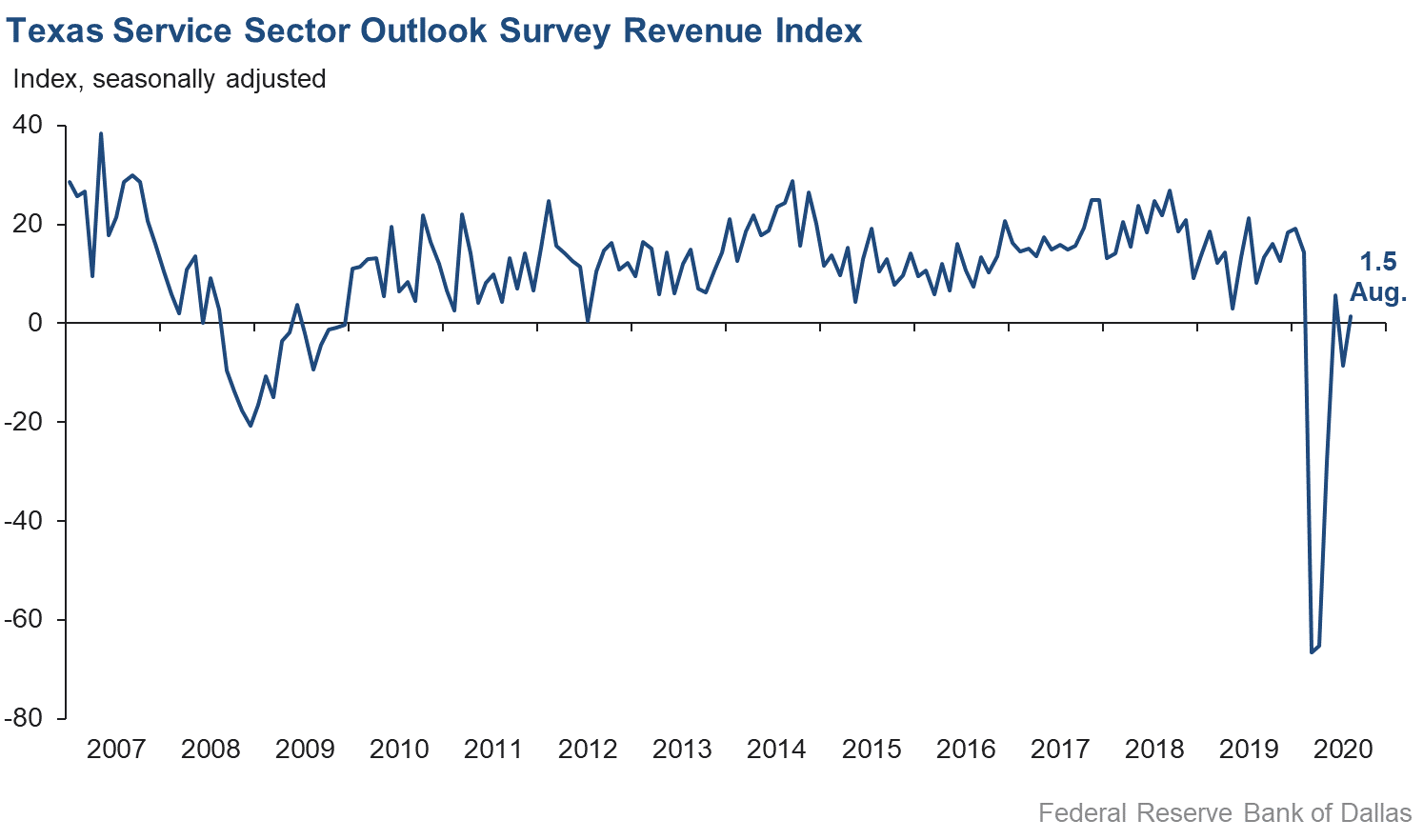

Activity in the Texas service sector held mostly steady in August after declining in July, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, rose from -8.5 in July to 1.5 in August.

Labor market indicators reflected a stabilization of employment and workweek length in August. The employment index rose six-and-a-half points to -0.3—its highest level since February and a level suggesting no net change in jobs compared with July, while the hours worked index rose nearly three points to -1.0.

Perceptions of broader business conditions rose back into positive territory in August. The general business activity index rebounded over 31 points to 4.7, while the company outlook index advanced from -15.8 to 5.6. Nearly one-quarter of respondents noted an improved outlook, compared with 17 percent noting a worsened outlook. The outlook uncertainty index also declined to 5.7, its lowest reading since February.

Wages picked up in August, while price pressures increased. The wages and benefits index rose from 0.4 to 4.9, while the selling prices index added 10 points, rising to 4.4. The input prices index picked up from 17.8 to 22.2, its highest value since February.

Respondents’ expectations regarding future business activity improved markedly in August. The future general business activity index rose over 28 points to 19.2, its highest level since late 2018, with 37 percent of respondents expecting improved activity over the next six months. The future revenue index surged over 17 points, increasing to 35.5. Other indexes of future service sector activity such as employment also rose to values last seen prior to the COVID-19 outbreak; this suggests expectations of more rapid improvement in economic activity over the next six months.

Texas Retail Outlook Survey

September 1, 2020

Texas Retail Sales Continue to Decline but at Notably Slower Pace

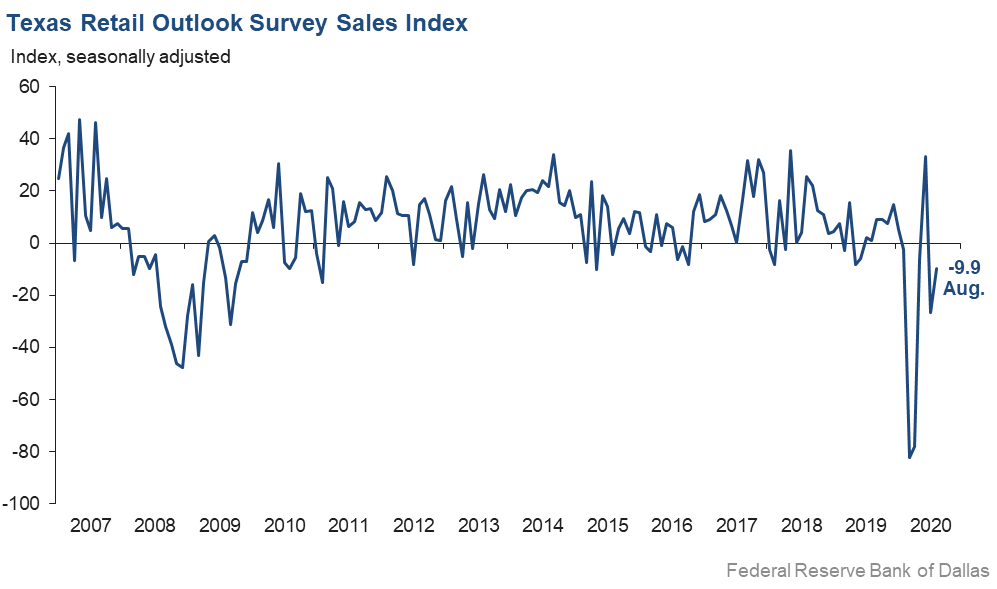

Retail sales activity declined in August, though at a much slower pace than July’s plunge, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, rose from -26.7 to -9.9. Over 35 percent of respondents reported decreased sales compared with July, while 25 percent reported increases. The decline in inventories also eased markedly, with the inventories index increasing nearly 13 points but remaining negative at -8.7.

Retail labor market indicators were mixed in August, with employment flattening out but the average workweek length shortening. The employment index added over 12 points, returning to positive territory at 1.4. The hours worked index fell from -7.8 to -13.9, with only 1 percent of respondents noting increases in workweek length.

Retailers’ perceptions of broader business conditions returned to positive territory in August. The general business activity index rose nearly 28 points to 4.2, while the company outlook index picked up from -6.8 in July to 9.6 in August. The outlook uncertainty index fell from 13.7 to 7.2.

Retail wages flattened out in August, while price pressures rose. The wages and benefits index rose from -5.3 to 0.9, a level suggesting little change in net wages compared with July. The selling prices index surged over 12 points to 14.3, while the input prices index dipped one point to 16.0.

Retailers’ perceptions of future activity reflected increased optimism in August compared with July. The future general business activity index advanced over 31 points to 28.1, while the future sales index inched up from 32.3 to 34.9. Other indexes of future retail activity such as employment increased significantly, suggesting overall expectations of more robust future activity.

The Texas Retail Outlook Survey is a component of the Texas Service Sector Outlook Survey that uses information only from respondents in the retail and wholesale sectors.

Next release: September 29, 2020

|

Data were collected August 18–26, and 242 Texas service sector and 57 retail sector business executives responded to the survey. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary. |

Texas Service Sector Outlook Survey

September 1, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 1.5 | –8.5 | +10.0 | 10.8 | 1(+) | 29.6 | 42.2 | 28.1 |

Employment | –0.3 | –6.8 | +6.5 | 6.0 | 6(–) | 13.3 | 73.0 | 13.6 |

Part–Time Employment | 0.1 | –11.5 | +11.6 | 1.2 | 1(+) | 9.0 | 82.1 | 8.9 |

Hours Worked | –1.0 | –3.7 | +2.7 | 2.2 | 6(–) | 9.8 | 79.4 | 10.8 |

Wages and Benefits | 4.9 | 0.4 | +4.5 | 13.9 | 3(+) | 14.2 | 76.5 | 9.3 |

Input Prices | 22.2 | 17.8 | +4.4 | 24.9 | 4(+) | 27.3 | 67.6 | 5.1 |

Selling Prices | 4.4 | –5.9 | +10.3 | 5.0 | 1(+) | 14.9 | 74.6 | 10.5 |

Capital Expenditures | –0.5 | –7.9 | +7.4 | 9.7 | 6(–) | 14.5 | 70.4 | 15.0 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 5.6 | –15.8 | +21.4 | 4.8 | 1(+) | 22.3 | 60.9 | 16.7 |

General Business Activity | 4.7 | –26.7 | +31.4 | 2.5 | 1(+) | 24.9 | 54.9 | 20.2 |

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 5.7 | 29.4 | –23.7 | 13.6 | 31(+) | 20.9 | 63.9 | 15.2 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 35.5 | 17.9 | +17.6 | 36.7 | 4(+) | 52.9 | 29.7 | 17.4 |

Employment | 21.9 | 5.1 | +16.8 | 21.5 | 4(+) | 33.6 | 54.7 | 11.7 |

Part–Time Employment | 1.8 | 0.0 | +1.8 | 6.3 | 1(+) | 13.5 | 74.8 | 11.7 |

Hours Worked | 7.2 | 7.6 | –0.4 | 5.3 | 4(+) | 15.2 | 76.8 | 8.0 |

Wages and Benefits | 23.8 | 19.1 | +4.7 | 35.7 | 4(+) | 31.6 | 60.6 | 7.8 |

Input Prices | 32.0 | 27.8 | +4.2 | 43.5 | 164(+) | 39.0 | 54.0 | 7.0 |

Selling Prices | 13.8 | 5.9 | +7.9 | 22.7 | 4(+) | 26.0 | 61.8 | 12.2 |

Capital Expenditures | 17.3 | 1.8 | +15.5 | 23.1 | 3(+) | 29.6 | 58.1 | 12.3 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 21.9 | –3.1 | +25.0 | 15.9 | 1(+) | 37.5 | 46.9 | 15.6 |

General Business Activity | 19.2 | –9.2 | +28.4 | 12.6 | 1(+) | 36.9 | 45.4 | 17.7 |

Texas Retail Outlook Survey

September 1, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | –9.9 | –26.7 | +16.8 | 5.6 | 2(–) | 25.5 | 39.0 | 35.4 |

Employment | 1.4 | –10.7 | +12.1 | 1.7 | 1(+) | 9.6 | 82.2 | 8.2 |

Part–Time Employment | –1.9 | –15.4 | +13.5 | –2.2 | 6(–) | 9.4 | 79.2 | 11.3 |

Hours Worked | –13.9 | –7.8 | –6.1 | –2.1 | 7(–) | 1.2 | 83.7 | 15.1 |

Wages and Benefits | 0.9 | –5.3 | +6.2 | 9.1 | 1(+) | 11.8 | 77.3 | 10.9 |

Input Prices | 16.0 | 17.1 | –1.1 | 18.6 | 4(+) | 24.6 | 66.8 | 8.6 |

Selling Prices | 14.3 | 2.0 | +12.3 | 9.9 | 3(+) | 26.8 | 60.7 | 12.5 |

Capital Expenditures | –2.8 | –6.2 | +3.4 | 7.6 | 6(–) | 11.2 | 74.8 | 14.0 |

Inventories | –8.7 | –21.3 | +12.6 | 2.5 | 7(–) | 24.3 | 42.7 | 33.0 |

Companywide Retail Activity | ||||||||

Companywide Sales | –4.5 | –21.7 | +17.2 | 7.0 | 2(–) | 30.5 | 34.6 | 35.0 |

Companywide Internet Sales | 0.4 | –10.5 | +10.9 | 6.2 | 1(+) | 21.7 | 57.0 | 21.3 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 9.6 | –6.8 | +16.4 | 3.2 | 1(+) | 24.6 | 60.4 | 15.0 |

General Business Activity | 4.2 | –23.7 | +27.9 | –1.1 | 1(+) | 26.1 | 52.0 | 21.9 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 7.2 | 13.7 | –6.5 | 10.9 | 2(+) | 17.9 | 71.4 | 10.7 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | 34.9 | 32.3 | +2.6 | 31.9 | 4(+) | 48.8 | 37.3 | 13.9 |

Employment | 19.5 | 2.3 | +17.2 | 11.7 | 4(+) | 27.2 | 65.1 | 7.7 |

Part–Time Employment | –0.4 | –8.0 | +7.6 | 0.5 | 2(–) | 11.4 | 76.8 | 11.8 |

Hours Worked | 1.9 | 5.0 | –3.1 | 2.6 | 4(+) | 9.3 | 83.3 | 7.4 |

Wages and Benefits | 18.3 | 21.1 | –2.8 | 26.8 | 4(+) | 24.5 | 69.3 | 6.2 |

Input Prices | 20.7 | 27.4 | –6.7 | 32.4 | 4(+) | 35.8 | 49.1 | 15.1 |

Selling Prices | 21.2 | 19.6 | +1.6 | 28.5 | 4(+) | 38.5 | 44.2 | 17.3 |

Capital Expenditures | 13.4 | 2.0 | +11.4 | 16.8 | 3(+) | 28.8 | 55.8 | 15.4 |

Inventories | 26.3 | 11.1 | +15.2 | 8.1 | 4(+) | 41.4 | 43.6 | 15.1 |

Companywide Retail Activity | ||||||||

Companywide Sales | 38.9 | 23.7 | +15.2 | 30.4 | 4(+) | 51.3 | 36.3 | 12.4 |

Companywide Internet Sales | 25.0 | 7.5 | +17.5 | 21.7 | 5(+) | 35.0 | 55.0 | 10.0 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 28.6 | 5.2 | +23.4 | 16.6 | 4(+) | 39.6 | 49.4 | 11.0 |

General Business Activity | 28.1 | –3.4 | +31.5 | 12.3 | 1(+) | 39.6 | 48.8 | 11.5 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

†Added to survey in January 2018.

Data have been seasonally adjusted as necessary, with the exception of the outlook uncertainty index which does not yet have a sufficiently long time series to test for seasonality.

Texas Service Sector Outlook Survey

September 1, 2020

Texas Retail Outlook Survey

September 1, 2020

Texas Service Sector Outlook Survey

September 1, 2020

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Support Activities for Mining

- With the pandemic and the drop in oil prices, uncertainty remains. The longer that the recovery takes, the greater the uncertainty in when and how fast it will recover.

Utilities

- No change; consumers are reluctant to part with their dollars, and bad debt is increasing.

Truck Transportation

- Unemployment pay must decrease so people will go back to work.

Pipeline Transportation

- COVID-19’s global demand destruction and the resulting impact on producers’ and refiners’ run rates/production still have the largest impact on our future.

Support Activities for Transportation

- Hurricane Hanna wiped out all the South Texas cotton crop. We lost $3 million in sales.

- As the unemployment benefits ramp down, we will find people more willing to re-enter the work force.

Warehousing and Storage

- We're cautiously optimistic as we set a new record for crude oil exports in July, and we expect crude to underpin our recovery. Our large LNG [liquefied natural gas] customer also gave guidance that they expect cargo cancellations to end in a matter of months, not quarters, which will help. We still remain at depressed levels for transportation fuel movements, however, so we are keeping a close eye on that. [Our] capital spending program remains curtailed at the moment, but we should begin spending money by the beginning of 2021. We expect to possibly accept head count attrition without replacement in the short term, however, so we may see the overall head count decrease.

Publishing Industries (Except Internet)

- General potentials continue to increase modestly for the next year.

Data Processing, Hosting and Related Services

- Business activity has definitely increased over the past two months—many more sales prospects, although some new deals have been delayed due to prospects' organizations being hit with the virus. Companies are asking for more digital self-serve options and collaborative digital solutions. There is a bit of fear and uncertainty in decisions due to the political climate, the unknown of how long the pandemic will impact the economy and social unrest in parts of the country. Hiring of skilled technical folks continues to be a challenge despite more availability in the marketplace. The quality locally is requiring much longer searches and loosening of education standards for some positions. Working remotely seems to be wearing thin with many employees, while others prefer it. Overall productivity has not decreased; however, team creativity and innovation are more challenging for sure.

Credit Intermediation and Related Activities

- We expect only slight changes, positive or negative, in business activity until the election. We still expect 2021 to be a tough year for many businesses, and the trickle-down effect could be challenging.

- The impacts of COVID-19 combined with the political unrest have created a greater sense of uncertainty. The competition for business relationships has accelerated, resulting in reducing margins due to lower pricing quotes. The short-term and long-range revenue projections are under pressure and will likely be impacted and will have to be offset by increased volume of loan production. The dry weather conditions are affecting anticipated agricultural production, which could result in lower market prices for livestock due to increases in liquidation and increased prices for other commodities due to reduced production of agriculture crops. Sales tax revenue is still ahead of last year to date due to construction projects in the area that are anticipated to slow down over the next several months as completion occurs.

- With school starting and athletic events occurring, we believe there will be another COVID-19 spike, which will set back any economic gains we have made.

- Our new collision business has opened successfully. We are hopeful about getting some of the capital that we need to complete our second location and get it up and running.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Recruiting continues to be a significant concern for us. We cannot find enough qualified employees. Customers are still hesitant to have meetings (online or in person) regarding changing service providers. This is causing a lag in sales activity. The paralyzing impact of COVID-19 can still be felt in consumers’ behavior.

- As a financial services company, we are both tied to investment markets and impacted by economic, fiscal and monetary changes.

Insurance Carriers and Related Activities

- Our "input prices" are insurance costs since we are brokers; our sales prices reflect the price quote we get from our insurance carriers. Mainly property rates, D&O [director and officer] and cyber liability rates are increasing. We are seeing some "net costs" drop from some clients as their business activity has slowed. Our hospitality clients like bars and restaurants have seen reduced sales, which may reflect in reduced insurance costs at audit time.

Real Estate

- We are very concerned about the overall health of the Houston economy for the balance of the year and early 2021. We believe uncertainty will continue until there is a broadly available COVID-19 solution.

- The elections I believe will start to weigh on everyone. While we [see] some increased activity, we are still seeing a lot of fear-driven resistance to people going out shopping or going to restaurants. I am also grateful that our state is allowing most businesses to open and operate. I do fear that given consumer confidence levels and any potential for Joe Biden to win in November, [these] will dampen economic activity.

- The election will make a difference on how people feel. If Biden is elected, buyers will stop spending to wait and see what his policies are.

- There is a general decline in the value of some commercial real estate assets, but the bid-ask has not compressed enough to generate more transactions. Lenders will need to start to move from forbearance to taking properties away from insolvent owners and moving properties to value-add and discount buyers.

Rental and Leasing Services

- How can anyone's outlook be the same or better with a virus that we do not understand, a self-induced economic catastrophe with absolutely no end in sight, and the most anti-business party ever about to win the White House and Congress? I don't know how you paint a more bleak future, and yet I am still positive we will survive.

Professional, Scientific and Technical Services

- It is very hard to say if uncertainty has changed when it’s pretty dismal business at the moment. I don’t see it increasing and I don’t see it decreasing. Obviously, the election will have a significant effect on my view of uncertainty. If Trump wins, it will decidedly increase. If Biden wins, I think uncertainty will decrease because he will put forth a clear direction for the country that involves everybody rather than just a rich few that think they’re above the law.

- Client demand remains stronger than expected after the pandemic first hit. Practice leaders are projecting a robust fourth quarter.

- The extended period of isolation is definitely hurting the office market. People are hesitant to leave their homes. Herd immunity is a ways off and, in general, it is hurting the economy, our business and the recovery. As a country, we must get moving.

- We set records in both orders and revenue for our residential division and had our best month since March in the commercial division. As the commercial real estate market continues to rebound, we anticipate having a strong fourth quarter to close out the year. We are still very cautious about what will happen next year once the stimulus money runs out. Even if we finally get a vaccine for the coronavirus, it remains to be seen what state our economy will be in with the amount of people that have filed for unemployment. How many jobs will be available in the retail, restaurant and the hotel sector is a big factor, and no one knows what our new normal will look like.

- We are soft on hours in the transactional area compared with last year. Other areas like bankruptcy and labor are, of course, busy. Overall, we will likely see a decrease in hours this year continuing into next year. Rates have held up generally, as have collections.

- As a consulting engineering company, we face considerable uncertainty about the response of the energy and chemical processing industries to the use of outsider services this year and next.

- The business climate is getting better after COVID-19.

Administrative and Support Services

- Continued COVID-19 spread has hiring at a standstill, and the uncertainty of the election—and the possible challenge to result—and civil unrest have negatively impacted demand.

- It's busy. However, there are no people to hire.

- We have brought more employees to handle the demand from our government customers. We have seen a 20 percent increase in transactions since the middle of July.

- I am afraid the contractors we use will be cutting our margins yet again in an effort to increase their profits and recover some revenue. We are working diligently to increase our retail business and find other contract work.

- Rather than a shortage of clients, we now face a shortage of temporary employees to fill our current orders.

- The silence of the luxury and corporate traveler is overwhelming. The uncertainty of the tomorrow (not months from now) is full of anxiety, which gives no one confidence in planning trips. The yo-yo effect of opening and closing on states and countries is confusing to travelers. I have reached out to our lawmakers to plead the case of travel advisors. Only confidence in a normal way of business/life will restore travel to acceptable levels; therefore, a great deal of assistance is needed on many levels.

- The level of stimulus and low interest rates are offsetting the overall concerns about GDP [gross domestic product], unemployment and general business activity. Not sure if the current situation is sustainable, which will eventually begin to seep into go-forward planning regarding staffing levels, capital expenditures, etc.

- We are still in a state of confusion over the economy and COVID-19. Most of our customers are still trying to figure out where their customers have gone and when they will return. Things have seemed to turn in regard to future business as of this past Monday. RFQs [requests for quotation] and callouts have increased twofold. The optimism that is starting to build over the election and Joe Biden's realistic chance to unseat Donald Trump has made a positive difference in the mood of business people I work and talk with on a daily basis. The corporate aviation sector as of last week has increased in RFQ and calendar inspection items. The industrial sector has remained flat, with just a small increase in RFQs for the September time frame. The oil sector has remained flat, with no changes expected soon.

Educational Services

- It has been very good to see increased retail activity and in local malls, shopping centers and of course grocery stores. I think the consumer is beginning to adjust to living life with a mask and going about their business. It will be critical in the next six-to-eight-month period to see increased movement in the hotel and hospitality industry, which is still lagging in economic activity.

Ambulatory Health Care Services

- We believe we will see relief from COVID-19 in the fall. We are planning some capital expenditures if business firms.

- Alas, we all suffer for calamities not foreseen; I spend half my days scrubbing my hands clean; many depressing corporate reports; safe bubbles only for those in sports; for holidays, top of my list is an everlasting vaccine. There is severe distress in the health care provider environment. Many are retiring, closing offices, limiting access, concierge, [working] part time, etc. Combine that with cuts by CMS [Centers for Medicare & Medicaid Services] and insurers, and there will be a growing and eventual massive physician shortage in coming years.

Social Assistance

- We are unable to hire workers due to unemployment benefits. Our entry-level employees make less than $12 per hour. We are seeing a large number of candidates receive an offer and then do not show up for orientation.

Performing Arts, Spectator Sports and Related Industries

- Our future business environment is affected by who wins the election.

Museums, Historical Sites and Similar Institutions

- Public attendance is not rising as hoped for.

Amusement, Gambling and Recreation Industries

- It is just so hard to make any definitive plans. We reopened in June, and the business was starting to come back. Then the mayor and governor put tighter restrictions back in place, and the business fell off again. We are slightly optimistic that we can increase the business slowly, very slowly from here, but the mayor has basically kept strict restrictions on us now until Dec. 15. It’s a very challenging time in the hospitality business.

- We are an amusement park, and people are not coming in sufficient numbers, even though we have all protocols in place. Our future is far from certain, as our period of operation was completely shut down during the COVID-19 lockdown. We will not be able to maintain our full-time employee base, which means next year’s opening will not be possible. Our savings and personal resources will be used up, causing a complete shutdown after Labor Day. Every day the news keeps reporting negative concerns, so the public cannot make any plans, as they don't know what will happen next.

Accommodation

- There is so much uncertainty right now, it is impossible to guess what will happen six weeks into the future. We are hopeful that COVID-19 will wane, and conditions will begin to improve for travel and meeting-related businesses.

- If last month was a great deal of uncertainty, then nothing has changed; there is still a great deal of uncertainty regarding our business. While we have seen a steady increase in leisure business, there is no group business to speak of. As the fall approaches, leisure demand will level off, but with no groups until sometime in 2021, we are in for a difficult four to six months.

Food Services and Drinking Places

- The next three-to-six-month impact of COVID-19 and all its adjustments are unknown. We are optimistic there will be better solutions by spring. We are still navigating insurance litigation from Hurricane Harvey in 2017. We had some boardwalk repairs from Hurricane Hanna that took three to four weeks to resolve and temporarily impacted revenues.

- Our game revenues have continued to improve, so overall sales are up. Cheese prices hit an all-time high in July but have pulled back in August. We are experiencing shortages in some chicken and other meat products.

- I believe Houston will feel the effects of the oil company layoffs in six to seven months.

- We are not being able to hire employees because they are making an extra $400 a week to stay home instead of working.

Merchant Wholesalers, Durable Goods

- We feel as if May was the bottom of the trough with respect to sales. Since then, we have seen small growth each month and expect that growth to continue.

- We are going out of business soon due to political concerns from our Taiwan headquarters and pandemic and other economic issues.

Merchant Wholesalers, Nondurable Goods

- COVID-19 is still keeping restaurants from fully opening. Our business will continue to fluctuate until restaurants open and patrons return. We still believe that demand is there, but patrons are not able to dine freely.

Motor Vehicle and Parts Dealers

- Lack of inventory of new and preowned cars has negatively impacted our business in August. Demand is still there, and we expect inventory to start to replenish in September and sales to improve.

- We believe that the certainty of continued financial stimulus by the government, low interest rates and the strong prospects for a vaccine for COVID-19 will continue to stabilize our economy. Consumer spending seems to be surprisingly resilient even on large-ticket items like automobiles. Vehicle inventories are the biggest issue at the moment. Supply and demand is intact.

- We are having difficulty hiring people for positions that pay $12 to $15 per hour.

- We expect inventories to improve from depressed levels. Business conditions are subject to change at any time due to COVID-19. We are very concerned that election results will negatively impact the long-term outlook for profitable growth. Margins remain under attack. We have overall concerns associated with COVID-19, unrest, riots and the political environment.

Building Material and Garden Equipment and Supplies Dealers

- Uncertainty over COVID-19 and these politicians are scaring everyone. Most of it is scare-tactic politics.

Clothing and Clothing Accessories Stores

- [We] filed for reorganization in May 2020. It appears that all stores will be liquidated by Sept. 30.

Nonstore Retailers

- We are pleased that our sales team has actually landed some new business for us; while not substantial enough to return us to pre-COVID revenues, we feel we are moving in the right direction again.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Christopher Slijk at christopher.slijk@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.