Missteps along U.S.–Mexico border hinder movement of COVID-19 biomedical trade

The Paso del Norte region—the cities of El Paso and Ciudad Juárez—is a hub of binational trade and manufacturing. While most activity is concentrated in automotive parts and electronic components, a cluster of biomedical manufacturers has emerged in Juárez in recent years.

The region’s biomedical device manufacturing industry produces a wide range of equipment, including electromedical apparatuses, laboratory instruments, surgical devices, pharmaceuticals and medicines, optical instruments and lenses, and irradiation units.

In 2020, Mexico exported $11.38 billion in biomedical manufactured goods to the United States. Almost a third of these biomedical goods, worth about $3.58 billion, passed through the El Paso Trade District last year, ranking it second behind San Diego.Despite heightened demand for biomedical goods as COVID-19 began spreading, the sector’s supply chain was interrupted when the border was closed for nonessential activities on March 21, 2020. Ten days later, the Mexican government nationally suspended all “nonessential activities,” without initially defining “essential.” As a result, manufacturing plants that supplied such products to U.S. companies closed.

Disjointed coordination between the U.S. and Mexico from the outset of the pandemic also hampered the full and timely renewal of vital supply-chain trade. Even with such disruptions, the Juárez manufacturing sector pivoted to produce respirators, ventilators and personal protection equipment, much of it for export to the U.S.[1]

Soon after the U.S.–Mexico border was closed to nonessential crossings, Mexico’s federal and state governments’ imposed limitations on manufacturing with little explanatory guidance. Manufacturing business contacts said these mandates were confusing, unclear and inconsistently enforced.

Moreover, the decrees failed to specify if plants integrated into supply chains that supported essential U.S. sectors could continue operations. Because of cross-border interdependencies, work stoppages interrupted the production and export of critical goods.

Additional plants temporarily closed in April 2020 amid general protests and strikes as the COVID-19 case count rapidly rose. When they were allowed to operate, these manufacturers were also required to scale back production, reduce on-site employment and send home workers who were pregnant or had high-risk comorbidities—diabetes, obesity and hypertension—and individuals age 60 and older.

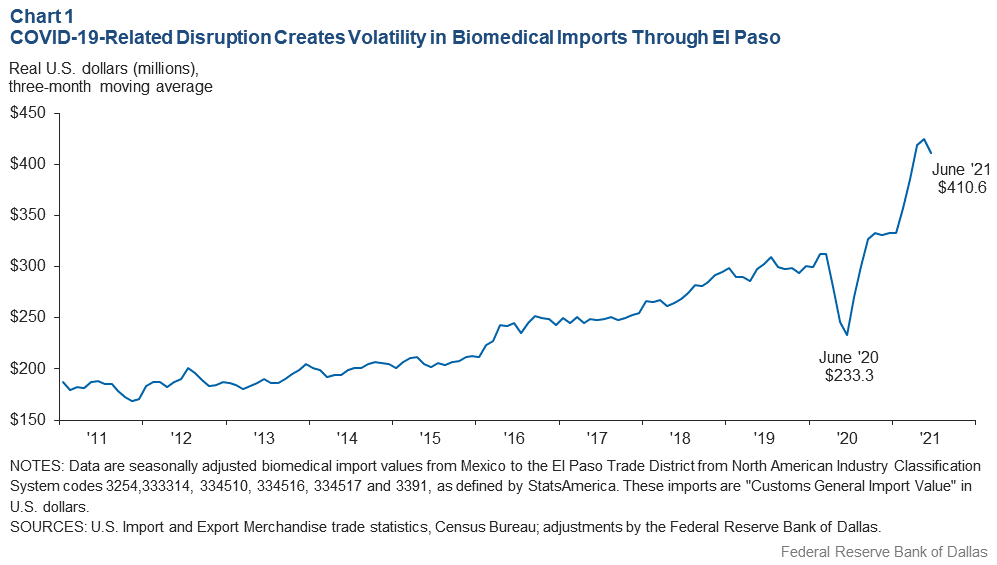

Following these interruptions, the three-month moving average of biomedical imports from Mexico through El Paso to the U.S. plunged 10.3 percent (-$32.1 million) in April 2020 and then a record 12.1 percent (-$33.8 million) in May. The following month, U.S. biomedical import volumes through El Paso from Mexico reached their lowest levels since March 2016, amounting to just $233.3 million (Chart 1).

The Mexican government began issuing clarifying guidelines in April 2020 that allowed essential businesses to expand operations. Many plants subsequently reopened and began manufacturing biomedical items.

Despite unprecedented production constraints in 2020, biomedical imports from Mexico via El Paso rose 1.1 percent above 2019’s import volume of $3.54 billion. The three-month moving average reached a record-high $424.9 million in May 2021.

With the pandemic ongoing and as more variants are discovered, clarity and uniformity in public health orders in Mexico and sustained collaboration with the U.S. government are necessary to manage the flow of people and trade.

Binational, coordinated public health measures are needed to keep the border open to critical supplies and equipment and ultimately ensure economic recovery.

Notes

- "COVID-19 Crisis: Juárez Maquiladoras Pivot to Manufacturing Ventilators, Face Masks," by Veronica Martinez, El Paso Times, April 15, 2020.

About the Authors

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: https://www.dallasfed.org/research/swe/2021/swe2103.