Texas economy rebounds from year-end slowdown, grows at moderate pace

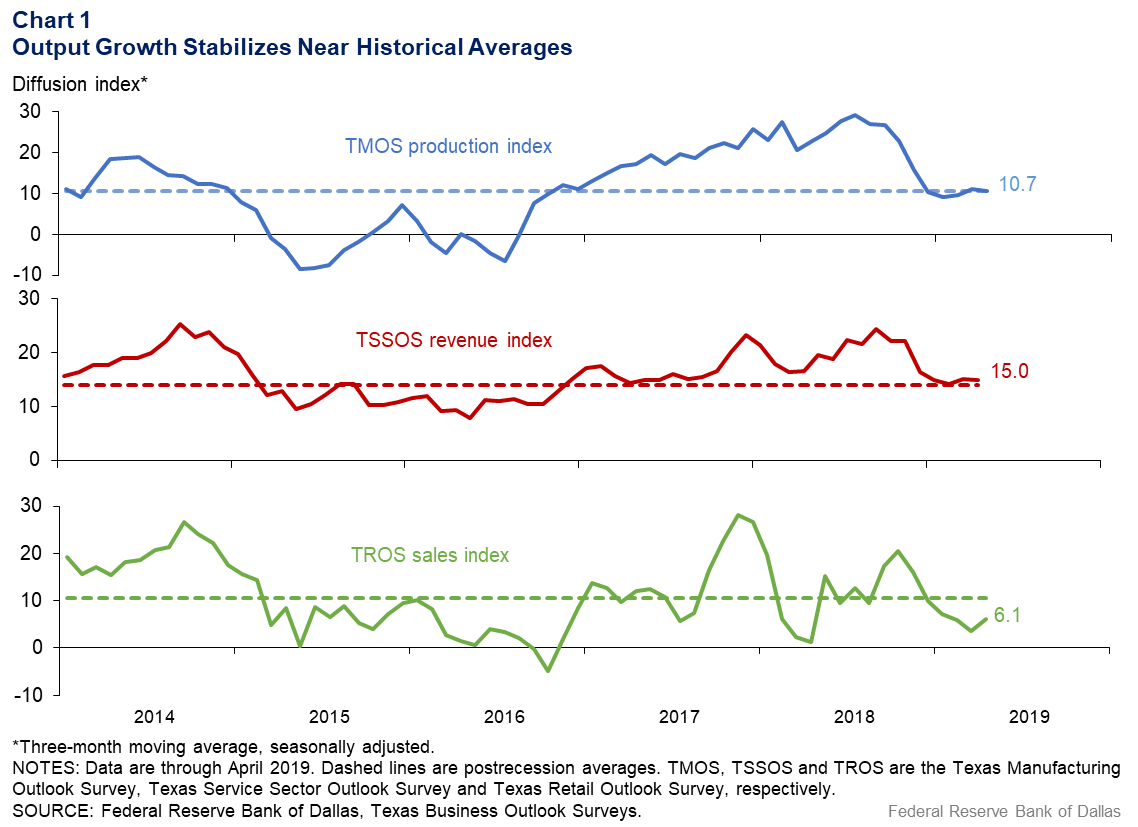

Texas economic activity expanded moderately in the first quarter after downshifting markedly in November and December. Reflecting that trend, headline Texas Business Outlook Survey (TBOS) indexes—in which positive numbers indicate a greater share of firms reporting a positive result than a negative one—have moved toward their historical averages (Chart 1).

Survey respondents reported an uptick in manufacturing production growth in April, though the three-month moving average slipped lower. Demand increased for nondurables and remained high for certain durables, including transportation equipment and construction-related products. Respondents were modestly more optimistic about the trade outlook.

While the three-month moving average of service sector growth moved lower in April, it remained near January and February levels. In April, there was especially pronounced activity in staffing services and continued strength in professional and business services and in accommodations and food services. Meanwhile, even with retail growth rebounding in April, the three-month moving average remained below trend levels amid reports that firms are unable to raise prices fast enough to cover increased input costs.

Job growth remains about 2 percent

Texas payroll employment grew at an annual rate of 2.2 percent in March and 2.1 percent for the first quarter. The first-quarter rate is slightly weaker than in fourth quarter 2018 and on par with the state’s long-run average rate. It also marked the sixth consecutive quarter in which Texas payroll employment growth exceeded the U.S. rate—though for five of those quarters, the lead has been less than Texas’ traditional 1 percentage-point advantage over the U.S.

While quarter-over-quarter employment growth has been largely stable statewide, differences across the state’s major metro areas persist. Dallas, San Antonio and Houston grew faster than the state as a whole in the first quarter, with payrolls rising at 4.6, 2.9 and 2.6 percent annual rates, respectively. Austin expanded at a 1.5 percent rate, and Fort Worth payrolls contracted 0.1 percent.

The Texas unemployment rate remained at 3.8 percent in March, and initial claims for unemployment insurance held near postrecession lows, suggesting labor markets remain very tight.

Residential real estate strengthens

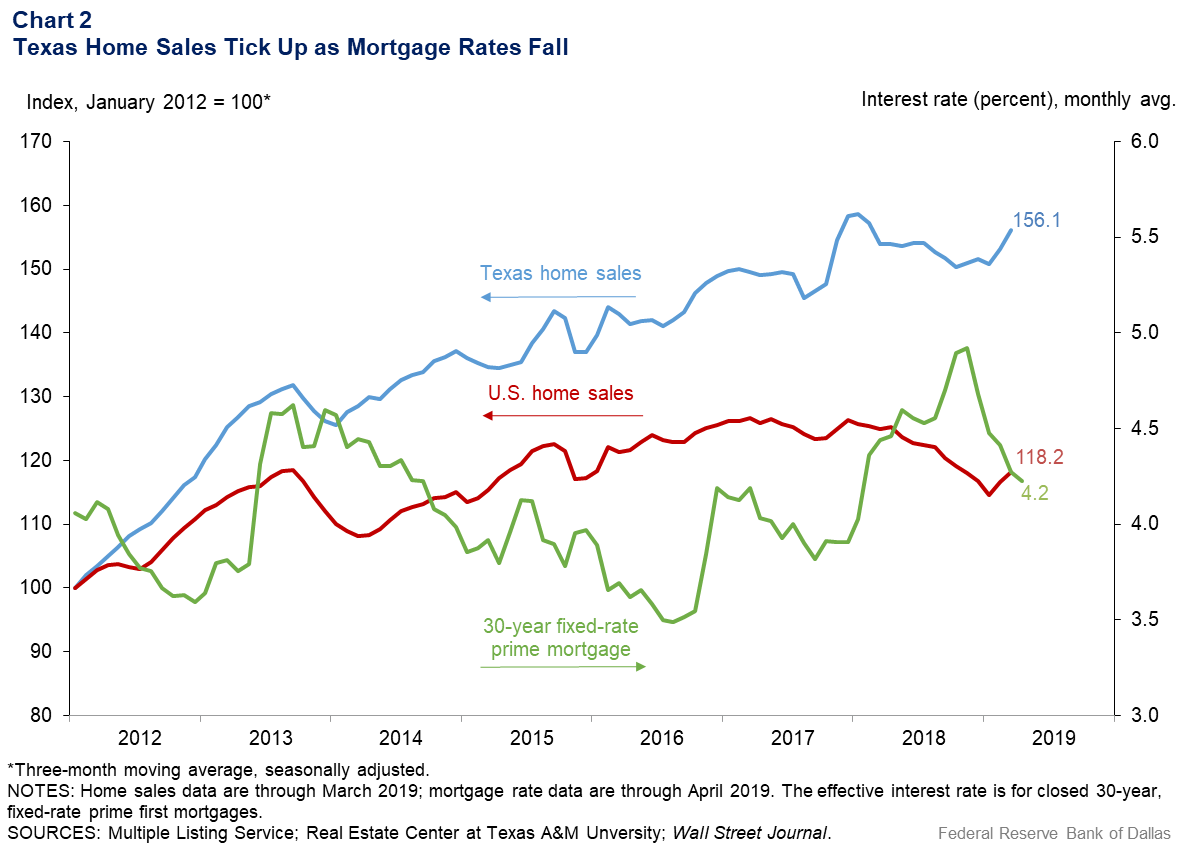

Texas home sales ticked up in the first quarter as mortgage rates fell, consistent with anecdotal reports of higher foot traffic and increased residential purchase activity beginning in mid-February (Chart 2). Contacts reported high demand but little supply at lower prices.

Most large metros experienced rising home sales in February and March as end-of-year economic softness receded. Inventory continued to rise and is approaching the national level of 3.9 months in most Texas metros, but it remains well below the six-month threshold at which markets are believed to be in balance.

Exports rise in January and February

Texas exports rose a cumulative 3.2 percent in January and February, partially erasing an end-of-year dip in export volumes. Exports remain near historically high levels despite a strong dollar, which makes those goods more expensive in the local currency, and recent trade policy uncertainty.

Lengthening wait times along the U.S–Mexico border are likely adversely affecting exports. Wait times have increased to more than 10 hours at some Texas crossing points after the U.S. government diverted border patrol personnel to assist with a large inflow of migrants seeking asylum.

Business groups across the state have noted that these border issues will inevitably affect firm cost structures and eventually firms’ willingness to hire. Remarkably, there are reports of firms protecting their supply chains by chartering planes to bring merchandise across the border rather than relying exclusively on truck or rail transport.

Outlook improving, with caveats

While business outlooks in the state weakened sharply late in 2018, the outlook has improved in the first four months of the year. Data suggest that growth has slowed only slightly and is near its long-term average.

The Dallas Fed’s Texas Leading Index, a measure of future activity in the state, rebounded in the first quarter. Help-wanted advertising and the stock prices of companies in Texas increased, offsetting the impacts of the stronger dollar. The Dallas Fed’s Texas Employment Forecast is for job growth of 1.8 percent in 2019, off from 2.3 percent in 2018 and the state’s long-run average of 2 percent.

Risks to the outlook include slowing international trade, energy price volatility and softening of the Mexican economy. The TBOS company outlook indexes also provide a cautionary note, remaining well below levels seen in the first three quarters of 2018 despite ticking up in March and April 2019.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.