Crude oil price changes quicker to register at gasoline pump

Crude oil prices can change dramatically. Between early October 2018 and late December 2018, benchmark Brent crude oil prices fell by about $35 per barrel. During the same period, U.S. retail gasoline prices dropped by about 65 cents per gallon.

With disruption to Saudi Arabian oil production in mid-September and elevated tensions in the Persian Gulf region, oil prices jumped. How big an impact should we expect on gasoline prices? Based on recent research, most of the initial effect showed up quickly at the pump.

Gasoline prices are among the most volatile consumer prices, mostly due to large fluctuations in global crude oil prices. Various types of surprise events, or “shocks,” are responsible for the swings in crude oil prices. These can be grouped into two basic categories—shocks that relate to the global supply of crude oil, such as geopolitical events affecting oil producers or technological advances in oil extraction, and shocks that relate to the global demand for crude oil—most notably, the global business cycle.

Prices at the pump

How much and how fast do swings in global crude oil prices affect retail gasoline prices U.S. consumers see at the pump? The sensitivity of retail gasoline prices to movements in crude oil prices is called “oil price pass-through” and reflects the typical change in retail gasoline prices following an increase in crude oil prices.

This oil price pass-through to retail gasoline prices is customarily expressed as a fraction of the initial crude oil price change. For example, a pass-through of 100 percent implies that a 1 percent crude-oil increase is followed by a 1 percent increase in retail gasoline prices.

One would expect oil price pass-through to be less than 100 percent, a situation known as “incomplete pass-through.” This occurs because crude oil prices are not the only cost component of retail gasoline prices. For example, refining and distribution costs are also important components of retail gasoline prices.

Daily pass-throughs

In the following exercise, a daily time horizon is chosen to look at price pass-through after an initial oil price change, though it’s possible to examine pass-through in different time horizons—weeks or months. The data consist of Brent crude oil prices (European Free Market Brent crude reported by the Financial Times), reported daily, and regular-grade U.S. retail gasoline prices, reported weekly.

Despite the apparent mismatch in frequencies of these two series, a statistical method is used that a coauthor and I recently developed to estimate daily oil price pass-through to retail gasoline prices. The sample runs from Jan. 16, 1991, to May 22, 2017.

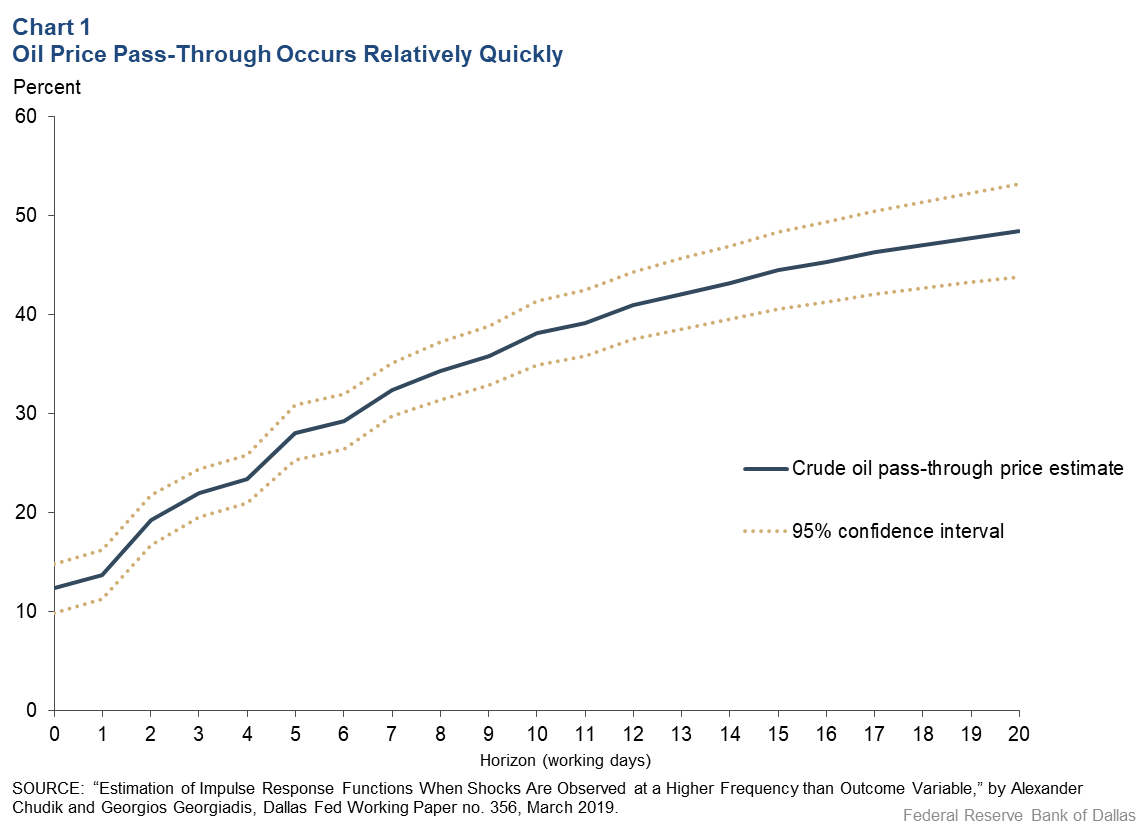

We find an incomplete crude oil price pass-through, about 55 percent in the long run (Chart 1).

This estimate is broadly in line with econometrician Jim Hamilton’s rule of thumb that a $10 crude oil price increase results in a 25-cent retail gasoline price rise. The pass-through is not immediate, but it is quite fast: About 12 percent of a crude oil price increase is passed through to retail gasoline prices on the same day (number of working days = 0 in Chart 1), gradually increasing to about 50 percent after 20 working days.

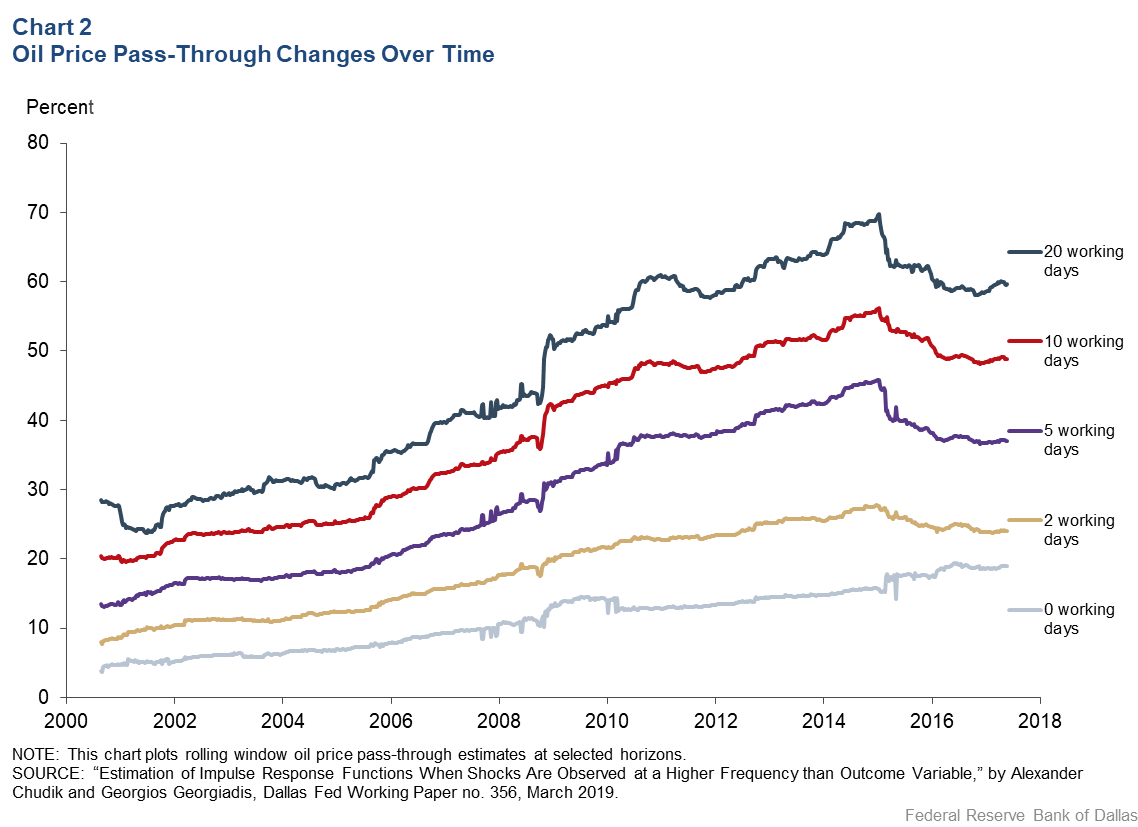

We also find that the pass-through has changed over time. To show how, we consider rolling windows over the full sample in which we follow the same statistical estimation methods for shorter subsamples (we chose each to include 500 weeks) and then compare how the price pass-through estimates evolve (Chart 2).

The evidence suggests that pass-through has increased over time for all reported horizons, with about 60 percent pass-through achieved after 20 working days in the most recent subsample, compared with only about 30 percent in the early 2000s.

About the Author

Alexander Chudik

Chudik is a senior economist in the Research Department at the Federal Reserve Bank of Dallas.

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.