Texas Employment Forecast

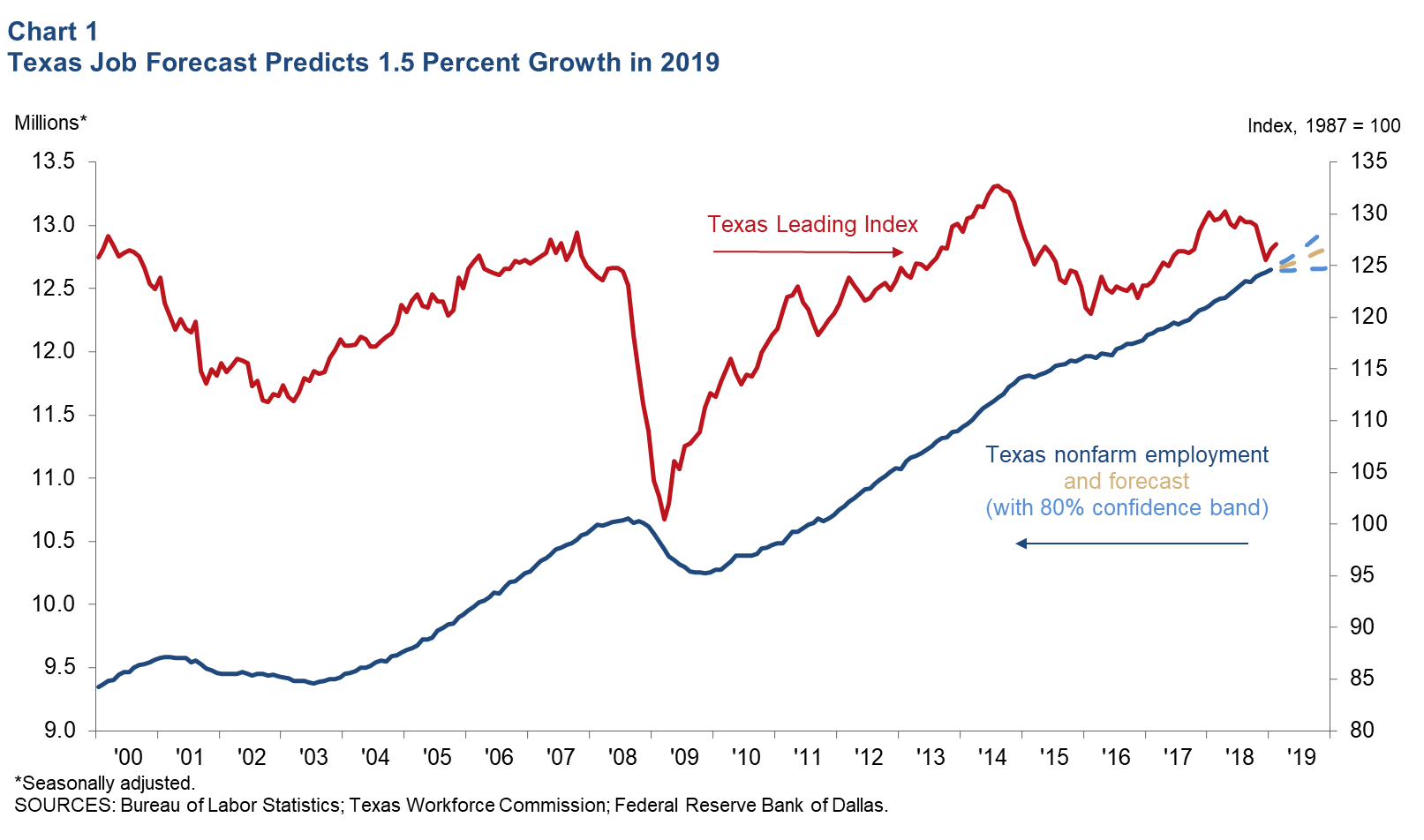

Incorporating February job growth of 1.8 percent and a second consecutive increase in the leading index, the Texas Employment Forecast suggests jobs will grow 1.5 percent this year (December/December), with an 80 percent confidence band of 0.2 to 2.8 percent. Based on the forecast, 194,900 jobs will be added in the state this year, and employment in December 2019 will be 12.8 million (Chart 1).

“After an increase in uncertainty about the national and global economies in the fourth quarter of last year, business outlooks improved in the first two months of 2019, and this improvement is reflected in the forecast,” said Keith R. Phillips, Dallas Fed assistant vice president and senior economist.

“Job growth in the first two months of the year generally was steady at a pace slightly below 2.0 percent—slower than the 2.3 percent growth in 2018. While the forecast has improved since January, it still suggests weaker job growth this year than in 2018. The three primary factors facing the Texas economy in 2019 remain historically tight labor markets, lower oil prices and continued uncertainty about trade restrictions. These factors will likely slow Texas job growth this year.”

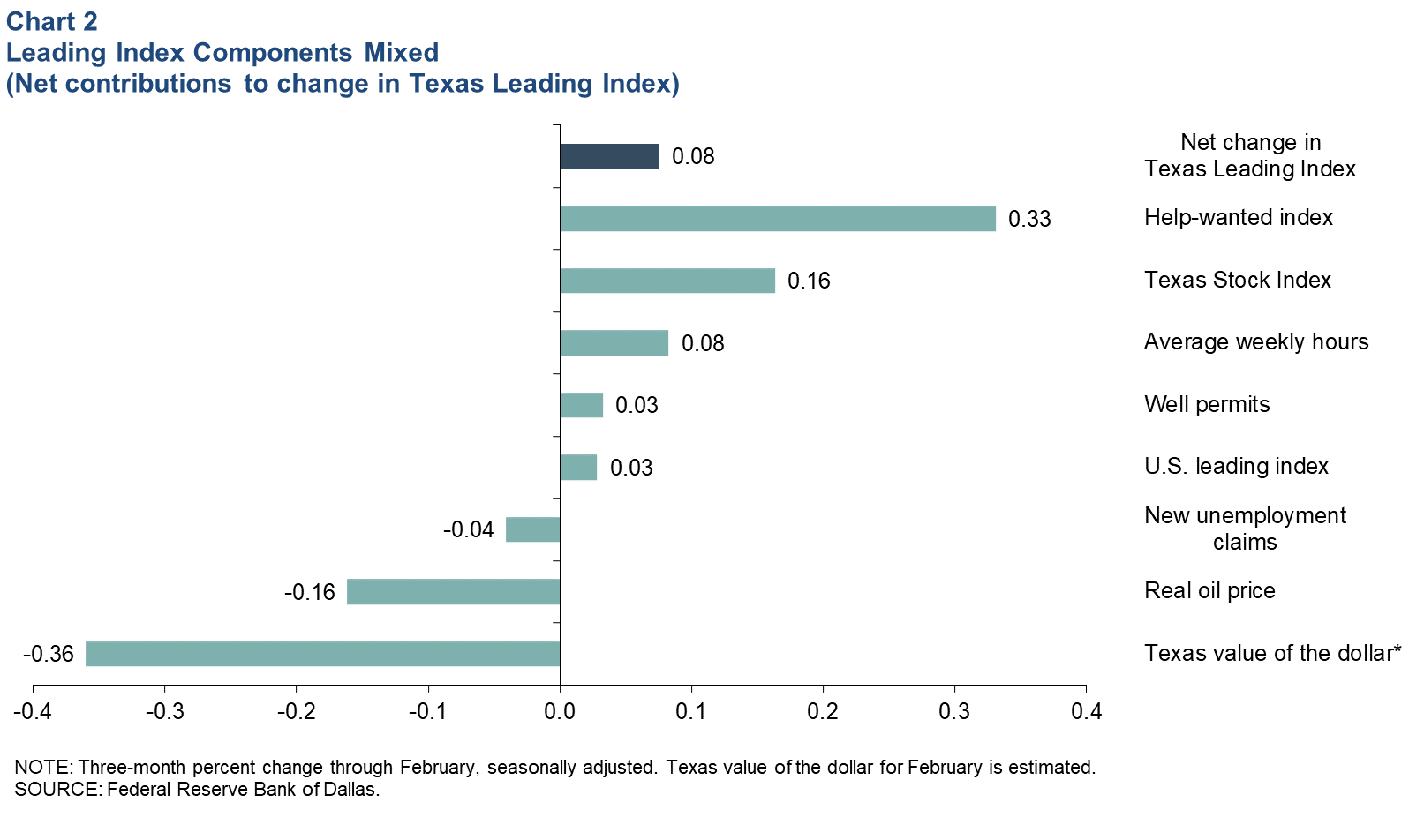

The Dallas Fed’s Texas Leading Index increased a slight 0.1 percent over the three months ending in February (Chart 2). Growth was mixed across the components with most showing little change over the period. Two broad measures of labor market conditions—initial claims for unemployment insurance and help-wanted advertising—were flat or showed mild improvement.

Energy indicators were somewhat mixed with oil prices down but permits to drill oil and gas wells flat. Manufacturing indicators were also mixed, with the increase in the Texas value of the dollar putting downward pressure on demand while a slight increase in hours worked suggested continued growth. The outlook for the U.S. economy as signaled by the U.S. leading index remained weak, while the stock prices of Texas companies increased modestly. Overall, recent movements in the Texas Leading Index are suggesting moderately weaker growth in Texas than existed last year.

Next release: April 19, 2019

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December. The forecast reported above is a point estimate with 80 percent confidence bands; in other words, the true forecast lies within the bands on Chart 1 with 80 percent probability.

The Dallas Fed Texas Employment Forecasting Model is based on a transfer function that utilizes past changes in state employment along with past changes in the Dallas Fed Texas Leading Index (TLI). Changes in the TLI have an impact on employment with a lead time of three months, and the effect dies out slowly over time. The regression coefficients on lagged changes in employment and the TLI are highly statistically significant, and the model as a whole has been accurate relative to other forecasters over the past two decades.

The forecasting model has been in use at the Dallas Fed since the early 1990s, and the employment forecast has been published in the Western Blue Chip Economic Forecast (WBCF) since 1994. Phillips and Lopez (2009) show that the model has been the most accurate in forecasting Texas job growth relative to other forecasters in the WBCF. In particular, the model had the lowest root mean squared error and has been the closest to the actual the most times (nine of the last 17 years) out of five forecasters that have consistently participated in the survey.

For more details about the model and its performance, see “An Evaluation of Real-Time Forecasting Performance Across 10 Western U.S. States,” by Keith R. Phillips and Joaquin Lopez, Journal of Economic and Social Measurement, vol. 34, no. 2–3, December 2009.

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org.