Texas Employment Forecast

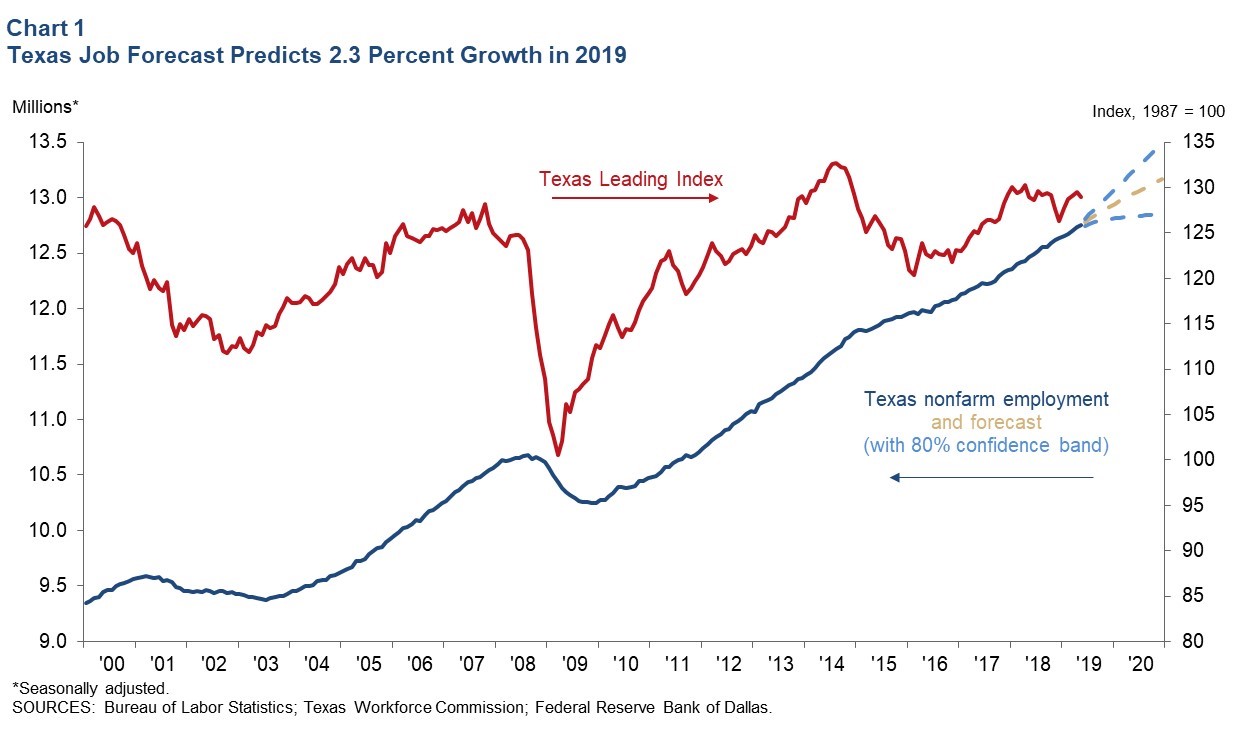

Incorporating May job growth of 2.1 percent and a moderate decrease in the leading index, the Texas Employment Forecast suggests jobs will grow 2.3 percent this year (December/December), with an 80 percent confidence band of 1.4 to 3.2 percent. Based on the forecast, 292,100 jobs will be added in the state this year, and employment in December 2019 will be 12.9 million (Chart 1).

“The manufacturing and mining sectors have slowed this year likely due to increased tariffs, a strong dollar, a weakening world economy and weaker oil prices,” said Keith R. Phillips, Dallas Fed assistant vice president and senior economist. “While these two important sectors have slowed, the private service-producing and construction sectors have accelerated moderately, leaving overall job growth so far this year at the same pace as in 2018.”

In May, the Dallas Fed’s Texas Business Outlook Surveys reported a sharp increase in economic uncertainty and weakened outlooks. Respondents expressed pessimism about the effects of escalating tariffs with China and expressed uncertainty about when trade tensions will be resolved.

“If these factors continue, the Texas Leading Index will likely continue to decline in the coming months and the forecast will likely weaken,” Phillips said.

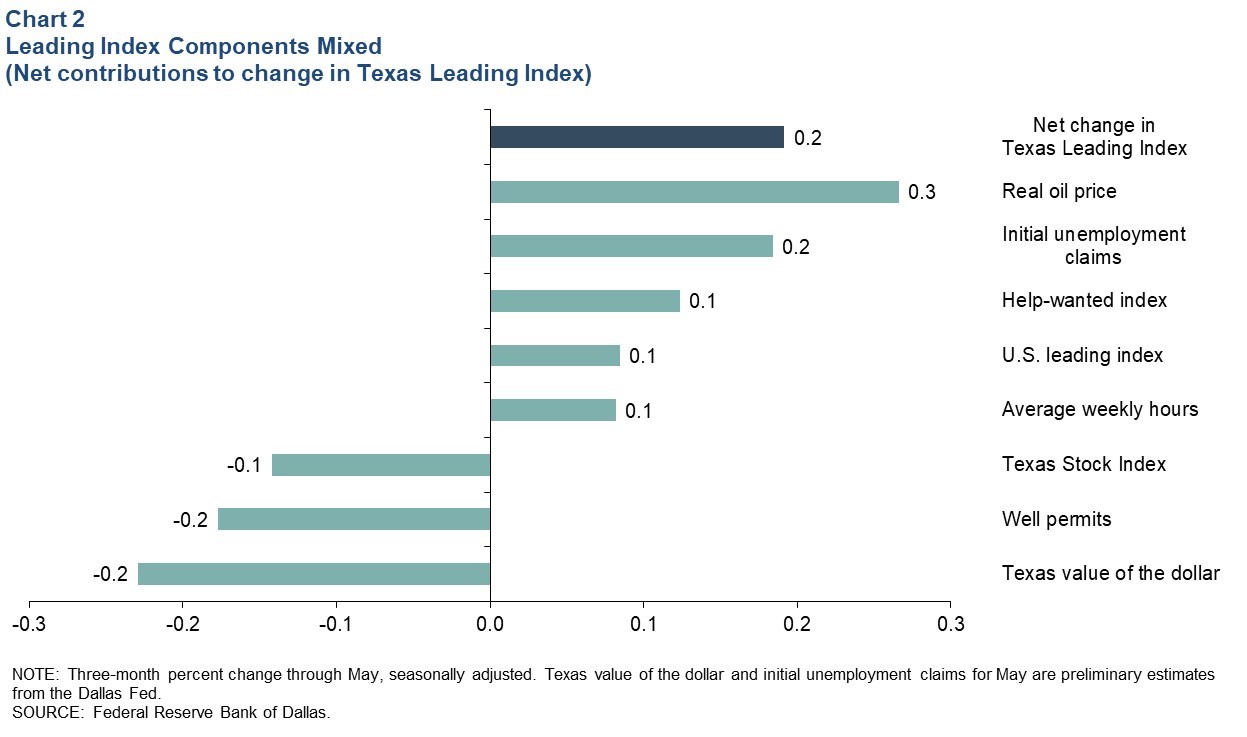

The Dallas Fed’s Texas Leading Index declined in May but increased a mild 0.2 percent over the three months ending in May (Chart 2). Growth was mixed across the components with five giving positive and three giving negative signals. Energy indicators were mixed with oil prices increasing and permits to drill new wells declining. Labor market indicators remained positive with initial claims for unemployment insurance declining, and help-wanted advertising and hours worked in manufacturing increasing. Gains in the U.S. leading index signaled continued stimulus from the national economy while strength in the Texas value of the dollar suggested potentially weaker international demand. Finally, declines in the stock prices of Texas companies suggested weaker corporate earnings in the future.

Next release: July 19, 2019

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December. The forecast reported above is a point estimate with 80 percent confidence bands; in other words, the true forecast lies within the bands on Chart 1 with 80 percent probability.

The Dallas Fed Texas Employment Forecasting Model is based on a transfer function that utilizes past changes in state employment along with past changes in the Dallas Fed Texas Leading Index (TLI). Changes in the TLI have an impact on employment with a lead time of three months, and the effect dies out slowly over time. The regression coefficients on lagged changes in employment and the TLI are highly statistically significant, and the model as a whole has been accurate relative to other forecasters over the past two decades.

The forecasting model has been in use at the Dallas Fed since the early 1990s, and the employment forecast has been published in the Western Blue Chip Economic Forecast (WBCF) since 1994. Phillips and Lopez (2009) show that the model has been the most accurate in forecasting Texas job growth relative to other forecasters in the WBCF. In particular, the model had the lowest root mean squared error and has been the closest to the actual the most times (nine of the last 17 years) out of five forecasters that have consistently participated in the survey.

For more details about the model and its performance, see “An Evaluation of Real-Time Forecasting Performance Across 10 Western U.S. States,” by Keith R. Phillips and Joaquin Lopez, Journal of Economic and Social Measurement, vol. 34, no. 2–3, December 2009.

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org.