Texas Employment Forecast

May 22, 2020

Texas jobs declined at a historic pace of 69.0 percent (9.3 percent non-annualized) in April. The Texas Leading Index declined at its steepest pace since the data series began in January 1981. The COVID-19 pandemic is unprecedented in recent history, and the standard time-series model that we use to forecast the Texas economy is unable to capture the rapid economic decline due to shelter-in-place mandates and social distancing nor the expected rebound in the second half as these constraints subside.

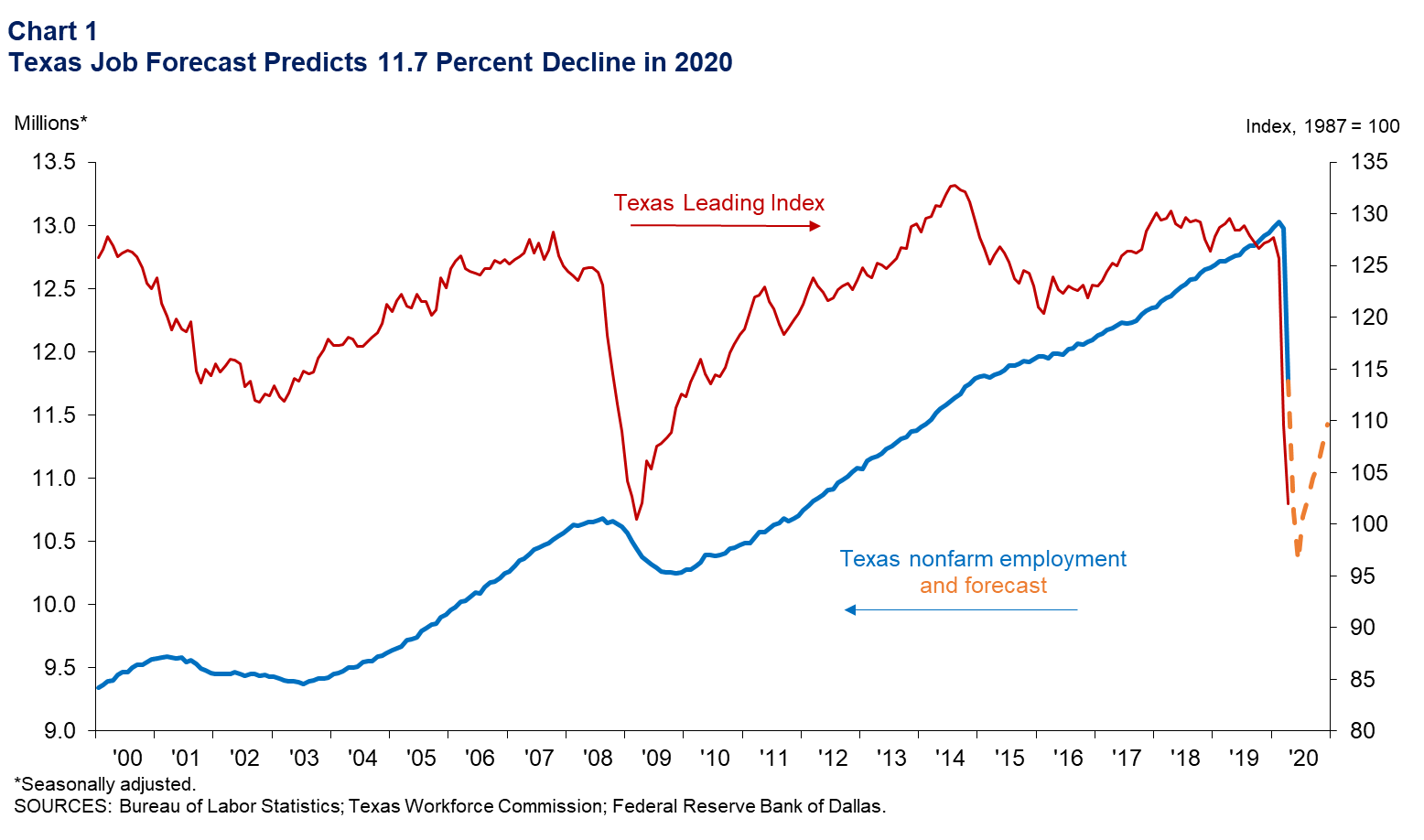

As a result, we use an alternative framework that is a top-down model that utilizes the pattern of growth forecasted for the national economy and separate effects of low oil prices on the Texas economy. Using this model, we estimate that jobs will decline 11.7 percent this year, and employment in December 2020 will be 11.4 million (Chart 1). However, uncertainty about when the number of new COVID-19 cases and the death rate will begin to decline in the state, and if a second wave of infections will occur in the fall, make the forecast particularly uncertain.

“While the rate of job decline in April was steepest in high-contact industries such as hotels, restaurants, personal care and retail, it was broad-based across sectors,” said Keith R. Phillips, Dallas Fed assistant vice president and senior economist. “Using the modified model, we estimate that employment will decline by a smaller percentage in May and begin to recover near mid-year, but prolonged weakness in the energy sector in the second half of the year will dampen the pace of the recovery.”

The Texas unemployment rate increased from 5.1 percent in March to 12.8 percent in April. Recent increases in weekly initial claims for unemployment insurance in Texas suggest a further increase in the unemployment rate in May to close to 20.6 percent. Using the same model as described above, we estimate that the unemployment rate in December will be close to 13.9 percent.

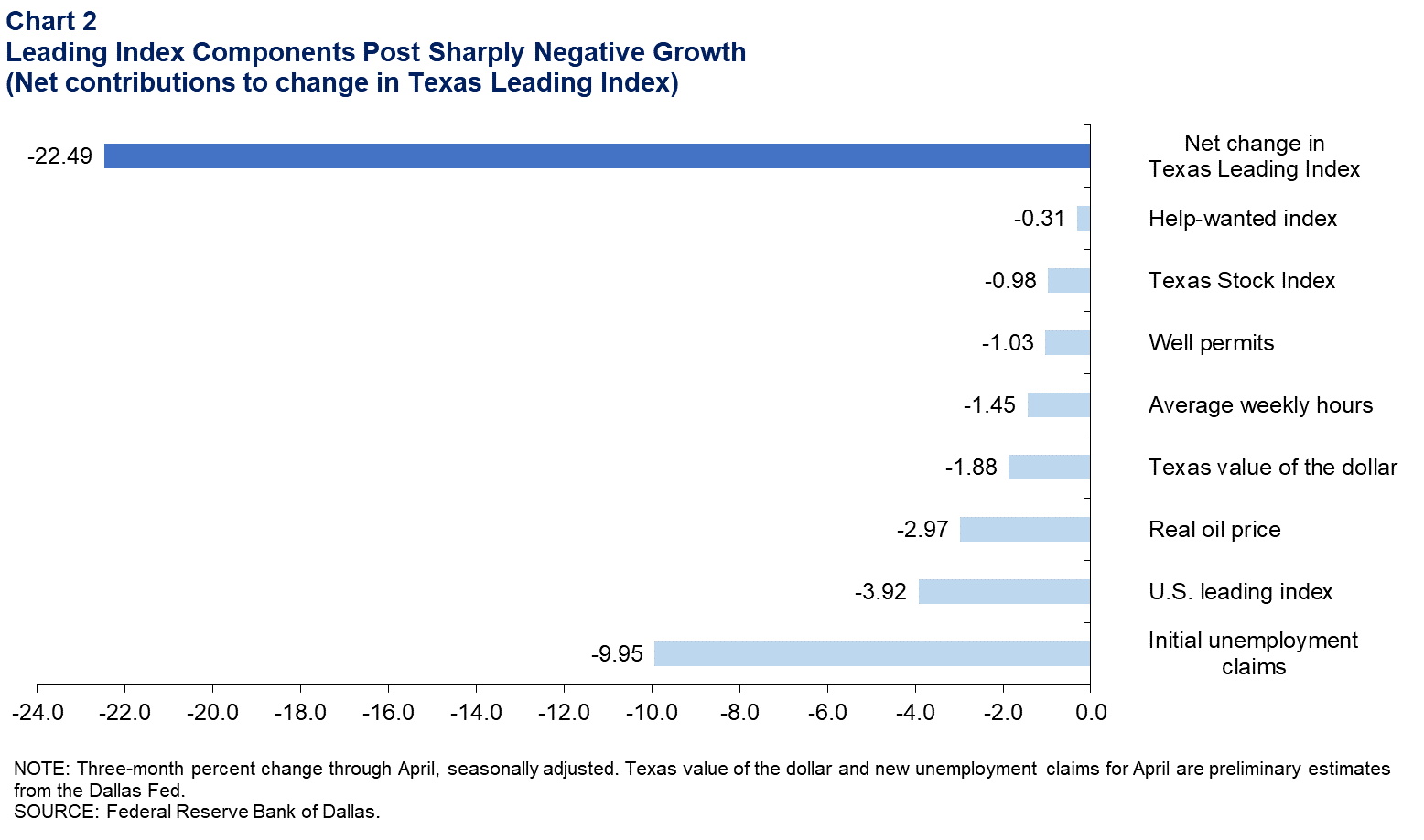

The Texas Leading Index reflects the historic decline in economic conditions since the start of the pandemic in mid-March. For the three months ending in April, all of the components declined (Chart 2). Leading the negative contributions was a large jump in initial claims for unemployment insurance and sharp declines in the U.S. leading index and oil prices. More moderately negative contributions were given by gains in the Texas trade-weighted value of the dollar, and declines in average weekly hours worked in manufacturing, permits to drill oil and gas wells, stock prices of Texas-based companies and help-wanted advertising.

Next release: June 19, 2020

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

Due to the rapid onset of the COVID-19 pandemic, the forecasting model used in this release of the Dallas Fed Texas Employment Forecast differs from the model used historically. In this case, payroll employment for May is estimated based on expected changes in the household employment survey from initial claims for unemployment insurance. From June to December, employment is estimated based on expectations for U.S. GDP growth for the remainder of 2020, a diminishment of direct COVID-19 impacts after May, and expected prices of West Texas Intermediate crude oil based on the futures curve.

For details regarding the forecasting model currently in use, please contact Keith Phillips at keith.r.phillips@dal.frb.org

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org or Christopher Slijk at christopher.slijk@dal.frb.org.