Texas Employment Forecast

September 18, 2020

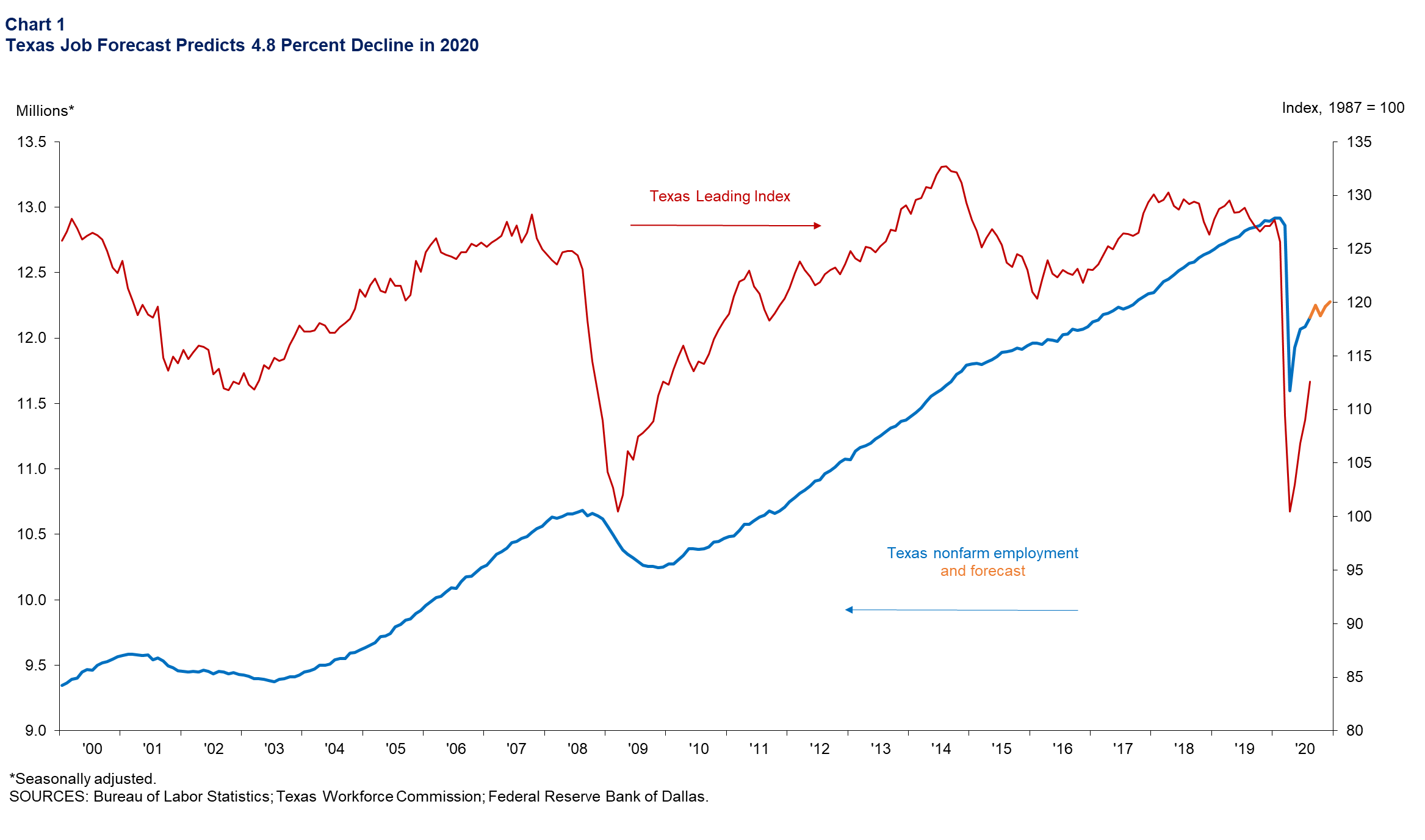

Texas job growth improved to 7.3 percent in August after increasing a revised 1.8 percent in July. Employment is down 8.4 percent since December 2019. The Texas Leading Index increased for the fourth consecutive month in August, indicating continued positive growth over the next six months. Using a top-down model based on national forecasts, COVID-19 infection rates and oil futures prices, we estimate that Texas jobs will continue to recover in the remainder of the year but not enough to fully offset the steep losses in March and April. The Texas Employment Forecast projects jobs will decline 4.8 percent this year (December/December). Based on the forecast, 619,000 jobs will be lost in the state this year, and employment in December 2020 will be 12.3 million (Chart 1).

“A significant decline in new COVID-19 cases and hospitalizations in Texas since the second half of July is good news for the economic recovery, although a rise in cases in the past week is concerning.” said Keith R. Phillips, Dallas Fed assistant vice president and senior economist. “Currently we expect job growth to be about 3.0 percent in the last 4 months of the year. If the recent rise in new cases continues, however, job growth will likely be weaker.”

After bouncing back in May and June, jobs in leisure and hospitality declined significantly in July and moderately in August. Oil and gas sector jobs fell sharply in August while local government jobs continued to increase strongly. Across the large metro areas, job growth was below the state pace in Houston and Ft. Worth, near the state pace in San Antonio and above the state pace in Austin, Dallas and El Paso.

The Texas unemployment rate decreased from 8.0 percent in July to 6.8 percent in August. After growing at a moderate pace of 0.3 percent (non-annualized) in July, the labor force growth grew at a very strong pace of 3.9 percent in August.

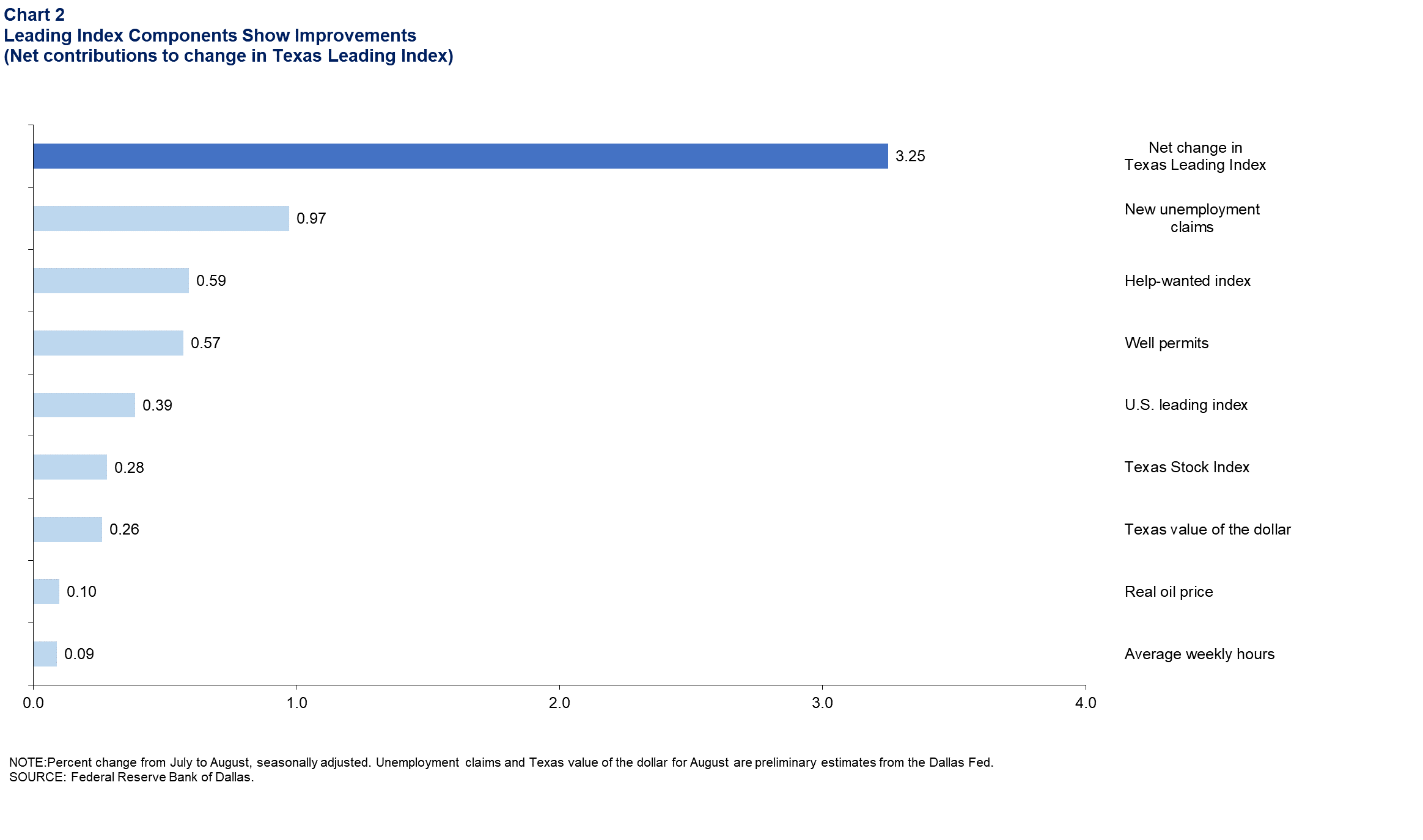

The Texas Leading Index increased for the fourth consecutive month in August (Chart 1). All eight indicators gave positive contributions to the leading index (Chart 2). A sharp decline in initial claims for unemployment insurance gave the strongest positive signal followed by gains in help-wanted advertising and permits to drill oil and gas wells. Other moderately positive contributions were given by gains in the U.S. Leading Index, the stock prices of Texas-based companies, the inflation-adjusted oil price, average weekly hours worked in manufacturing and a decline in the Texas trade-weighted value of the dollar.

Next release: October 16, 2020

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

Due to the rapid onset of the COVID-19 pandemic, the forecasting model used in this release of the Dallas Fed Texas Employment Forecast differs from the model used historically. In this case, payroll employment for September to December is forecasted based on the Texas Weekly Employment Estimate, expectations for U.S. GDP growth for the remainder of 2020, an estimate of direct COVID-19 impacts in March and April, and expected prices of West Texas Intermediate crude oil based on the futures curve.

For additional details see dallasfed.org/research/forecast/

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org or Christopher Slijk at christopher.slijk@dal.frb.org.