Texas Employment Forecast

January 29, 2021

Texas employment grew an annualized 7.1 percent in December after increasing a revised 5.2 percent in November. Jobs had been rising since May, but they still ended the year down 4.5 percent from December 2019. The Texas Leading Index increased for the eighth consecutive month in December, indicating continued positive growth over the next six months.

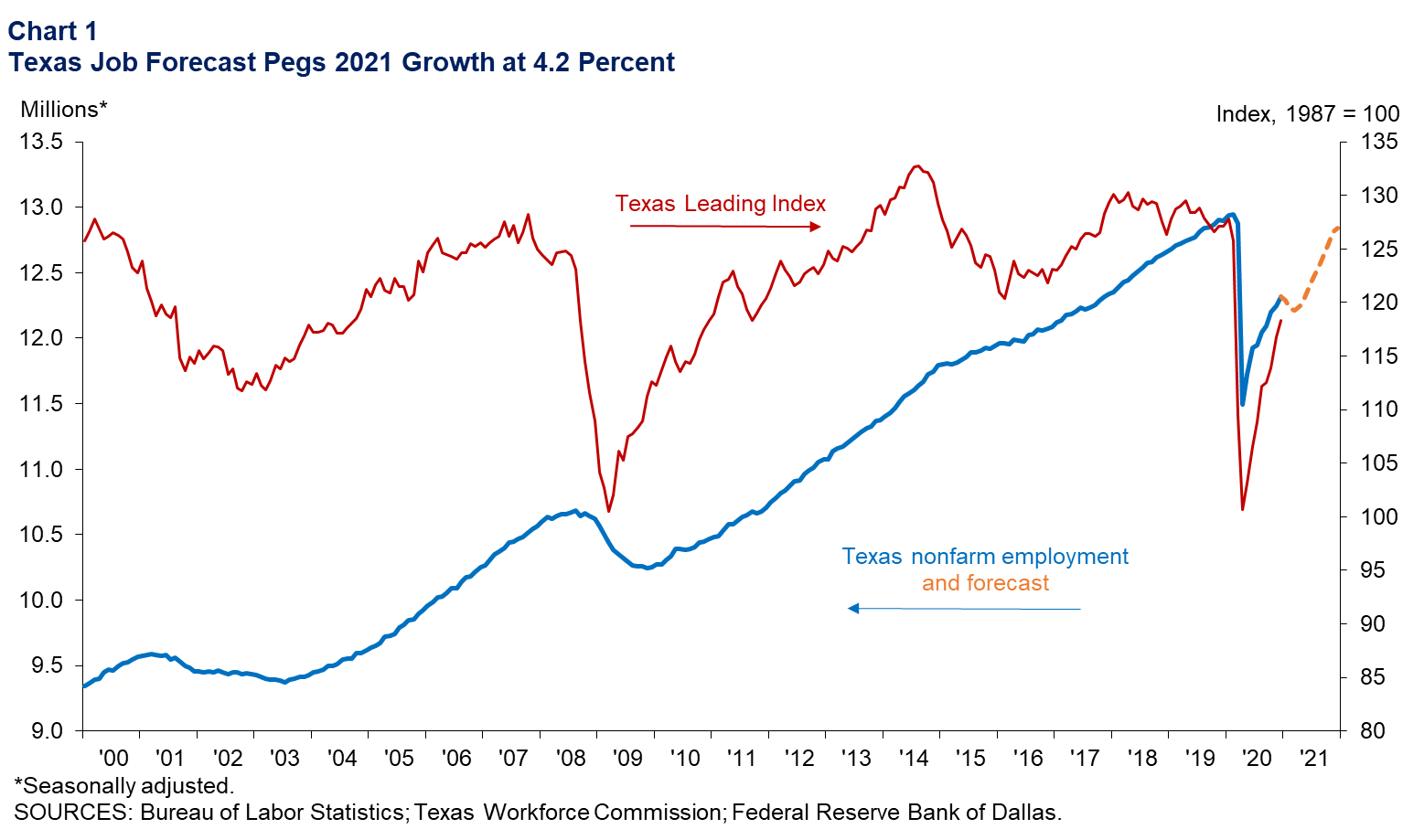

Using a top-down model based on national forecasts, COVID-19 hospitalizations and oil futures prices, we estimate that job growth will be 4.2 percent in 2021, with an 80 percent confidence band of 3.1 to 5.3 percent. Based on the forecast, 518,000 jobs will be added in the state this year, and employment in December 2021 will be 12.8 million (Chart 1).

“In December, despite a sharp rise in COVID-19 cases, Texas job growth picked up as mobility and engagement (MEI) continued to rise,” said Keith R. Phillips, Dallas Fed assistant vice president and senior economist. “However, cases and hospitalizations accelerated further from mid-December to mid-January, reaching new records. A decline in the MEI and other high-frequency data during this period suggest a sharp weakening of job growth in January, as shown by the Texas Weekly Employment Index. However, a recent decline in COVID-19 hospitalizations suggests a peak may have occurred near the third week of January. A continued decline in new infections and hospitalizations would likely result in improved job growth in February and March.”

While employment increased at a strong pace in December, the impact of the surge in COVID-19 infections was felt in the battered leisure and hospitality sector, which saw job growth slow from an annualized rate of 26.1 percent in November to 3.5 percent in December. Jobs in this industry declined 16.8 percent last year.

The Texas unemployment rate fell from 8.1 percent in November to 7.2 percent in December, remaining above the U.S. rate of 6.7 percent. The higher unemployment rate in Texas was partly due to more workers coming back into the labor market. The labor force in Texas bounced back sharply in the second half of last year, ending the year with a slight December-over-December increase of 0.1 percent, while the U.S. labor force declined 2.4 percent.

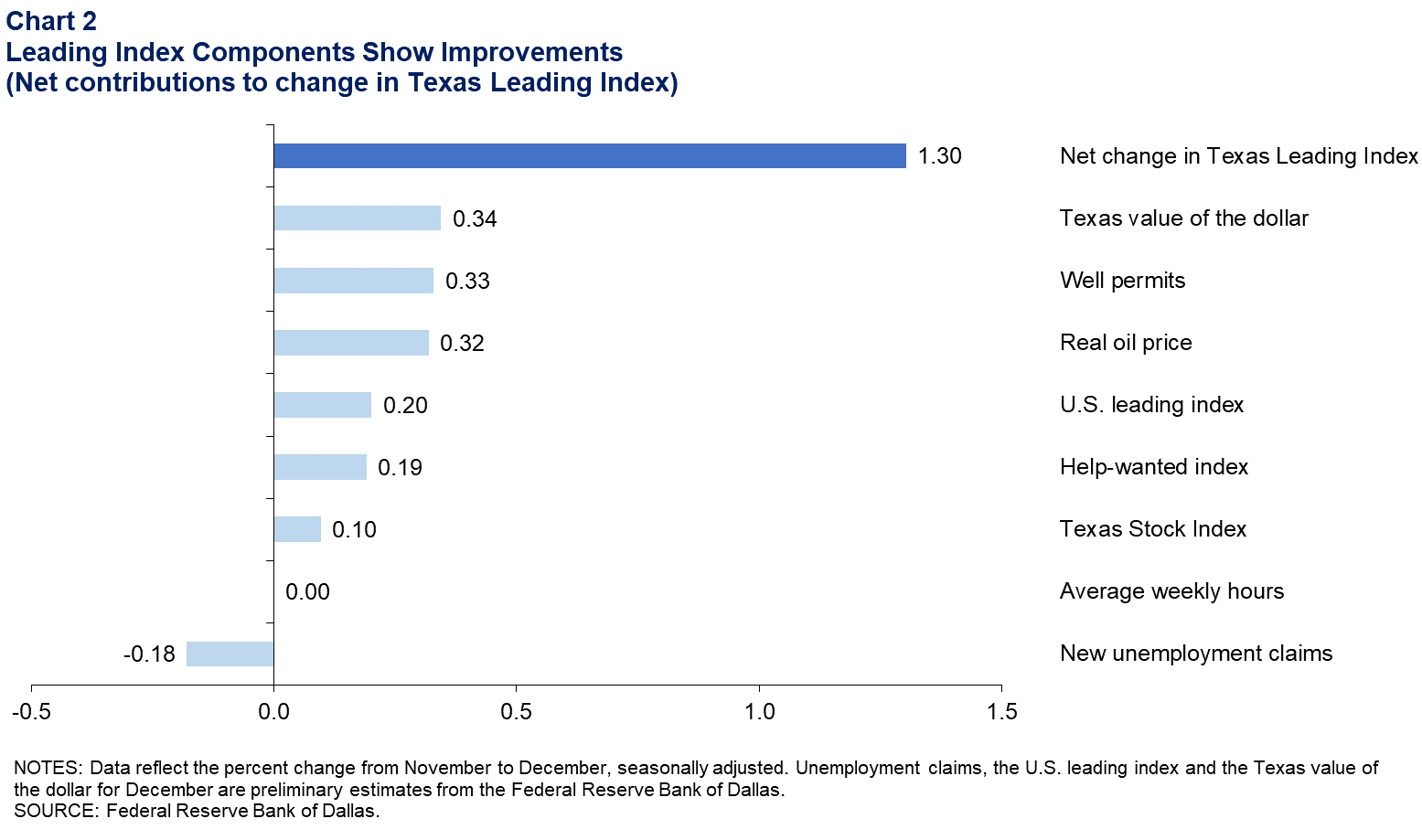

Seven of the eight components contributed positively to December’s increase in the Texas Leading Index (Chart 2). Declines in the Texas export-weighted value of the dollar, and increases in permits to drill oil and gas wells and in the price of oil, contributed the most to the rise in the index. The U.S. leading index, help-wanted advertising, the stock prices of Texas-based companies and average weekly hours in manufacturing gave more moderately positive signals, while an increase in new unemployment claims had a slight negative effect on the index.

Next release: March 12, 2021

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

Due to the rapid onset of the COVID-19 pandemic, the forecasting model used in this release of the Dallas Fed Texas Employment Forecast differs from the model used historically. In this case, payroll employment estimates for 2021 are based on monthly hospitalization projections due to COVID-19 in Texas, direct COVID-19 impacts in March through May 2020, U.S. GDP growth estimates for 2021, and prices for West Texas Intermediate crude oil following the futures contract curve.

For additional details see dallasfed.org/research/forecast/

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org or Christopher Slijk at christopher.slijk@dal.frb.org.