Texas Employment Forecast

September 17, 2021

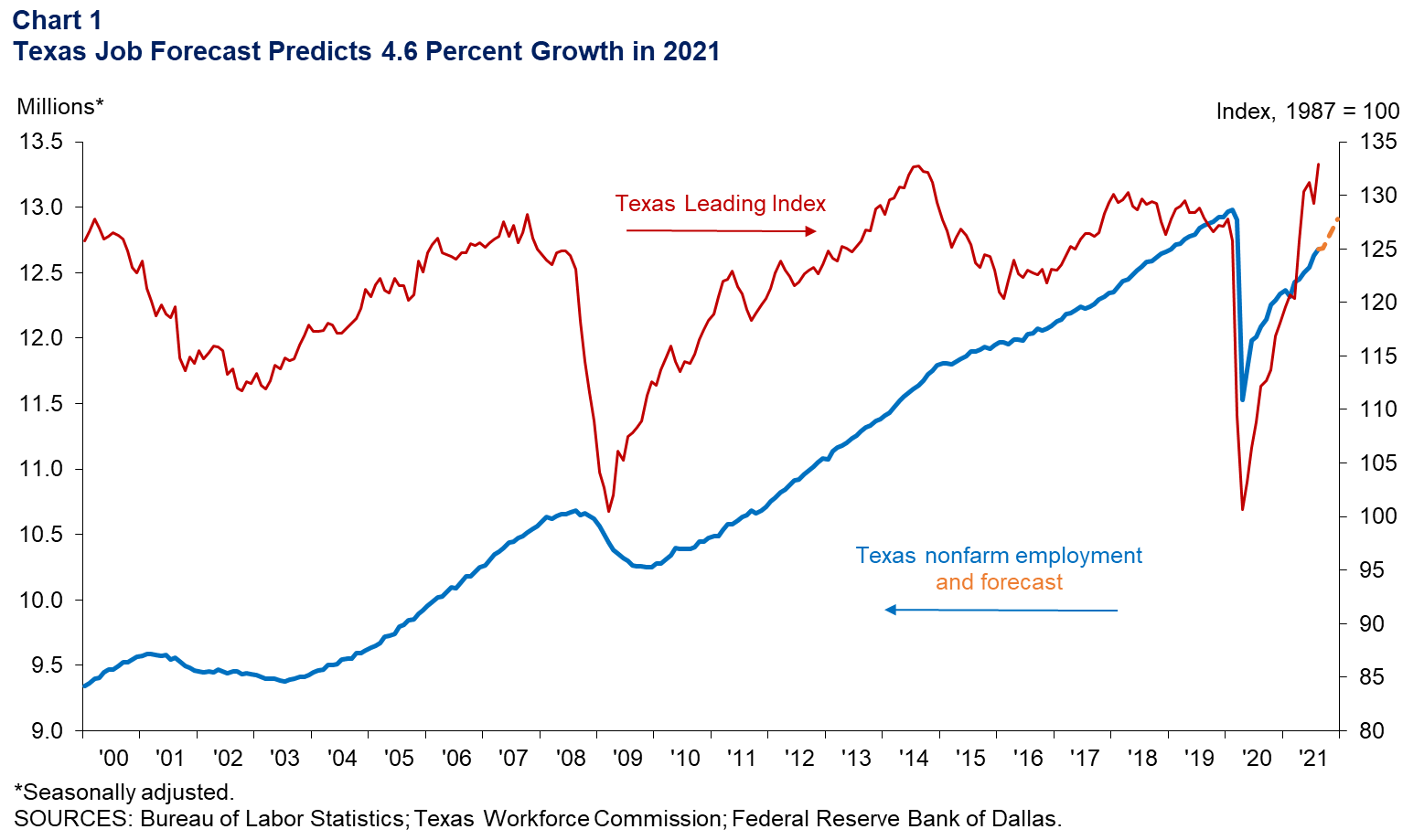

Texas employment growth slowed to a 4.4 percent annualized rate in August after an upwardly revised 9.0 percent (previously 7.1 percent) in July. The Texas Leading Index increased strongly after dipping in July—overall, continuing an upward trend that began in May 2020. The movement of the index over the past three months suggests positive growth over the next three to six months.

Using a top-down model based on national forecasts, Texas COVID-19 hospitalizations and oil futures prices, we estimate that jobs will increase by 4.6 percent in 2021—up from last month’s estimate of 4.3 percent—with an 80 percent confidence band of 4.0 to 5.3 percent. Based on the forecast, 571,800 jobs will be added in the state this year, and employment in December 2021 will be 12.9 million (Chart 1).

“The surge in COVID-19 cases and hospitalizations in August dampened job growth, particularly in high-contact industries such as leisure and hospitality services,” said Keith Phillips, Dallas Fed assistant vice president and senior economist. “Business contacts in most industries reported that the recent COVID-19 surge has had a less-negative impact on demand than past surges but that many were experiencing employees being out sick or in quarantine. Tight labor markets and continued supply-chain issues were constraining output across a wide range of industries.”

The Texas unemployment rate declined from 6.2 percent in July to 5.9 percent in August. With federal unemployment benefits ending in late June and COVID-19 surging in August, labor force growth improved modestly from 1.1 percent in June to 3.2 percent in July but then slowed to 2.0 percent in August.

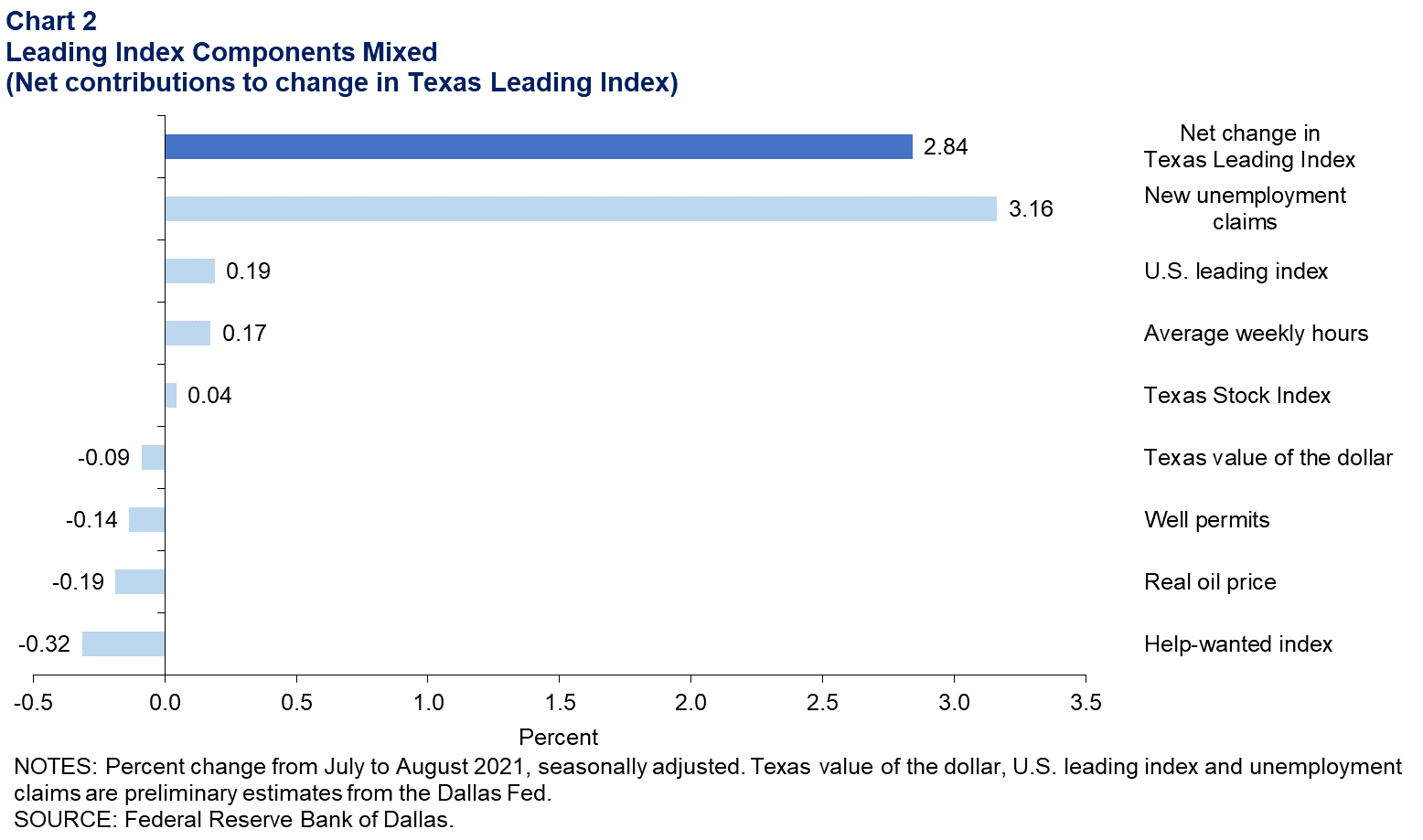

The Texas Leading Index bounced back in August, with four of the eight indicators giving positive contributions (Chart 2). The increase in the index was concentrated in a significant positive contribution from a sharp decline in initial claims for unemployment insurance, which followed a spike in July. The U.S. leading index, average weekly hours worked in manufacturing and the Texas Stock Index gave moderately positive signals. In contrast, moderately negative signals were given by changes in help-wanted advertising, the oil price, permits to drill oil and gas wells, and the Texas trade-weighted value of the dollar.

Next release: October 22, 2021

Methodology

The Dallas Fed Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

Due to the rapid onset of the COVID-19 pandemic, the forecasting model used in this release of the Dallas Fed Texas Employment Forecast differs from the model used historically. In this case, payroll employment is estimated based on expectations for U.S. GDP growth for 2021, an estimate of direct COVID-19 impacts from March to May 2020, projected hospitalizations in Texas for COVID-19 from the Institute for Health Metrics and Evaluation and expected prices of West Texas Intermediate crude oil based on the futures curve.

For additional details, see dallasfed.org/research/forecast/

Contact Information

For more information about the Texas Employment Forecast, contact Keith Phillips at keith.r.phillips@dal.frb.org or Christopher Slijk at christopher.slijk@dal.frb.org.