Texas Employment Forecast

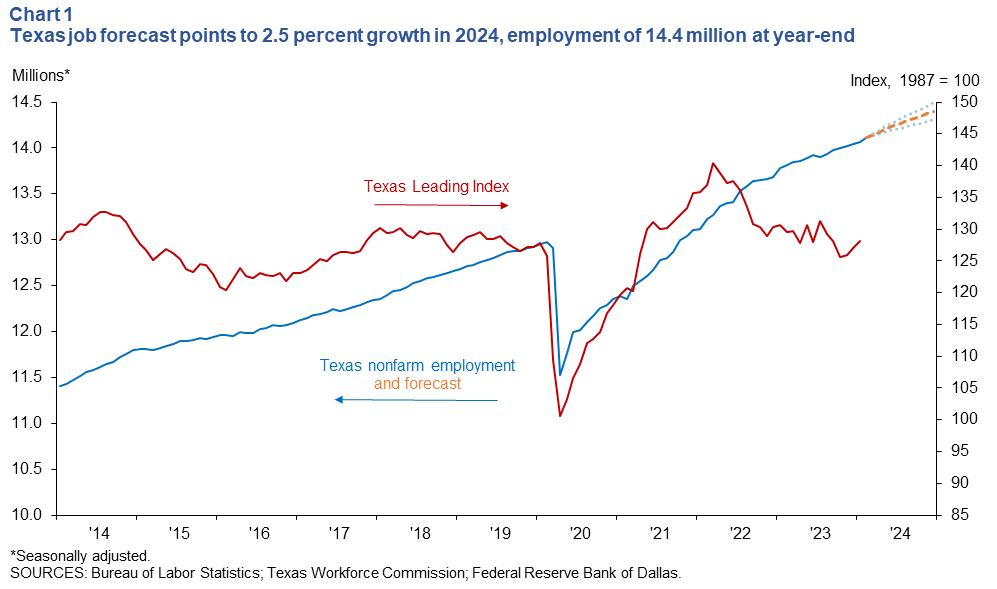

The Texas Employment Forecast indicates jobs will increase 2.5 percent (352,800 jobs) in 2024, with an 80 percent confidence band of 1.9 to 3.1 percent. The forecast is based on an average of four models that include projected national GDP, oil futures prices and the Texas and U.S. leading indexes. The forecast suggests job growth will be above the state’s long-term average, and employment in December 2024 will reach 14.4 million (Chart 1).

Texas employment grew 4.3 percent in February, with 49,000 jobs added, and January employment growth was slightly revised down to 1.9 percent.

“Job growth accelerated in February, with broad-based gains seen across most industries,” said Luis Torres, Dallas Fed senior business economist. “The outlook for growth in the first half has improved by 0.6 percentage points. Strong job gains in February, continued solid U.S. economic growth, and recent increases in oil prices have bolstered the forecast. Though higher oil prices hurt consumers, the rise is a net positive for Texas economic growth.”

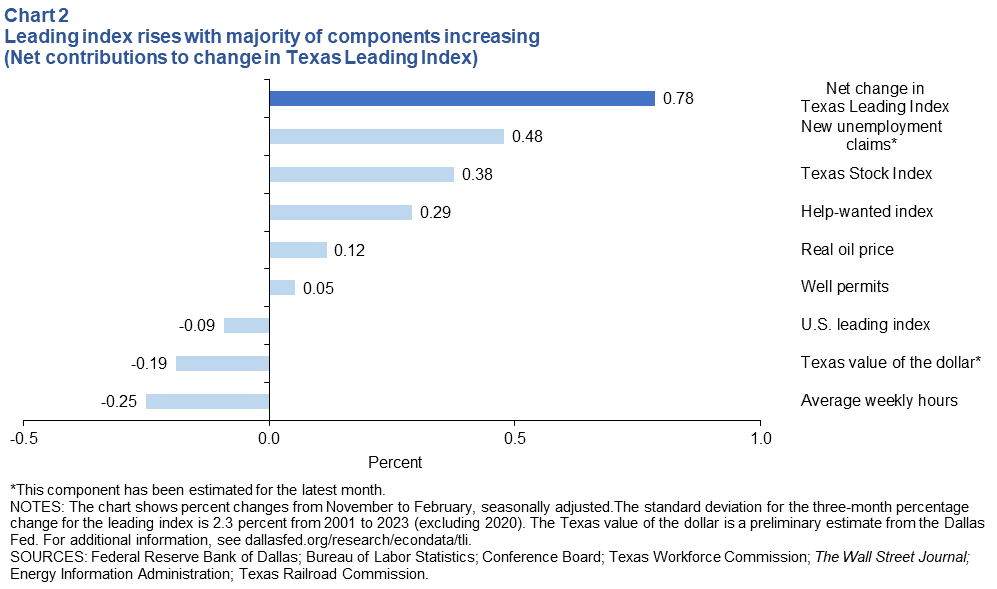

The Texas Leading Index was little changed in February. The three-month change was positive, buoyed by declines in new unemployment claims and increases in the Texas Stock Index and help-wanted advertising (Chart 2). Gains in oil prices and well permits also contributed to growth, while several factors dragged on the index: declines in the U.S. leading index and average weekly hours and increases in the Texas value of the dollar.

Next release: April 19, 2024

Methodology

The Dallas Fed’s Texas employment forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

The forecast is based on the average of four models. Three models are vector autoregressions where Texas payroll employment is regressed on the lags of West Texas Intermediate (WTI) oil prices, the U.S. leading index and the Texas Leading Index, respectively. The fourth model is an autoregressive distributed lag model with regression of payroll employment on lags of payroll employment, current and lagged values of U.S. GDP growth and WTI oil prices, and Texas COVID-19 hospitalizations through March 2023. Forecasts of Texas payroll employment from this model also use as inputs forecasts of U.S. GDP growth from Blue Chip Economic Indicators and WTI oil price futures. All models include four COVID-19 dummy variables (March–June 2020).

For additional details, see dallasfed.org/research/forecast/.

Contact Information

For more information about the Texas Employment Forecast, contact Luis Torres at luis.torres@dal.frb.org.