Austin Economic Indicators

| Austin economy dashboard (March 2025) | |||

| Job growth (annualized) Dec. '24–March '25 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 1.2% | 3.4% | $35.65 | 2.5% |

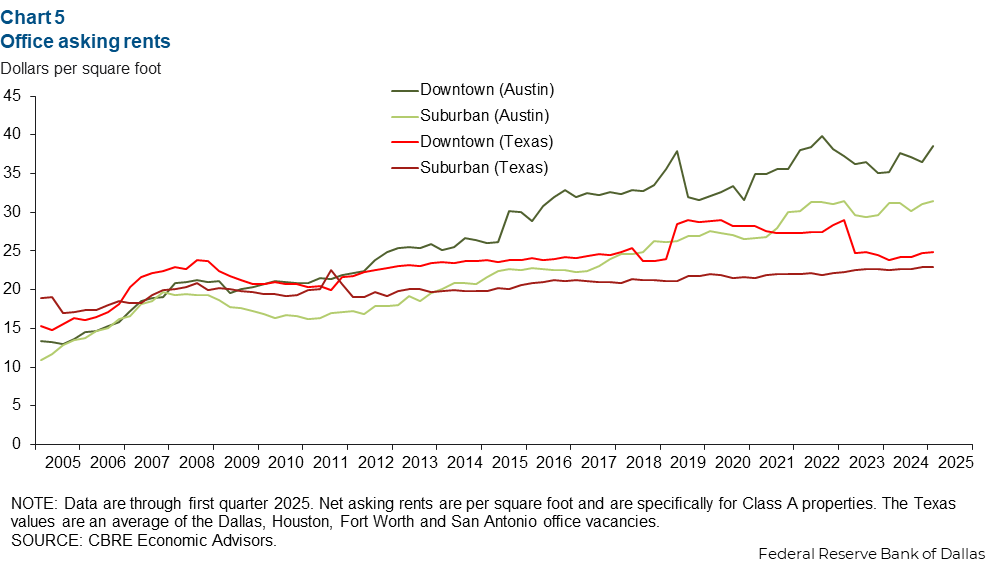

Austin employment rose in March, paired with a stable unemployment rate, and wages increased. Suburban office vacancies increased in the first quarter, while downtown office vacancies declined. In contrast, both suburban and downtown office asking rents increased at the start of the year.

Labor market

Unemployment flat

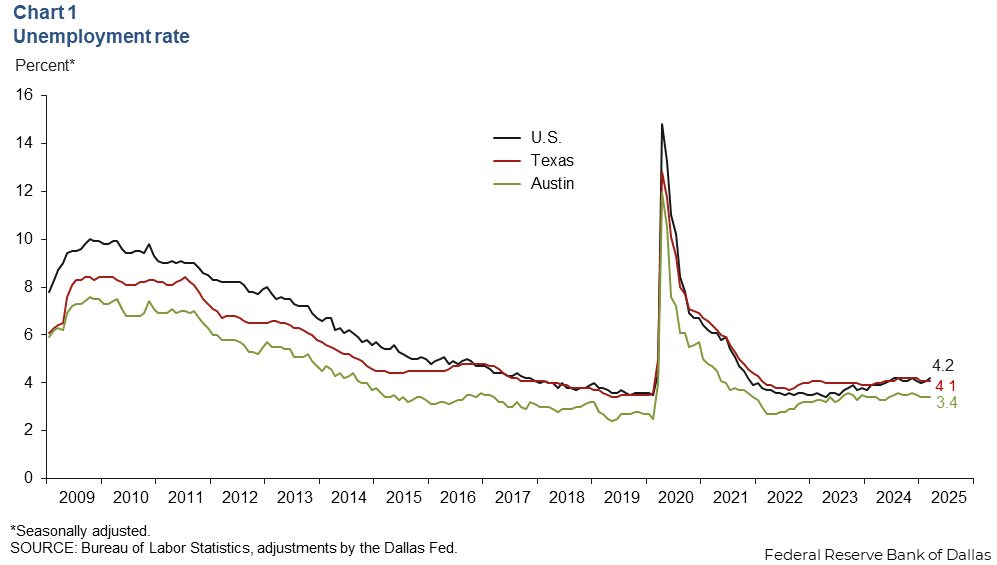

Austin’s unemployment rate stayed at 3.4 percent in March, below the state and national rates of 4.1 and 4.2 percent, respectively (Chart 1). In March, the local labor force decreased slightly, down 0.9 percent, while the state’s increased 0.6 percent, and the nation’s grew 1.6 percent.

Employment growth picks up

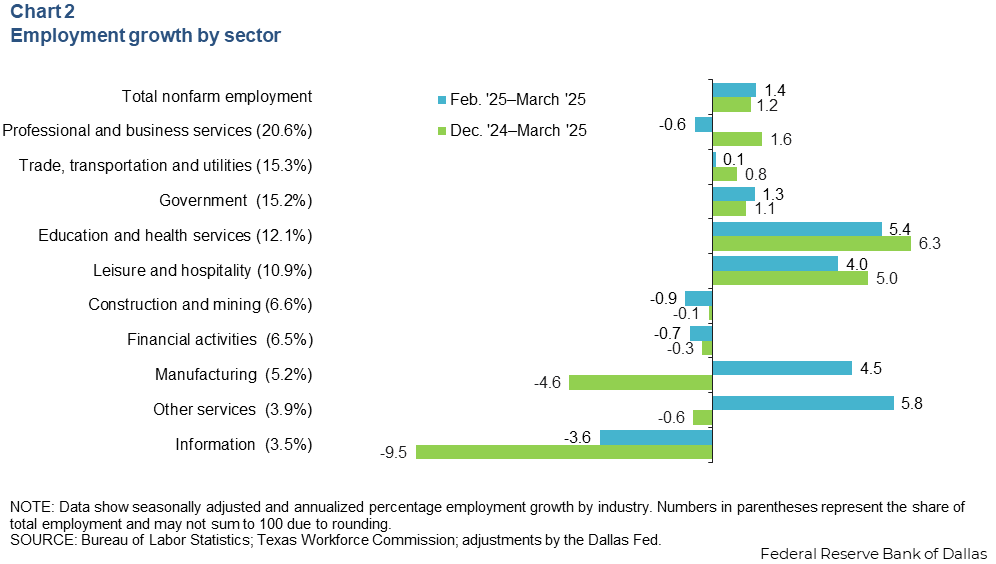

Austin employment increased an annualized 1.4 percent in March—faster than the 0.7 percent growth in February. In the first quarter, employment increased 1.2 percent (Chart 2). The greatest gains were in education and health services (2,550 jobs) and leisure and hospitality (1,810 jobs). Sectors that declined included information (1,220 jobs) and manufacturing (860 jobs). Austin’s year-to-date employment in March grew slower than Texas,’ which boasted 1.9 percent growth, but was was faster than the nation's gains of 1.0 percent.

Wages increase

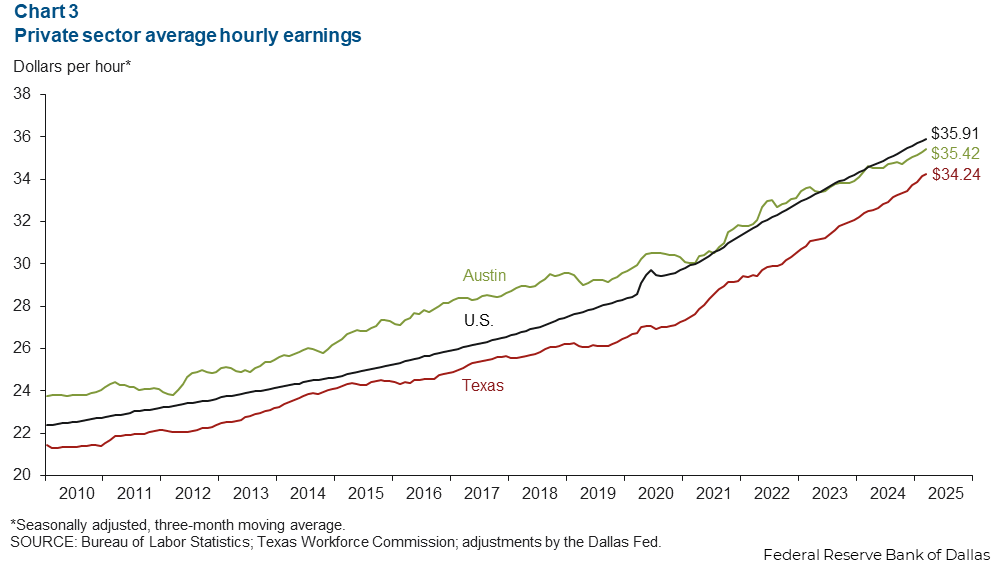

Austin’s average hourly wage was $35.65 in March, up from February. The three-month moving average for wages increased an annualized 4.8 percent in March to $35.42, lower than the nation’s average of $35.91 but higher than the state’s rate of $34.21 (Chart 3). Year over year, Austin’s 2.5 percent wage growth was slower than the state’s and nation’s gains of 5.7 and 3.8 percent, respectively.

Office markets

Office vacancies

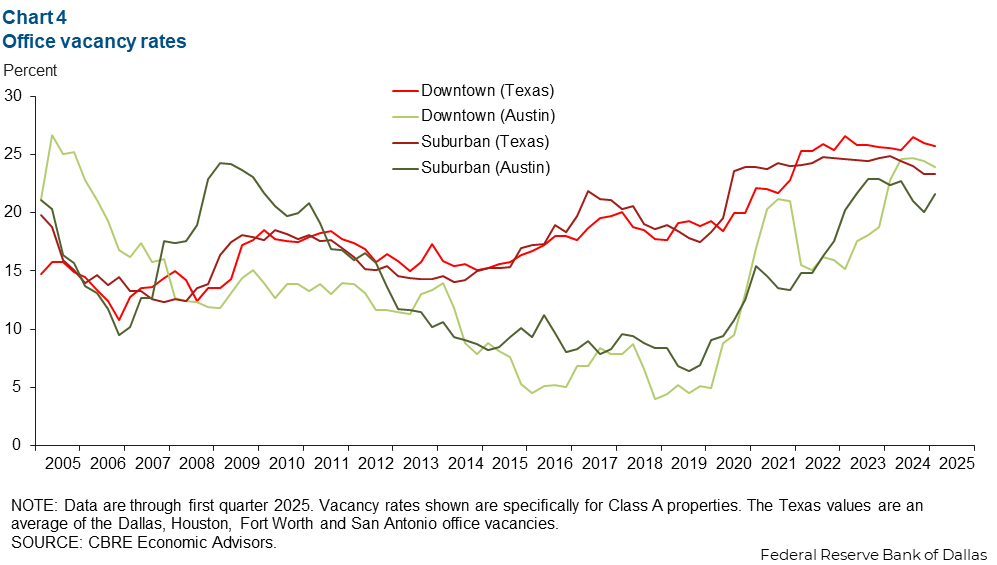

In the first quarter, Austin suburban office vacancies rose to 21.6 percent, while downtown vacancies fell to 23.9 percent (Chart 4). Suburban office vacancies fell sharply in 2024 but are picking back up. Downtown vacancies reached a peak in third quarter 2024 and are now falling.

The Austin suburban and downtown office markets registered lower vacancy than the average of the other Texas metros. The average vacancy rates of the other Texas metros (specifically, Dallas, Houston, Fort Worth and San Antonio) were 23.3 percent for suburban offices and 25.8 percent for downtown locations. These other Texas metros had stable vacancy rates in the first quarter compared with fourth quarter 2024.

Office asking rents

Austin net asking rents increased in the first quarter by 1.5 percent in suburban markets and 5.9 percent in the downtown market (Chart 5). Both markets have had steady rent growth, with the downtown market growing faster. Both downtown and suburban Austin markets’ asking rents grew faster than the other Texas metros, which grew 0.3 percent and 0.1 percent in the first quarter, respectively.

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions or suggestions can be addressed to Isabel Dhillon at Isabel.Dhillon@dal.frb.org.

Austin Economic Indicators is released on the first Thursday of every month.