Dallas-Fort Worth Economic Indicators

Dallas–Fort Worth economic activity accelerated in April, with the Dallas and Fort Worth business-cycle indexes posting above-trend growth and payroll employment climbing in both metros. The unemployment rate held steady near a 17-year low for both Dallas and Fort Worth, and regional real estate indicators point to continued housing growth.

Labor Market

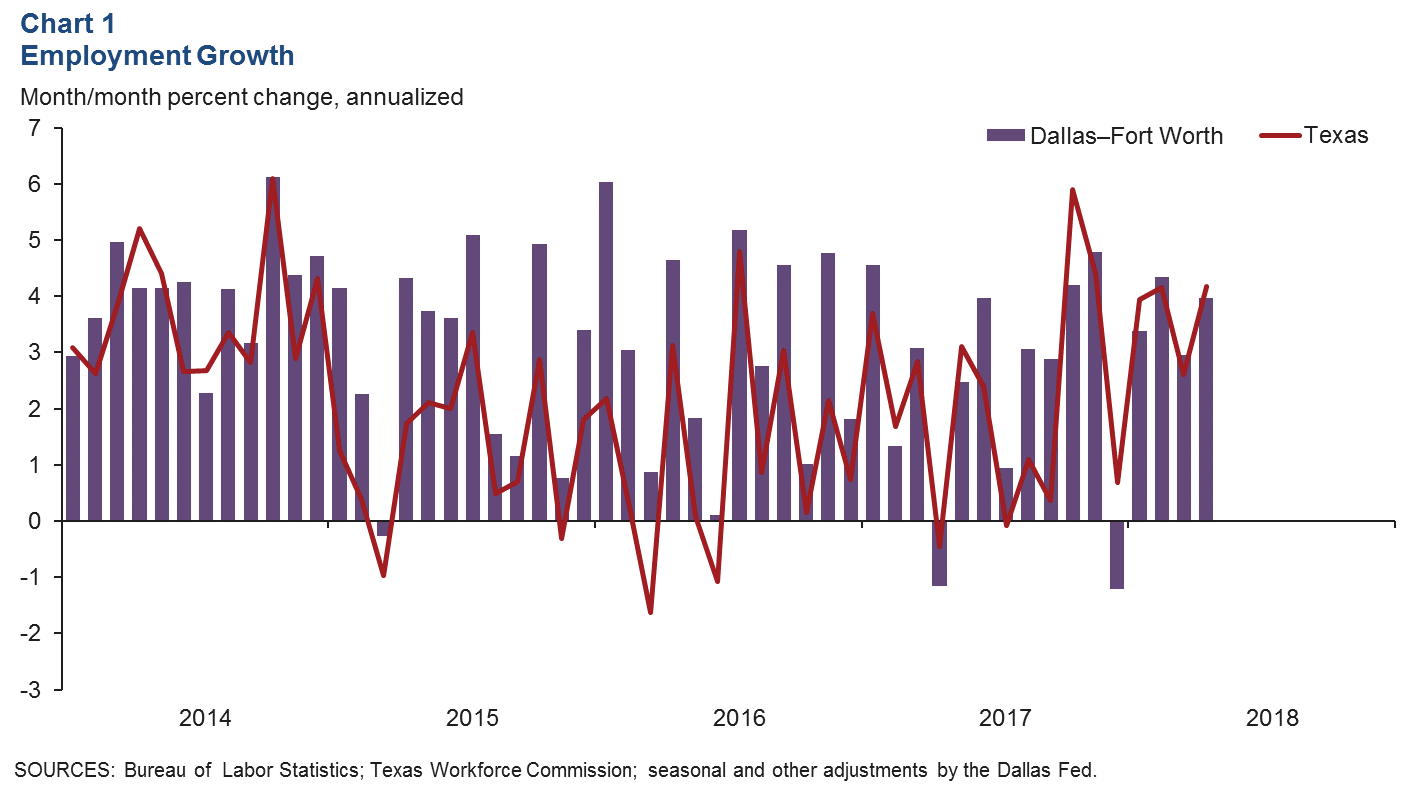

Solid Payroll Expansion in April

DFW jobs grew at a 4.0 percent annualized rate (11,890 jobs) in April (Chart 1). Payrolls in Dallas rose 3.6 percent (7,720 jobs), and Fort Worth saw 4.9 percent growth (4,170 jobs). Year-to-date employment in DFW has expanded at a robust 3.7 percent annual rate, matching the state’s 3.7 percent growth this year and surpassing the metro’s 2.4 percent growth in 2017 (December/December).

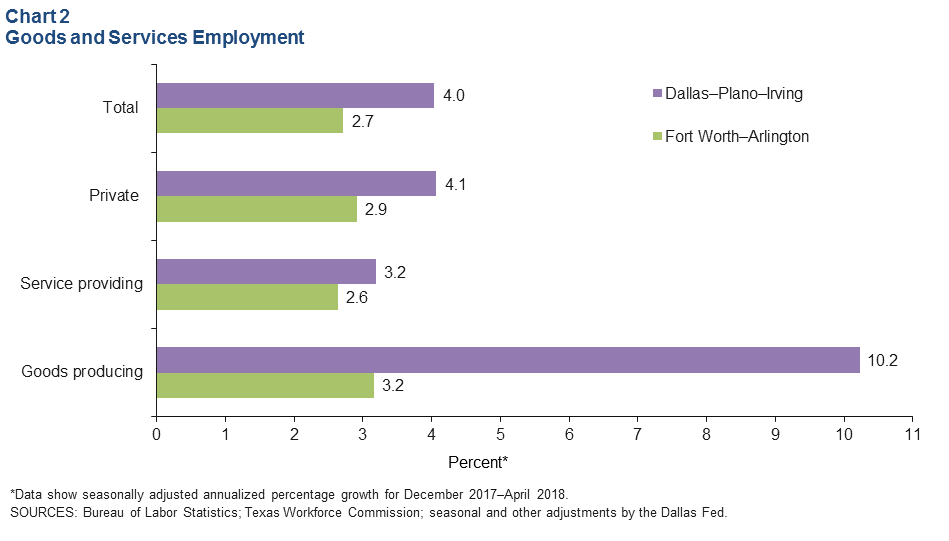

Goods Sector Leads Job Growth

Employment gains have been widespread across sectors in both metros; however, payrolls in the goods-producing sector (manufacturing, construction and mining) expanded at a faster clip than service-related employment (Chart 2). In Dallas, the goods sector saw a solid 10.2 percent increase—more than three times the growth posted by the services sector. Job growth in Fort Worth’s goods-producing sector (3.2 percent) has also outpaced its services sector growth rate (2.6 percent). Through April, payroll expansion in Dallas has outperformed Fort Worth, with Dallas adding jobs at a 4.0 percent annualized pace, ahead of Fort Worth’s 2.7 percent increase.

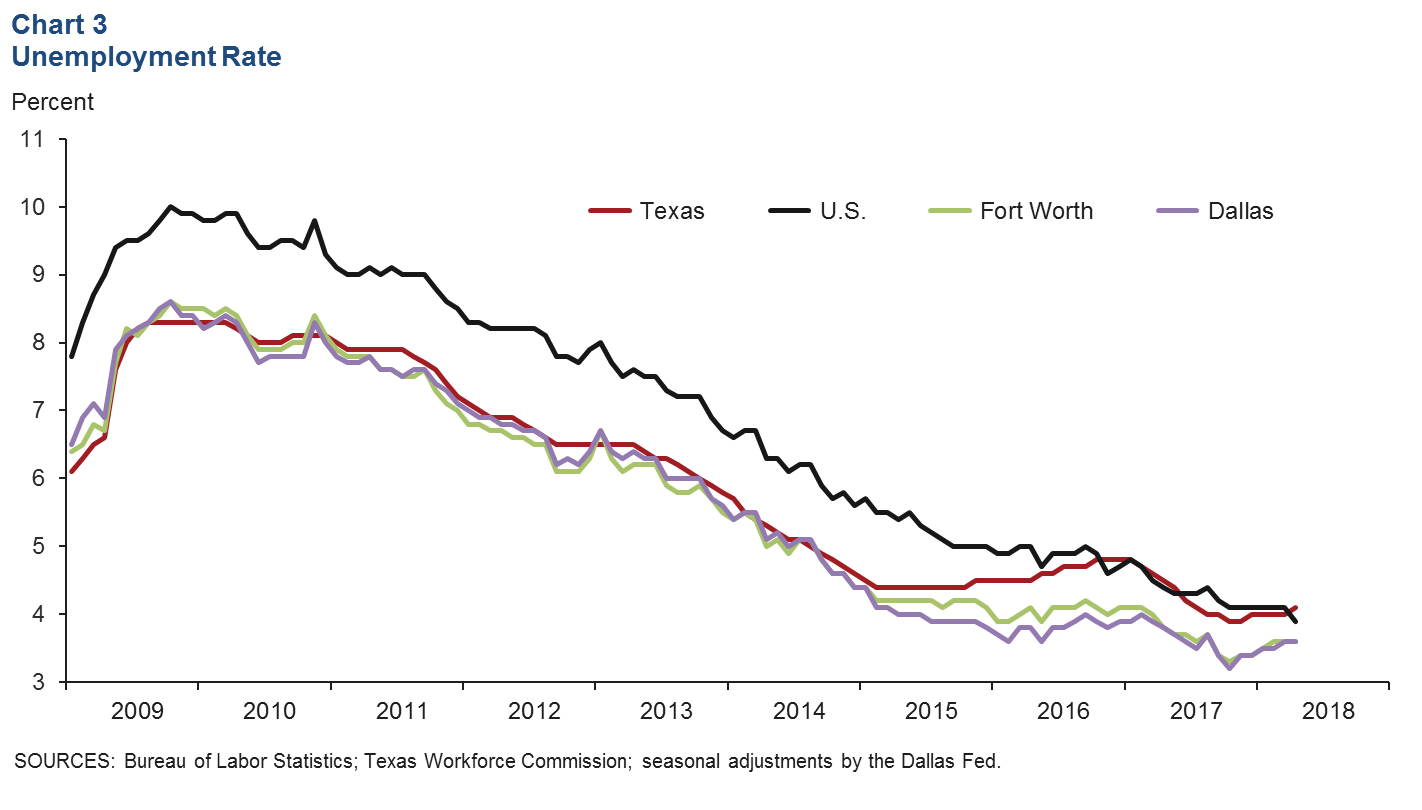

Unemployment Rates Hold Steady Near Multiyear Lows

The labor market remained tight. The jobless rate in Dallas held steady at 3.6 percent in April, near the 17-year low of 3.2 percent seen in October 2017 (Chart 3). Similarly, unemployment in Fort Worth was also unchanged at 3.6 percent—close to its 17-year low of 3.3 percent last seen also in October 2017. Unemployment in both metros remains lower than the state and U.S. rates. Unemployment ticked up to 4.1 percent in Texas, but dipped to 3.9 percent in the U.S.

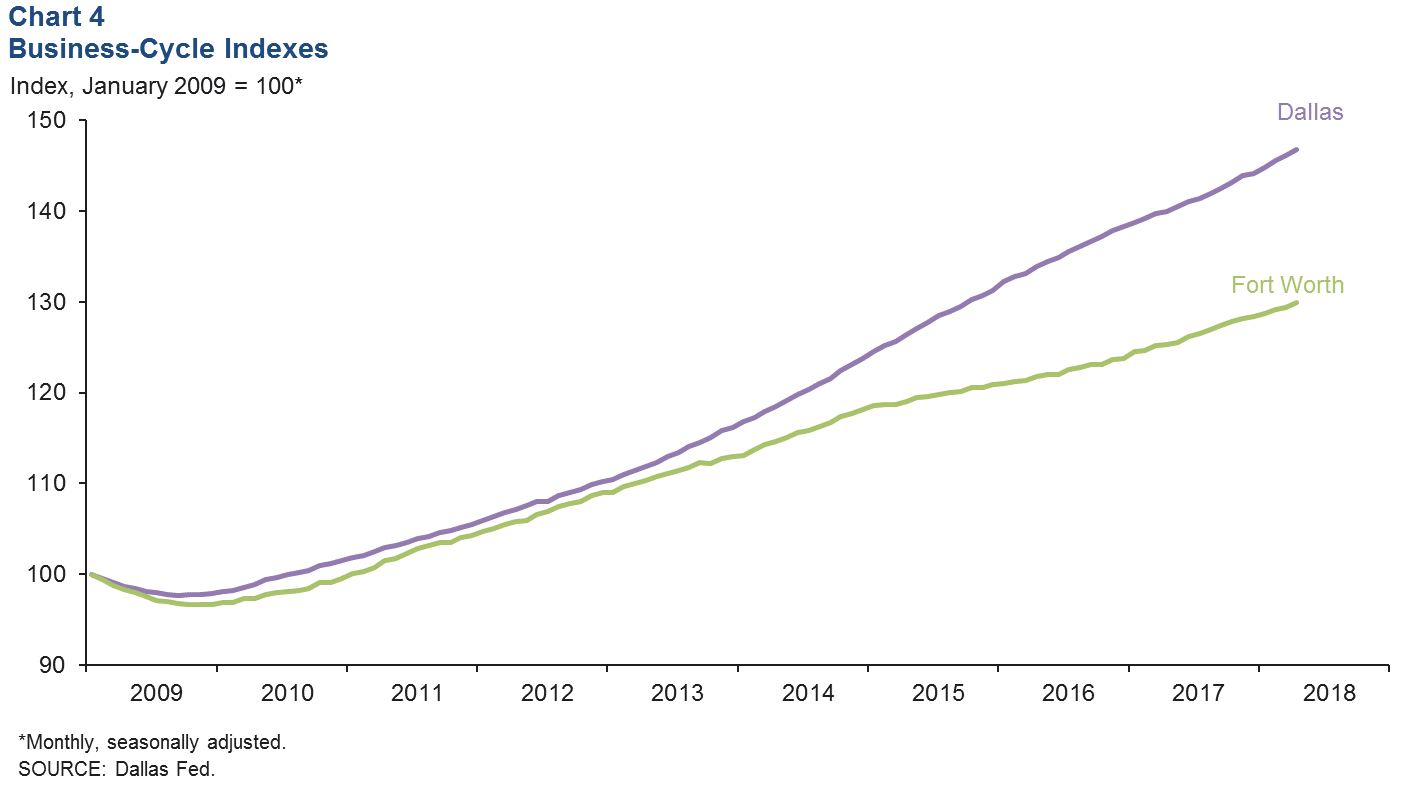

Business-Cycle Indexes

Growth in the Dallas and Fort Worth business-cycle indexes picked up in April, supported by strong job growth and low unemployment in the metroplex (Chart 4). The Dallas index expanded an annualized 5.5 percent in April, faster than March’s 4.6 percent pace. Growth in the Fort Worth index accelerated to 5.3 percent in April, following the previous month’s 2.5 percent increase. Expansion in both indexes was above their long-term averages. Year over year in April, the Dallas index was up 4.8 percent, while the Fort Worth index rose 3.8 percent.

Housing Market

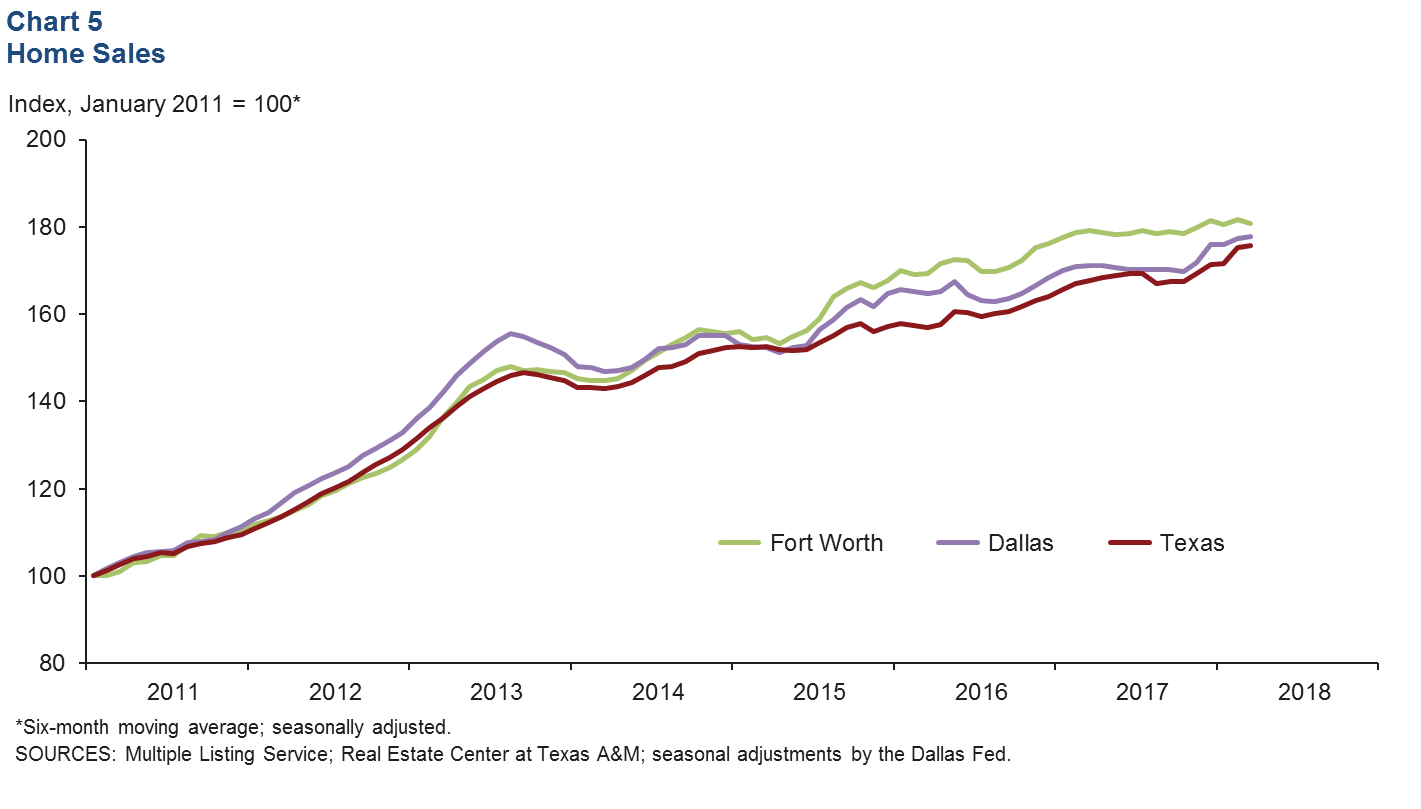

Home Sales Mixed

DFW existing-home sales fell in March after rising in February. The six-month moving averages show a slight increase in Dallas but a dip in Fort Worth (Chart 5). In March, DFW home sales were lower than the all-time high set in December 2017. New-home sales for low- to mid-priced homes remain strong in the metroplex, according to Dallas Fed Beige Book contacts. Through March, existing-home sales were up 1.1 percent in DFW and 3.1 percent in Texas compared with the same period last year.

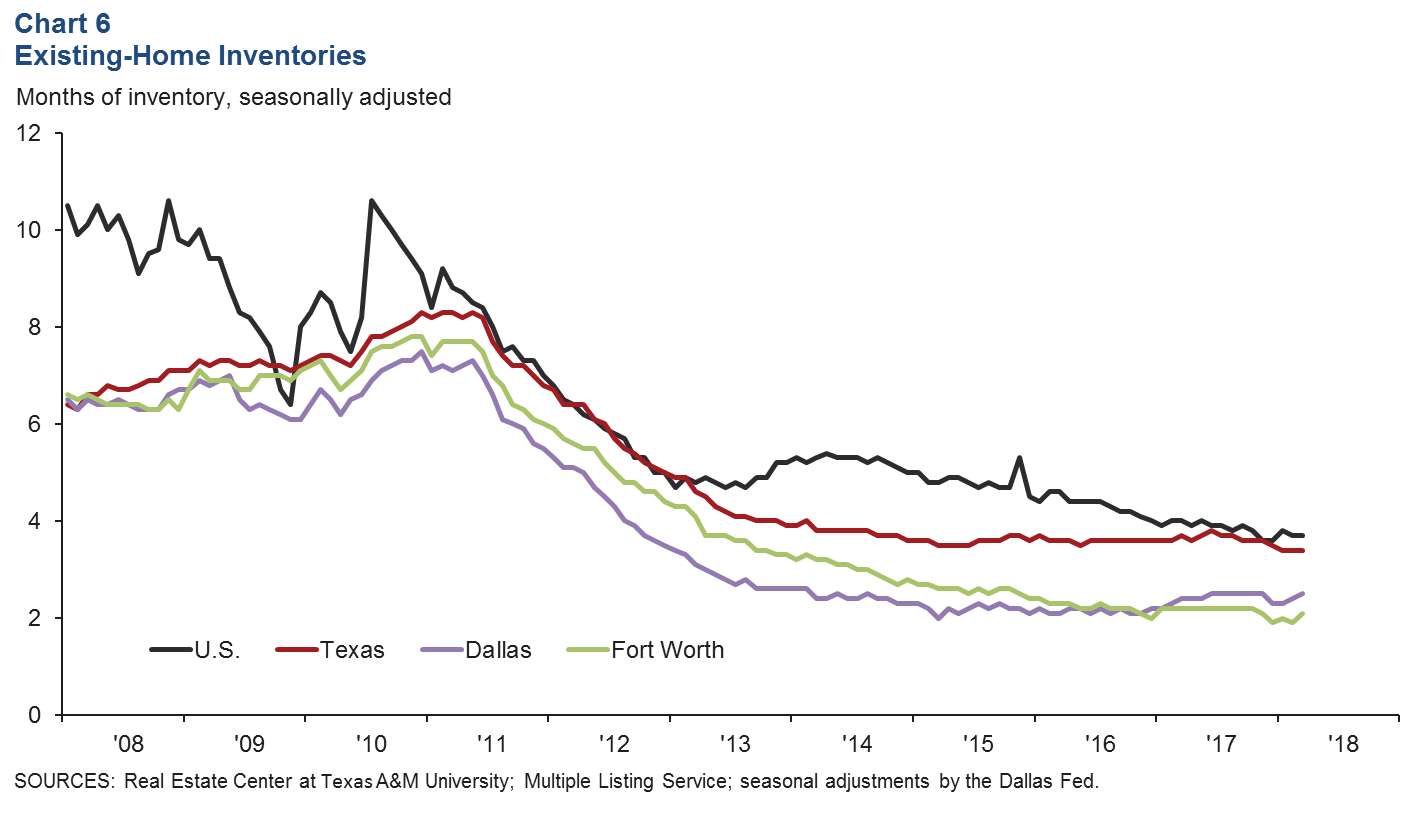

Home Inventories Still Tight

DFW existing-home inventories remain tight at just over two months, well below the six months’ supply typically associated with a balanced market (Chart 6). In March, inventories were at 2.5 months in Dallas and 2.1 months in Fort Worth. Inventories in both metros have been under six months since 2012, putting upward pressure on home prices.

NOTE: Data may not match previously published numbers due to revisions.

About Dallas–Fort Worth Economic Indicators

Questions can be addressed to Laila Assanie at laila.assanie@dal.frb.org. Dallas–Fort Worth Economic Indicators is published every month on the Tuesday after state and metro employment data are released.