Dallas-Fort Worth Economic Indicators

| DFW economy dashboard (April 2024) | |||

Job growth (annualized)

Jan.–April '24 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

2.8% |

3.8% | $34.50 | 0.8% |

The Dallas–Fort Worth economy strengthened in April. Payroll employment accelerated, and unemployment remained stable. Retail sales tax collections dipped. Apartment demand increased, but rents remained flat, and multifamily construction permits rose strongly.

Labor market

Job growth strengthens

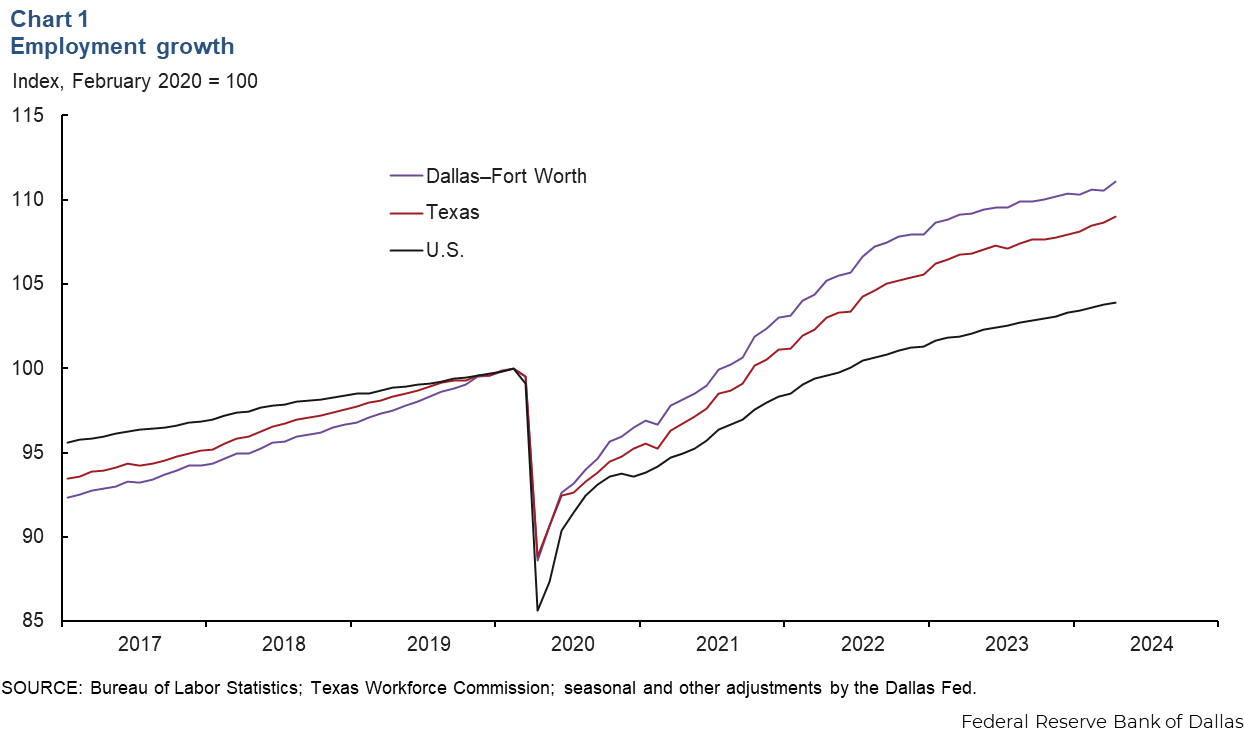

DFW employment expanded an annualized 6.0 percent (20,700 jobs nonannualized) in April (Chart 1). Payrolls in Dallas rose an annualized 6.5 percent (16,100), and Fort Worth employment grew 4.7 percent (4,600). Meanwhile, Texas job growth increased to 4.0 percent in April after rising 1.5 percent in the prior month. U.S. payroll employment grew 1.3 percent in April. Through April, DFW employment has risen a modest 1.9 percent (annualized), in line with U.S. job growth but lagging behind the state’s 2.9 percent increase.

Unemployment remains stable

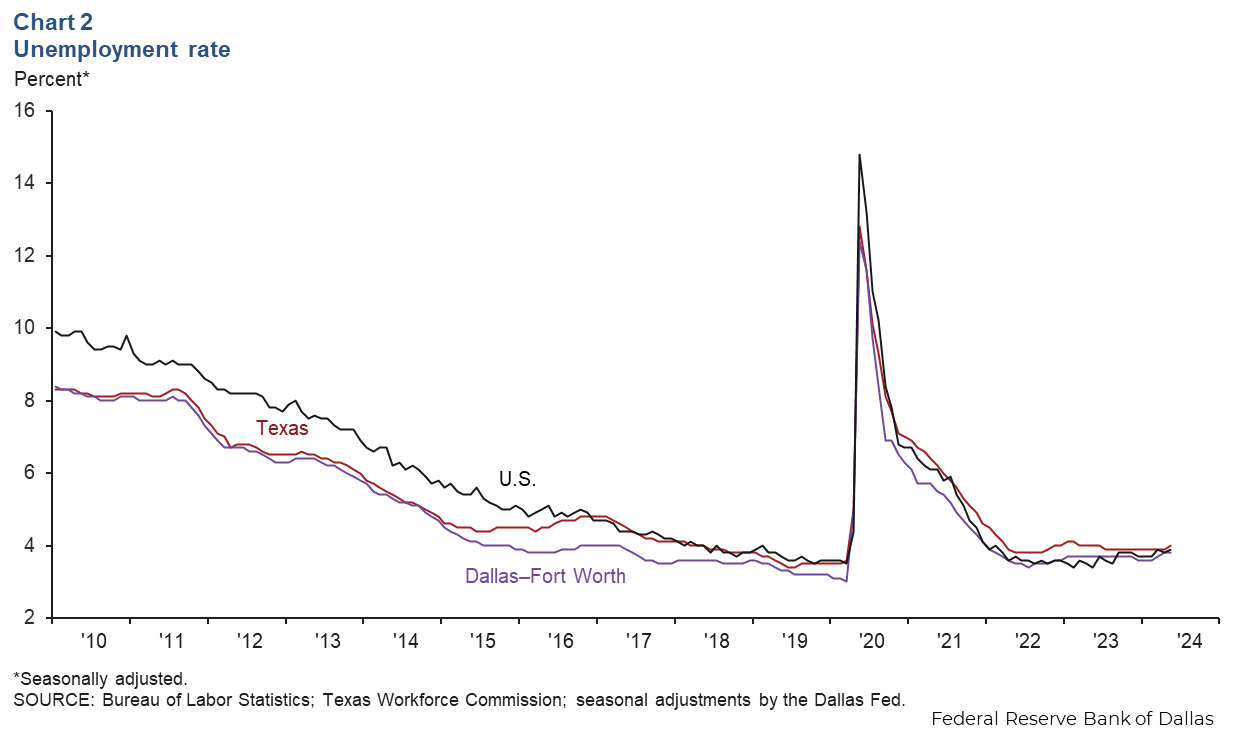

The DFW labor market continued to be tight in April. The DFW unemployment rate held steady at 3.8 percent, below the state’s jobless rate of 4.0 percent and the nation’s 3.9 percent (Chart 2). The labor force expanded an annualized 2.2 percent in DFW and in Texas from January through April, outpacing the nation’s 1.7 percent increase.

Retail sales tax collections

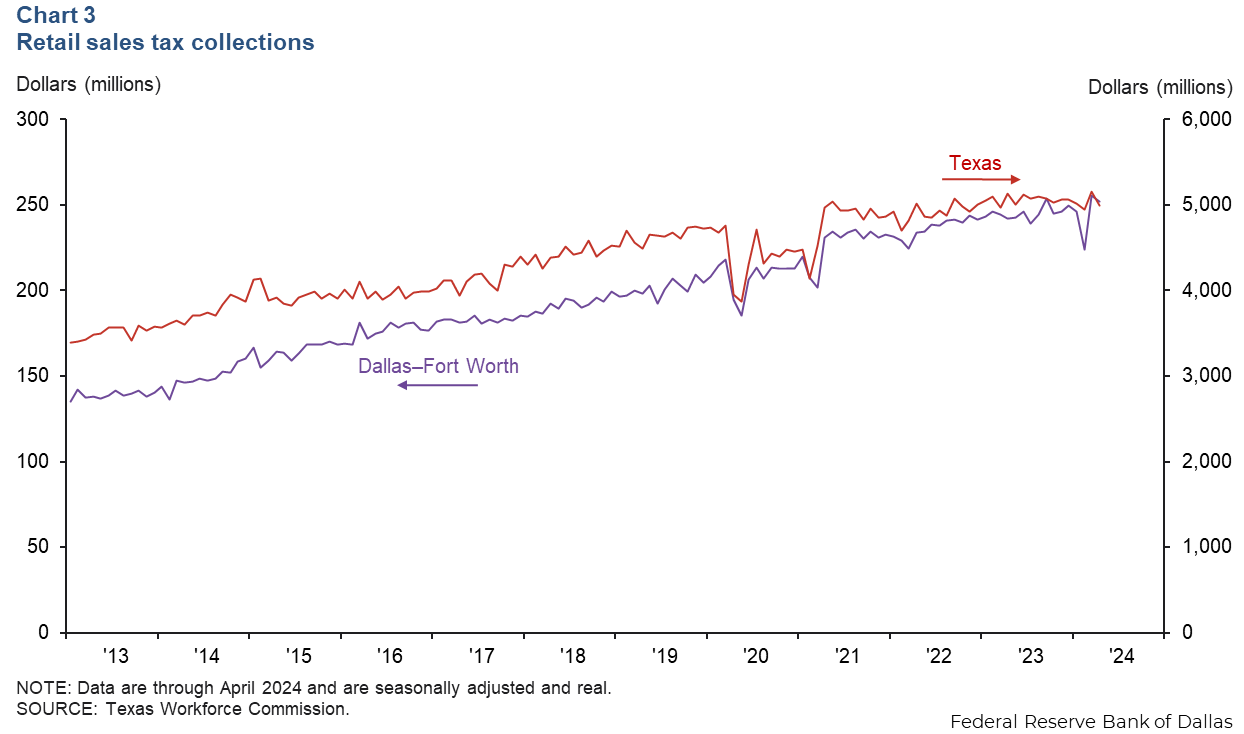

In April, DFW retail sales tax collections dipped to $252 million (Chart 3). Sales tax collections were down 1.2 percent in Dallas, 0.5 percent in Fort Worth and 3.1 percent in Texas. Year over year, the metroplex’s retail sales tax collections were up 4.0 percent, while Texas’ collections fell 2.6 percent.

Multifamily housing

Apartment absorption picks up

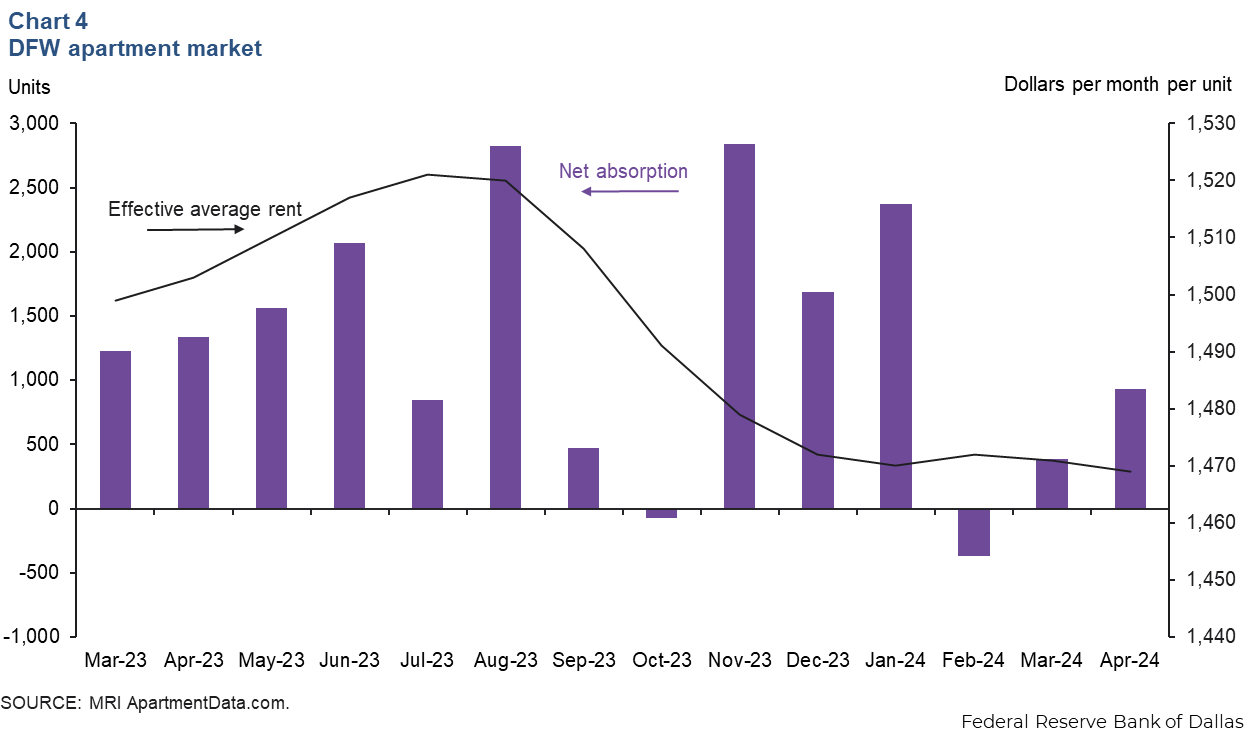

DFW apartment absorption strengthened in March and April following weak demand in February. Net absorption was 1,300 units in those two months (Chart 4). Even with demand improving, effective monthly rents in DFW were relatively flat at $1,469 per unit in April compared with year-end 2023 and were down 2.3 percent from year-ago levels. Occupancy dipped to 88.6 percent and was 2.1 percentage points below April 2023 levels. An elevated level of apartment completions continues to weigh down occupancy and rents.

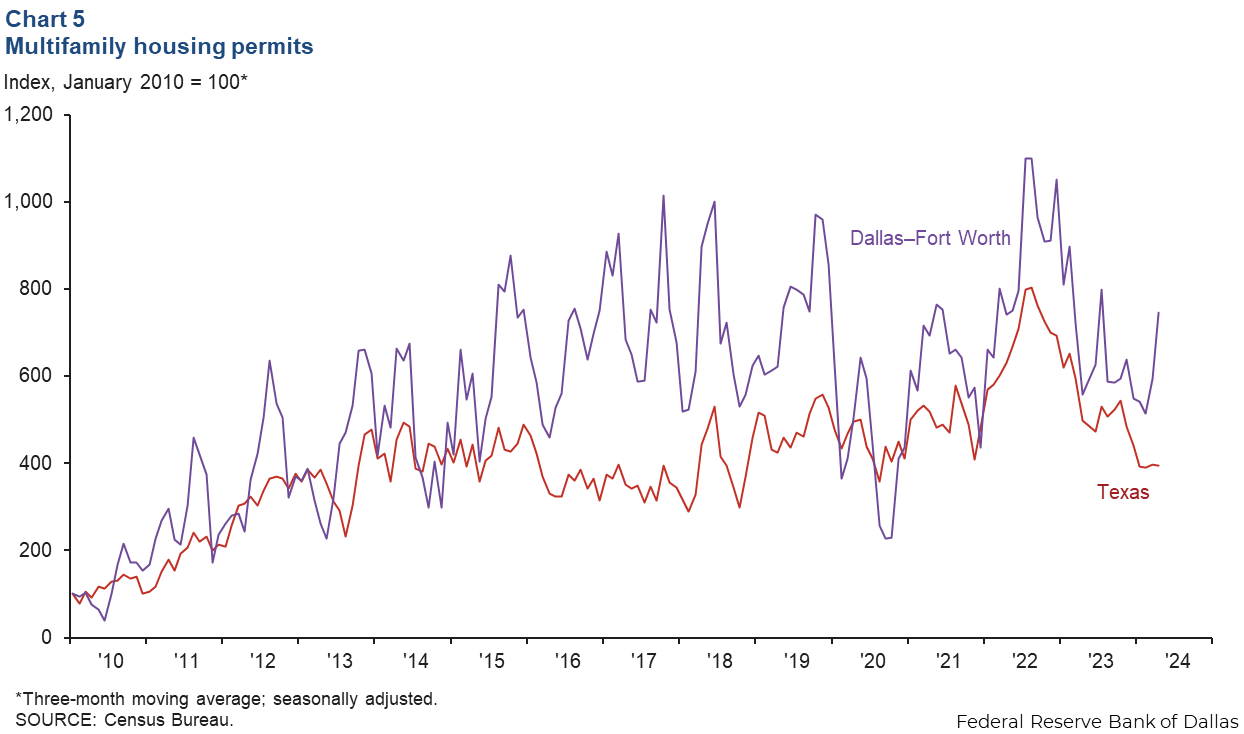

Multifamily permit issuance rebounds

Multifamily permit issuance, which leads apartment construction, climbed in April (Chart 5). The three-month moving average of multifamily permits rose 25.5 percent in DFW but was flat in Texas. DFW multifamily building remains elevated compared with historical levels, with the metroplex ranking among the busiest large U.S. metros in apartment construction.

NOTE: Data may not match previously published numbers due to revisions.

About Dallas–Fort Worth Economic Indicators

Questions or suggestions can be addressed to Laila Assanie at laila.assanie@dal.frb.org. Dallas–Fort Worth Economic Indicators is published every month after state and metro employment data are released.