Houston Economic Indicators

| Houston economy dashboard (October 2023) | |||||

| Job growth (annualized) July–Oct. '23 |

Unemployment rate |

Avg. hourly earnings | Avg. hourly earnings growth y/y |

||

| 3.7% | 4.4% | $34.65 | 9.6% | ||

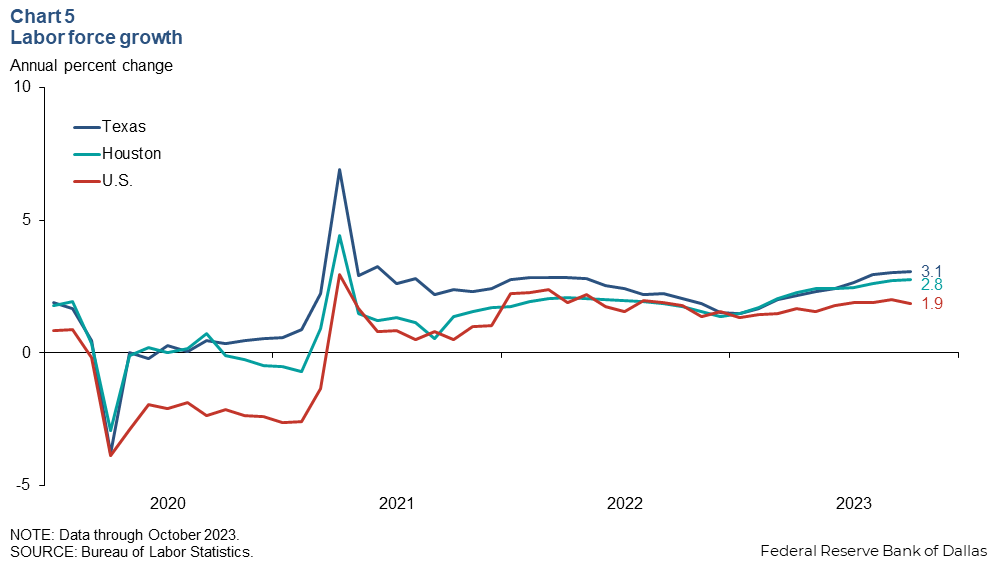

Houston employment was stronger than anticipated in October, as the latest early benchmark revision put employment growth at 3.0 percent in the 12 months ending in October 2023. Leisure and hospitality, government and information led growth, while professional and business services and construction showed declines from July to October. Real earnings in the metro area are higher than the state, the nation and the major Texas metros, but so is unemployment. Houston’s labor force continued to grow faster than the national average but below the state average in September.

Employment

Houston job growth revised up in early benchmark

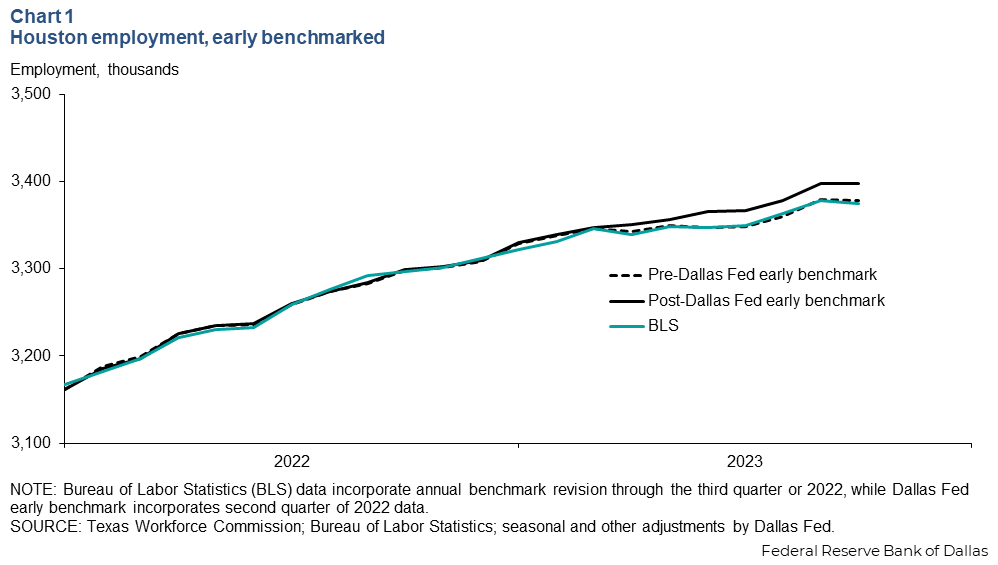

Houston employment reached 3.4 million jobs in October 2023, according to the latest data benchmarked by the Dallas Fed (Chart 1). The latest early benchmark revision added 0.6 percent to October employment when compared with the unadjusted release.

These data were revised according to the Dallas Fed’s early benchmarking procedure, which adjusts the payroll survey to match the growth shown in the Quarterly Census of Employment and Wages (QCEW). Since the QCEW covers about 97 percent of employment compared with the payroll survey’s less than 30 percent, this adjustment produces a more accurate estimate of Houston employment than the initial release.

Leisure and hospitality leads growth while construction drives declines

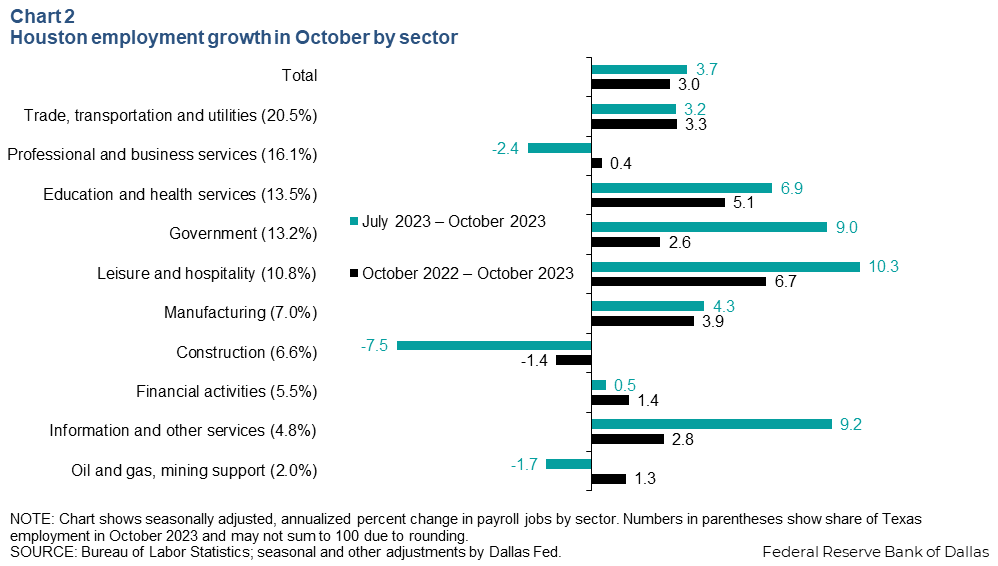

After accounting for the benchmark, Houston employment grew an annualized 3.7 percent (30,474 jobs) in the three months ending in October (Chart 2). The leisure and hospitality sector grew a whopping 10.3 percent (8,899 jobs), with government (9,578 jobs) and information and other services (3,529 jobs) both growing more than 9 percent.

However, construction continued the decline that began in January 2023, with employment falling an annualized 7.5 percent (-4,417 jobs) from July to October. The sector’s employment is 1.4 percent below its October 2022 level and 2.8 percent below its January 2023 peak. Professional and business services and oil and gas also fell over the last three months, declining 2.4 percent and 1.7 percent, respectively.

Labor market

Real earnings in Houston higher than Texas, U.S.

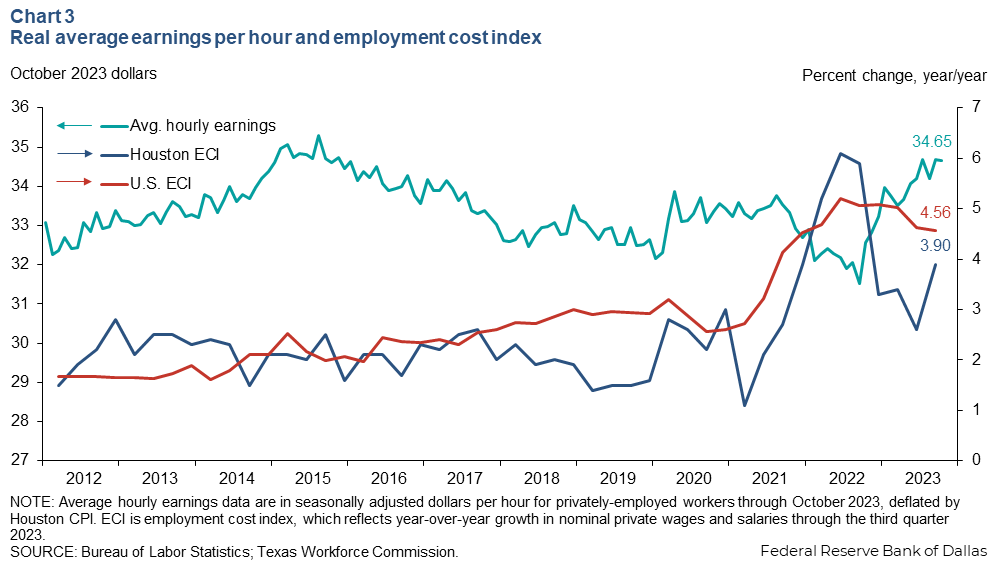

In October, real Houston average earnings per hour reached $34.65, a level not seen since early 2015 (Chart 3). However, the growth in wages and salaries as measured by the employment cost index, which controls for composition effects, was slower in the third quarter of 2023 than the nation overall, coming in at 3.9 percent compared with the nation’s 4.6 percent. This is a smaller gap than the second quarter of 2023, when Houston wages grew 2.6 percent year over year while the nation’s wages and salaries grew 4.6 percent.

Houston unemployment dips, still higher than state and nation

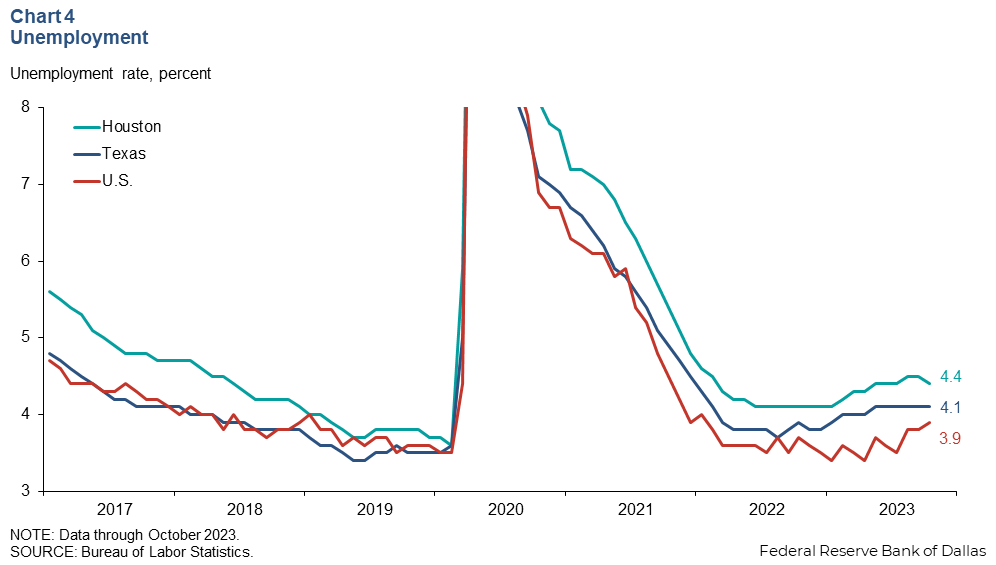

Houston-area unemployment ticked down to 4.4 percent in October after reaching 4.5 percent in both September and October (Chart 4). Houston unemployment is historically higher than both the state and the nation, even in the prepandemic era, and that held true in October as Texas posted 4.1 percent and the nation had 3.9 percent unemployment.

Compared with other major Texas metros, Houston unemployment is on the higher end. Dallas (3.8 percent), Austin (3.4 percent) and San Antonio (3.8 percent) all had lower unemployment rates in October, while El Paso was just slightly higher at 4.5 percent.

Houston labor force grows faster than U.S., lags Texas

Houston’s labor force grew 2.8 percent in the 12 months ending in October, compared with 3.1 percent for Texas and 1.9 percent for the U.S. (Chart 5). Houston's labor force growth has outpaced the nation since January 2023, and has lagged the state since July. Strong labor force growth is a good sign for the state and the metro, as the inflows of jobs and people stimulate the local economy and help it grow.

NOTE: Data may not match previously published numbers due to revisions.

About Houston Economic Indicators

Questions or suggestions can be addressed to Ana Pranger at ana.pranger@dal.frb.org. Houston Economic Indicators is posted on the second Monday after monthly Houston-area employment data are released.