Permian Basin Economic Indicators

The Permian Basin economy continued its rapid expansion in May. Employment surpassed its prebust peak as unemployment fell to a record low. Oil indicators (rig count, spot price and production) remain robust despite some moderate weekly rig count readings in June. Home sales fell slightly as prices accelerated. New banking data show increases in all loan categories, with most categories outpacing U.S. and Texas gains.

Labor Market

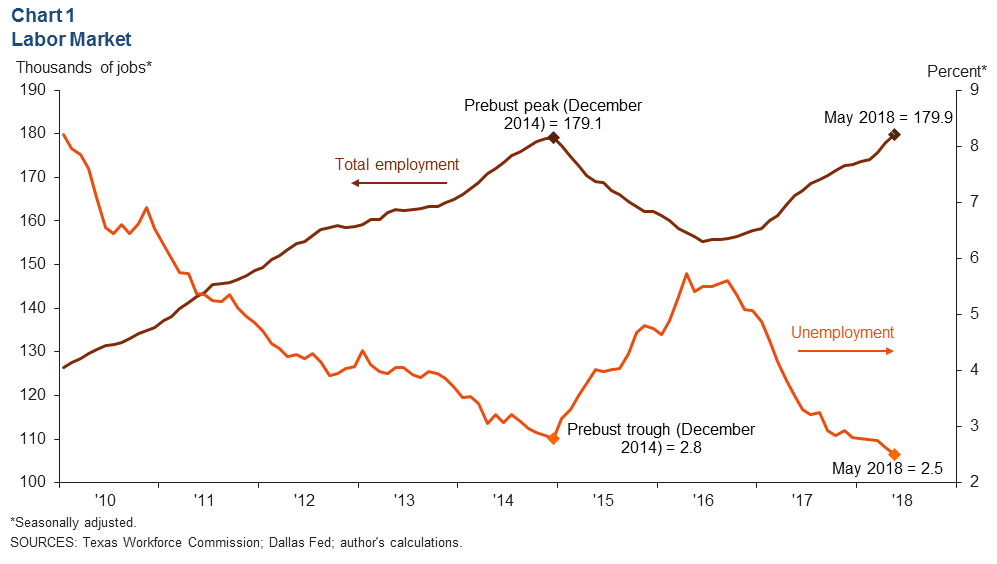

Midland–Odessa’s total nonfarm employment grew at a 14 percent annualized rate between April and May. This is the third month in a row Midland–Odessa has added jobs at an annualized rate above 10 percent. With this acceleration in hiring, total nonfarm employment stood at 179,900 in May, surpassing its prebust peak of 179,100 set in December 2014 (Chart 1).

Midland–Odessa’s unemployment rate fell to a fresh low of 2.5 percent in May from 2.6 percent in April. This is significantly under the U.S. rate of 3.8 percent and the Texas rate of 4.1 percent.

Energy

Rig Count Remains Stable, Production Increases

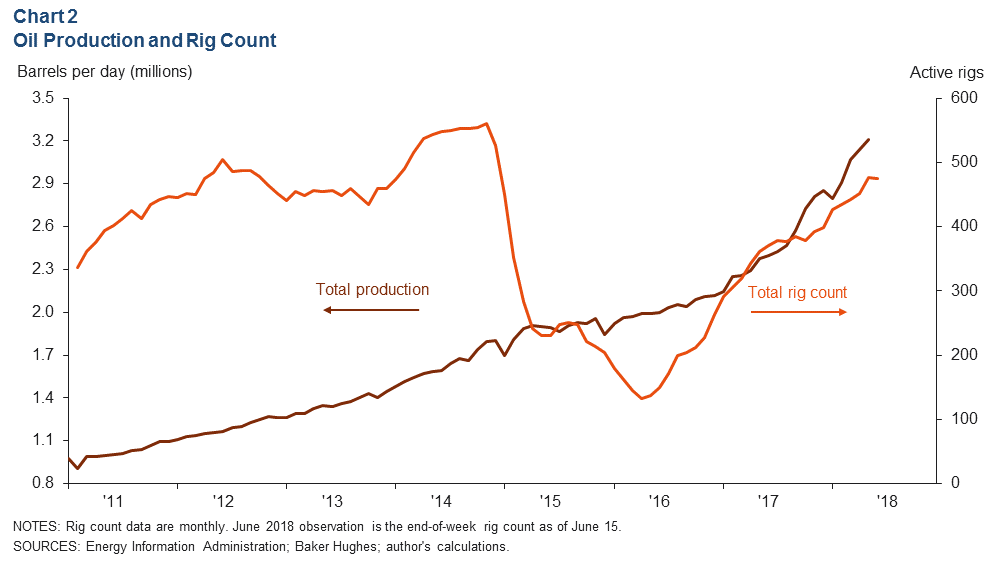

The Permian Basin rig count at the end of May was 477, a 5.5 percent increase from April (Chart 2). The rig count has averaged about the same in June’s weekly readings and was at 475 for the week ending June 15. The Permian Basin currently accounts for about 55 percent of the total U.S. rig count, which ended May at 859 and has inched up in June.

The Permian’s production rose by about 70,000 barrels per day (b/d) for the second month in a row to 3.21 million b/d in May. The Energy Information Administration expects production to increase by a similar amount in June. Beige Book contacts reported that drilling and completion activity expanded in May but expressed concerns about future production constraints such as pipeline capacity, labor shortages and supply-chain issues.

Price of WTI Recedes During June

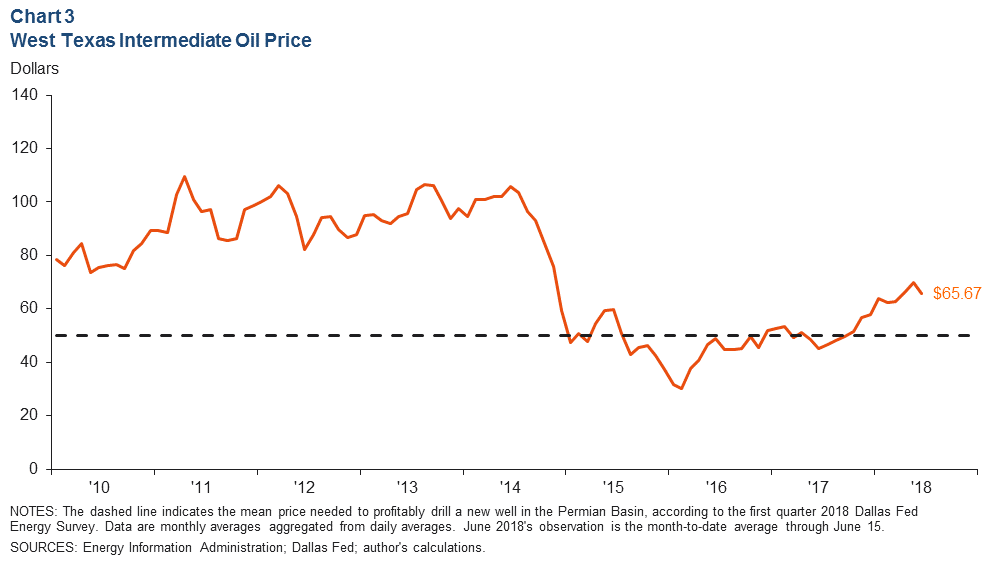

The West Texas Intermediate (WTI) spot price averaged about $70 per barrel in May—an increase from about $66.25 in April (Chart 3). May’s increase was largely related to geopolitical issues in major oil-producing countries such as Iran and Venezuela. Prices have receded during June as Saudi Arabia and Russia expressed a willingness to increase production and offset potential issues. The WTI spot price has averaged $65.67 per barrel during the first half of June. The average is still well above the Permian Basin’s breakeven price.

Permian’s Drilled but Uncompleted Wells Still on the Rise

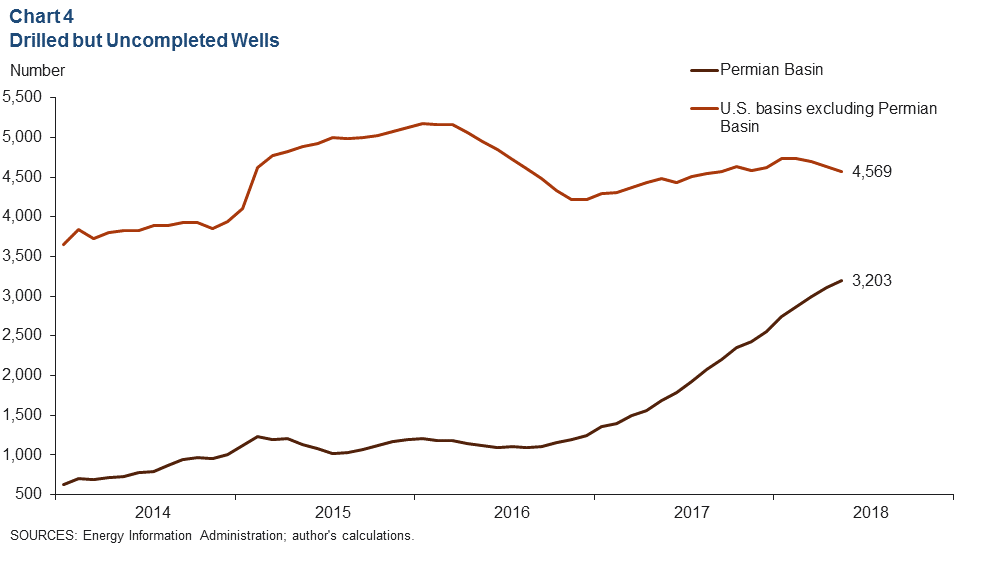

The Permian Basin’s number of drilled but uncompleted wells (DUCs) expanded to 3,203 between April and May, while the DUC count outside the Permian Basin declined to 4,569 in May (Chart 4). The number of DUCs has nearly doubled in the Permian over the past year, accounting for just over 40 percent of total U.S. DUCs.

Housing

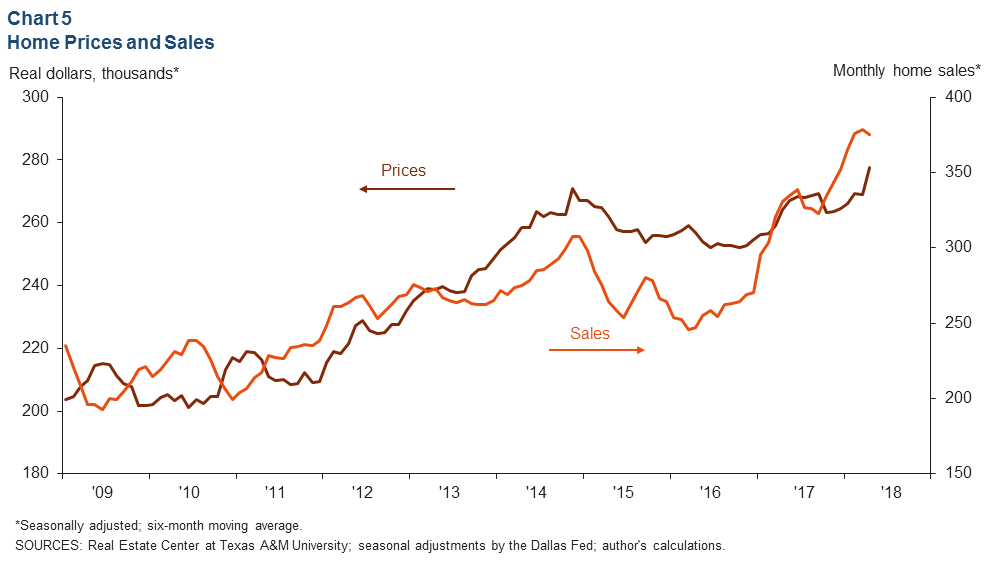

Sales Fall and Prices Accelerate in Midland–Odessa

The six-month moving average for existing-home sales ticked down from 378 in March to 375 in April—the first decrease since September 2017 (Chart 5). Year-over-year growth in the six-month moving average for home sales has moderated in recent months but remains robust. Prices accelerated between March and April, with the six-month moving average rising from about $268,900 to just under $277,800. Existing-home inventories and total listings remain constrained in Midland and Odessa.

Banking

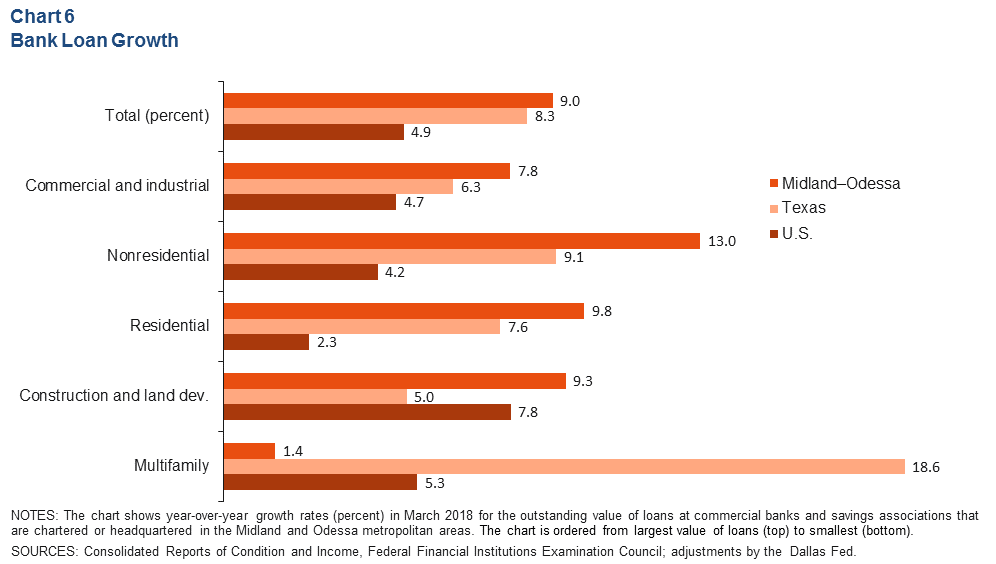

The outstanding value of loans increased 9 percent in Midland–Odessa in first quarter 2018 compared with the year-ago quarter—faster than the Texas and U.S. averages (Chart 6). Almost all loan categories in the area grew faster than in the state and the U.S., except for multifamily housing loans. The value of the Midland–Odessa’s nonresidential real estate loans, which is the largest commercial real estate loan type as a share of total assets, grew the fastest of all loan categories.

NOTES: Data are for the Midland–Odessa metropolitan statistical area (Martin, Midland and Ector counties), except for energy data, which cover the 55 counties in West Texas and southern New Mexico that make up the Permian Basin region. Data may not match previously published numbers due to revisions.

About Permian Basin Economic Indicators

Questions can be addressed to Dylan Szeto at Dylan.Szeto@dal.frb.org. Permian Basin Economic Indicators is released on the third Wednesday of every month.