Permian Basin Economic Indicators

Permian Basin total nonfarm employment picked up in July, but year-to-date payrolls remain flat. Oil production reached a new high last month, while the rig count has steadied and growth in the number of drilled but uncompleted wells has also slowed. Existing-home sales continued to fall, while the median home price climbed further.

Labor Market

Employment Flat

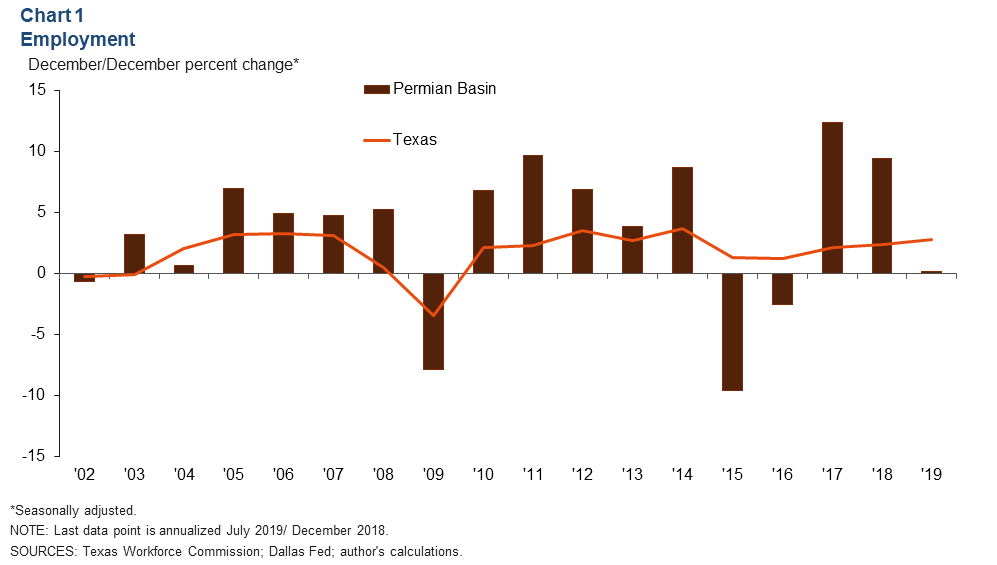

Permian Basin job growth has been sluggish this year. Through July, employment is little changed at an annualized 0.1 percent (Chart 1). This marks the first time since 2016 that Permian Basin employment has lagged Texas job growth.

Payroll Gains Mixed

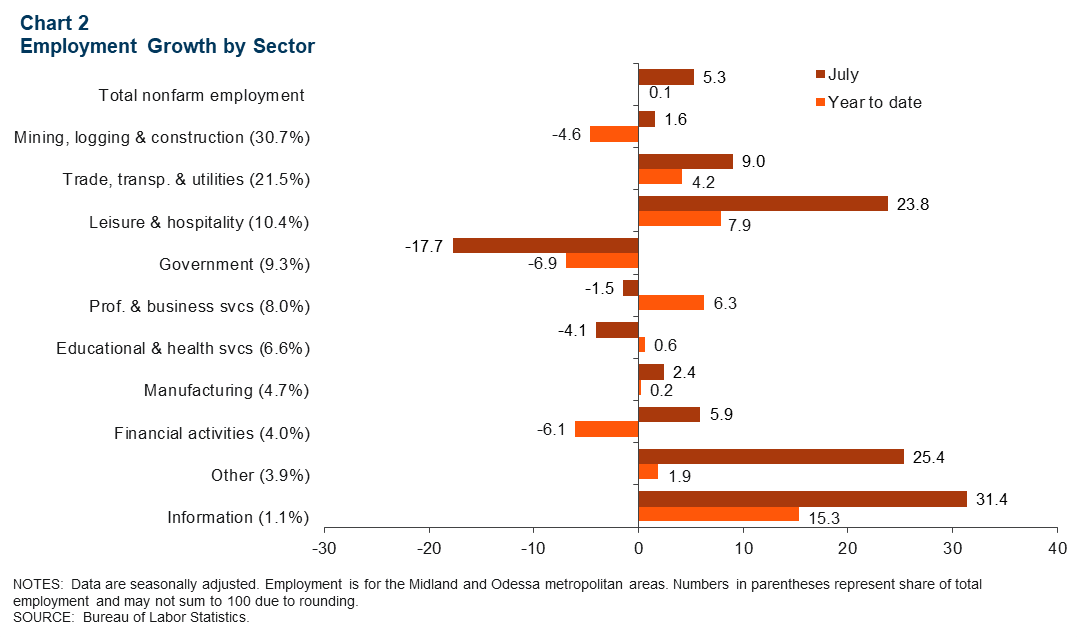

In July, mining, logging and construction, the Permian’s largest sector, posted annualized growth of 1.6 percent, boosting total employment gains (Chart 2). While the mining sector added jobs in July, job losses earlier in the year have led to a net job loss of 1,700 in the sector year to date. Government, which accounts for one in 10 jobs in the Permian, has also posted losses in 2019, shedding about 500 jobs. On net, the Permian Basin has added about 100 jobs this year, compared with 13,500 over the same time period a year ago.

Unemployment Inches Up

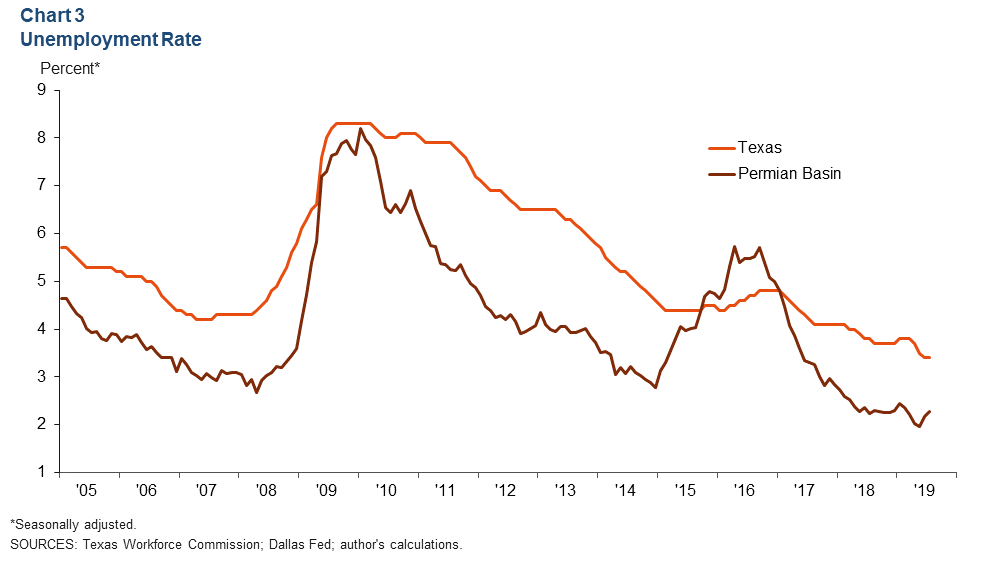

As job growth has slowed, the Permian Basin unemployment rate has picked up. In July, it stood at 2.3 percent, up from 2.2 percent the previous month (Chart 3). While the area’s jobless rate has inched up, it remains well below the U.S. rate of 3.7 percent and Texas rate of 3.4 percent

Energy

Oil Production Climbs, Rig Count Steadies

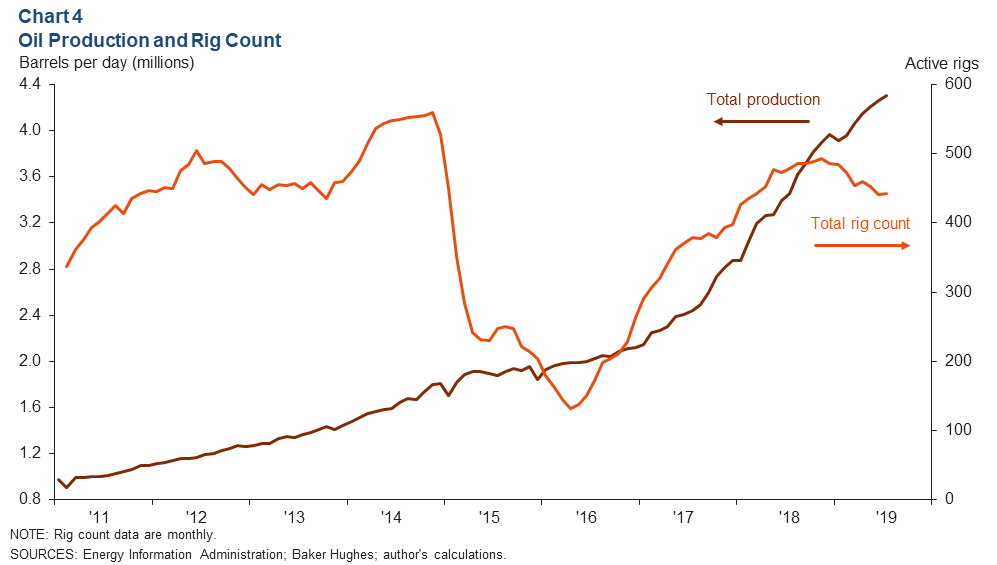

The Permian rig count has steadied—averaging 443 in July, nearly on par with June’s 441 (Chart 4). Meanwhile, Permian Basin oil production continues to climb, with production estimated to have reached an all-time high of 4.3 million barrels per day in July.

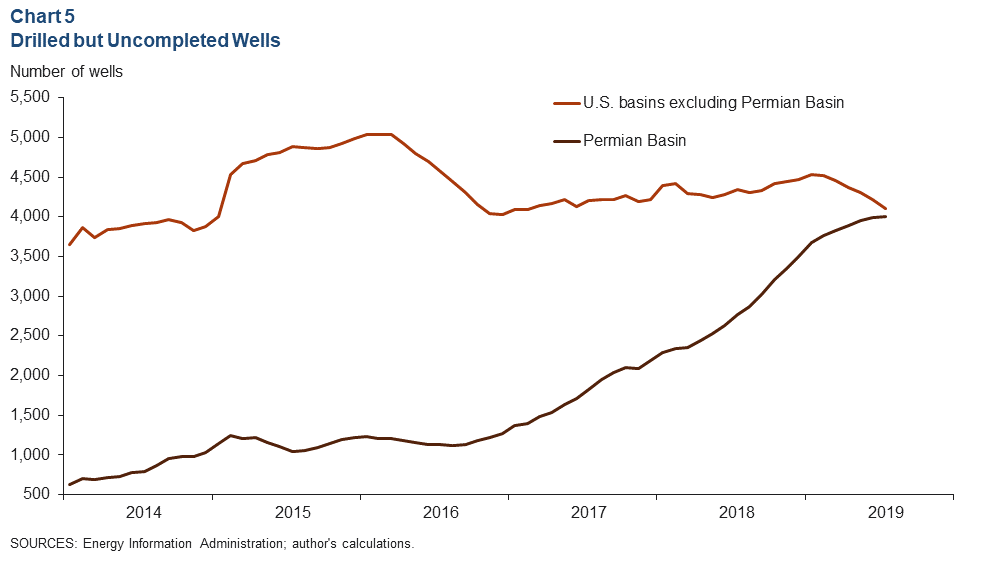

Drilled but Uncompleted Wells Slowly Rising

Drilled but uncompleted wells (DUCs) in the Permian Basin now account for about half of all DUCs in the U.S. Permian DUCs were at nearly 4,000 in July, just a 0.2 percent increase from June (Chart 5). Meanwhile, DUCs outside of the Permian continue to decline, down 2.6 percent over that time. The elevated level of Permian DUCs may be linked to the pipeline capacity that is expected to come online soon.

Housing

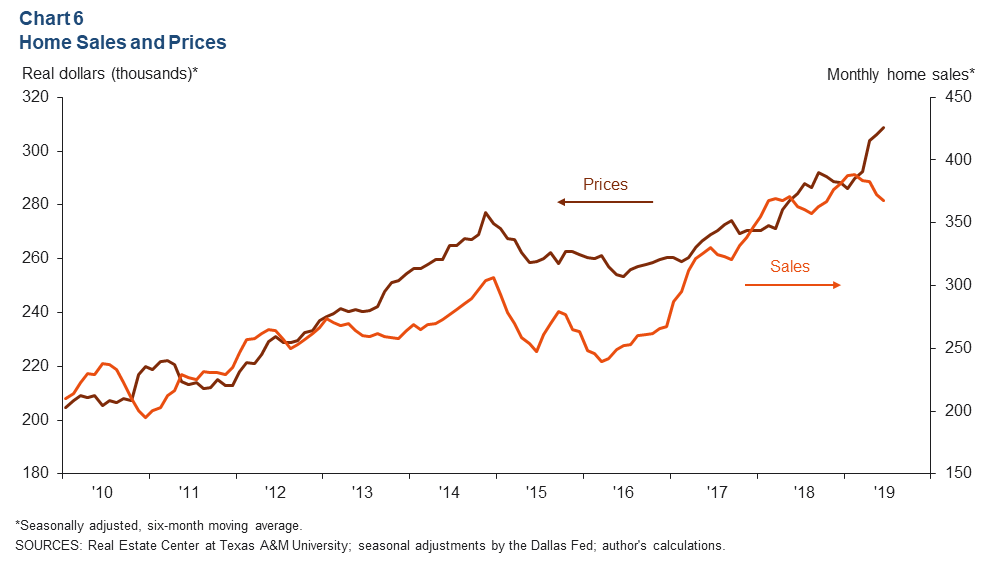

Existing-home prices continued to climb higher in June, while existing-home sales declined. The median home price in the Permian was $308,722, up 8.6 percent from a year earlier (Chart 6). Meanwhile, monthly home sales edged down to 368 in June, dropping 1.3 percent from May figures.

As sales have slowed, inventories of existing homes have inched up. In June, Midland’s supply stood at 2.1 months, up from 1.9 in May. Meanwhile, Odessa’s supply was 1.5 months in June, compared with 1.3 months in May.

NOTES: Employment data are for the Midland–Odessa metropolitan statistical area (Martin, Midland and Ector counties), unless otherwise specified. Energy data include the 55 counties in West Texas and southern New Mexico that make up the Permian Basin region. Data may not match previously published numbers due to revisions.

About Permian Basin Economic Indicators

Questions can be addressed to Marycruz De León at marycruz.deleon@dal.frb.org. Permian Basin Economic Indicators is released monthly.