San Antonio Economic Indicators

August 27, 2020

Growth in the San Antonio Business-Cycle Index slowed sharply in July as the number of new cases of COVID-19 increased significantly between mid-June and mid-July. While the unemployment rate declined slightly, jobs fell. Local consumer spending also slipped from mid-June to mid-July but has improved since then as the number of new cases of COVID-19 has fallen. Home sales improved in July, and stock prices of San Antonio-based companies increased over the four weeks ending Aug. 21.

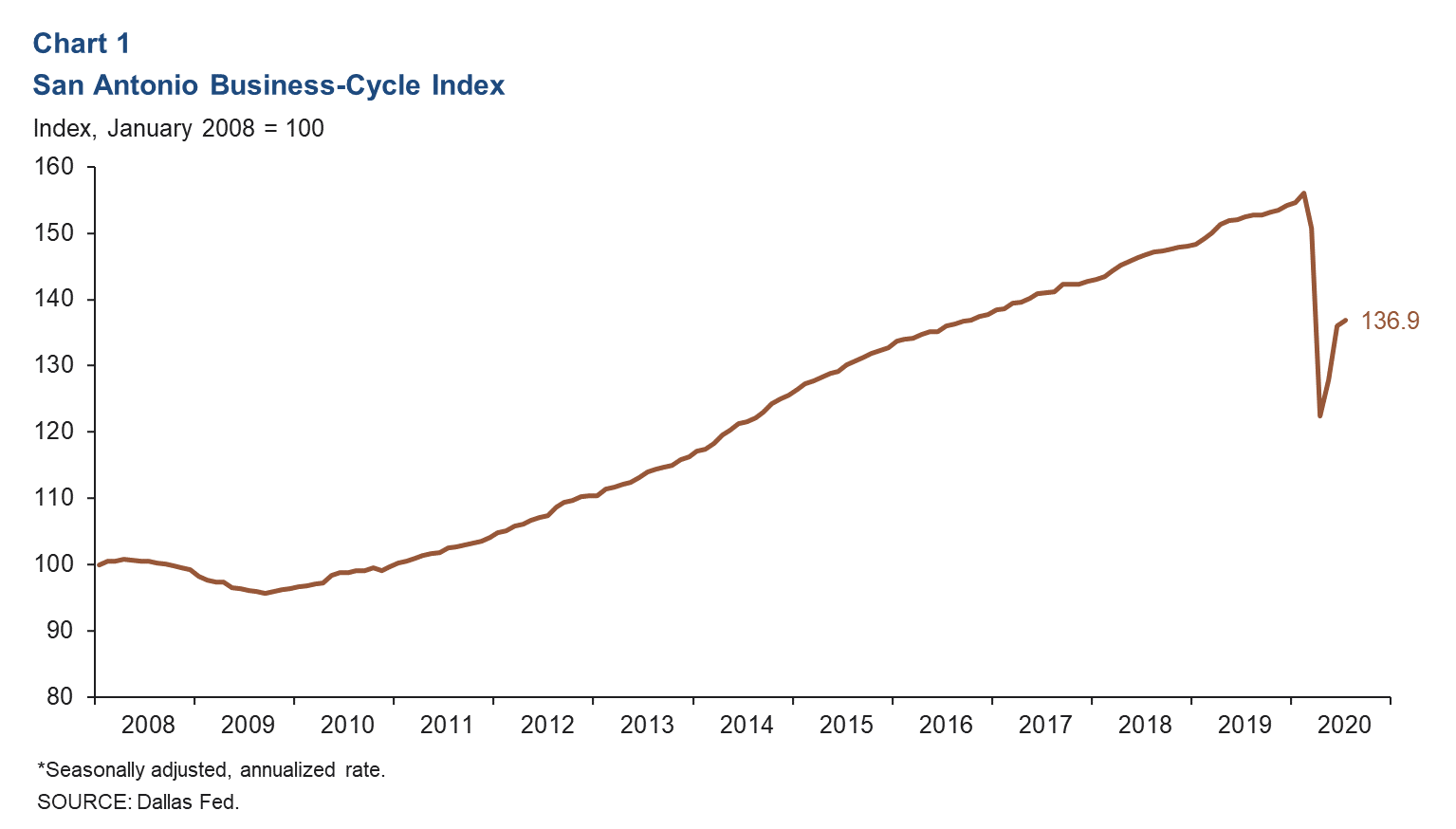

Business-Cycle Index

The San Antonio Business-Cycle Index—a broad measure of economic activity in the metro—increased in July but at a slower pace than in May and June (Chart 1). While the unemployment rate improved, jobs declined for the first time in three months.

Labor Market

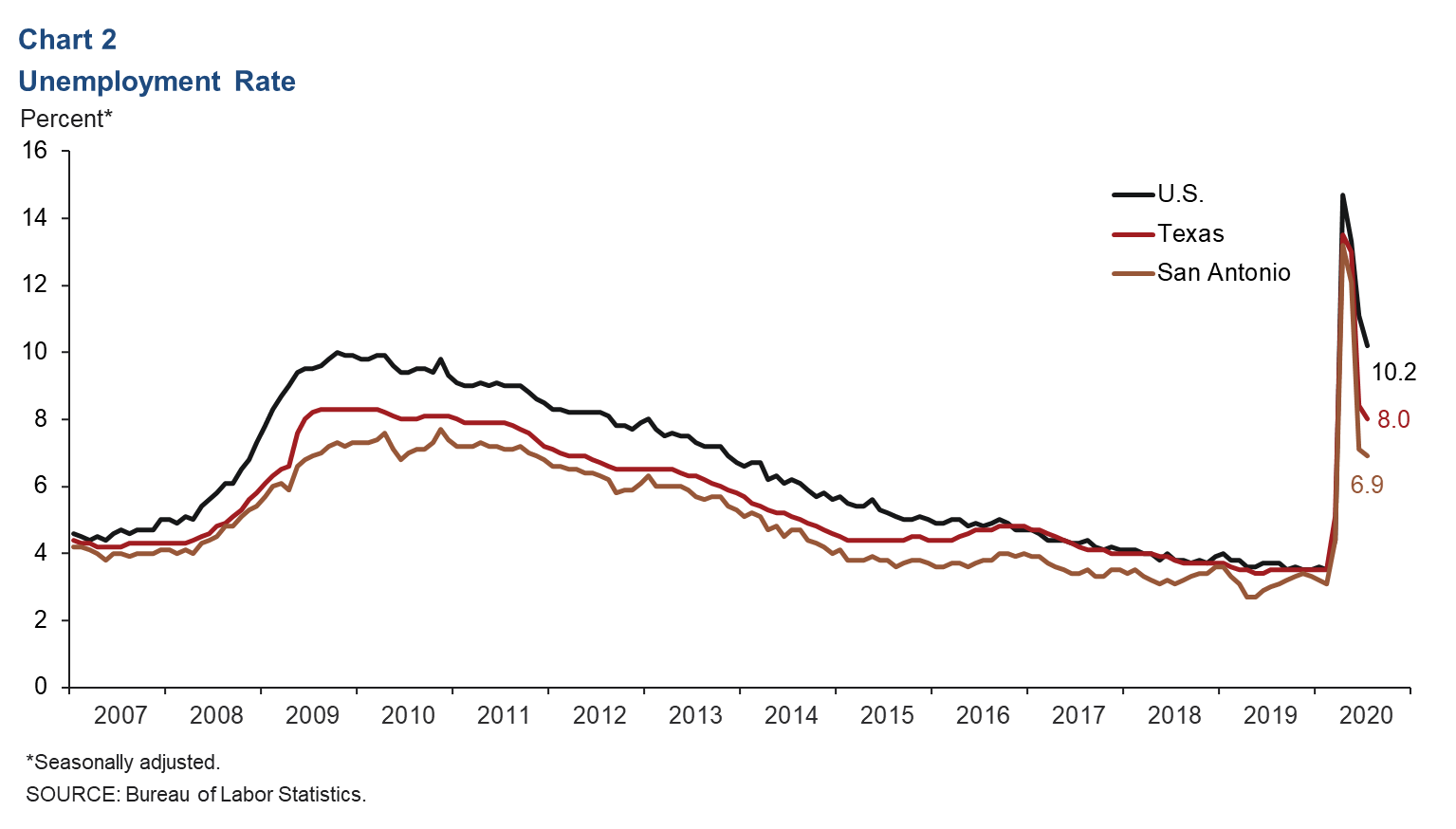

Unemployment Rate Falls Further

The metro’s unemployment rate declined to a still-elevated 6.9 percent in July, below the Texas and U.S. rates of 8.0 percent and 10.2 percent, respectively (Chart 2).

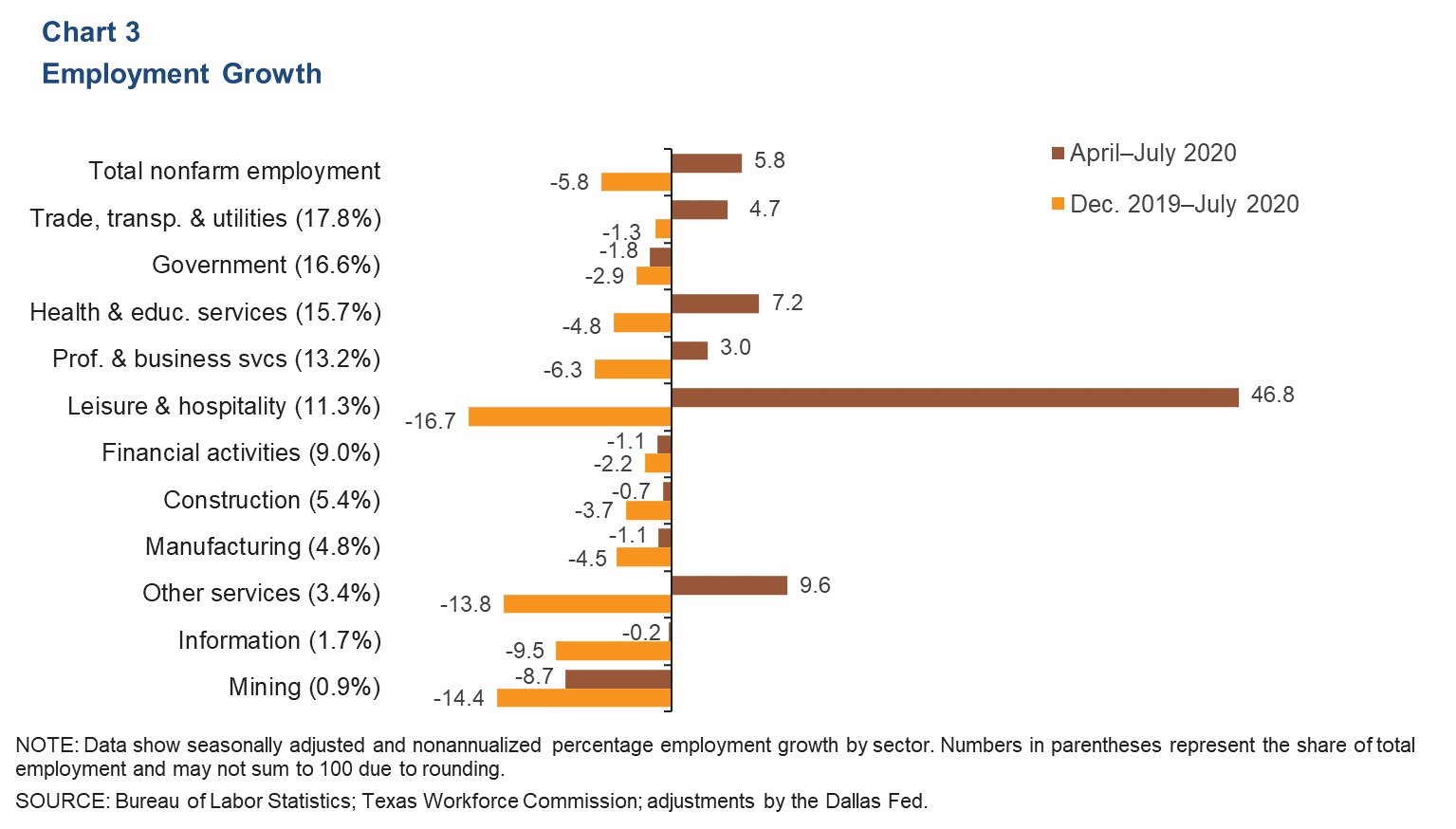

Service Sector Jobs Rebound

San Antonio jobs increased a nonannualized 5.8 percent (56,200 jobs) in the three months ending in July, with mixed performance by sectors (Chart 3). Leisure and hospitality saw the most gains (46.8 percent, or 37,000 jobs) and was followed by other services (9.6 percent, or 3,100 jobs), health and private education services (7.2 percent, or 11,000 jobs) and trade, transportation and utilities (4.7 percent, or 8,200 jobs). The mining sector shed the most jobs, contracting 8.7 percent (-840 jobs). While increases over the past three months have generally been strong, they have not been large enough to offset the declines in March and April. So far this year, jobs have declined by a large 5.8 percent, with shortfalls across all sectors.

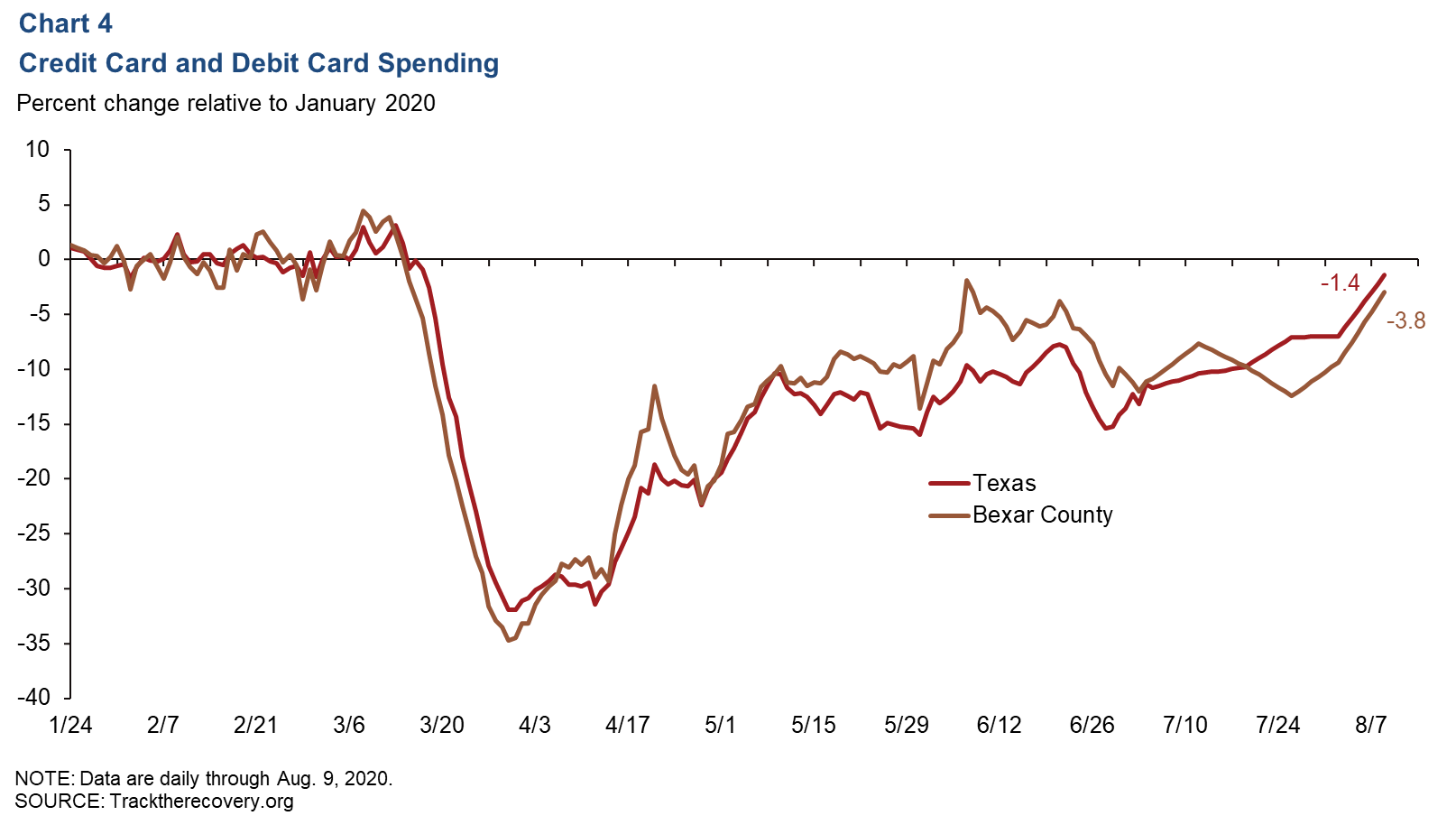

Consumer Spending

From early April until about mid-June, consumer spending (measured by credit and debit card spending) in Bexar County generally increased. However, as new COVID-19 cases accelerated in San Antonio from mid-June to mid-July, spending declined. In recent weeks COVID-19 cases and hospitalizations have fallen, and spending has increased. As of Aug. 9, spending in Bexar County was down 3.8 percent relative to January 2020 and was down 1.4 percent in the state (Chart 4).

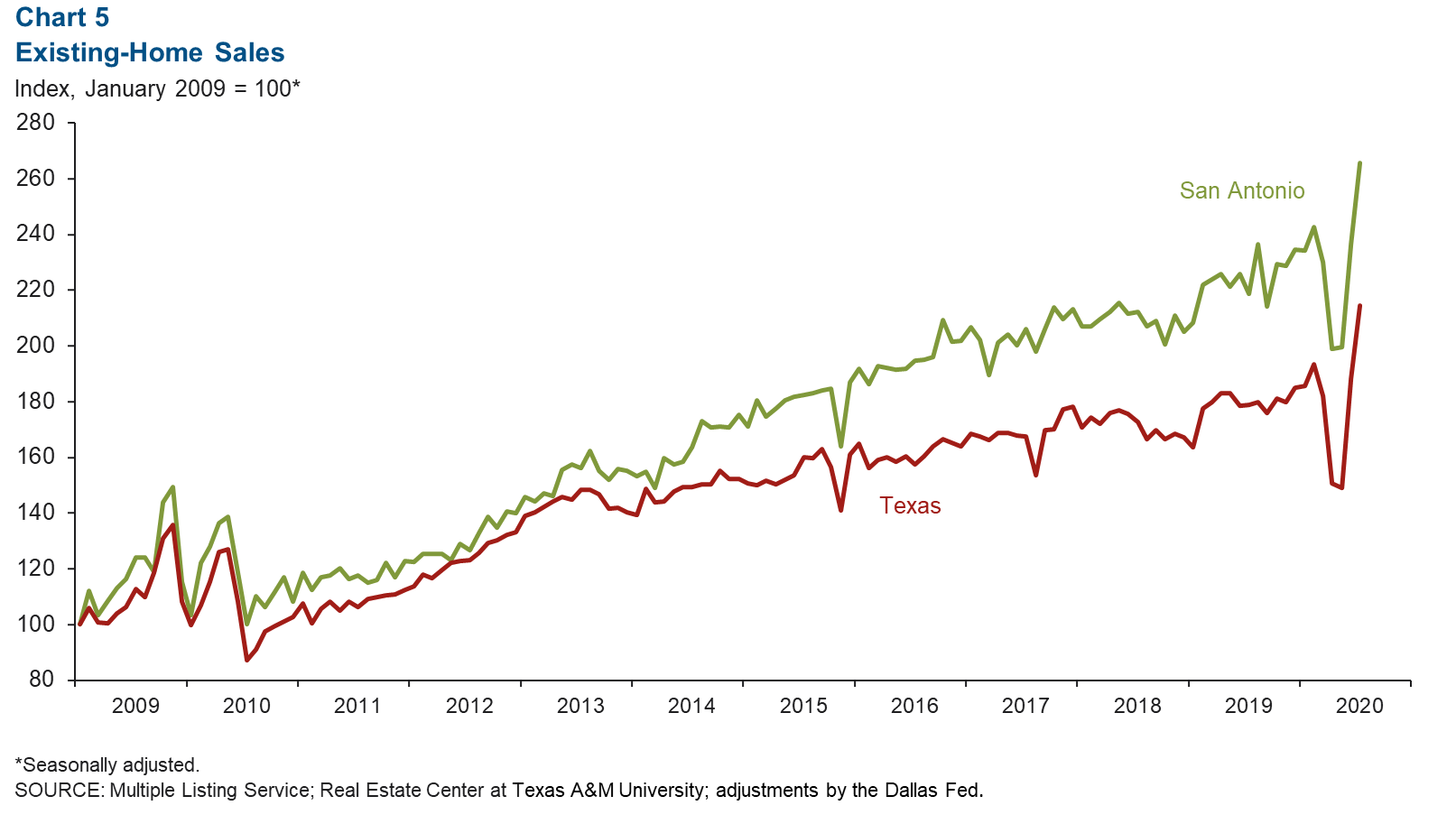

Real Estate

July existing-home sales rose 12.3 percent in San Antonio and 14.1 percent in the state (Chart 5). Home sales in San Antonio were 4.0 percent higher in the first seven months of 2020 relative to the same time last year; Texas sales were up 1.4 percent over the same period. The median price of homes sold in July was $251,446 in San Antonio—up 8.0 percent from a year ago—and $261,568 in Texas, up 8.2 percent.

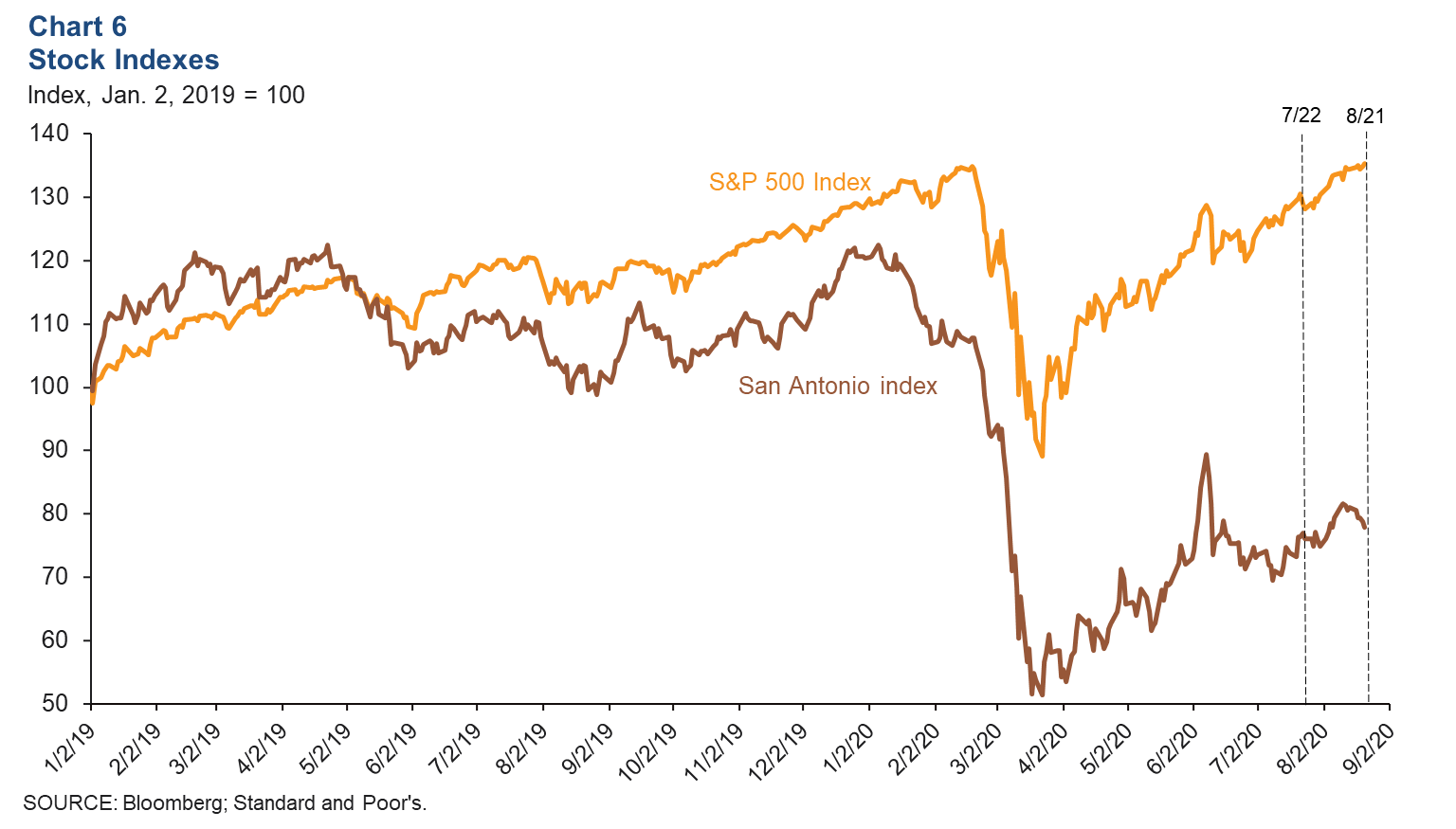

Stock Prices

Stock prices of San Antonio-based companies grew 2.1 percent from July 22 to Aug. 21, while the S&P 500 expanded 3.7 percent during the same period (Chart 6). Manufacturing firms saw gains in stock value, while the communications, finance and food service industries posted mixed performance. Energy companies experienced declines.

NOTE: Data may not match previously published numbers due to revisions.

About San Antonio Economic Indicators

Questions can be addressed to Judy Teng at judy.teng@dal.frb.org or Christopher Slijk at christopher.slijk@dal.frb.org. San Antonio Economic Indicators is published every month on the Thursday after state and metro employment data are released.