San Antonio Economic Indicators

| San Antonio economy dashboard (May 2025) | |||

| Job growth (annualized) Feb.–May '25 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 3.7% | 4.0% | $31.70 | 9.0% |

San Antonio payrolls and wages grew in May. Wage growth exceeded both the state and the nation, while the unemployment rate rose. Sales tax revenue fell.

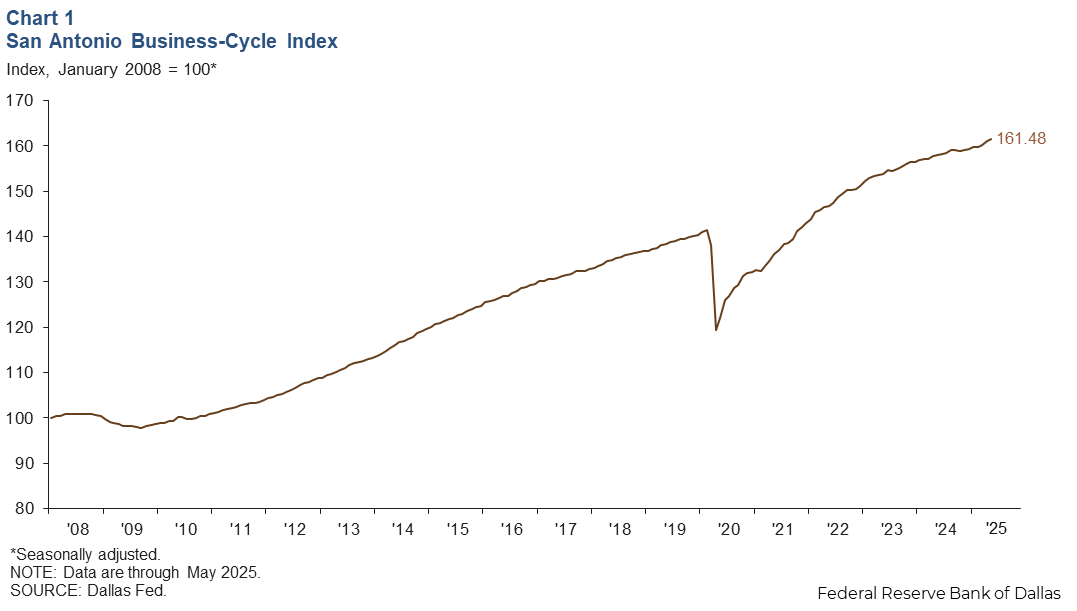

Business-cycle index

The San Antonio Business-Cycle Index, a gauge of economic conditions in the metro area, increased an annualized 7.2 percent in May (Chart 1).

Labor market

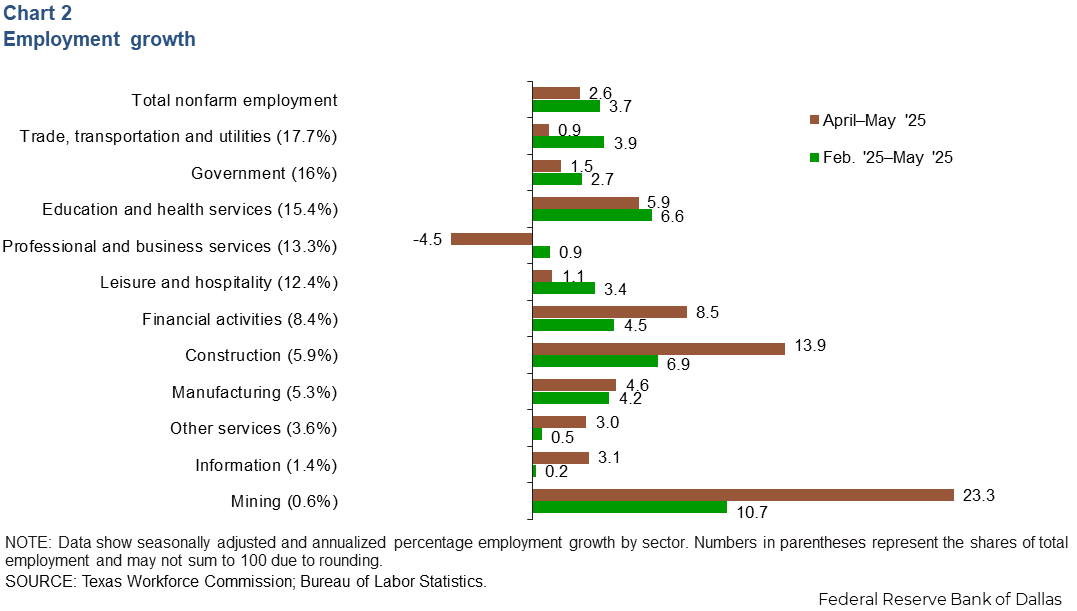

Employment growth continues

San Antonio payrolls rose in May, growing an annualized 2.6 percent. Payrolls grew 3.7 percent (10,800 jobs) February through May, led by gains in education and health services (6.6 percent, or 2,900 jobs) and trade, transportation, and utilities (3.9 percent, or 2,000 jobs) (Chart 2). The federal government lost jobs. Year over year, total nonfarm employment growth in San Antonio was 1.5 percent, slower than gains in Texas (1.8 percent) but faster than the U.S. (1.1 percent).

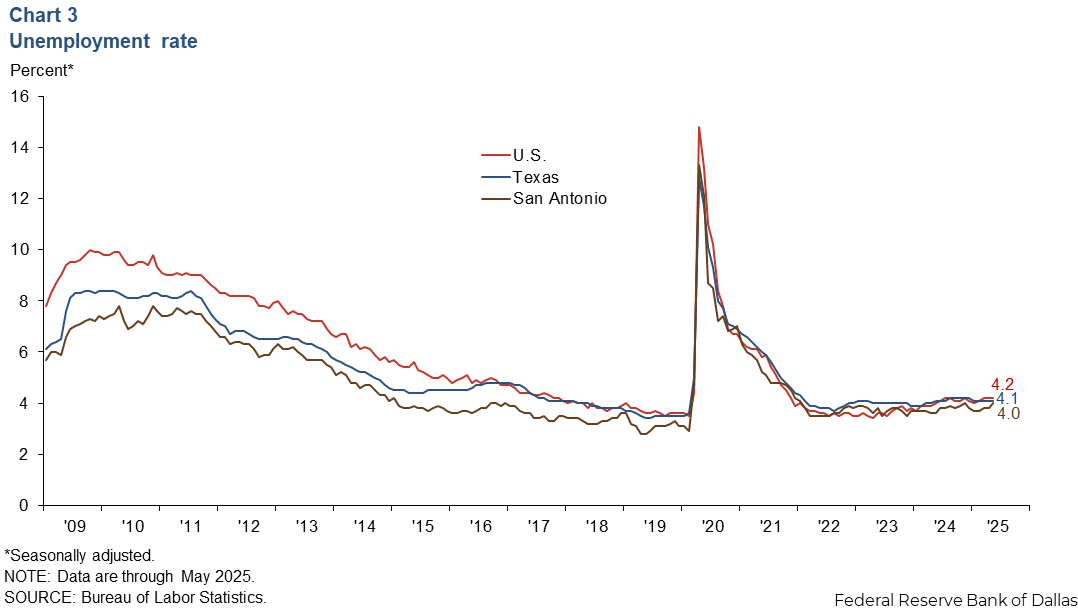

Unemployment rate ticks up

The San Antonio unemployment rate rose to 4.0 percent in May (Chart 3). The jobless rate is higher in Texas at 4.1 percent and the U.S. at 4.2 percent.

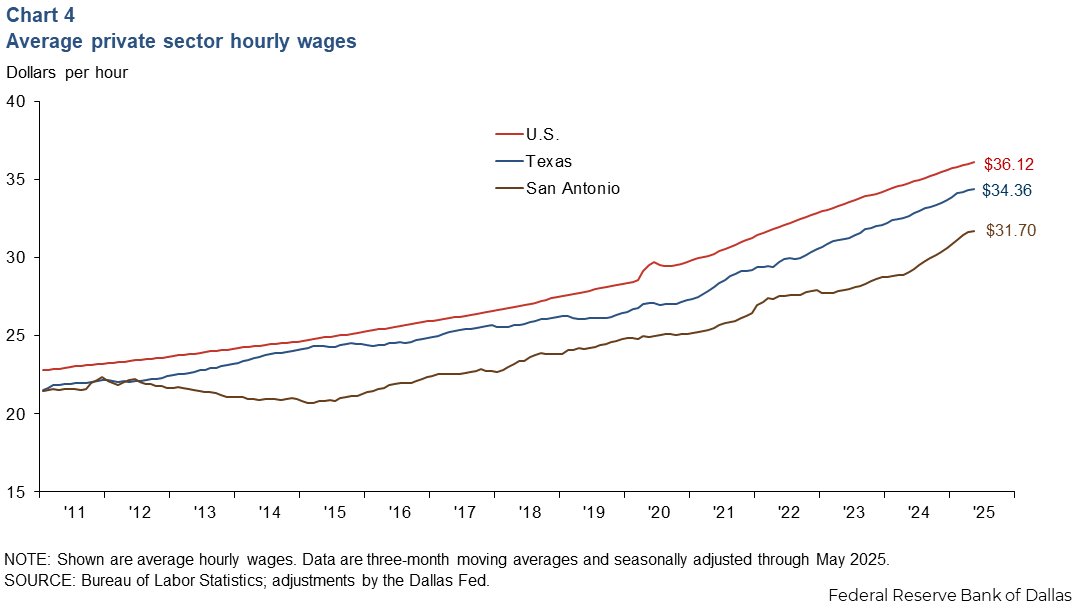

Wages rise

The average nominal hourly wage in San Antonio rose to $31.70 in May from April’s $31.66 (Chart 4). Wages are seasonally adjusted and smoothed with a three-month moving average. Year over year, wages grew 9.0 percent in May, while wages in Texas rose 5.1 percent and increased 3.9 percent in the nation. Earnings in San Antonio continue to be lower than both the state ($34.36) and nation ($36.12).

Consumer spending

Sales tax receipts are a proxy for consumer spending patterns. San Antonio sales tax revenue, smoothed and adjusted for inflation, increased 2.9 percent in May 2025 from May 2024, while Texas’ receipts rose 3.0 percent (Chart 5).

Housing market

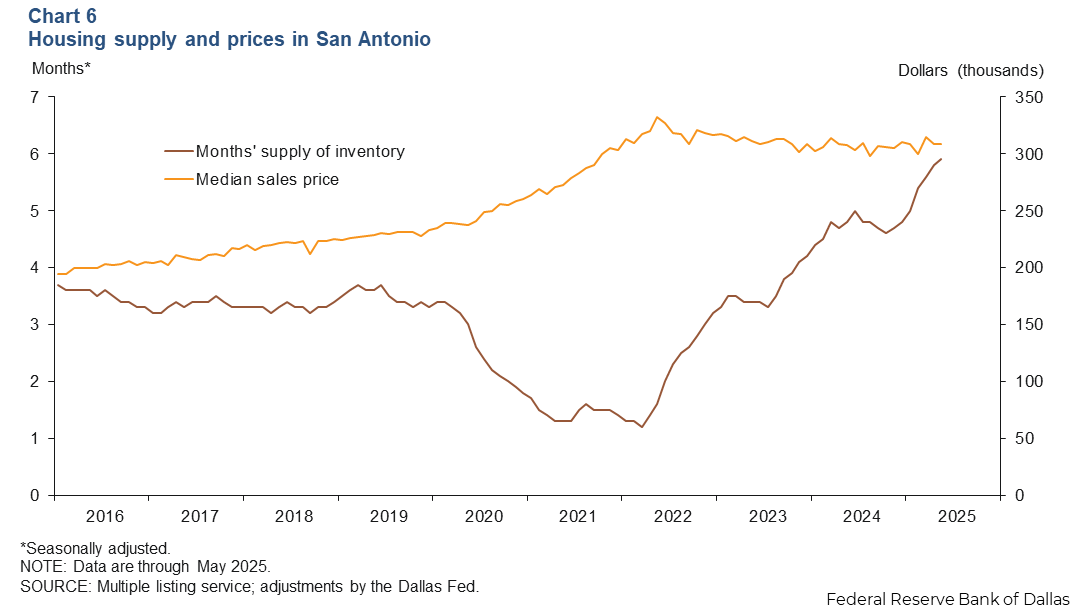

The supply of existing homes in San Antonio rose to 5.9 months in May, slightly greater than the state’s 5.6 months of supply (Chart 6). Since October 2012, inventories have remained below six months, which is generally considered a balanced housing market. The rise in inventory is mostly led by homes valued over $400,000. Homes valued over $1 million have an inventory of 15.2 months.

Median home prices stayed the same in May and were up 0.5 percent year over year. Meanwhile, home prices in Texas fell 1.6 percent in May and were down 1.3 percent year over year. According to Redfin, San Antonio has the second-highest share of single-family homes at risk at selling at a loss in the U.S. (10.2 percent).

NOTE: Data may not match previously published numbers due to revisions.

About San Antonio Economic Indicators

Questions or suggestions can be addressed to Ethan Dixon at Ethan.Dixon@dal.frb.org. San Antonio Economic Indicators is published every month during the week after state and metro employment data are released.