Texas Economic Indicators

April 19, 2022

The Texas economy expanded in March. Payroll employment growth was mixed across sectors, and initial unemployment claims were close to record lows. The March Texas Business Outlook Surveys (TBOS) indicated that price pressures remain highly elevated and are at or near all-time highs. Growth in Texas exports remained strong in February, and residential construction was elevated. Consumer spending rose, bolstered by spring break-related activity.

Labor market

Employment gains mixed

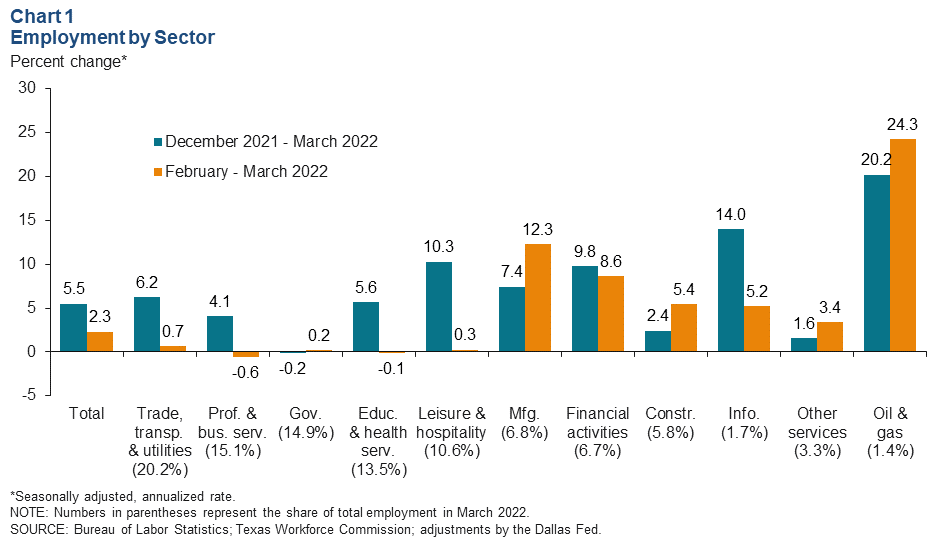

Texas employment expanded an annualized 2.3 percent (24, 900 jobs) in March after growing an upwardly revised 9.4 percent in February (Chart 1). Job growth was mixed by sector, with oil and gas employment seeing the fastest growth at an annualized 24.3 percent, followed by manufacturing and financial activities. Payrolls in professional and business services, government, leisure and hospitality, and education and health services were little changed. Through March, employment in all major sectors except government increased. The Dallas Fed’s Texas Employment Forecast predicts 3.3 percent job growth this year (December/December).

Initial unemployment claims still at low levels

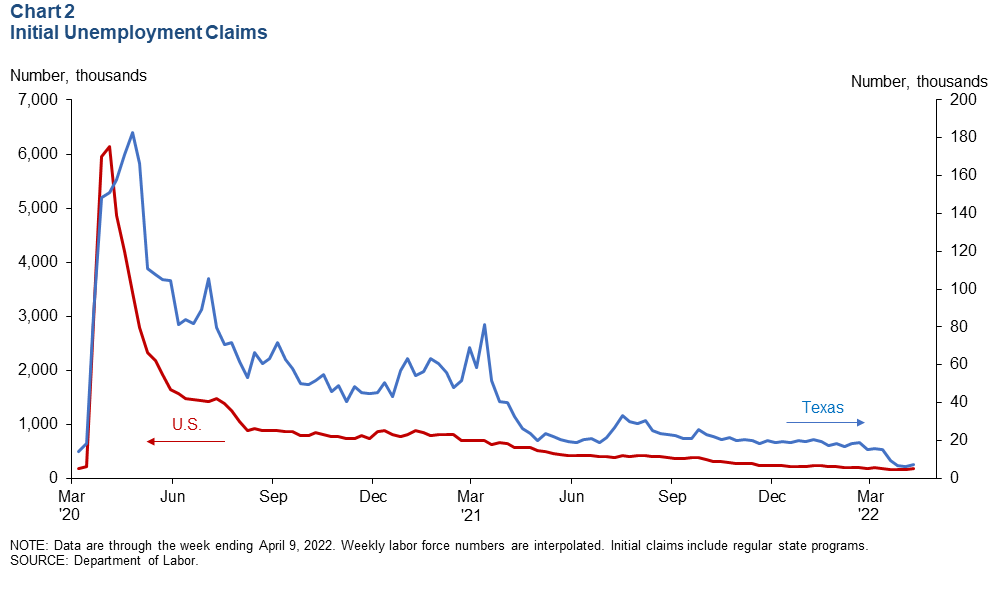

Initial unemployment claims ticked up both nationally and in Texas in early April (Chart 2). During the week ending April 9, initial claims in Texas rose to 7,214 but remained near postpandemic lows and were significantly below the peak recorded in the week ended April 25, 2020. In March, the Texas unemployment rate fell to 4.4 percent, while U.S. unemployment dipped to 3.6 percent.

Texas Business Outlook Surveys

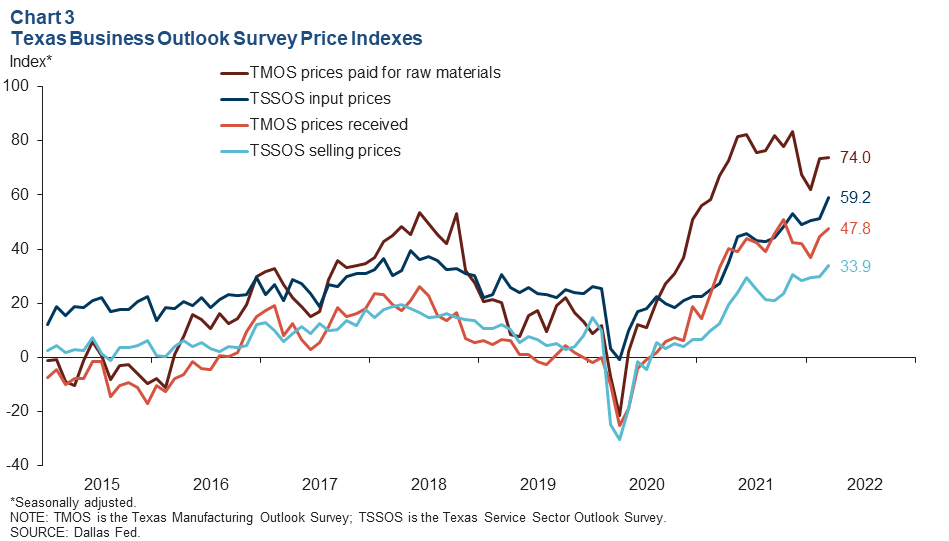

The Texas Business Outlook Surveys’ price indexes were at or near historical highs in March, indicative of elevated inflationary pressures (Chart 3). The manufacturing price index for raw materials came in at 74.0 in March, while the prices received index rose from 44.6 to 47.8. The service sector input prices index surged from 51.2 to 59.2—a new high. The service sector selling price index climbed from 29.9 to 33.9. In the March TBOS survey, Texas business executives indicated they expect a 6.4 percent increase in selling prices and an 8.5 percent increase in input costs on average this year.

Texas exports

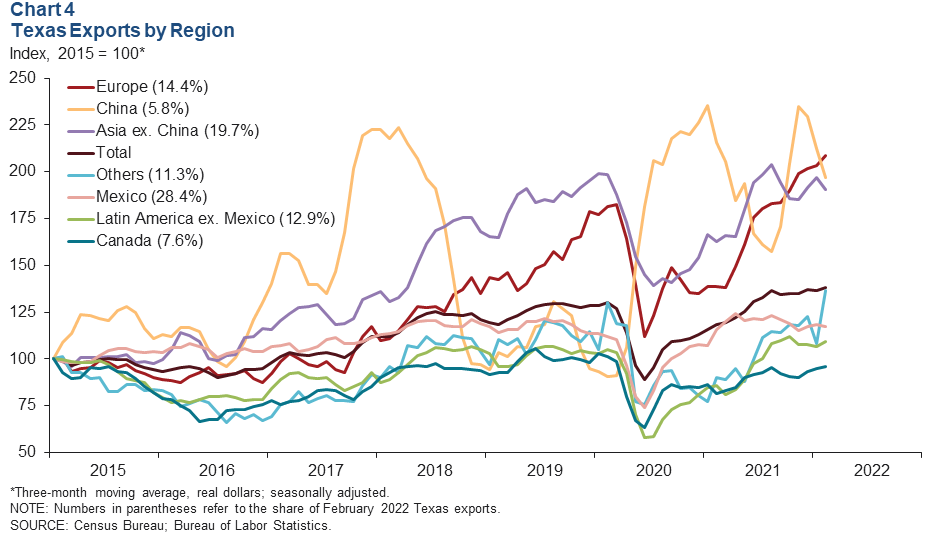

Texas exports expanded 5.8 percent in February, and the three-month moving average rose 1.0 percent (Chart 4). On a smoothed basis, exports to Texas’ largest trading partners were mixed. Exports to Europe (2.7 percent), Latin America excluding Mexico (2.3 percent) and Canada (1.1 percent) rose, while exports to China (-7.4 percent), the rest of Asia (-3.4 percent) and Mexico (-1.0 percent) declined. Through February this year, Texas exports were above same period last year.

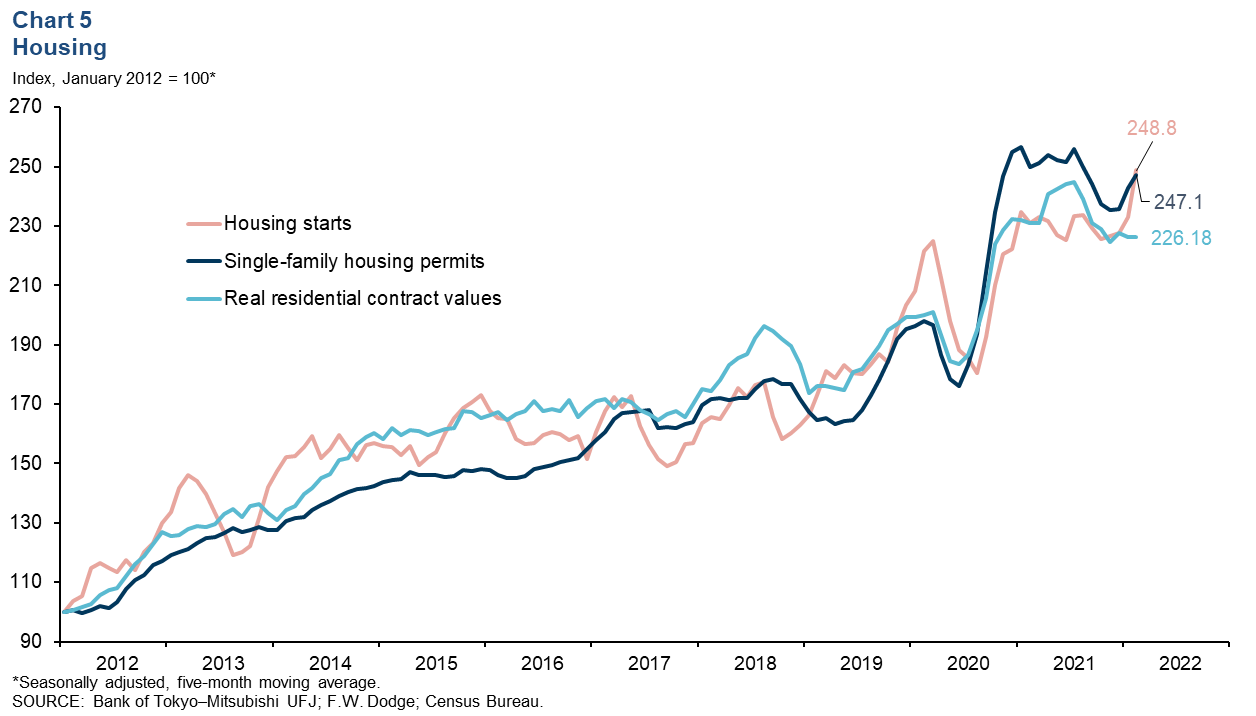

Housing

In February, indicators of Texas residential construction activity varied but remained elevated compared with prepandemic levels (Chart 5). The five-month moving average of single-family housing permits increased 1.7 percent in February, while housing starts (including multifamily construction) expanded 6.8 percent. Residential contract values were flat. In February, single-family housing permits and residential contract values were up 16.5 percent and 5.9 percent, respectively, from year-ago levels.

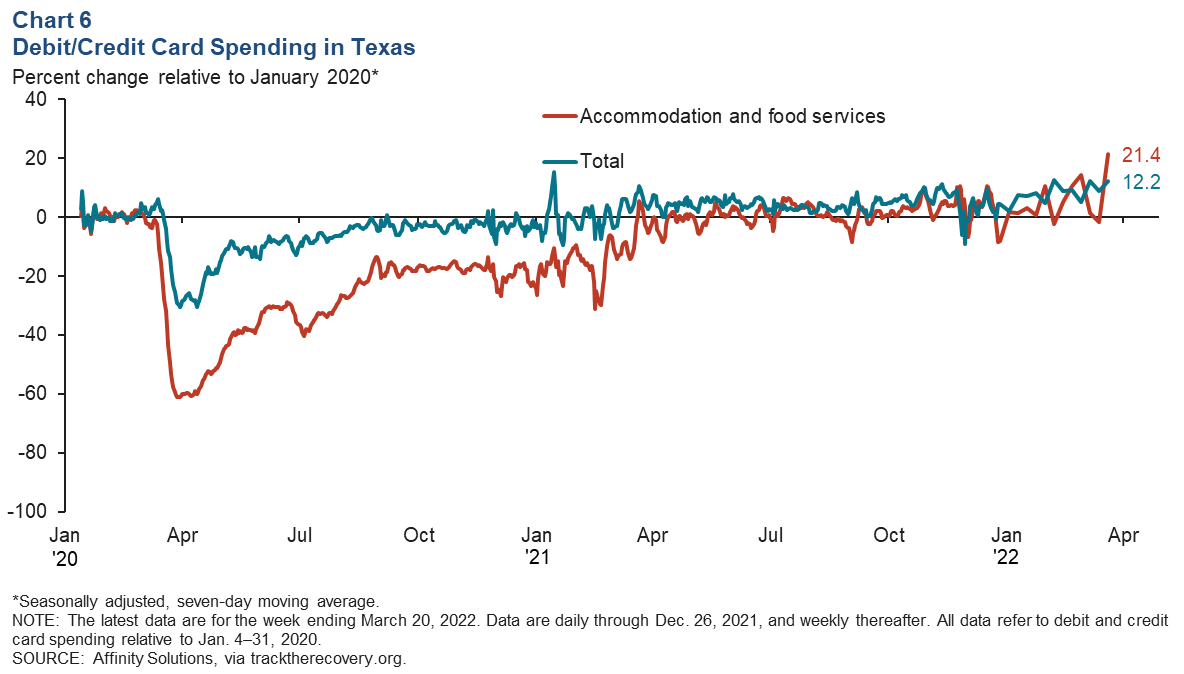

Consumer spending

Relative to January 2020 levels, consumer spending in Texas continued to increase (Chart 6). The growth in overall consumer spending indicates that consumers may be absorbing inflationary price increases. As of the week ending March 20, total debit and credit card spending rose and was 12.2 percent above January 2020 levels. Accommodation and food services spending surged, likely due to spring break activity, rising 21.4 percent above January 2020 levels.

NOTE: Data may not match previously published numbers due to revisions.

About Texas Economic Indicators

Questions can be addressed to Laila Assanie at Laila.Assanie@dal.frb.org and Mytiah Caldwell at Mytiah.Caldwell@dal.frb.org. Texas Economic Indicators is published every month during the week after state and metro employment data are released.