Banking Conditions Survey

May 2020

May 2020

What’s New

Many financial institutions are participating in the Small Business Administration’s Paycheck Protection Program (PPP), launched on April 3, 2020. For this survey, respondents were asked to answer the questions excluding PPP loans.

Also for this survey, respondents were asked supplemental questions on the impacts of the coronavirus (COVID-19). Read the special questions results.

Results Tables

Historical data are available from March 2017.

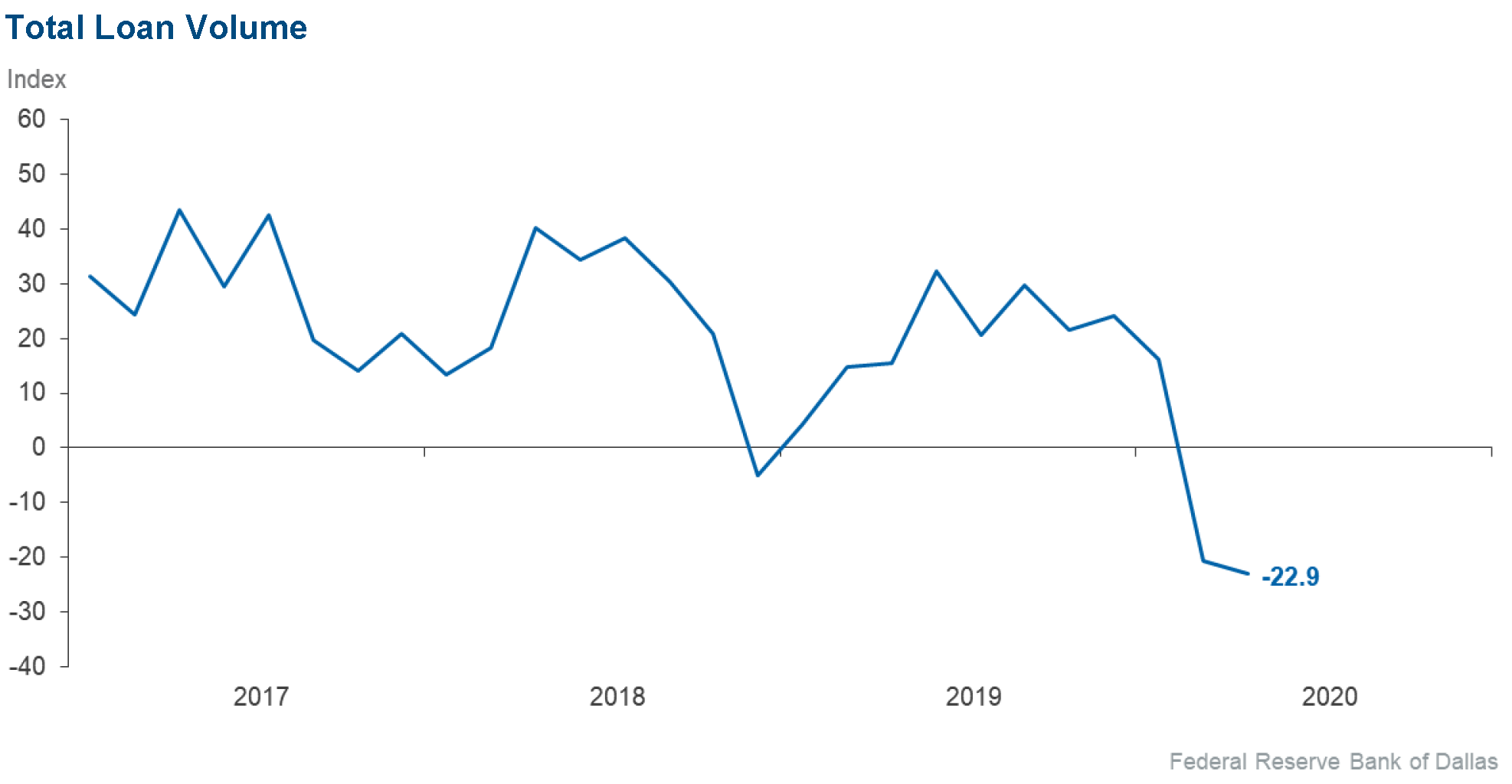

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –22.9 | –20.6 | 27.1 | 22.9 | 50.0 |

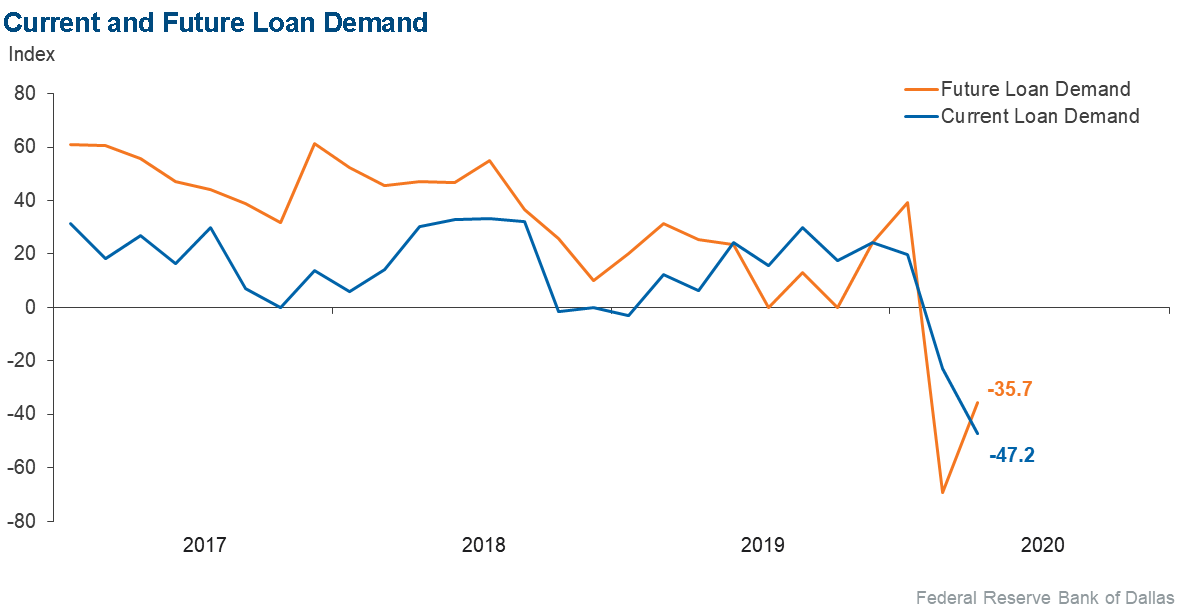

Loan demand | –47.2 | –23.0 | 17.1 | 18.6 | 64.3 |

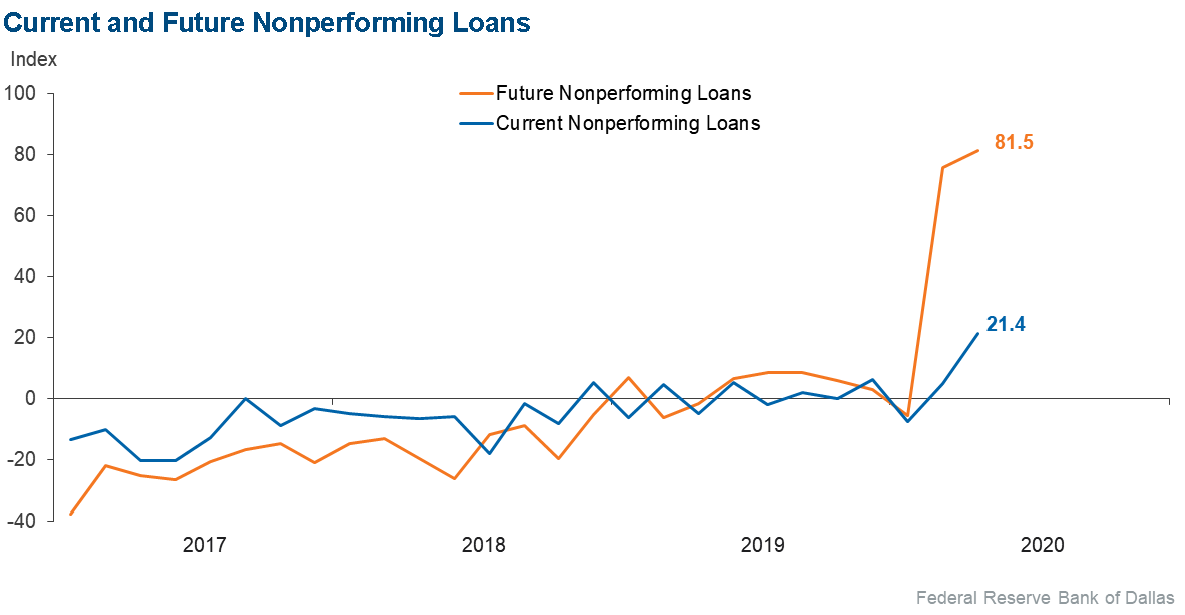

Nonperforming loans | 21.4 | 5.1 | 27.1 | 67.1 | 5.7 |

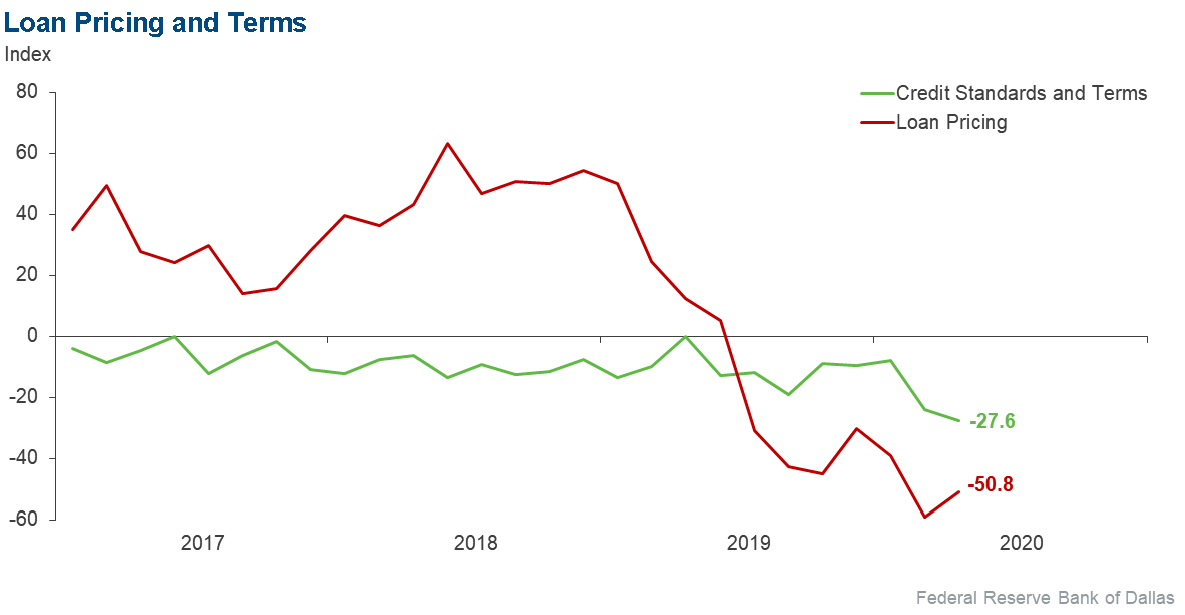

Loan pricing | –50.8 | –59.0 | 4.3 | 40.6 | 55.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –27.6 | –24.1 | 6.2 | 60.0 | 33.8 |

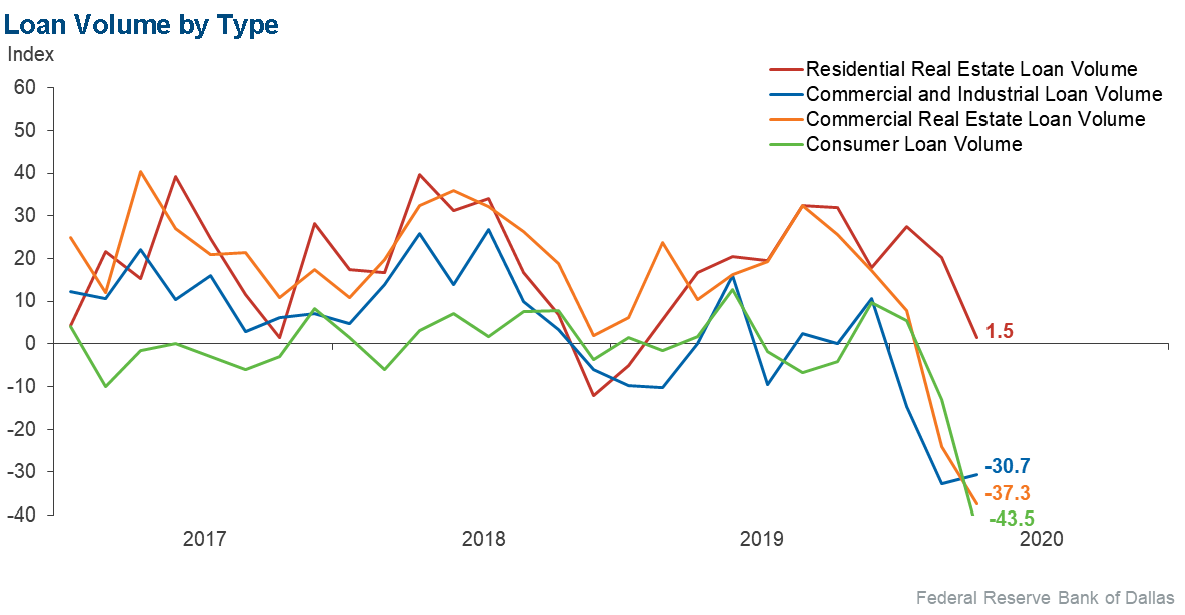

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –30.7 | –32.8 | 10.8 | 47.7 | 41.5 |

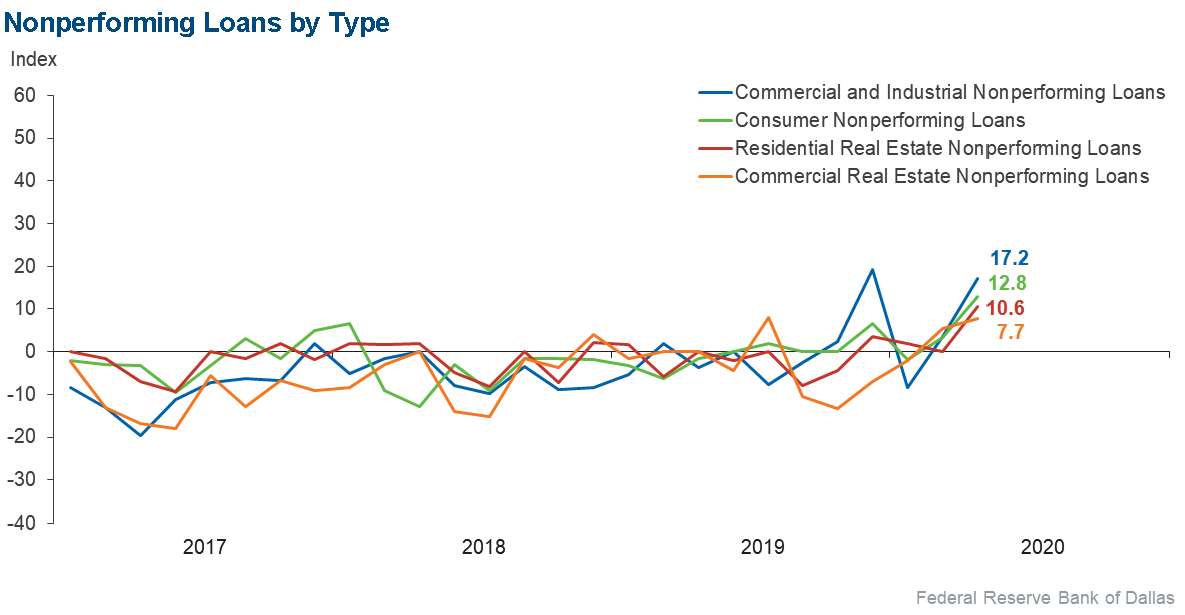

Nonperforming loans | 17.2 | 3.6 | 18.8 | 79.7 | 1.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –33.3 | –24.6 | 3.2 | 60.3 | 36.5 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –37.3 | –24.1 | 7.5 | 47.8 | 44.8 |

Nonperforming loans | 7.7 | 5.4 | 10.8 | 86.2 | 3.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –24.3 | –26.3 | 1.5 | 72.7 | 25.8 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 1.5 | 20.3 | 34.8 | 31.8 | 33.3 |

Nonperforming loans | 10.6 | 0.0 | 12.1 | 86.4 | 1.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –13.8 | –16.1 | 0.0 | 86.2 | 13.8 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –43.5 | –13.1 | 11.6 | 33.3 | 55.1 |

Nonperforming loans | 12.8 | 3.4 | 17.1 | 78.6 | 4.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.3 | –8.2 | 4.2 | 87.3 | 8.5 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | –35.7 | –69.4 | 24.3 | 15.7 | 60.0 |

Nonperforming loans | 81.5 | 75.8 | 82.9 | 15.7 | 1.4 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

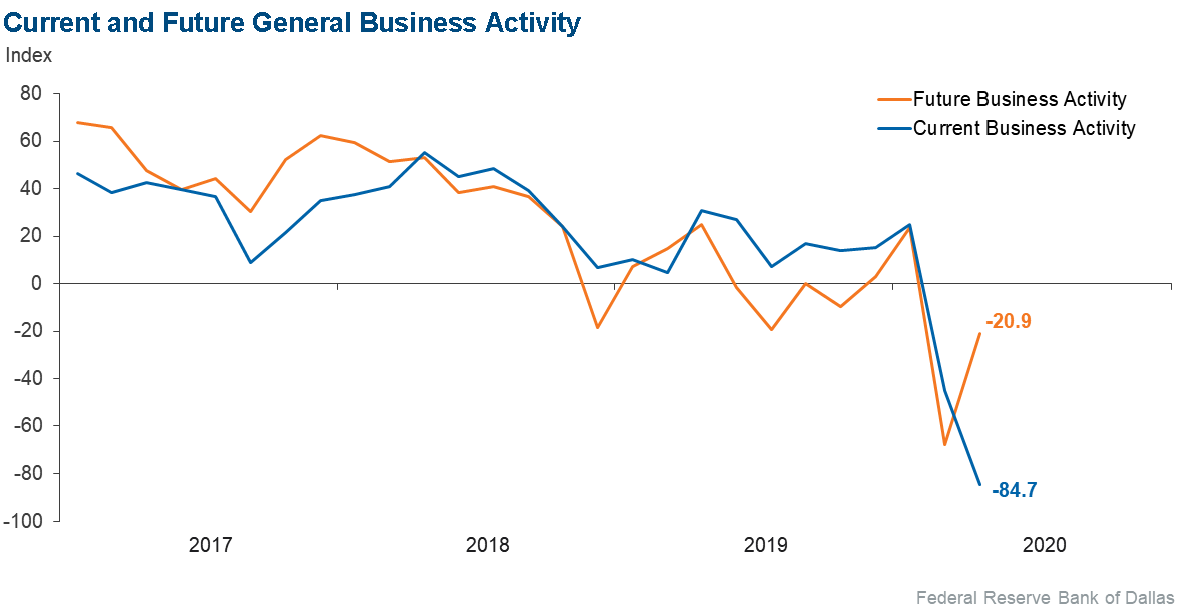

Over the past six weeks | –84.7 | –45.2 | 4.2 | 6.9 | 88.9 |

Six months from now | –20.9 | –67.7 | 34.7 | 9.7 | 55.6 |

Next release: June 29

|

Data were collected April 28–May 6, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease. |

May 2020

May 2020

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

Economic Disruption

- The impact of the drastic decrease in the price of crude oil and the ongoing decrease in oilfield activity will negatively impact loan credit quality and overall economic activity in the next six months.

- Most small retail businesses located in our markets are suffering financially from this economic downturn. Their inventory is financed and has not turned over, and now they need to place orders for the upcoming season. Without the appropriate credit line to support additional inventory, I am very concerned regarding their future viability and surviving the upcoming months. Their demise will negatively impact many small rural towns throughout the region.

- If we move quickly to reopen the economy, the general business activity and banking outlook will improve. On the other hand, delays in reopening will result in a long, slow slog to return to better days.

- The longer businesses are closed, the worse the conditions will be. All of the loan programs won’t help if there is no revenue to make the payments.

- The economy is in a state of extreme stress. We expect a slow recovery over the next year—and by no means a “V” shaped recovery. We expect margins to become compressed as provisions are bulked up and rates continue to be very low for the next 12 to 18 months. It is positive to see the government establishing programs to assist businesses and consumers in this time of need. However, we have experienced stress and problems with regard to dealing with the SBA [Small Business Administration] and their PPP [Paycheck Protection Program], as I believe many smaller community institutions have.

- With the COVID-19 scenario and the PPP loan program in play, it is difficult to predict what will happen in the future. Our county has relaxed some COVID-19 rules as it pertains to restaurants, etc. As a result, our town was teeming with folks going out to eat and picnicking on the town square. I think there is a lot of pent-up desire to get out and about, and our economic rebound will be on its way. Our county only experienced 15 or so confirmed cases, and many of those have recovered. Sadly, we had one death of a 72-year-old man.

- We expect that once businesses are opened up, demand for real estate will return to its previous levels in the next six months or so.

- There is a slowdown in the economy due to mandated business shutdowns due to the COVID-19 pandemic.

- The economy is being artificially inflated by the CARES Act and payment-extension options provided by the bank. As the pandemic marches on, I foresee trouble for all of us.

- Our issue of concern is the global pandemic and the related economic issues.

- I believe that the economy will continue a slow decline but that it will be short-lived as restrictions are lifted. The growth, or reestablishment of the economy, will be gradual and painful at times, but the climb out of the economic abyss will begin in earnest this fall.

Lending

- Loan volume for non-SBA loan categories has remained steady, except for personal loans, which continue to decline.

- Stay-at-home orders adversely affected consumer lending and transaction revenue lines. The economic situation caused by COVID-19 is resulting in an increased volume of loan deferral requests, which soon will likely transition to increases in workout loan volume and delinquencies/charge-offs. Provision expense increased based on an initial estimate. The only bright spot at this time is that lowered interest rates are benefiting those who are able to refinance mortgage loans. It is exceptionally difficult to forecast the economics without being able to know the future path of the health crisis. We appreciate the regulatory flexibility and guidance offered during this time; it has been helpful.

- Loan modifications have increased significantly but do not show up as nonperforming.

- We are concerned how the Treasury/SBA will handle the forgiveness aspect of the PPP loan program that has been hurriedly pushed out into the banks.

- Due to COVID-19, everything is up in the air now. Plans for branch growth are continuing but at a slower pace. I am very concerned about how bad delinquency and charge-offs for affected loans will be in 12–18 months from now. Hopefully, things won’t get worse, but who knows?

- Of course, COVID-19, massive layoffs, etc., are hurting. We have 0 percent loans to help our members and are doing a huge number of extensions, month to month. We’re not sure where charge-offs are going to be in six months; we’re doing a lot of financial counseling.

- We serve grocery retail, and our members are working harder and longer than usual. Therefore, our deposits and loans are up slightly. Still cloudy is the asset quality. As of today, we have not seen an uptick in delinquency.

- Commercial lending projects have been delayed or canceled. Our focus has been setting up procedures to take and process SBA PPP loans. In addition, we have numerous mortgage loan extension requests due to COVID-19. Some customers not significantly impacted by COVID-19 are requesting interest rate reductions based on the lower rates.

- The coronavirus (COVID-19) has impacted our volume of normal banking business. We expect our banking business to improve as the virus cases decrease.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.