Banking Conditions Survey

August 2020

August 2020

What’s New

For this survey, respondents were asked supplemental questions on the impacts of the coronavirus (COVID-19). Read the special questions results.

Many financial institutions are participating in the Small Business Administration’s Paycheck Protection Program (PPP), launched on April 3, 2020. For this survey, respondents were asked to answer the questions excluding PPP loans.

Results Tables

Historical data are available from March 2017.

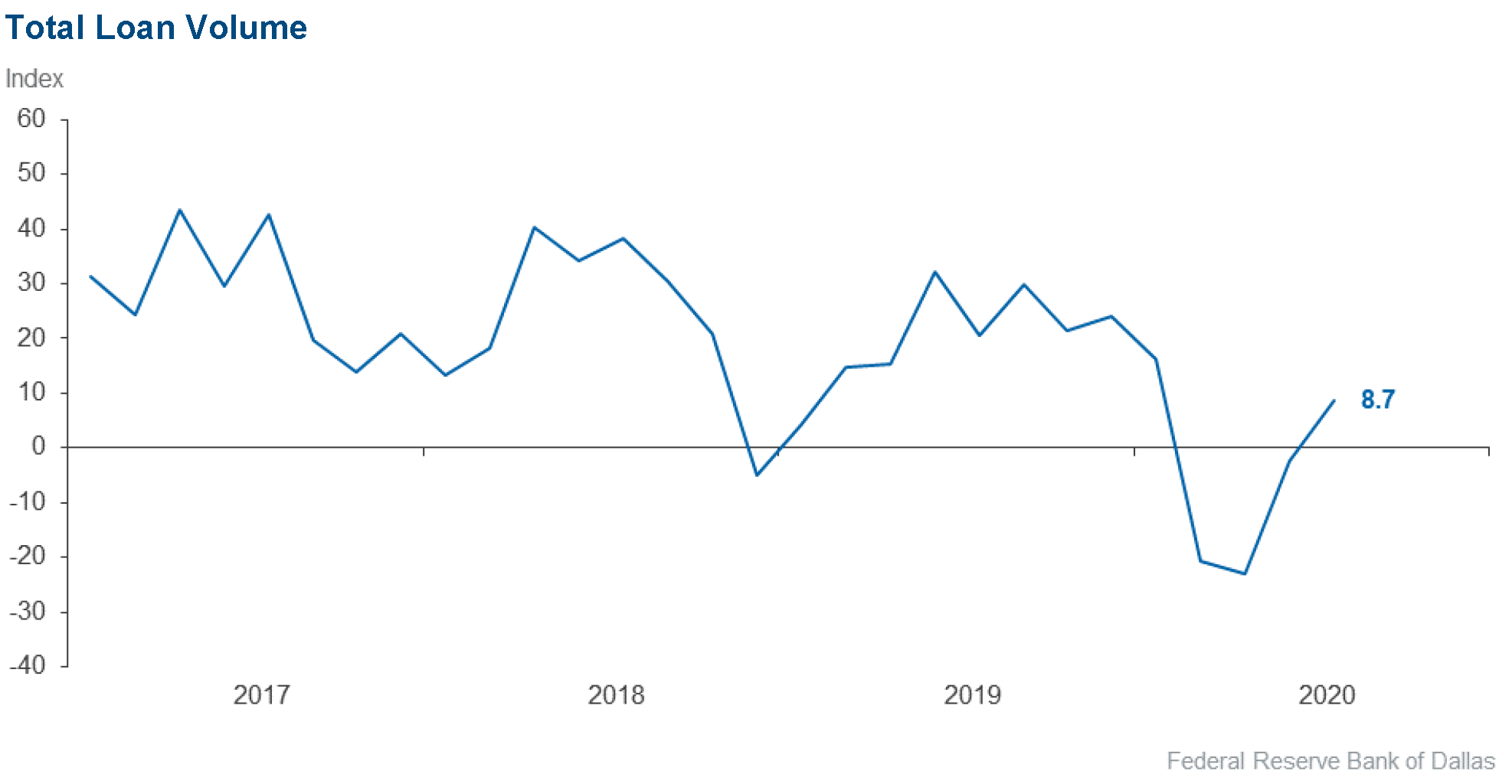

| Total Loans: Over the past six weeks, how have the following changed? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Loan volume |

8.7 |

–2.5 |

42.0 |

24.6 |

33.3 |

|

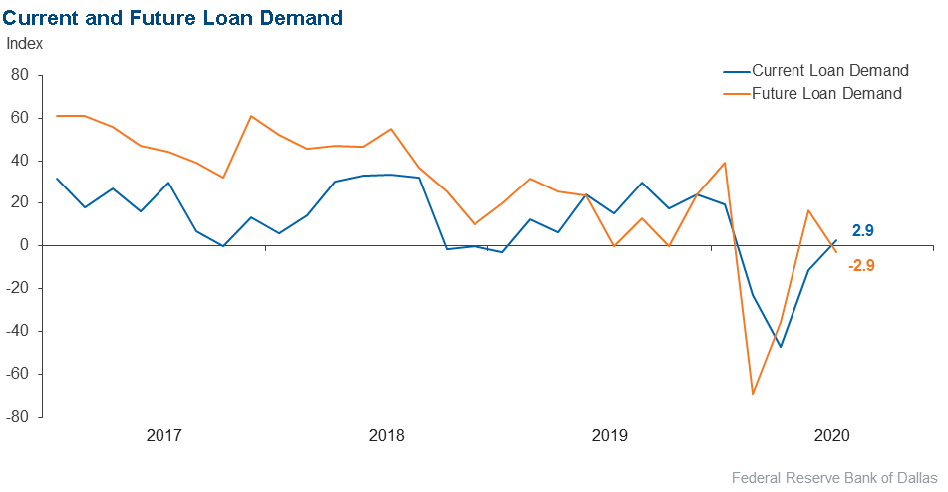

Loan demand |

2.9 |

–11.5 |

38.2 |

26.5 |

35.3 |

|

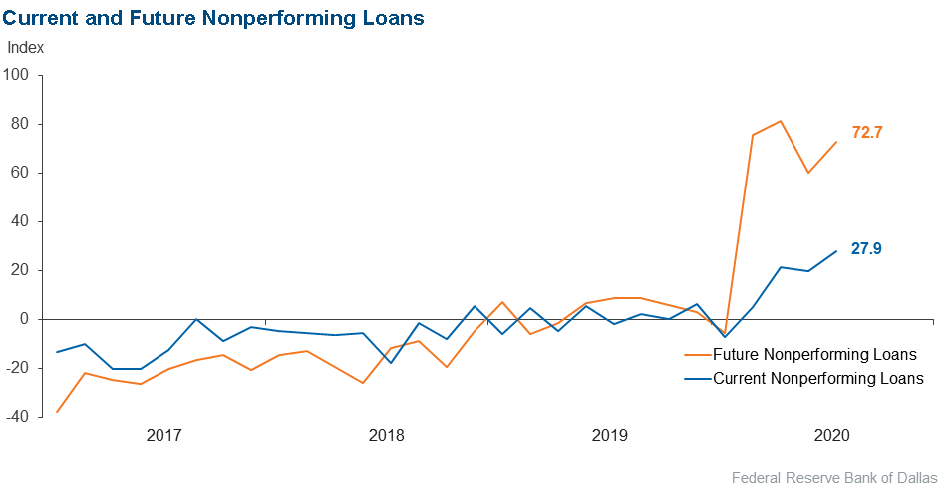

Nonperforming loans |

27.9 |

19.5 |

33.8 |

60.3 |

5.9 |

|

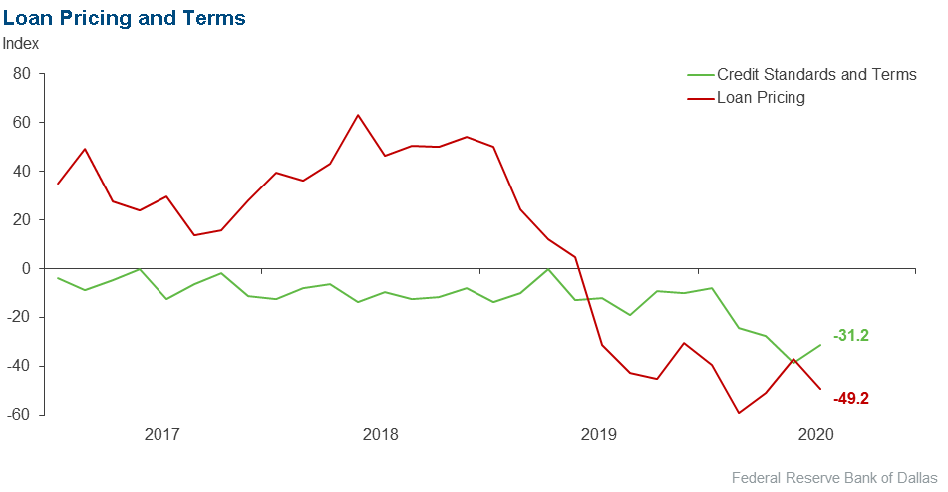

Loan pricing |

–49.2 |

–36.8 |

1.5 |

47.8 |

50.7 |

| |

|||||

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

|

Credit standards and terms |

–31.2 |

–38.4 |

1.6 |

65.6 |

32.8 |

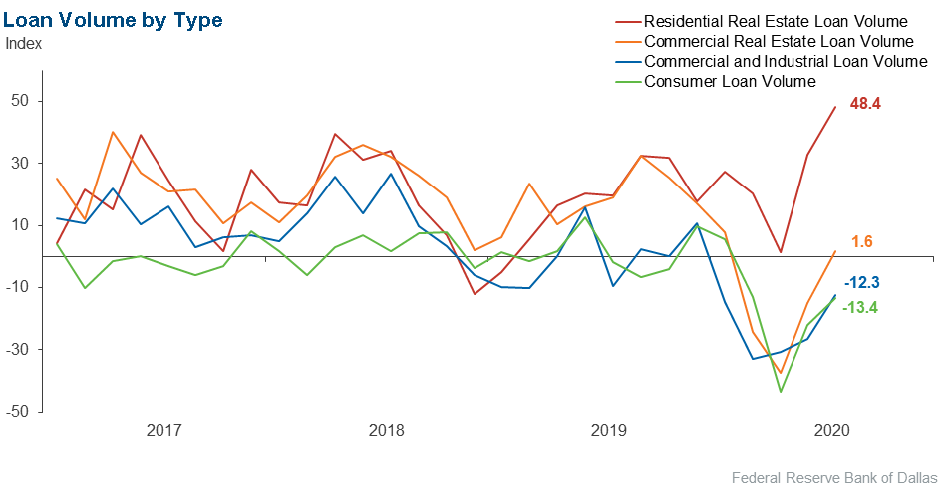

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Loan volume |

–12.3 |

–26.4 |

16.9 |

53.8 |

29.2 |

|

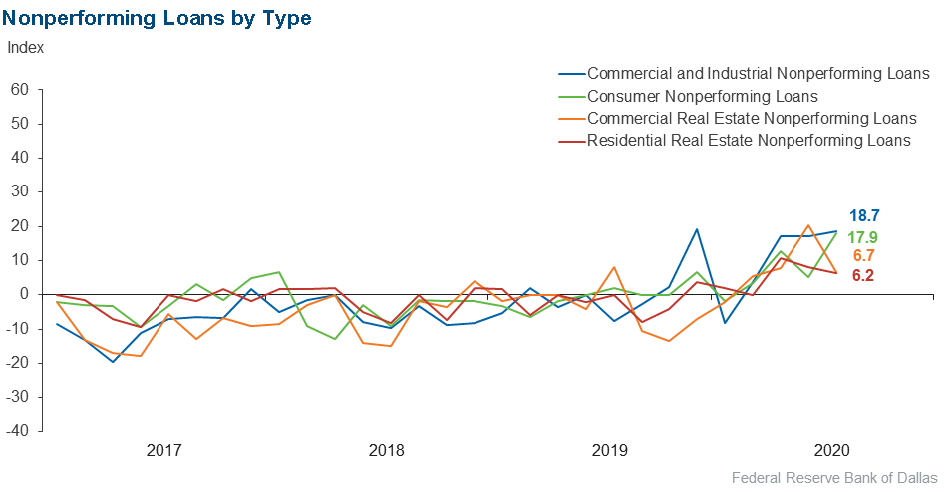

Nonperforming loans |

18.7 |

17.1 |

23.4 |

71.9 |

4.7 |

| |

|||||

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

|

Credit standards and terms |

–27.4 |

–42.6 |

0.0 |

72.6 |

27.4 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Loan volume |

1.6 |

–14.8 |

25.8 |

50.0 |

24.2 |

|

Nonperforming loans |

6.7 |

20.3 |

10.0 |

86.7 |

3.3 |

| |

|||||

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

|

Credit standards and terms |

–25.0 |

–40.3 |

0.0 |

75.0 |

25.0 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Loan volume |

48.4 |

32.9 |

53.1 |

42.2 |

4.7 |

|

Nonperforming loans |

6.2 |

8.2 |

7.8 |

90.6 |

1.6 |

| |

|||||

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

|

Credit standards and terms |

–9.3 |

–14.1 |

1.6 |

87.5 |

10.9 |

| Consumer Loans: Over the past six weeks, how have the following changed? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Loan volume |

–13.4 |

–22.1 |

17.9 |

50.7 |

31.3 |

|

Nonperforming loans |

17.9 |

5.2 |

19.4 |

79.1 |

1.5 |

| |

|||||

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

|

Credit standards and terms |

–11.9 |

–12.0 |

1.5 |

85.1 |

13.4 |

| Banking Outlook: What is your expectation for the following items six months from now? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

|

Total loan demand |

–2.9 |

16.5 |

32.4 |

32.4 |

35.3 |

|

Nonperforming loans |

72.7 |

60.2 |

72.7 |

27.3 |

0.0 |

| General Business Activity: What is your evaluation of the level of activity? |

|||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

|

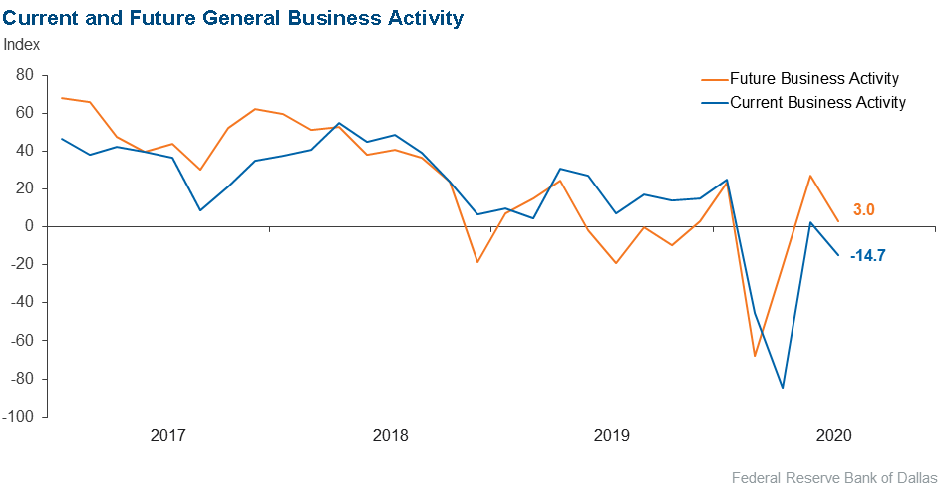

Over the past six weeks |

–14.7 |

2.6 |

23.5 |

38.2 |

38.2 |

|

Six months from now |

3.0 |

26.9 |

41.8 |

19.4 |

38.8 |

Next release: October 5

|

Data were collected Aug. 4–12, and 69 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease. |

August 2020

August 2020

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

Economic Disruption

- We have concerns around small businesses (retail, specialty, restaurants, gyms, bars, etc.) either not surviving or not having a desire to survive beyond fourth quarter 2020. Also, more businesses are realizing staff can work remotely and there will be less need for brick and mortar. This will create a decrease in demand for commercial real estate; therefore, foreseeable values are expected to decline significantly.

- Concerns still exist around the uncertainty of what the economic landscape will look like in the next one to six months. We are working with many individuals and businesses to see how we may be of assistance. In our business communities, we see a great deal of worry about when the economy will see increased activity. Many do not expect activity to return to pre-coronavirus levels until months or years after a vaccine is found. Particularly in the restaurant, bar and amusement industries, a great deal of regulations from the governor coupled with coronavirus fears are putting extreme stress on business operations. Many businesses are walking a thin line between attempting to follow our governor’s orders, weak sales and attempting to spend extra funds to modify usual operational processes to keep their businesses afloat. The timing of a coronavirus vaccine is becoming a critical issue as most, but not all, landlords are starting to demand rent payments. This adds expenses to an already stressed business balance sheet.

- COVID issues are still a wild card.

- We anticipate continued volatility and uncertainty over the next several months until we get past the election season, with cautious optimism that the next several months will bring additional positive news on the COVID front, from vaccines and mitigation efforts.

- An inability to understand where the economy is going is causing many of our customers to retreat to the sidelines until there is more certainty. Others are going forward, but with pro formas that are utilizing “pre-COVID” assumptions, which makes underwriting difficult and speculative.

- The prolonged shutdown has hurt small businesses. Those that survive should rebound to close to normal levels six to 12 months out. The big unknown is how the presidential election will impact the outlook and activity of businesses.

- The election and finding a vaccine for COVID-19 are issues of concern. Until the vaccine is found and is working well, the economy will not recover. Also, there are concerns that certain businesses will not recover and go out of business.

- The federal government needs to put on a mask and get back into the office so businesses will follow; that will make a lot of difference.

Lending and Banking

- The TRID [TILA RESPA Integrated Disclosure rule] greatly hampers our ability to serve our customers. It just costs everyone time and money, bank and consumer.

- We have experienced a 15 percent increase in deposits (excluding PPP loan deposits) since February 2020 (about 60 percent from business deposits; about 40 percent from consumer deposits). Customers are sitting on cash. Loan volume and demand have diminished (mainly small business customers).

- I am concerned about excess liquidity and declining net interest margins.

- With the exception of residential real estate loans in Central Texas, I expect all real estate lending opportunities to continue to decline. I also expect there will be substantial deterioration in bank NFNR [nonfarm nonresidential] loan portfolios because of the changes promulgated from the remote/work-at-home practices which have evolved during the pandemic.

- We feel that loan demand and general business activity will continue to decline until there is a vaccine for the COVID-19 virus.

- We have been blessed with consistent but slowed business. Losses have been minimal, so far.

- PPP loan forgiveness needs to be a priority for the SBA [Small Business Administration] and Treasury.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.