Banking Conditions Survey

For this survey, Eleventh District banking executives were asked supplemental questions on outlook concerns, commercial real estate and interest rates. Read the special questions results.

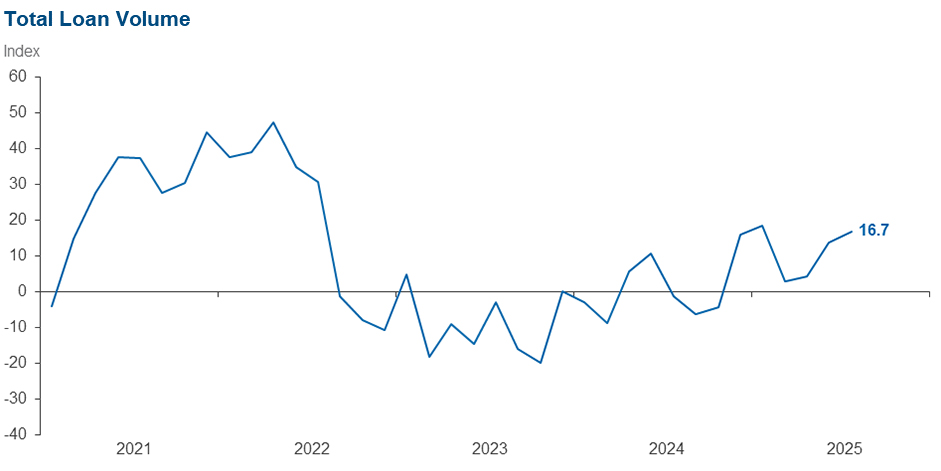

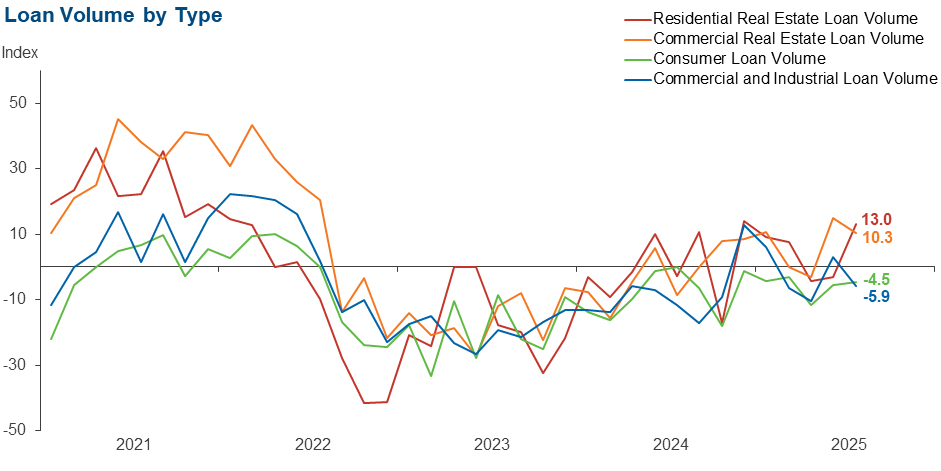

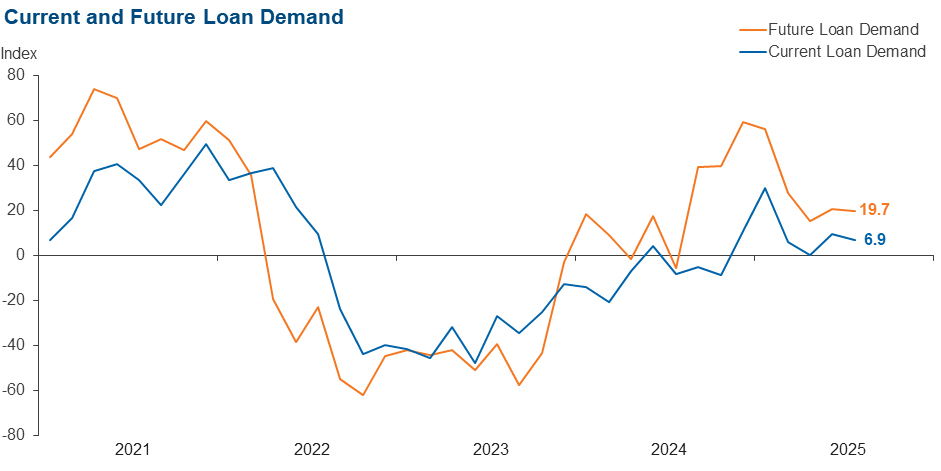

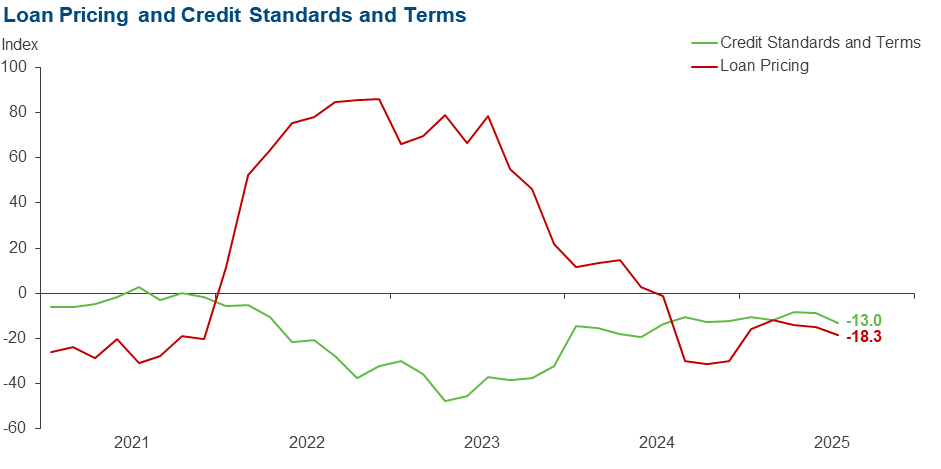

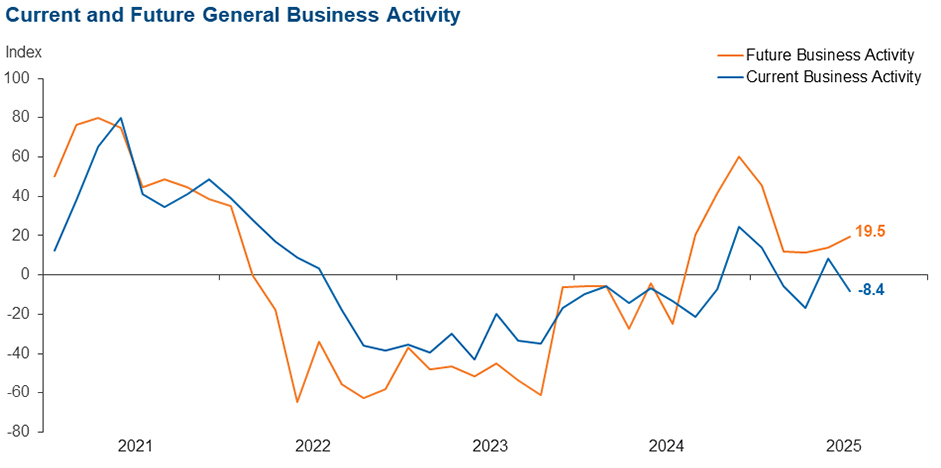

Loan volume and demand increased in August. Loan volume was driven by a sharp acceleration in residential real estate loans, which had contracted in the prior period. Credit tightening continued, but loan pricing declined, both at a pace slightly faster than in June. Across all loan types, loan performance deteriorated. Bankers reported declining general business activity; however, their outlook is mildly optimistic. Survey respondents expect growth in loan demand and business activity six months from now, with a minor deterioration in loan performance.

Next release: September 29, 2025

Data were collected August 5–13, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 16.7 | 13.7 | 40.3 | 36.1 | 23.6 |

Loan demand | 6.9 | 9.6 | 36.1 | 34.7 | 29.2 |

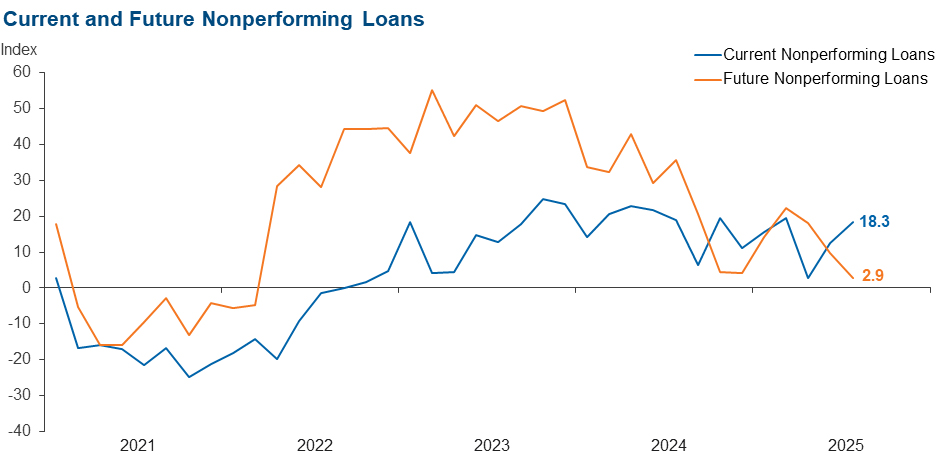

Nonperforming loans | 18.3 | 12.5 | 31.0 | 56.3 | 12.7 |

Loan pricing | –18.3 | –15.1 | 0.0 | 81.7 | 18.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

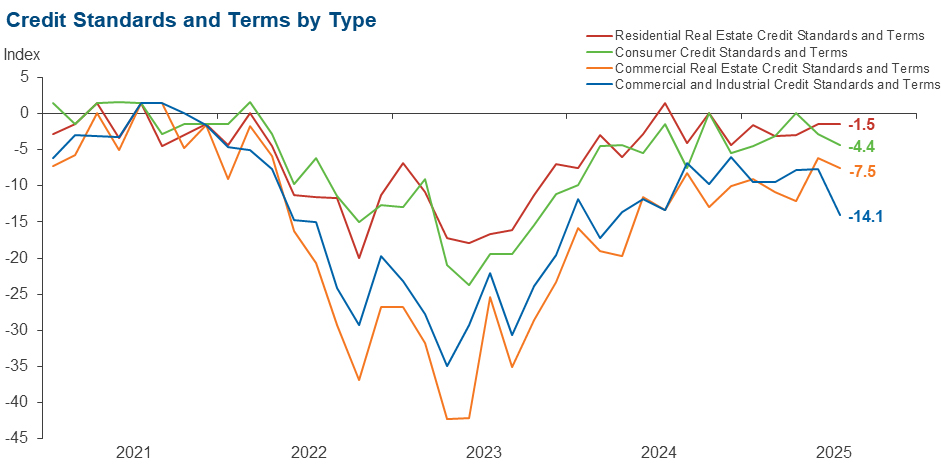

Credit standards and terms | –13.0 | –8.8 | 0.0 | 87.0 | 13.0 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –5.9 | 3.0 | 19.1 | 55.9 | 25.0 |

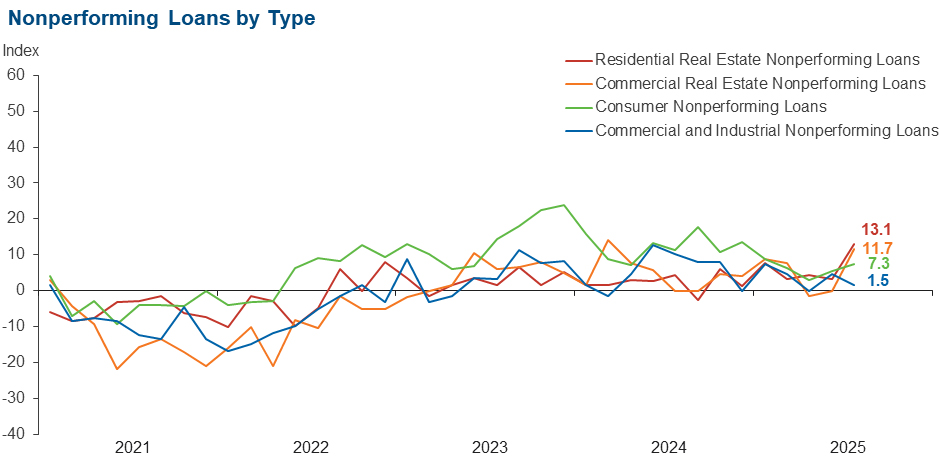

Nonperforming loans | 1.5 | 4.6 | 7.4 | 86.8 | 5.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –14.1 | –7.7 | 0.0 | 85.9 | 14.1 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 10.3 | 14.9 | 30.9 | 48.5 | 20.6 |

Nonperforming loans | 11.7 | 0.0 | 17.6 | 76.5 | 5.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –7.5 | –6.1 | 0.0 | 92.5 | 7.5 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 13.0 | –3.0 | 33.3 | 46.4 | 20.3 |

Nonperforming loans | 13.1 | 3.1 | 17.4 | 78.3 | 4.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.5 | –1.5 | 0.0 | 98.5 | 1.5 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –4.5 | –5.5 | 17.6 | 60.3 | 22.1 |

Nonperforming loans | 7.3 | 5.5 | 14.7 | 77.9 | 7.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.4 | –2.9 | 0.0 | 95.6 | 4.4 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 19.7 | 20.6 | 49.3 | 21.1 | 29.6 |

Nonperforming loans | 2.9 | 9.7 | 23.2 | 56.5 | 20.3 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | –8.4 | 8.2 | 19.4 | 52.8 | 27.8 |

Six months from now | 19.5 | 13.7 | 43.1 | 33.3 | 23.6 |

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- Regional business activity is improving, along with loan demand. Business owners are willing to move forward despite uncertainties tied to tariffs, interest rates and other factors.

- The longer that trade policy changes drag on without being finalized, the longer borrowers will pause on capital spending.

- Uncertainty remains in the market; however, rate cuts will have an impact. Current rates are having a negative psychological impact when there is a perceived likelihood of a federal funds rate cut in the third or fourth quarter of this year.

- We believe there are three areas that are affecting loan demand in this environment. One, customers are taking a wait-and-see attitude toward the next rate decrease—by when and how much. They are looking over the horizon and will wait for the decrease. Two, the really smart borrowers loaded up when rates were low, and they are working through their capital spends with the cheaper dollars. They also have a wait-and-see attitude. Three, we are seeing some banks (just a few) alter rates and terms just to get a deal. They are competing with credit unions that are offering unrealistic terms and conditions. Some [offerings] seem to border on safety and soundness—including long terms, low rates and no personal guarantees.

- We are seeing a slowdown across a number of metrics as the year has progressed.

- Borrowers and applicants seem to have increasing concerns regarding the uncertainty of the timing and direction of rate changes.

- We have increased demand from the new development in northeast Louisiana. Logging and agriculture-related businesses are struggling. Rental demand is strong, but new development struggles to generate cash flow due to the rate environment.

- Construction activity has decreased somewhat as a result of a lack of availability of workers due to Immigration and Customs Enforcement raids. Regulatory burden has eased as a result of the change in administration.

- Overall, commercial lending is very slow. We are not seeing commercial investments being made by small business owners. Consumer real estate lending is primarily second-lien home equity loans to customers who have low-interest-rate first-lien loans. Presently, our primary focus is to help meet the needs of the flood victims in our Kerrville and San Angelo markets.

- I expect increased nonperforming loans and repossessions, resulting in significant charge-offs, as a result of overpriced vehicles financed since the pandemic.

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.