Special Questions

Special Questions

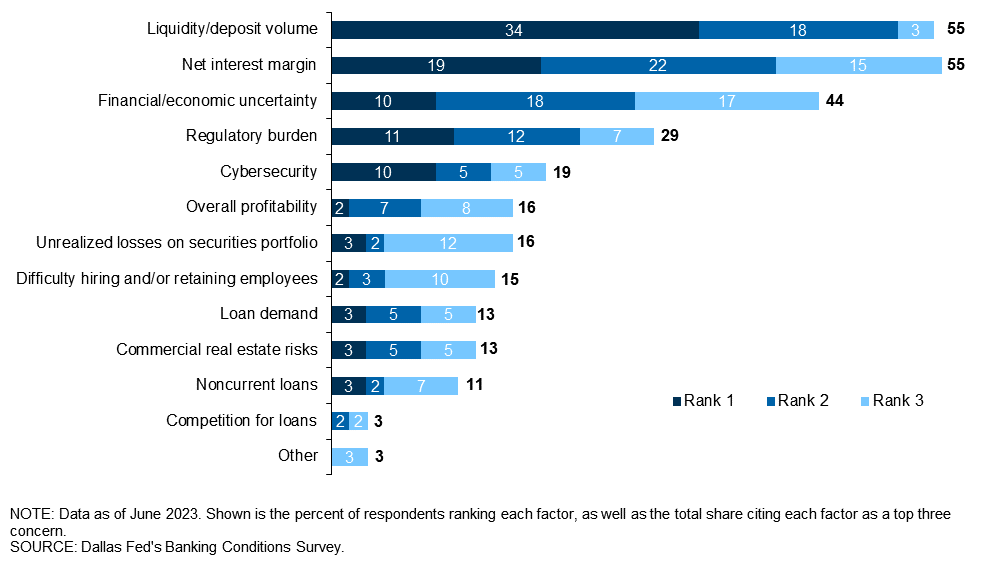

| May '23 | Jun. '23 | ||||

| Total (percent) |

Total (percent) |

Rank 1 (percent) |

Rank 2 (percent) |

Rank 3 (percent) |

|

| Liquidity/deposit volume | 61.3 | 54.8 | 33.9 | 18.3 | 3.4 |

| Net interest margin | 46.8 | 54.8 | 19.4 | 21.7 | 15.3 |

| Financial/economic uncertainty | 46.8 | 43.5 | 9.7 | 18.3 | 16.9 |

| Regulatory burden | 35.5 | 29.0 | 11.3 | 11.7 | 6.8 |

| Cybersecurity | 22.6 | 19.4 | 9.7 | 5.0 | 5.1 |

| Overall profitability | 17.7 | 16.1 | 1.6 | 6.7 | 8.5 |

| Unrealized losses on securities portfolio | 14.5 | 16.1 | 3.2 | 1.7 | 11.9 |

| Difficulty hiring and/or retaining employees | 11.3 | 14.5 | 1.6 | 3.3 | 10.2 |

| Loan demand | 19.4 | 12.9 | 3.2 | 5.0 | 5.1 |

| Commercial real estate risks | 6.5 | 12.9 | 3.2 | 5.0 | 5.1 |

| Noncurrent loans | 4.8 | 11.3 | 3.2 | 1.7 | 6.8 |

| Competition for loans | 8.1 | 3.2 | 0.0 | 1.7 | 1.7 |

| Other | 1.6 | 3.2 | 0.0 | 0.0 | 3.4 |

NOTE: 62 responses.

| Jun. '23 (percent) |

|

| Paying a higher interest rate to retain core deposits | 73.5 |

| Declining deposit volume | 23.5 |

| Increased cost of noncore funding | 2.9 |

| Difficulty accessing liquidity | 0.0 |

| Other | 0.0 |

NOTES: 34 responses. This question only posed to those who selected "Liquidity/deposit volume" on question 1.

| Jun. '23 (percent) |

|

| Increased slightly | 26.2 |

| Increased significantly | 0.0 |

| No change | 23.0 |

| Decreased slightly | 45.9 |

| Decreased significantly | 4.9 |

NOTE: 61 responses.

| Jun. '23 (percent) |

|

| Increase slightly | 30.6 |

| Increase significantly | 1.6 |

| No change | 33.9 |

| Decrease slightly | 33.9 |

| Decrease significantly | 0.0 |

NOTE: 62 responses.

| Jun. '23 (percent) |

|

| Keeping them at the Fed | 47.5 |

| Lending them to customers | 29.5 |

| Lending them to other banks or third parties | 11.5 |

| Paying down Federal Home Loan Bank borrowings | 3.3 |

| Investing them in short-term securities | 3.3 |

| Investing them in long-term securities | 0.0 |

| Other | 4.9 |

NOTES: 61 responses.

| Jun. '23 (percent) |

|

| Commercial real estate loans | 52.8 |

| Commercial & industrial loans | 26.4 |

| Consumer loans | 11.3 |

| Residential real estate loans | 9.4 |

NOTES: 62 responses. The results exclude the 14.5 percent of respondents that answered, "Not applicable; we did not increase loan pricing."

| Jun. '23 (percent) |

|

| Commercial real estate loans | 72.5 |

| Consumer loans | 12.5 |

| Commercial & industrial loans | 7.5 |

| Residential real estate loans | 7.5 |

NOTES: 62 responses. The results exclude the 35.5 percent of respondents that answered, "Not applicable; we did not tighten credit standards and terms."

| No | Yes, some tightening | Yes, significant tightening | |

| Construction and land development | 27.5 | 56.9 | 15.7 |

| Industrial | 50.0 | 48.0 | 2.0 |

| Retail | 37.3 | 54.9 | 7.8 |

| Multifamily | 35.6 | 51.1 | 13.3 |

| Office | 34.8 | 43.5 | 21.7 |

| Hotels/lodging | 33.3 | 41.0 | 25.6 |

| Other | 56.0 | 40.0 | 4.0 |

NOTE: 52 responses.

Special Questions Comments

These comments have been edited for publication.

- Our chief deposit concern is that consumer access to treasuries and nonbank alternatives is becoming easier, creating greater pricing parity. The unprecedented pace of Fed funds rate increases has put the industry far behind the curve of the nonbank markets. We believe the industry will come out of this situation with a much tighter deposit cost and margin that will promote consolidation and cheaper digital channels. The tighter margins will force it. Our strategic focus is redesigning our business model to align with that future.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.