Texas Service Sector Outlook Survey

Modest expansion continues in Texas service sector, though outlooks worsen

For this month’s survey, Texas business executives were asked supplemental questions on their revenue outlook and concerns. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

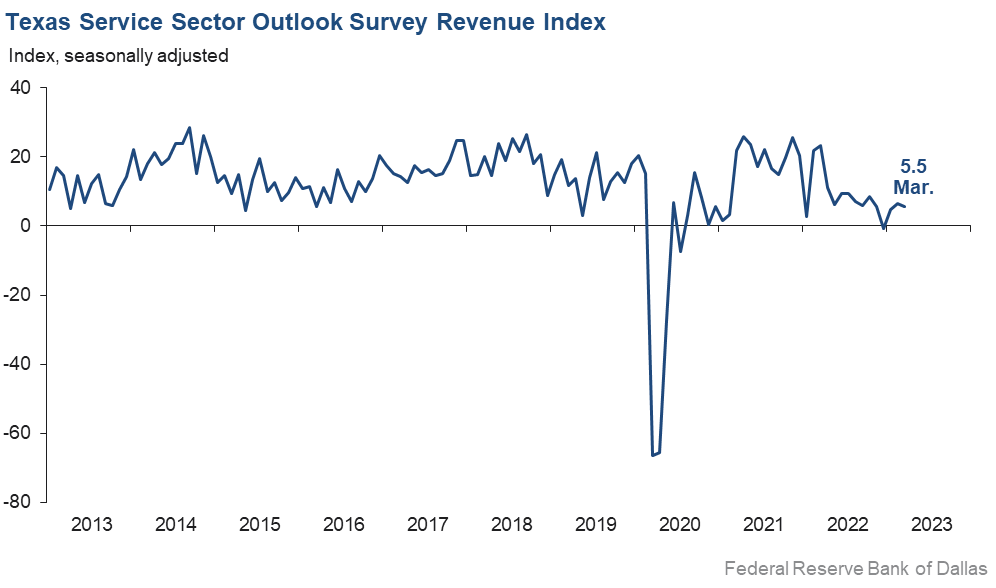

Growth in Texas service sector activity continued in March, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, edged down just over one point to 5.5, suggesting a slight slowdown in activity growth.

Labor market indicators pointed to mostly flat employment and a slight contraction in workweeks. The employment index fell below zero—for the first time since July 2020—to -0.4, indicating employment growth stalled in March. The part-time employment index fell three points to 1.4, and the hours worked index moved down from 1.8 to -1.8.

Perceptions of broader business conditions worsened further in March as uncertainty picked up. The general business activity index moved down nine points to -18.0. The company outlook index also fell, from -1.7 to -11.3, while the outlook uncertainty index rose 10 points to 22.8—above its series average of 13.5.

Price pressures eased, and wage pressures remained elevated. The input prices index ticked down from 40.6 to 38.3, and the selling prices index dropped eight points to 11.4. The wages and benefits index remained flat at 19.8, still elevated relative to its average reading of 15.7.

Respondents’ expectations regarding future business activity were mixed in March. The future general business activity index remained negative, falling from -3.6 to -12.2. The future revenue index stayed positive but fell eight points to 34.4. Other future service sector activity indexes such as employment and capital expenditures also decreased but remained in positive territory, reflecting expectations for slower growth the rest of the year.

Texas Retail Outlook Survey

Texas retail sales hold steady

Retail sales activity flattened in March, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, was 0.8, suggesting sales were mostly flat in March. Retailers’ inventories increased at a slower rate than last month, with the index falling from 9.6 to 4.9.

Retail labor market indicators reflected contraction in employment and notably shorter workweeks in March. The employment index dropped from 6.9 to -6.8. The part-time employment index fell from 1.7 to -0.4. The hours worked index decreased nine points to -10.9.

Retailers’ perceptions of broader business conditions continued to worsen in March as both the general business activity and company outlook indexes remained in deeply negative territory. The general business activity index fell eight points to -26.9, while the company outlook index edged up to -15.7. The outlook uncertainty index shot up 12 points to 25.4.

Price pressures eased, while wage pressures increased slightly in March. The selling prices index dropped 10 points to 6.8, and the input prices index fell four points to 30.0. The wages and benefits index rose three points to 19.7.

Expectations for future retail growth were mixed in March. The future general business activity index remained unchanged at -17.1, while the future sales index rose five points from 11.4 to 16.7. Other indexes of future retail activity such as employment and capital expenditures remained positive, reflecting expectations for growth in retail activity later in the year.The Texas Retail Outlook Survey is a component of the Texas Service Sector Outlook Survey that uses information only from respondents in the retail and wholesale sectors.

Next release: April 25, 2023

Data were collected March 14–22, and 300 Texas service sector business executives, of which 63 were retailers, responded to the survey. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 5.5 | 6.6 | –1.1 | 11.0 | 3(+) | 28.5 | 48.4 | 23.0 |

Employment | –0.4 | 8.8 | –9.2 | 6.5 | 1(–) | 12.7 | 74.2 | 13.1 |

Part–Time Employment | 1.4 | 4.0 | –2.6 | 1.5 | 3(+) | 8.8 | 83.8 | 7.4 |

Hours Worked | –1.8 | 1.8 | –3.6 | 2.8 | 1(–) | 6.7 | 84.8 | 8.5 |

Wages and Benefits | 19.8 | 19.4 | +0.4 | 15.7 | 34(+) | 22.0 | 75.8 | 2.2 |

Input Prices | 38.3 | 40.6 | –2.3 | 27.6 | 35(+) | 40.9 | 56.5 | 2.6 |

Selling Prices | 11.4 | 19.8 | –8.4 | 7.5 | 32(+) | 20.4 | 70.6 | 9.0 |

Capital Expenditures | 7.4 | 10.6 | –3.2 | 10.1 | 32(+) | 17.6 | 72.2 | 10.2 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –11.3 | –1.7 | –9.6 | 4.9 | 10(–) | 12.0 | 64.7 | 23.3 |

General Business Activity | –18.0 | –9.3 | –8.7 | 3.2 | 10(–) | 9.4 | 63.2 | 27.4 |

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 22.8 | 12.9 | +9.9 | 13.5 | 22(+) | 33.9 | 55.0 | 11.1 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 34.4 | 42.2 | –7.8 | 37.8 | 35(+) | 49.4 | 35.7 | 15.0 |

Employment | 21.5 | 28.9 | –7.4 | 23.2 | 35(+) | 32.7 | 56.1 | 11.2 |

Part–Time Employment | 2.4 | 5.7 | –3.3 | 6.9 | 9(+) | 11.4 | 79.6 | 9.0 |

Hours Worked | 1.6 | 4.4 | –2.8 | 5.9 | 35(+) | 7.9 | 85.8 | 6.3 |

Wages and Benefits | 36.9 | 40.4 | –3.5 | 37.3 | 35(+) | 40.1 | 56.7 | 3.2 |

Input Prices | 42.1 | 53.7 | –11.6 | 44.7 | 195(+) | 47.3 | 47.5 | 5.2 |

Selling Prices | 24.4 | 31.9 | –7.5 | 24.6 | 35(+) | 32.3 | 59.8 | 7.9 |

Capital Expenditures | 13.1 | 22.4 | –9.3 | 23.5 | 34(+) | 24.4 | 64.3 | 11.3 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –5.3 | 10.8 | –16.1 | 16.1 | 1(–) | 18.2 | 58.3 | 23.5 |

General Business Activity | –12.2 | –3.6 | –8.6 | 12.9 | 11(–) | 16.8 | 54.2 | 29.0 |

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 0.8 | –19.9 | +20.7 | 4.4 | 1(+) | 27.7 | 45.5 | 26.9 |

Employment | –6.8 | 6.9 | –13.7 | 1.9 | 1(–) | 9.0 | 75.2 | 15.8 |

Part–Time Employment | –0.4 | 1.7 | –2.1 | –1.6 | 1(–) | 10.3 | 79.0 | 10.7 |

Hours Worked | –10.9 | –1.6 | –9.3 | –1.8 | 4(–) | 2.9 | 83.3 | 13.8 |

Wages and Benefits | 19.7 | 16.6 | +3.1 | 11.1 | 32(+) | 22.8 | 74.1 | 3.1 |

Input Prices | 30.0 | 33.7 | –3.7 | 22.5 | 35(+) | 40.5 | 48.9 | 10.5 |

Selling Prices | 6.8 | 17.2 | –10.4 | 13.9 | 34(+) | 29.6 | 47.6 | 22.8 |

Capital Expenditures | 5.9 | 10.1 | –4.2 | 8.1 | 26(+) | 18.4 | 69.1 | 12.5 |

Inventories | 4.9 | 9.6 | –4.7 | 2.3 | 10(+) | 23.2 | 58.5 | 18.3 |

| Companywide Retail Activity | ||||||||

Companywide Sales | –8.2 | –13.0 | +4.8 | 5.8 | 13(–) | 19.1 | 53.6 | 27.3 |

Companywide Internet Sales | –9.9 | –22.2 | +12.3 | 4.8 | 6(–) | 9.0 | 72.1 | 18.9 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –15.7 | –18.4 | +2.7 | 2.5 | 13(–) | 9.7 | 64.9 | 25.4 |

General Business Activity | –26.9 | –18.7 | –8.2 | –1.2 | 11(–) | 2.9 | 67.3 | 29.8 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 25.4 | 13.2 | +12.2 | 11.0 | 22(+) | 34.9 | 55.6 | 9.5 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 16.7 | 11.4 | +5.3 | 31.6 | 9(+) | 36.2 | 44.3 | 19.5 |

Employment | 10.8 | 10.1 | +0.7 | 13.0 | 35(+) | 19.2 | 72.4 | 8.4 |

Part–Time Employment | –1.5 | –5.4 | +3.9 | 1.7 | 4(–) | 8.2 | 82.1 | 9.7 |

Hours Worked | –11.9 | –0.3 | –11.6 | 2.8 | 6(–) | 2.4 | 83.3 | 14.3 |

Wages and Benefits | 25.3 | 31.2 | –5.9 | 29.2 | 35(+) | 30.8 | 63.6 | 5.5 |

Input Prices | 20.0 | 39.4 | –19.4 | 34.3 | 35(+) | 35.0 | 50.0 | 15.0 |

Selling Prices | 5.1 | 25.8 | –20.7 | 29.9 | 35(+) | 23.7 | 57.6 | 18.6 |

Capital Expenditures | 1.6 | 18.3 | –16.7 | 17.7 | 34(+) | 13.3 | 75.0 | 11.7 |

Inventories | 17.8 | 8.6 | +9.2 | 10.7 | 35(+) | 33.0 | 51.8 | 15.2 |

| Companywide Retail Activity | ||||||||

Companywide Sales | 11.9 | 7.2 | +4.7 | 30.2 | 2(+) | 28.3 | 55.3 | 16.4 |

Companywide Internet Sales | 4.2 | 15.4 | –11.2 | 22.1 | 4(+) | 17.0 | 70.2 | 12.8 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –9.0 | –8.0 | –1.0 | 16.0 | 11(–) | 15.0 | 61.0 | 24.0 |

General Business Activity | –17.1 | –17.0 | –0.1 | 11.4 | 12(–) | 13.4 | 56.1 | 30.5 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Texas Retail Outlook Survey

Texas Service Sector Outlook Survey

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- The financial market activities are unnerving and impacting mergers and acquisitions opportunities as many are buckling down to preserve liquidity and wait to see how all lands in the next six months. We were optimistic and seeing improved opportunity ahead of the bank failures, but our clients’ outlook and transactional activities have taken a quick pessimistic bend.

- The real estate industry faces a liquidity crisis that has to date been largely ignored. Much of the industry is already in recession, and higher interest rates are driving many properties toward failure, and the absence of liquidity will push this pressure to banks.

- We are a family-run commercial real estate firm. Our business is acquiring, financing, leasing and managing a portfolio of commercial real estate properties, including retail, office and office-flex, totaling about 1.3 million square feet, primarily in Dallas–Fort Worth and Central Texas and extending into Oklahoma. We also have several land development projects, primarily in Sherman, Texas, with commercial land sales, ground leases and build-to-suit projects. The rapidity with which interest rates have risen has caused interim financing costs to skyrocket and exit capitalization cap rates to substantially increase, while construction costs have not declined, and rental rates can no longer support new construction. We fortunately secured long-term, fixed-rate financing for multiple assets in 2021–22; however, there are some assets with debt maturities within the next 18 to 24 months that are cause for concern since they are at currently below-market interest rates and net operating incomes that will not be underwritten to refinance the entire principal amounts. Thus, this increased uncertainty is causing heightened anxiety due to increased risk of the available liquidity in the capital markets.

- In our consulting engineering field, the outlook for 2023 has improved, but 2024’s has worsened. Six months ago, our forecast was for 2023 to see a slight decline in revenue and 2024 to be a growth year. Changes in economic conditions have caused the revenue dip in our forecast to shift from 2023 to 2024.

- We had two full months with minimal to no new contracts signed. March has finally seen client contract signatures improve, but they were still below the levels we expected for March.

- We just had our worst month since before the Great Recession. We are down in every way you might measure dollars, hours billed, proposals closed, proposals written, etc. Development is really slowing down.

- We feel the cost of providing our service is increasing but are not sure about passing that to our clients since we have just gone through a buy-out, and 90 percent of our customers are nonprofits—organizations also taking a hit from the unsettled economic times.

- Increasing interest rates greatly affect the cash flow of most of our clients. As rates continue to climb, they [clients] have less money to spend on our services.

- Although residential real estate orders have rebounded slightly since the beginning of the year, commercial real estate orders have declined by 40–50 percent over last year. Our outlook for the real estate market has significantly declined due to the banking issues that we are facing. Hopefully, this will settle down, so we can figure out where this market is headed.

- The anxiety over future work seems to be abating, but it is still too early to tell. [There is] tremendous uncertainty about the economy, and workforce availability, quality and competency are all piling on and making it difficult to plan for growth or to add staff. The remote work structure is beginning to show weaknesses, and lack of accountability is resulting in lost revenue.

- We do not see evidence of so-called imminent or pending recession or economic downturn. [We are] still having trouble hiring and retaining qualified, trained staff.

- The SVB [Silicon Valley Bank] failure has frightened our clients, but we believe that will blow over.

- Employers are apprehensive about hiring due to the SVB failure, Federal Reserve interest rate increases and general economic unease. Clients continue to need to hire but are taking longer to pull the trigger on hiring decisions. Thankfully, local DFW clients have not been laying off. [We are] grateful for the stronger-than-national Texas economy.

- There are indications that the economy might slow down later this year. We remain in search of employees.

- The Fed [Federal Reserve] will continue to have a very difficult time getting inflation under control. The tools that worked in the late ’70s and early ‘80s are not as effective today because there are variables that are out of the control of the Federal Reserve. Economic uncertainty has increased recently but so has political uncertainty, compounding the stresses that we face looking forward. Market demand continues to grow, but political and economic limitations may mean we can't take full advantage of the growth.

- Angst has generated a triple limerick this month (by the way, liquidity and loans are very tight and getting tighter). There was a time, not long ago when banks, alas, began to go; Their balance sheets strained; Their liquidity waned; And the economy sank so low; The Fed to the rescue, they came; To save the banks from financial shame; With loans and support they held the fort; And prevented the system’s maim; So now we must hope, and we must pray; That our economy stays in play; That banks won’t falter and our money won’t alter; Thanks to the Fed, come what may!

- Inflation continues to be a huge problem, with limited ability to seek appropriate adjustments in revenue. The labor market continues to be challenging. We have seen an uptick in applications for open positions but continue to see the same issues with candidates not calling back (i.e., "ghosting") after initial contact made or interviews set.

- [There is] considerably less demand for my company’s services—well beyond what is typical for the season.

- The residential real estate market is still normalizing to prepandemic activity levels. We expect 2023 to be another challenging year unless long-term rates move lower by 100 basis points.

- The banking issues have created another distrust and unstable stock market, causing buyers to have uncertainty about buying a new home.

- While the outlook is very good, we are starting to see weakness in our smaller tenants, so we expect that the effect of rate increases, and other factors is beginning to impact our weaker retailers.

- [It is] likely that a further constriction of commercial real estate lending in the wake of bank failures will have an adverse impact on real estate deal-making.

- People are spending money. We do not feel a recession.

- The economy greatly affects our business. Truck rates have declined, so our customers are putting off the maintenance they need. Freight has slowed down and parts’ prices are up.

- [It’s] still tough finding people to work.

- Import and export volumes have dropped significantly. The train derailments have added more delays to the supply chain.

- [There is] not much change in our outlook currently. There are some positives (new pipeline announcements for crude capacity, LNG [liquefied natural gas] plant expansions) that will benefit our port, offset by some concerns (impact of the SVB failure on capital markets, continued political unrest). On balance, [things] seem to even out for now. We are seeing a cooling in inflationary pressures for services and goods, which should be helpful. We will continue hiring throughout the year.

- With the media reporting on the recent bank failures, there is elevated concern about the unpredictable reaction by some customers. However, at this point in time, there have been only a few inquiries. The community banks in general are not getting much feedback about concerns for the banking system in our markets. The issue will depend on the extent of the contagion that a lack of liquidity could cause in the larger regional banks.

- We are concerned about renewing our expiring debt facility. Our cost of funding will probably go up by 3–4 percent if we are able to renew.

- As the cost of debt for commercial real estate has increased, especially for short-term lending, we are seeing more inquiries from people who are becoming more interested in medium- and long-term fixed- rate debt sources, which is the market segment we work in most often. Refinancing will be difficult but readily available for those who can either bring in new partners or who have the wherewithal to otherwise inject more equity into their projects. We also think that the recent examples of the dangers of mismatched duration between assets and liabilities for several banks will result in banks being more reluctant to make longer-term fixed-rate mortgage loans on commercial real estate. Insurance company lenders on the other hand, prefer to do fixed-rate loans with a maturity of at least 10 years.

- Events such as the collapse of the SVB create heightened uncertainty among our investors, partners and customers that indirectly impacts us and creates ambiguity around the economic condition. In this environment, we continue to reduce spending on capital expenditures and wages so that we are prepared for any broader downturn. While there is reason to hope for improvement, uncertainty around Fed [Federal Reserve] actions and how markets and institutions, and subsequently consumers, will react is forcing us to be extremely conservative in this period.

- It seems more and more people chose to travel this spring break, which resulted in them not shopping as much as prior years. February’s comparison to March is hard with Texas weather. We will be more curious how April and March do, together with Easter being much later this year versus last year. March and April combined will give me a better outlook on how we will be trending going into summer and early fall.

- The banking situation is worrisome. We don't think the Fed [Federal Reserve] can control inflation if the federal government doesn't stop with the excessive spending. We no longer have the work backlogs that we had in recent months, but things are still OK. Labor shortage is no better; we need to hire drivers badly, and we can't find them.

- Inflation is still having an impact on our foreign restaurant customers. Due to the higher cost of goods being imported from the U.S., some have started looking for local sources of supply (in their home countries), but they still prefer to import from the U.S. because of better quality and consistent supply.

- The recent SVB failure has us questioning the strength of our financial leadership in the current administration. Our business decisions can be sound when we can make accurate assumptions, but in the current environment, we are unsure. We believe we need to take a pause regarding any major decisions until we see more stability in the markets.

- Our consumers are resisting increases in financing costs.

- We have declining sales due to slowing activity in home sales. Manufacturing cost is going up, and prices are going down.

- The volatility in the financial sector has introduced increased caution and delay/suspension of some planned capital spending. Our stance has shifted from cautiously optimistic to hold in place for the next 30 days.

- The labor shortage continues to be our No. 1 concern with little to no end in sight.

- We see a continuing shortage of available labor and an increased cost of labor. Inflation and all other operating costs are putting significant pressure on profit margins. Slow business travel continues to be an issue.

- Borrowing costs are significantly slowing down expansion plans and consumer spending.

- The failure of our federal government to properly manage our fiscal affairs continues to be a drag on optimism. We cannot continue to spend more than we take in. The prospect of war over Taiwan is also weighing on us.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Jesus Cañas at jesus.canas@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.