Texas Service Sector Outlook Survey

Modest growth in Texas service sector activity continues

For this month’s survey, Texas business executives were asked supplemental questions on expected demand and recent storms. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

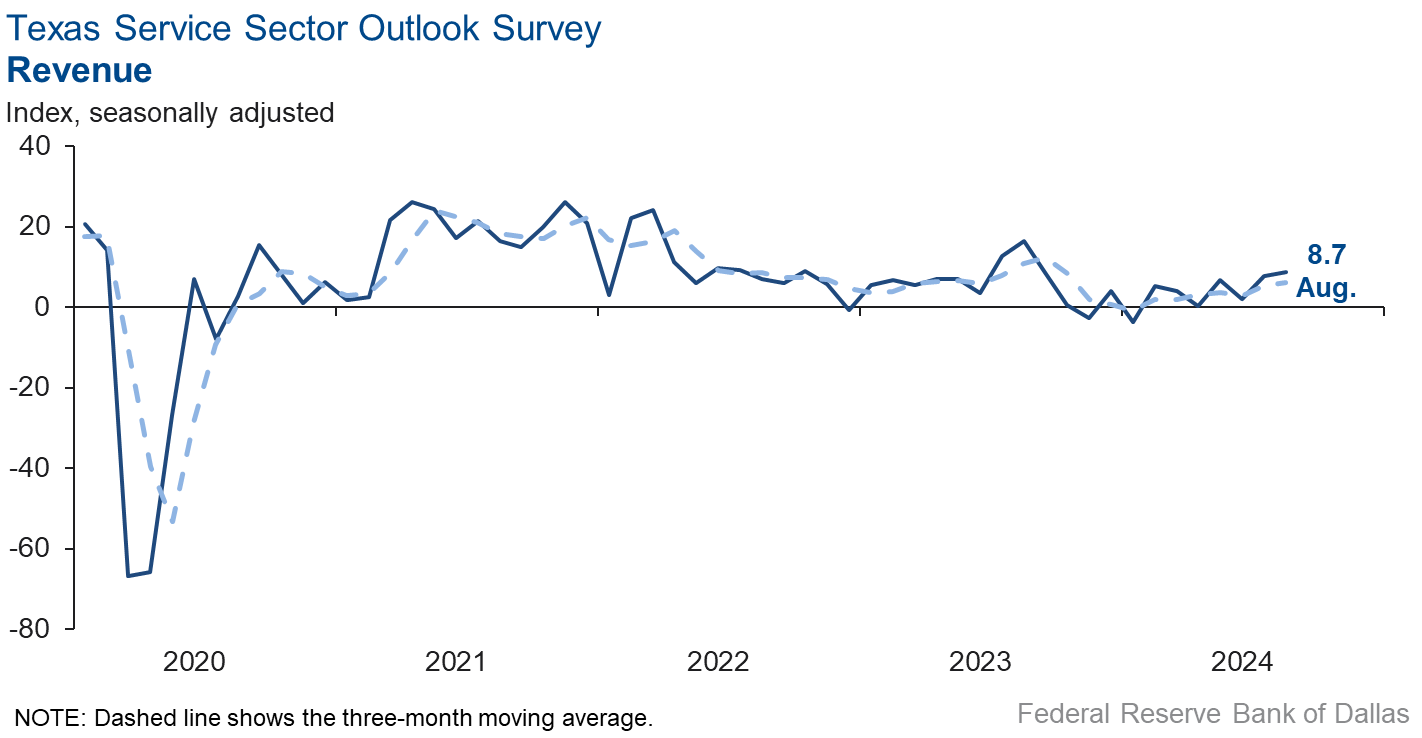

Texas service sector activity expanded at about the same pace in August as the prior month, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, was little changed at 8.7.

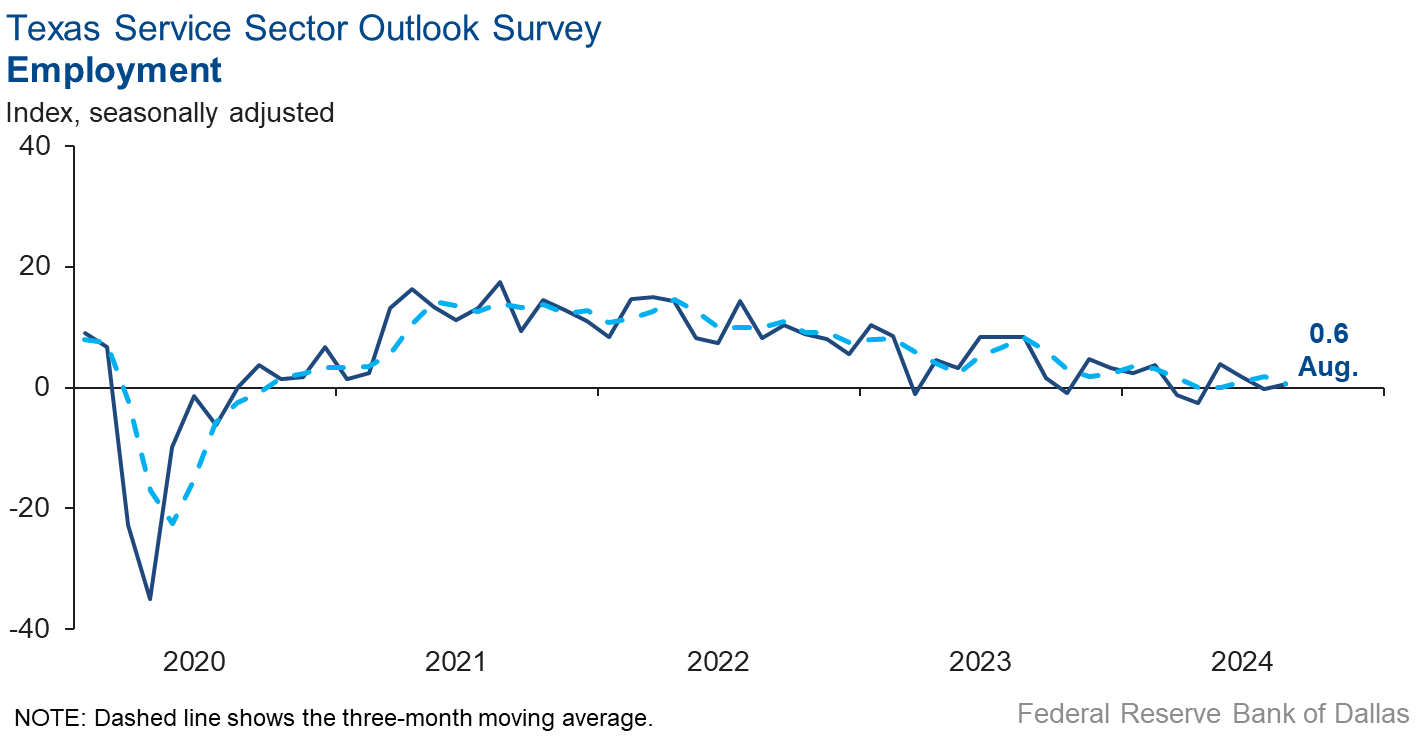

Labor market measures suggested no growth in employment in August and no change in hours worked. The employment index held fairly steady at 0.6, with the near-zero reading signaling little change in employment from July. The part-time employment index fell to -4.9 while the hours-worked index was unchanged at -0.7.

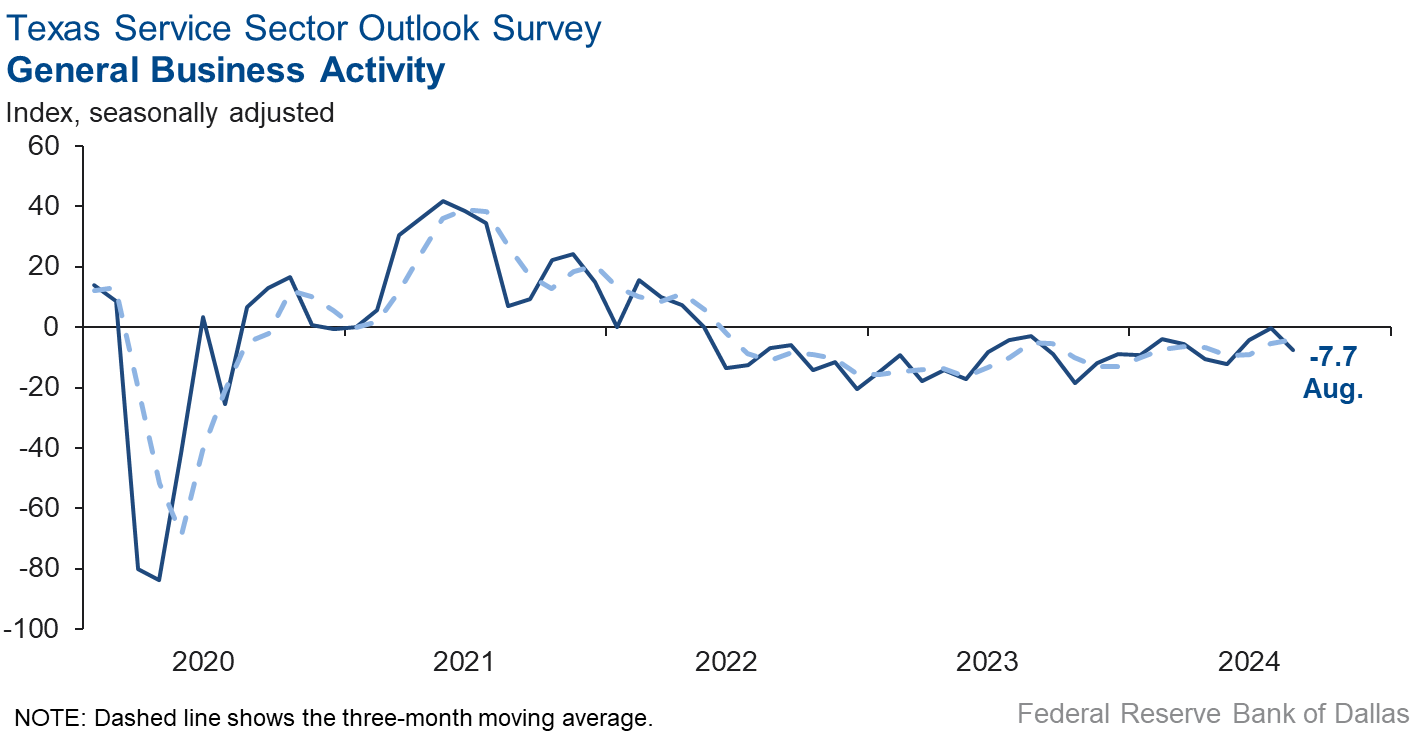

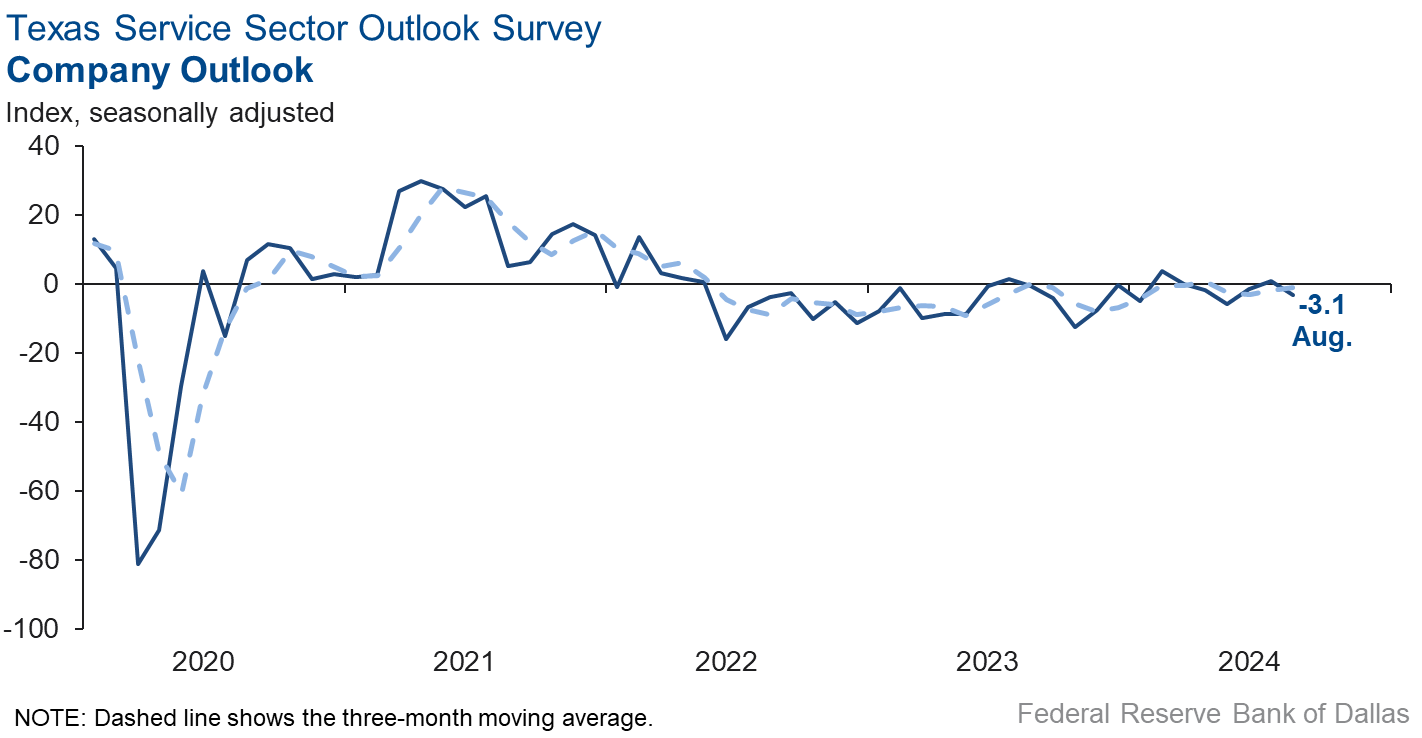

Perceptions of broader business conditions worsen slightly in August. The general business activity index fell to -7.7 from -0.1. The company outlook index also fell to -3.1 from 1.0. The outlook uncertainty index increased to 13.9 from 8.4.

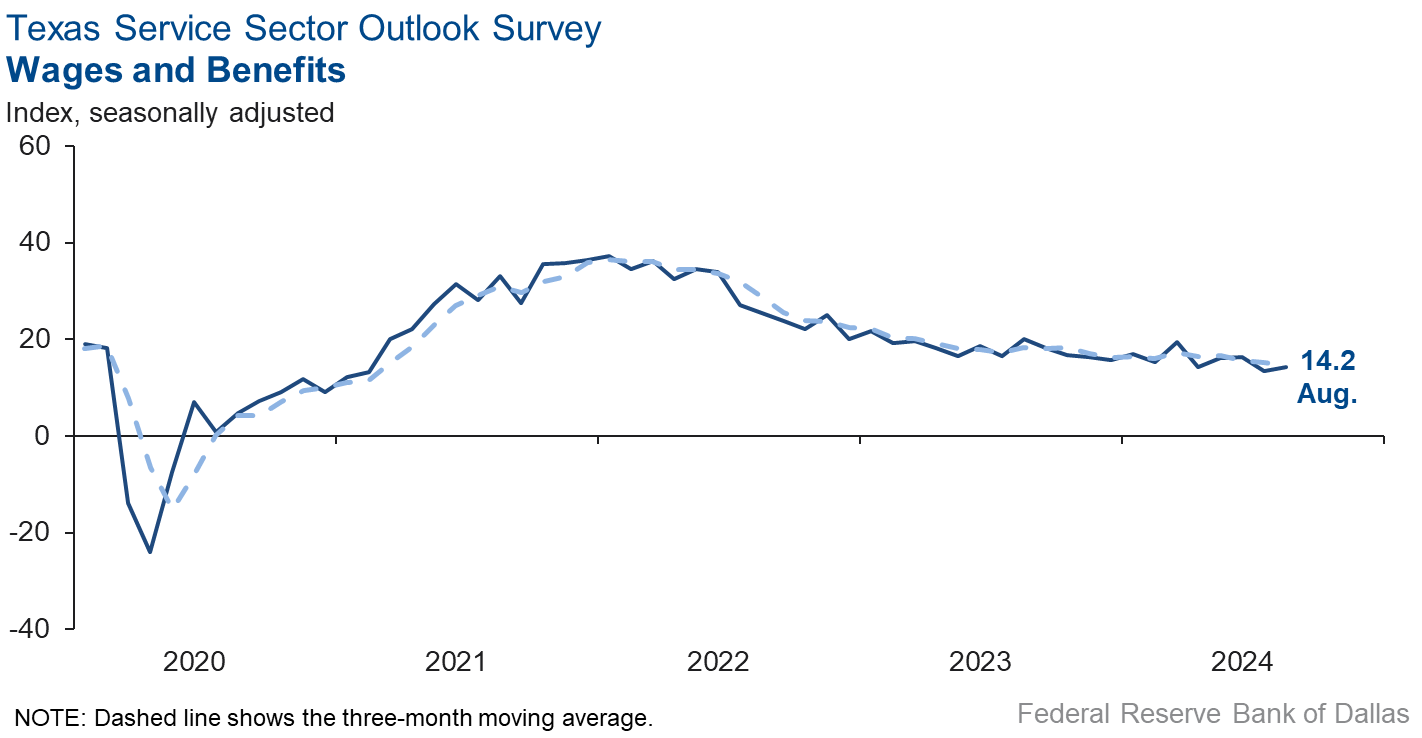

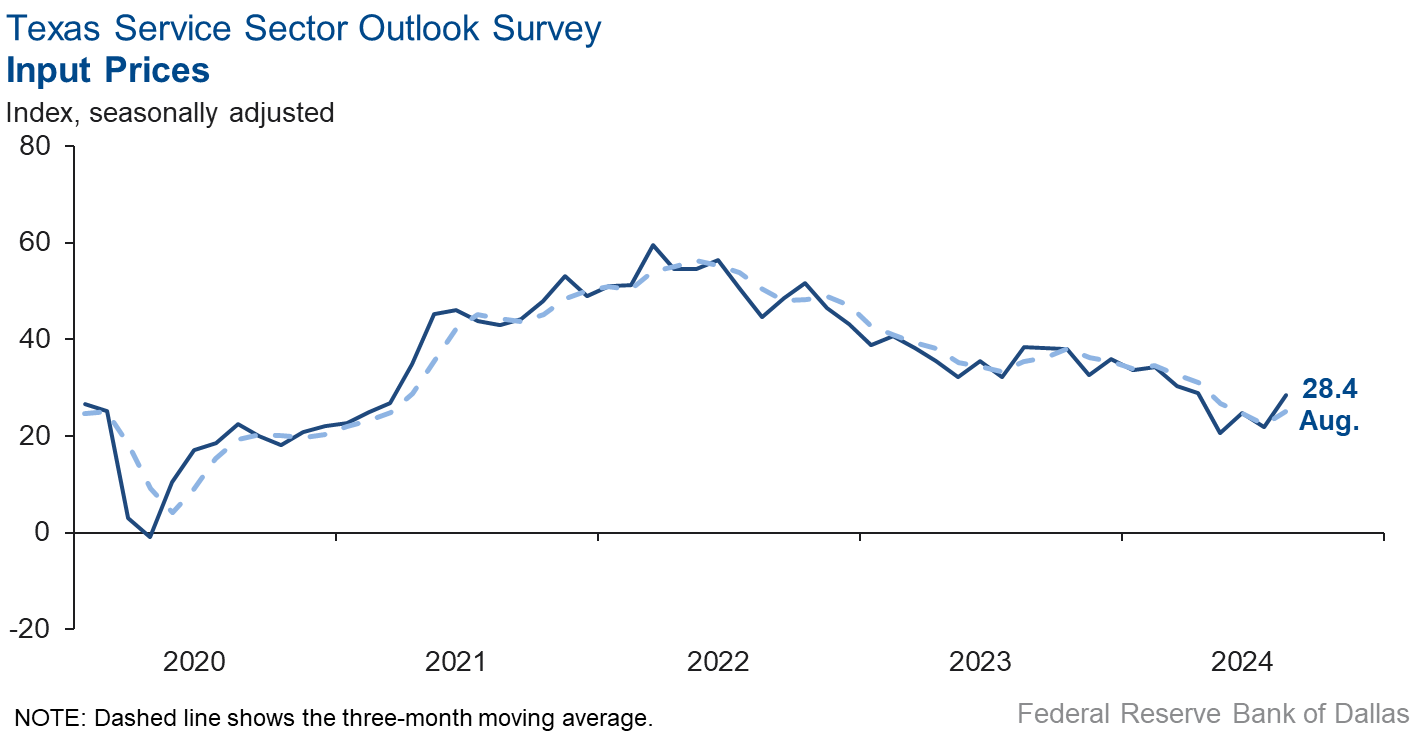

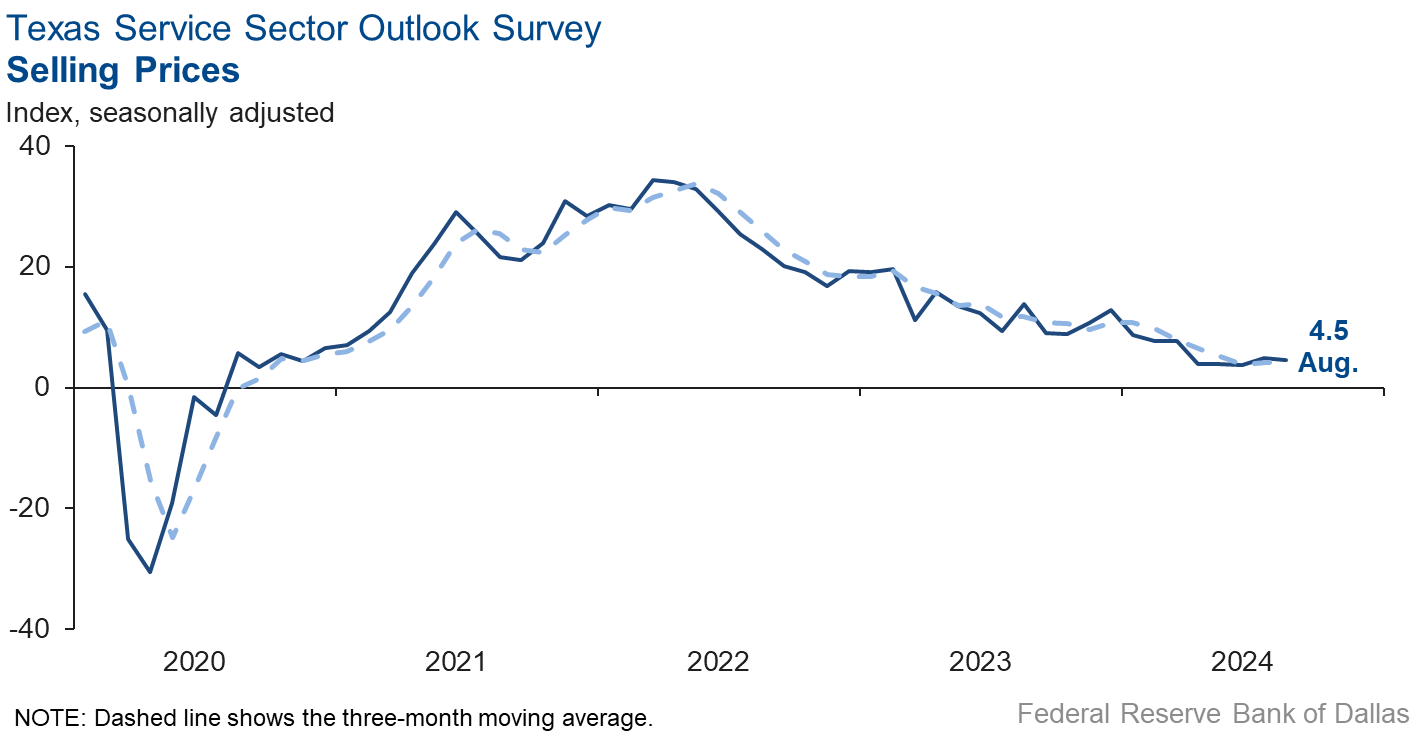

Selling prices and wage pressures held steady, while input price pressures increased in August. The selling price index was basically unchanged at 4.5 while the wages and benefits index held steady at 14.2. The input price index rose to 28.4 from 21.8.

Respondents’ expectations regarding future business activity reflected waning optimism in August. The future general business activity index fell 16 points to 3.3, while the future revenue index fell four points to 31.3. Other future service-sector activity indexes such as employment and capital expenditures remained in positive territory, reflecting expectations for growth in the next six months.

Texas Retail Outlook Survey

Texas retail sales decline slows

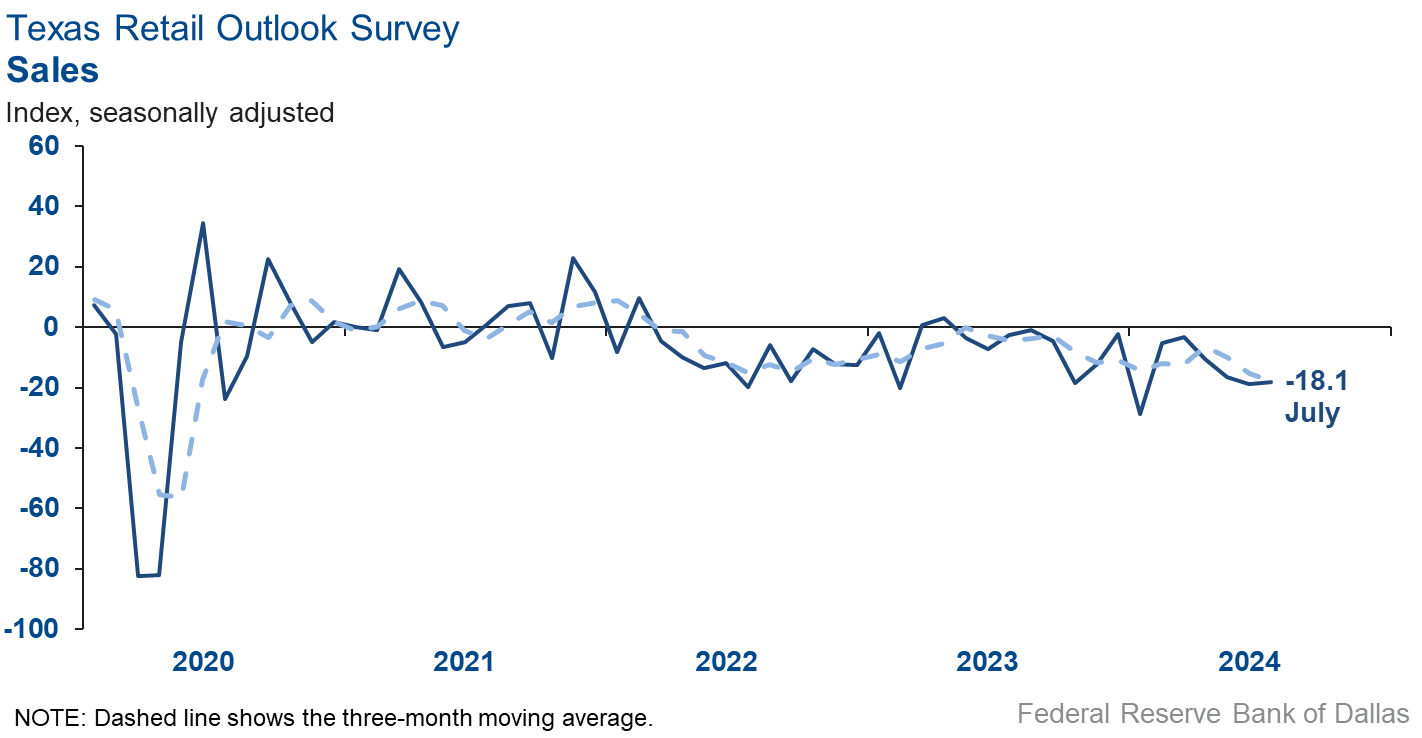

Retail sales activity declined at a slower pace in August than in the prior month, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, increased to -6.2 from -18.1, indicating retail sales declines were more modest than in the previous month. Retailers’ inventories grew over the month, with the August index at 15.8.

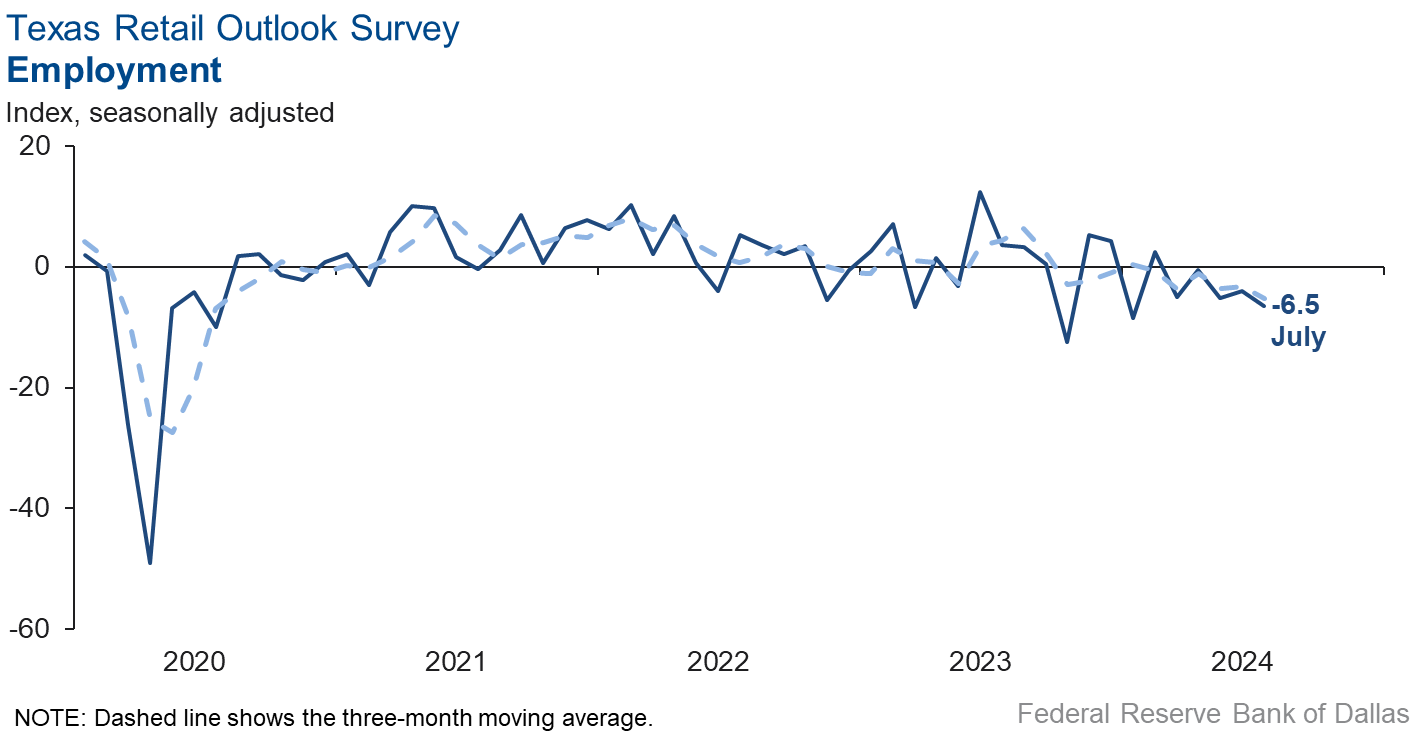

Retail labor market indicators suggested a contraction in employment and workweeks in August. The employment index was basically unchanged at -5.9, while the part-time employment index fell to -18.6. The hours worked index continued in negative territory but increased to -8.6.

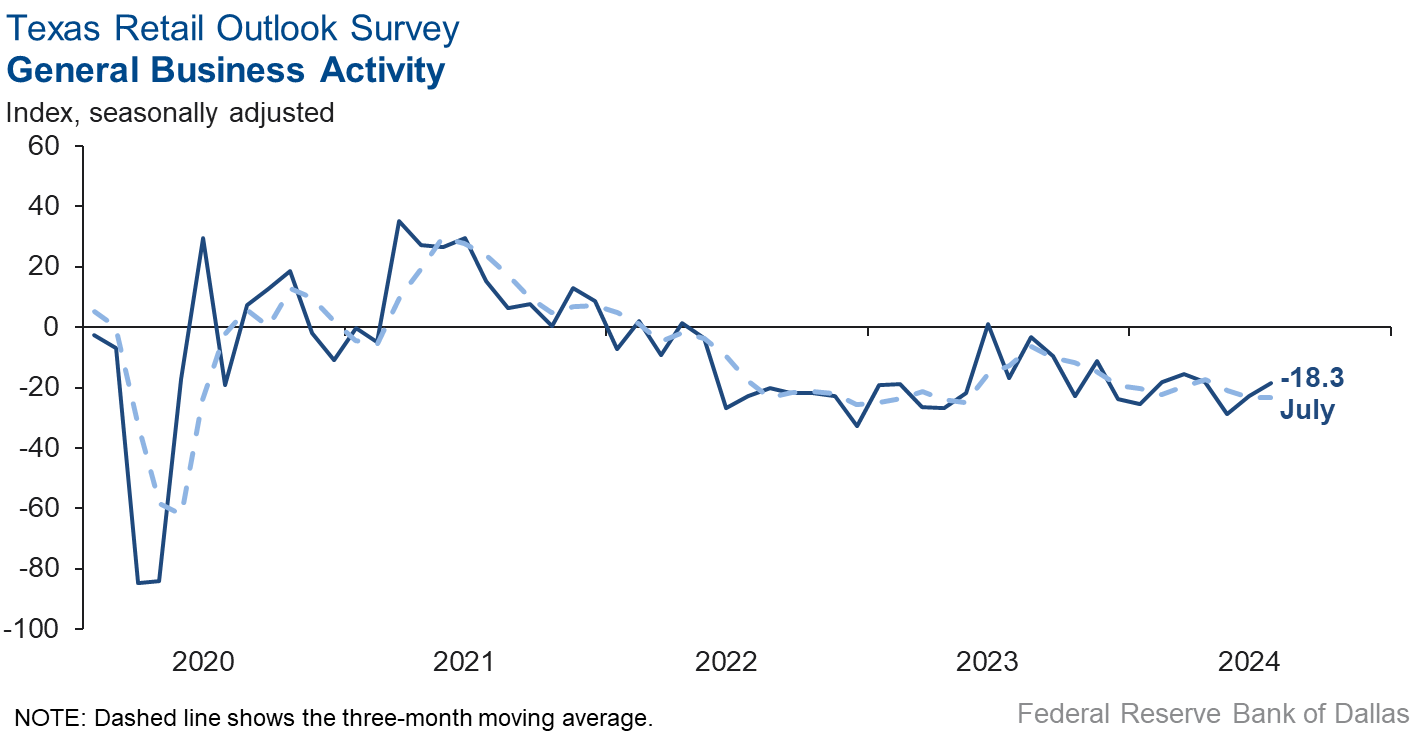

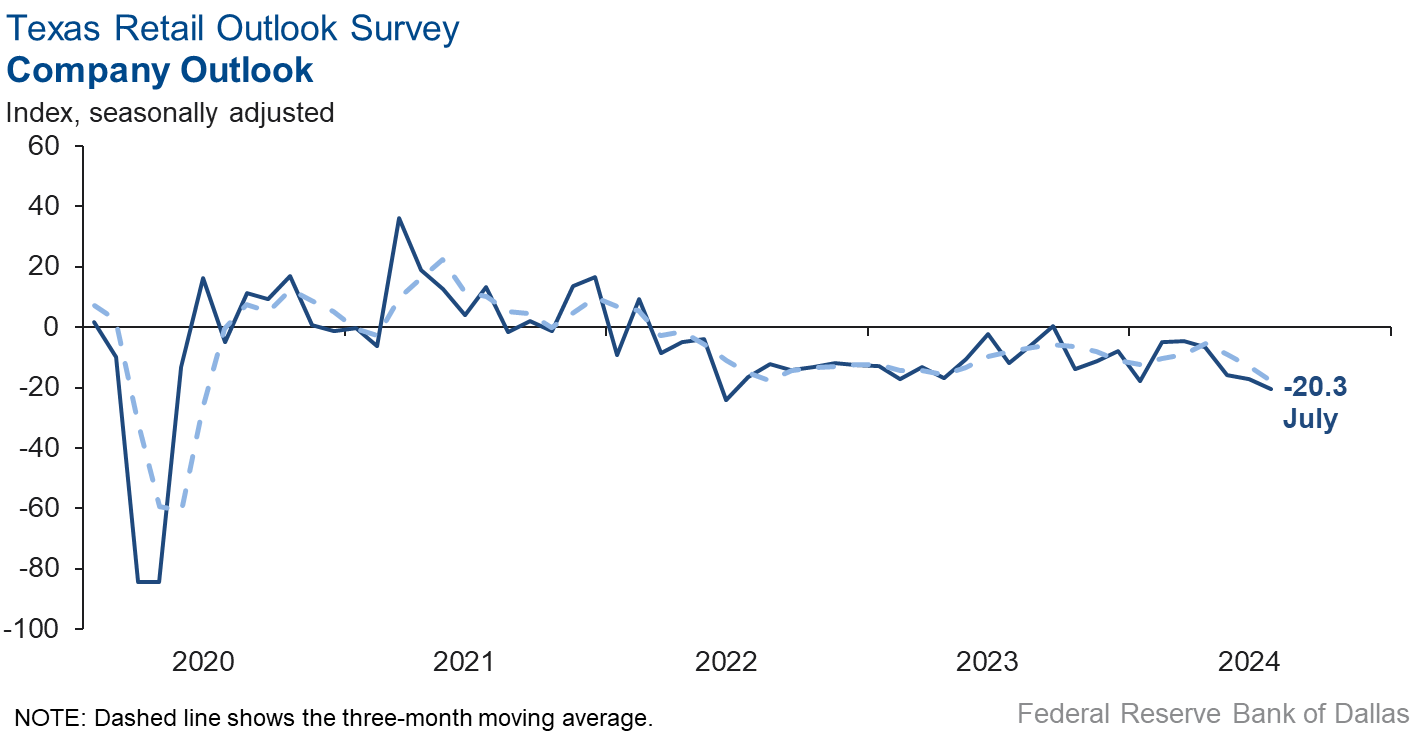

Retailers continued to perceive a worsening of broader business conditions in August. The general business activity index remained in negative territory but improved to -15.9 from -18.3. The company outlook index also improved to -11.8. However, uncertainty about the outlook increased in August.

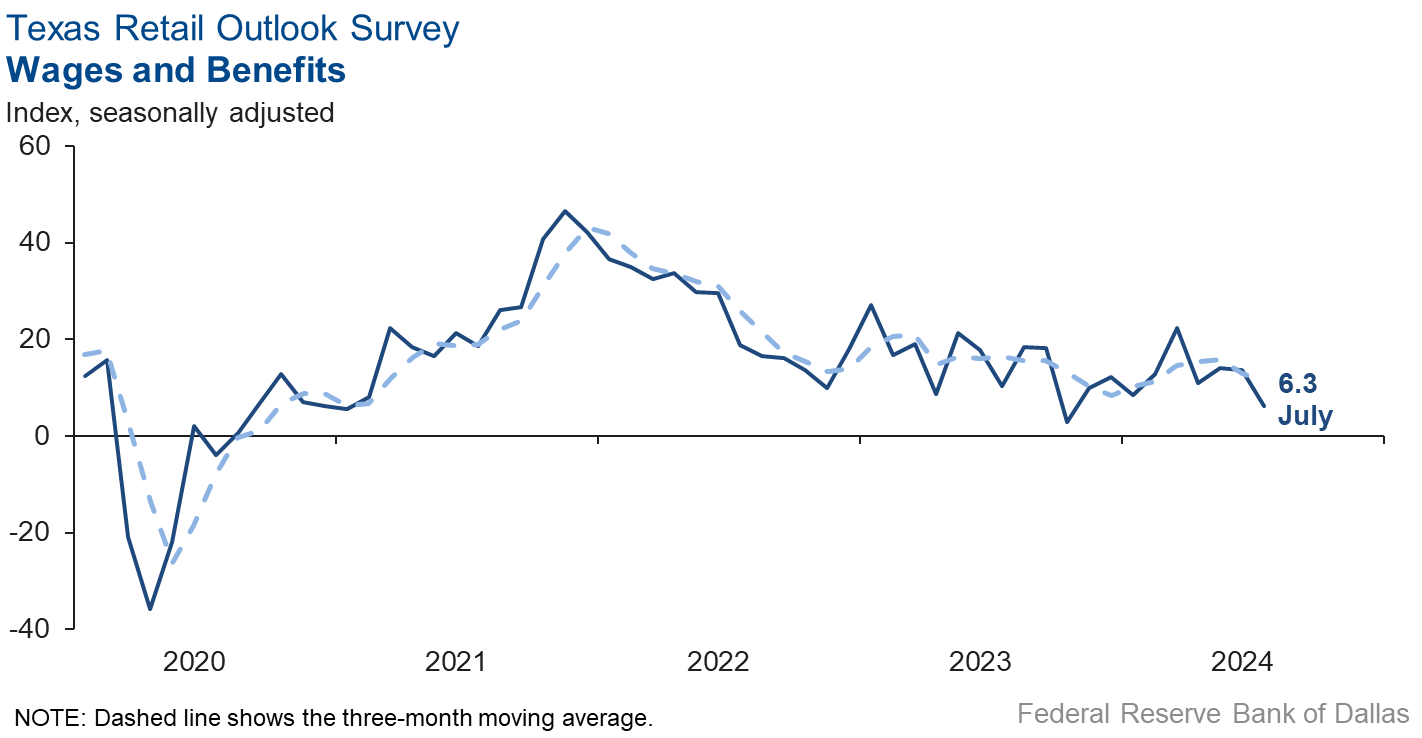

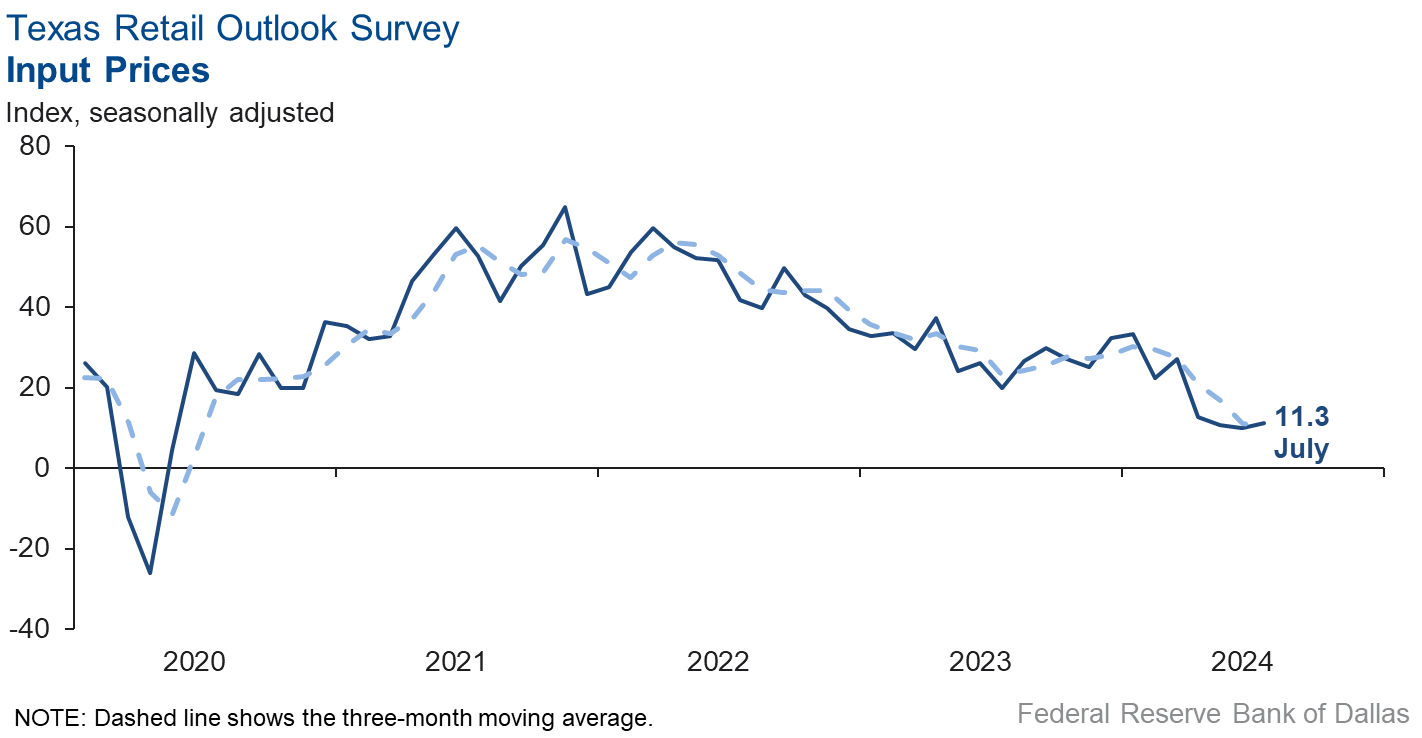

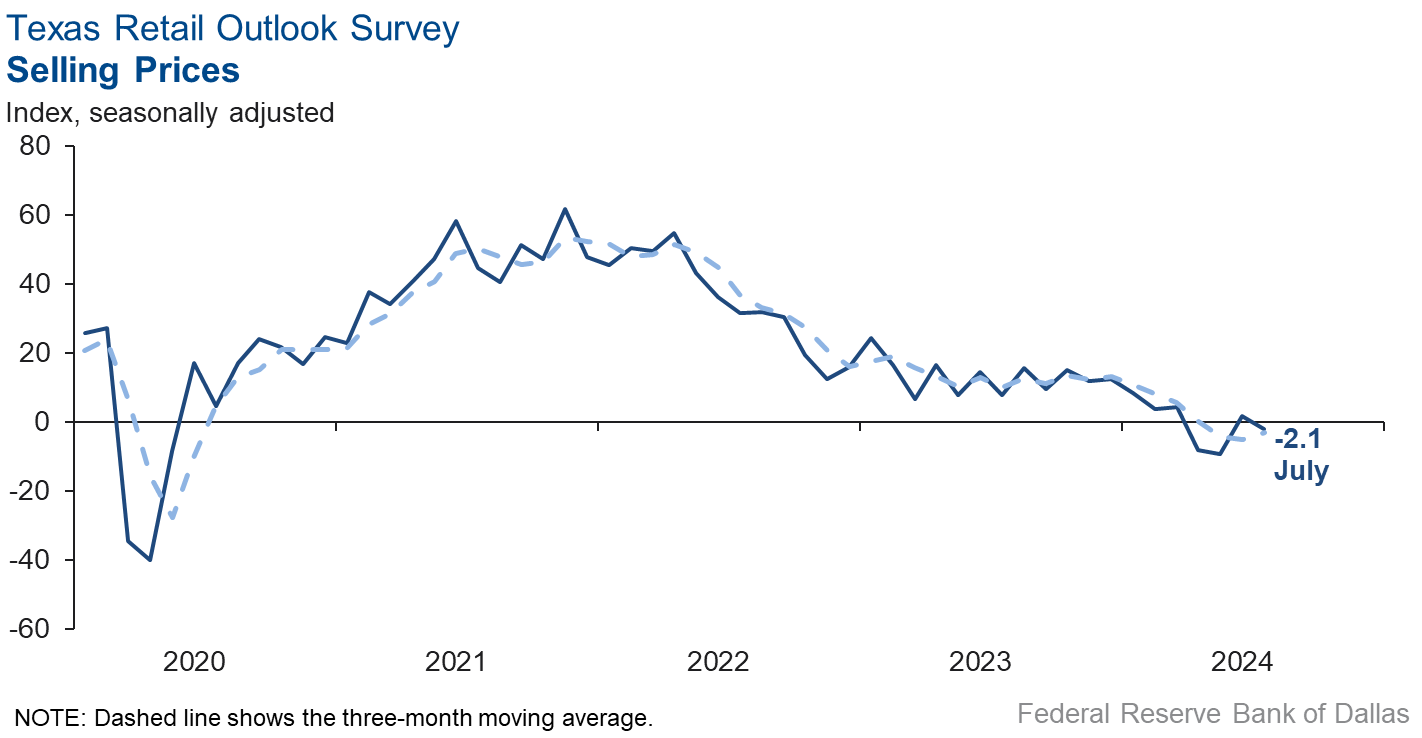

Selling prices stabilized in August, while input price growth increased, and wage pressures held steady from the prior month. The selling price index increased to 0.8, with the near-zero reading signaling no change in prices from August. The input price index increased to 21.4 from 11.3, and the wages and benefits index was essentially unchanged at 5.5.

Expectations for future business conditions in retail improved in August, but optimism was more limited. The future general business activity index remained in positive territory but fell to 2.2 from 17.0 while the future sales index fell to 14.2 from 30.9. Other indexes of future retail activity such as employment and capital expenditures were mixed, with the future employment index remaining in negative territory for the second month in a row and the capital expenditures index remaining positive.

Next release: October 1, 2024

Data were collected August 13–21, and 262 of the 406 Texas service sector business executives surveyed submitted responses. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 8.7 | 7.7 | +1.0 | 10.6 | 7(+) | 28.2 | 52.3 | 19.5 |

Employment | 0.6 | –0.2 | +0.8 | 6.3 | 1(+) | 13.8 | 73.0 | 13.2 |

Part–Time Employment | –4.9 | –2.3 | –2.6 | 1.4 | 4(–) | 3.4 | 88.3 | 8.3 |

Hours Worked | –0.7 | –0.9 | +0.2 | 2.6 | 2(–) | 6.0 | 87.3 | 6.7 |

Wages and Benefits | 14.2 | 13.4 | +0.8 | 15.8 | 51(+) | 18.6 | 77.0 | 4.4 |

Input Prices | 28.4 | 21.8 | +6.6 | 27.9 | 52(+) | 33.1 | 62.2 | 4.7 |

Selling Prices | 4.5 | 4.9 | –0.4 | 7.6 | 49(+) | 14.6 | 75.3 | 10.1 |

Capital Expenditures | 5.3 | 6.0 | –0.7 | 9.9 | 49(+) | 12.6 | 80.1 | 7.3 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –3.1 | 1.0 | –4.1 | 4.3 | 1(–) | 11.9 | 73.1 | 15.0 |

General Business Activity | –7.7 | –0.1 | –7.6 | 2.3 | 27(–) | 12.4 | 67.5 | 20.1 |

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 13.9 | 8.4 | +5.5 | 13.4 | 39(+) | 23.3 | 67.3 | 9.4 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 31.3 | 35.7 | –4.4 | 37.3 | 52(+) | 45.9 | 39.5 | 14.6 |

Employment | 17.1 | 17.8 | –0.7 | 23.0 | 52(+) | 26.3 | 64.5 | 9.2 |

Part–Time Employment | 1.8 | 3.7 | –1.9 | 6.6 | 3(+) | 8.2 | 85.4 | 6.4 |

Hours Worked | 4.1 | 6.7 | –2.6 | 5.8 | 52(+) | 8.6 | 86.9 | 4.5 |

Wages and Benefits | 33.5 | 35.6 | –2.1 | 37.4 | 52(+) | 37.9 | 57.7 | 4.4 |

Input Prices | 36.6 | 32.5 | +4.1 | 44.4 | 212(+) | 44.0 | 48.6 | 7.4 |

Selling Prices | 18.0 | 18.9 | –0.9 | 24.6 | 52(+) | 28.8 | 60.4 | 10.8 |

Capital Expenditures | 13.9 | 16.6 | –2.7 | 22.8 | 51(+) | 22.6 | 68.8 | 8.7 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 12.4 | 20.5 | –8.1 | 15.4 | 10(+) | 25.0 | 62.5 | 12.6 |

General Business Activity | 3.3 | 19.1 | –15.8 | 11.9 | 4(+) | 21.7 | 59.9 | 18.4 |

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | –6.2 | –18.1 | +11.9 | 3.4 | 16(–) | 19.4 | 55.0 | 25.6 |

Employment | –5.9 | –6.5 | +0.6 | 1.7 | 6(–) | 10.9 | 72.3 | 16.8 |

Part–Time Employment | –18.6 | 0.3 | –18.9 | –1.6 | 1(–) | 1.2 | 79.0 | 19.8 |

Hours Worked | –8.6 | –12.3 | +3.7 | –2.2 | 8(–) | 2.3 | 86.8 | 10.9 |

Wages and Benefits | 5.5 | 6.3 | –0.8 | 11.2 | 49(+) | 12.3 | 80.9 | 6.8 |

Input Prices | 21.4 | 11.3 | +10.1 | 22.6 | 52(+) | 31.7 | 58.0 | 10.3 |

Selling Prices | 0.8 | –2.1 | +2.9 | 13.3 | 1(+) | 17.6 | 65.6 | 16.8 |

Capital Expenditures | 1.7 | –1.5 | +3.2 | 7.6 | 1(+) | 12.5 | 76.7 | 10.8 |

Inventories | 15.8 | –7.7 | +23.5 | 2.7 | 1(+) | 32.6 | 50.6 | 16.8 |

| Companywide Retail Activity | ||||||||

Companywide Sales | –12.9 | –14.5 | +1.6 | 4.5 | 5(–) | 14.7 | 57.7 | 27.6 |

Companywide Internet Sales | –10.9 | 1.5 | –12.4 | 4.0 | 1(–) | 12.8 | 63.5 | 23.7 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –11.8 | –20.3 | +8.5 | 1.5 | 11(–) | 7.1 | 74.0 | 18.9 |

General Business Activity | –15.9 | –18.3 | +2.4 | –2.6 | 14(–) | 9.3 | 65.5 | 25.2 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 8.7 | 0.0 | +8.7 | 11.0 | 1(+) | 19.6 | 69.6 | 10.9 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 14.2 | 30.9 | –16.7 | 30.4 | 15(+) | 29.5 | 55.2 | 15.3 |

Employment | –4.2 | –2.1 | –2.1 | 12.7 | 2(–) | 7.3 | 81.2 | 11.5 |

Part–Time Employment | –1.5 | –0.4 | –1.1 | 1.6 | 3(–) | 7.0 | 84.5 | 8.5 |

Hours Worked | –3.3 | 3.9 | –7.2 | 2.4 | 1(–) | 5.3 | 86.1 | 8.6 |

Wages and Benefits | 14.9 | 26.8 | –11.9 | 29.0 | 52(+) | 21.2 | 72.5 | 6.3 |

Input Prices | 26.7 | 14.9 | +11.8 | 33.8 | 52(+) | 37.8 | 51.1 | 11.1 |

Selling Prices | 13.3 | 8.6 | +4.7 | 28.7 | 52(+) | 31.1 | 51.1 | 17.8 |

Capital Expenditures | 4.9 | 22.2 | –17.3 | 16.7 | 9(+) | 16.1 | 72.7 | 11.2 |

Inventories | 21.4 | 20.6 | +0.8 | 10.7 | 10(+) | 30.4 | 60.6 | 9.0 |

| Companywide Retail Activity | ||||||||

Companywide Sales | 16.2 | 22.8 | –6.6 | 28.9 | 15(+) | 30.0 | 56.2 | 13.8 |

Companywide Internet Sales | 9.7 | 16.2 | –6.5 | 21.1 | 7(+) | 22.6 | 64.5 | 12.9 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Aug Index | Jul Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 3.5 | 9.2 | –5.7 | 14.9 | 7(+) | 17.5 | 68.5 | 14.0 |

General Business Activity | 2.2 | 17.0 | –14.8 | 10.3 | 2(+) | 19.5 | 63.3 | 17.3 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Texas Retail Outlook Survey

Texas Service Sector Outlook Survey

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- I feel that a recession is going to hit the U.S.

- Things are relatively stable, prices increasing but not at such a rapid pace that we have any undue concerns.

- Our data supports the thesis that consumer spending is paring back materially. We will start seeing significant negative impacts to our business if spending continues to decline at the current rate through the end of the year. We are very concerned that the Federal Reserve has waited too long to trim rates and that by the time any future cuts begin impacting the economy, consumer spending will be at recession levels.

- We are looking forward to some modest cooling expected on compensation increases and some purchasing budgets.

- Costs continue to rise while pressure from customers and prospects to decrease prices is continually increasing.

- The economy is subject to fluctuating market changes caused by anticipated interest rate variations and political instability. Loan activity is slowly improving, but liquidity is continuing to be a challenge with competition for deposits remaining active.

- The Federal Reserve lowering rates will decrease our cost of funds immediately.

- Farm and cattle incomes are up this year. Oil and gas activity and tourism have slowed.

- The amount of political noise is disruptive to business owners. Political ads are proliferating, providing little value and worrying business owners.

- Activity is stalled slightly due to increasing personal debt along with [interest] rate uncertainty.

- New projects and new home purchase customers (for insurance) seem to have slowed somewhat.

- As stress percolates through the multifamily real estate industry, we see litigation increasing. Desperate owners and suppliers are filing absurd suits against anyone they think they can blame or collect from.

- Anticipated lower interest rates will certainly improve the outlook for commercial real estate investments heading into 2025.

- I feel that the election will dampen activity until after the inauguration, at which time things will pick back up, barring no major problems with the election.

- We are a large, heavy equipment distributor in Texas, Oklahoma and New Mexico At the end of July we were down 6.3 percent. That decline in this year versus last year has been consistently increasingly throughout the year. We were only down 10 percent during the pandemic of 2020, and we average 10.7 percent increase in sales per year over 65 years. So, this year's decline is unusual for us and is unsettling! People are out of money. They're parking their cars and throwing their keys to the dealership or banker, as it’s car or food for the family. And worst of all, I think it has just begun.

- Hiring has become easier. Importing our equipment has become easier. We don't import directly, but our rental equipment is manufactured in Korea, and we buy from the importer. Tariffs on Korea would really foul us up if that happened next year. We would have to pass on those costs to our customers, which would inflate our prices in proportion to the tariff.

- It's curious that news headlines say inflation is going down, but in the design and construction industry, we have not seen prices going down. In fact, they’re going up. For example, a door that cost $3,000 a year or so ago is now pricing in at $10,000. There is less competition in the market. There are fewer local companies. Many have closed due to difficulty in maintaining a workforce and owners close to retirement. Others have sold out. There are still long lead times for items such as transformations and generators.

- From 2022 we are down 40 percent. We only sold two building permit expediting jobs last month. In July of 2022, we sold over 30. New construction is dwindling. This is much worse than during the Great Recession.

- It seems like everyone is pretty sure about the way the election and the economy are going. We are not seeing the uncertainty that we normally see in the third quarter of a presidential election year. Our biggest problem is finding qualified engineers. We could grow our business a lot if we could find the right people.

- Understanding that the psychology of people and the market is a major driver of the economy, the upcoming election will determine the course of American business for the next four years. Honestly, I do not think this economy can withstand the ravages of what it has experienced since 2021.

- As interest rates remain high, the overall real estate market continues to retract. Orders for both commercial and residential transactions have continued to decline, and we feel the market will not recover until interest rates decrease.

- We are seeing a little increase in real estate and finance transactions

- The market and the economy are top priorities.

- The cost of health care and liability insurance is significantly affecting our business outlook.

- We continue to get business inquiries and new contracts, though we are experiencing a delay in accounts receivable. We are spending more time trying to get some clients to pay. They are paying eventually, but it is taking longer.

- We continue to see delays in purchase decisions. We have come to the conclusion that some of it may be due to a fractured decision-making process within our clients’ firms. While a decision was made in a group setting previously, with more distributed workers, these conversations are now a series of one-on-one conversations. These conversations take quite a bit of additional time and in each conversation, they can decide to delay or cancel a project, but all conversations must be positive for approval.

- The biggest issue keeping companies from doing much, in my opinion, is politics.

- We cannot hire in the wage bracket we compete in.

- As a search and staffing firm in the business of hiring not only in North Texas but across Texas and the U.S., we have felt like we are in a recession now for months. Senior vice presidents of talent acquisition at 40,000 employee businesses have told us confidentially they are not backfilling roles when existing employees leave the company. Fortune 100 clients have put hiring freezes in place. Mid-market companies are posting fake jobs to pipeline candidates for when they can hire again, as they are not allowed to fill the roles they are posting. Clients are taking longer to pay their invoices, and the few who are hiring are taking longer to make decisions. I have eliminated one position already and am reducing the wages of the staff I have left. Please lower interest rates. I'm very worried you are already too late. But we have to try to get the economy back on track.

- We are concerned about interest rates and their impact on real estate and general business activity. Financial performance remains strong for those companies not heavily leveraged.

- Higher education enrollment patterns in Texas are finally starting to incorporate national trends, with declines in undergraduate student populations. Although it is early, we expect this decline is likely to increase, creating higher uncertainty and reduced revenue in the coming year.

- Customers are having difficulty coming up with funds to pay for our services.

- One opines that interest rates a bit too high.

Many borrowers in pain and let out a sigh.

We plead with grace

Bring rates to a place

Where capital formation does not result in a cry!

- Weather has been the real negative factor for our business.

- In my 15 years at this location, this summer has been the worst business period I have seen in my area (not including COVID). Several factors are contributing to this including construction around the area and lack of group business in the market.

- Revenue struggles continue mostly due to poor back-to-office reality compared to reports of improved office occupancy. Same for business travel Monday through Thursday. Also, there are clear signs of customers pulling back spending due to our increased prices necessitated by continuing increases in COGS [cost of goods sold] price and wage pressures.

- The rise in utility bills, insurance and property taxes, plus the fear of recession, are changing my customers’ buying habits.

- So much depends on the election and what happens after that!

- The sales price per new and used vehicle sold has not changed. However, the volume has increased substantially. With the possibility of lower interest rates, we are optimistic for increased unit volumes over the next six months.

- Auto sales continue to soften on new vehicles and used vehicles.

- August has been very soft, even more than usual. Back to school usually sees us slow down some, but not at the current level.

- A softening in credit terms is resulting in renewed expansion planning as the company looks to new markets and measured expansion in existing markets. The supply of labor seems to have increased, leading to slightly longer employment terms and reduced turnover. Enormous fiscal irresponsibility at the federal level is a continuing concern and will continue to temper leverage and growth.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Jesus Cañas at jesus.canas@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.