COVID-19 poses stubborn challenge to economic growth in Mexico

With COVID-19 sweeping across the world, Mexico’s gross domestic product (GDP) contracted the most in a quarter century in 2020.

The Mexican economy has since proceeded along two tracks—external trade-related sectors performing well, and the service sector struggling. Workers have been especially hard hit in the informal sector—where activity is not reported to the government and whose participants do not pay employment taxes or receive government-mandated benefits and pensions. They have suffered the largest job losses.

Insufficient fiscal stimulus from the government has likely contributed to shrinking GDP.

While COVID-19 cases have dropped sharply since hitting a postholiday peak in January, strict social-distancing measures will be needed to minimize the likelihood of another infection wave given that a national vaccine program is proceeding very slowly.

Testing for the virus remains an ongoing challenge. Mexico has not followed the World Health Organization’s testing recommendation, arguing that the country lacks proper infrastructure. Mexico tests only the sickest patients who seek medical attention. There are few prevention measures and little contact tracing.

Recent Economic Developments

The Mexican economy shrank 4.5 percent in 2020 as the pandemic ravaged factories, businesses and households. It was the greatest contraction since the 1994 Tequila Crisis that followed a peso devaluation.[1] The latest decline compared with the downturn in Chile (-5.0 percent) and was more severe than the ones in the U.S. (-2.4 percent) and in Brazil (-1.2 percent), the largest economy in Latin America.

Output in service-related activities (including trade and transportation) dropped 5.2 percent in Mexico, while goods-producing industries (including manufacturing, construction and utilities) fell 0.5 percent. Agricultural output increased 4.4 percent.

As in other countries, COVID-19 disproportionately affected the service industry, particularly leisure and hospitality—businesses such as hotels and restaurants. While e-commerce thrives, brick-and-mortar retail has suffered. Because e-commerce is tiny in Mexico by developed-country standards, it has provided little offset for the decline in the traditional service sector.

Additionally, the government has provided scant fiscal support for the economy. Mexico’s stimulus plan—which includes a mix of loans and tax credits, tax payment deferrals and job training—amounts to 1.1 percent of GDP compared with plans in Brazil (8.4 percent) and Chile (4.7 percent).

Mexico’s real retail sales index remains 5.5 percent below levels seen in February 2020, while Chile’s retail sales are 4.3 percent above its pre-COVID-19 performance as the country regained prepandemic levels in August. Brazil’s sales began rebounding in June 2020 and expanded during third quarter 2020, recovering to levels seen before the pandemic despite a resurgence of the virus.

Although Mexico’s lack of fiscal stimulus has hurt households and businesses, it has helped the government avoid large deficits and accompanying inflation that could depress the currency. The peso regained much of its strength relative to the dollar in the second half of 2020 after sliding with the onset of the pandemic. The peso averaged 19.9 per dollar in December, a net depreciation of 1.1 pesos for the year.

Inflation finished 2020 at 3.1 percent in December (12-month change), firmly within the central bank’s target range.[2] Mexico’s refusal to boost public spending to mitigate COVID-19’s economic impact will likely result in the lowest budget deficit among Latin America’s major economies in 2020, though its recovery is likely to lag behind the region.

Strong Manufacturing Output

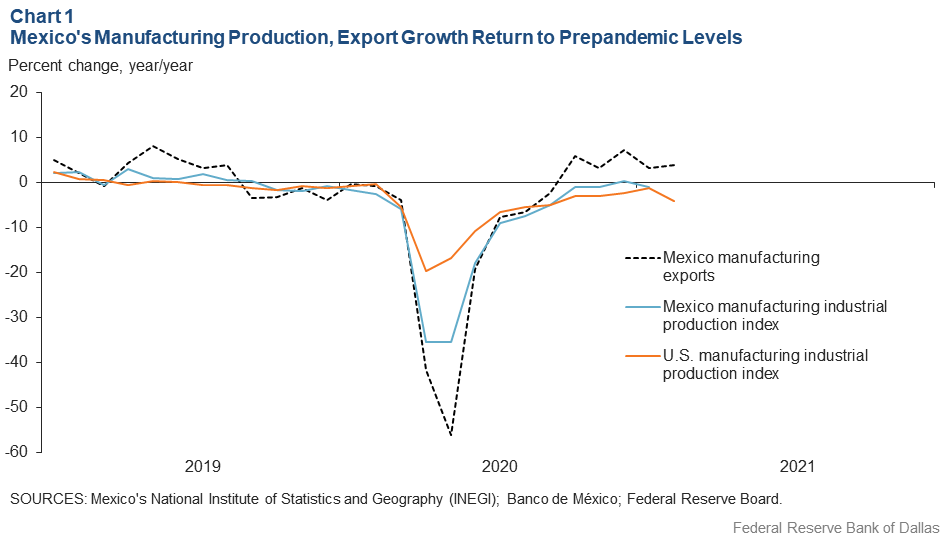

Mexico’s manufacturing production and manufacturing exports are above pre-COVID-19 levels, reflecting a strong correlation with what has been a resilient U.S. manufacturing sector (Chart 1).[3] These ties between the two countries, largely involving intra-industry trade, took root and grew with the 1994 North American Free Trade Agreement, which was recently supplanted by the United States–Mexico–Canada Agreement (USMCA).

Manufacturing exports represent 90 percent of total exports, and Mexico sends 81 percent of its total exports to the U.S. Thus, U.S. economic stimulus bolsters Mexico’s manufacturing export sector. Higher global oil prices are a tailwind for Mexico’s recovery, with the price of Mexican mix at around $50 per barrel, up from $17 per barrel in April. Crude oil production in Mexico is down 50 percent in the past 10 years, however.

Normalization of trade flows between the United States and Mexico has helped speed a sectoral manufacturing recovery.

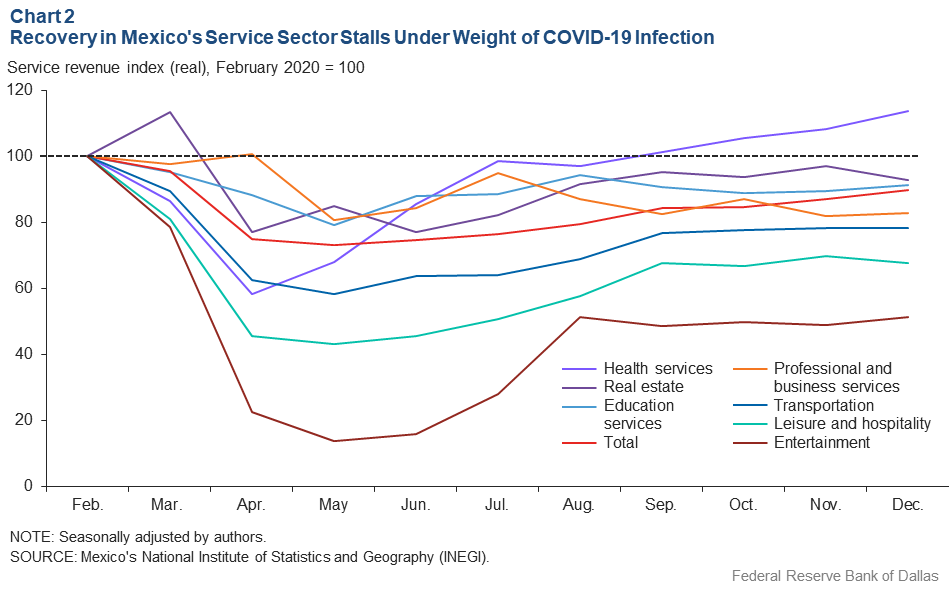

Meanwhile, the performance of Mexico’s service sector has not recovered, although the extent of progress varies by industry (Chart 2). Revenue in health care services, real estate, education, and professional and business services has been the most resilient. However, output in entertainment (down 49 percent from prepandemic levels), leisure and hospitality (off 32 percent) and transportation services (down 22 percent) have proven the most vulnerable.

Mexico’s large informal sector challenges economic recovery as well as efforts to contain the virus’ spread. Mexico’s national employment survey pegged total employment at 53.3 million in December 2020, with formal employment representing 44 percent of the total and informal employment 56 percent.

The majority of informal work is in high-contact industries such as retail trade, miscellaneous services (temporary workers and gig labor) and construction. Informal work produces 23 percent of GDP, according to Mexico’s National Statistics Institute (INEGI).

Unlike workers in the formal economy, who benefit from legal and social protections, informal workers lack such a safety net. They are mostly self-employed, working in street vending, domestic work and transportation. Some also work as off-the-books day laborers in factories, farms and other formal businesses that don’t extend full rights or protections to all employees.

Pandemic control measures, such as sheltering in place and social distancing, achieved more inconsistent adoption in the informal sector relative to the formal sector. The informal sector’s behavior and its likely ties to recurring waves of COVID-19 infections could be key to the introduction of any future national government-mandated restrictions—ones that might well slow an economic recovery.

Disproportionate COVID-19 Impact

Total Mexico employment fell 3.7 percent from March 2020 to December 2020. Formal employment dropped 2.6 percent (626,000 jobs) and informal employment fell 4.5 percent (1.4 million jobs) (Table 1). The most-affected sector was leisure and hospitality, followed by miscellaneous services.

Table 1: Mexico's Total Employment Shows Strains of Recurring Pandemic Surges

| Economic sector | Total employment (millions of workers) | Dec/Mar chg (%) |

Share (%) |

Formal employment (millions of workers) | Dec/Mar chg (%) |

Share (%) |

Informal employment (millions of workers) | Dec/Mar chg (%) |

Share (%) |

| Total | 53.3 | -3.7 | 100.0 | 23.7 | -2.6 | 100.0 | 29.6 | -4.5 | 100.0 |

| Leisure and hospitality | 3.7 | -17.5 | 6.9 | 1.0 | -23.5 | 4.3 | 2.6 | -15.0 | 8.9 |

| Miscellaneous services | 5.2 | -8.6 | 9.8 | 1.0 | -8.0 | 4.1 | 4.3 | -8.8 | 14.4 |

| Oil, mining and electricity generation | 0.4 | -4.8 | 0.7 | 0.3 | -8.1 | 1.3 | 0.1 | 17.3 | 0.2 |

| Transportation, communications and warehousing | 2.7 | -4.4 | 5.1 | 1.4 | 2.6 | 6.1 | 1.3 | -11.1 | 4.4 |

| Manufacturing | 8.7 | -4.3 | 16.3 | 5.4 | -4.8 | 23.0 | 3.3 | -3.5 | 11.0 |

| Professional and financial services | 3.8 | -3.9 | 7.1 | 2.7 | -1.1 | 11.4 | 1.1 | -10.3 | 3.6 |

| Trade | 10.6 | -1.4 | 19.9 | 4.3 | 0.7 | 18.2 | 6.3 | -2.8 | 21.3 |

| Construction | 4.3 | -1.0 | 8.0 | 0.9 | -9.3 | 3.7 | 3.4 | 1.3 | 11.5 |

| Social services | 4.4 | -0.3 | 8.3 | 3.6 | 2.0 | 15.3 | 0.8 | -9.5 | 2.7 |

| Agriculture | 6.7 | 1.6 | 12.5 | 0.9 | -2.0 | 3.6 | 5.8 | 2.2 | 19.6 |

| Government | 2.5 | 2.8 | 4.8 | 2.1 | 2.7 | 8.9 | 0.4 | 3.2 | 1.5 |

| Other | 0.3 | -9.0 | 0.6 | 0.0 | 38.4 | 0.2 | 0.3 | -14.5 | 0.8 |

| NOTE: Rank is in terms of total employment losses. SOURCE: National employment survey, December 2020, Mexico’s National Institute of Statistics and Geography (INEGI). |

|||||||||

The largest employment base within the informal sector is in trade, agriculture and miscellaneous services (55 percent), while the highest concentration of formal jobs is in manufacturing, trade and social services (56 percent).

More women—particularly in the informal sector—have lost their jobs during the pandemic in developing economies such as Mexico, according to the World Bank. While men represent 61 percent of informal jobs, their employment only fell 2.4 percent. Among women—who account for 39 percent of informal jobs—employment dropped 7.6 percent.

Continued COVID-19 Outbreak

Mexico’s first confirmed COVID-19 case was reported on Feb. 28, 2020, ultimately prompting public health measures that included travel restrictions, social distancing, school closures and the shutdown of nonessential activities.

The government announced plans to begin normalization of economic activities in mid-May, including a green-yellow-orange-red color system to represent the extent of activities allowed in individual states. For example, states with the most active cases were designated as red and would remain in forced quarantine. Officials also added construction, mining and transport equipment manufacturing to the list of essential activities.

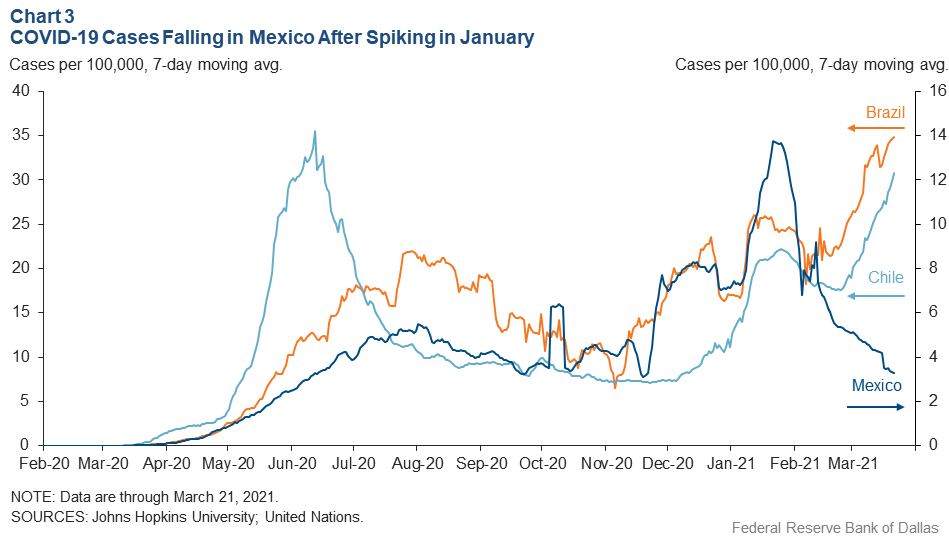

Mexico’s COVID-19 cases spiked first in early August before reaching a second peak in December and an all-time high in late January. Recently, cases per 100,000 people have fallen in Mexico, while a new surge has begun in Chile and Brazil (Chart 3).

Mexico isn’t performing widespread COVID-19 tests of its population—just 12 tests per 100,000 people. Mexico’s 46 percent positivity rate—second only to Paraguay worldwide—is an indication that only the sickest patients seeking medical attention are tested. Absent contact tracing or widely administered medical treatment, detecting a new wave of infections is difficult.

Governments should see positivity rates below 5 percent for at least 14 days before relaxing social-distancing measures, according to the World Health Organization. Nevertheless, restrictions in Mexico were lessened as the holiday wave waned.

In the March 1–14, 2021, monitoring report, none of the Mexican states were in red for the first time since late September/early October 2020. Ten states were in orange, the second-most restrictive tier; 20 states were in yellow; and two states were in green, the point at which activities are allowed without restriction.

Vaccinations began in late December, when Mexico became the first Latin American country to receive a vaccine shipment. The inoculation effort has since stalled due to mismanagement and a global vaccine shortage. Just 0.5 percent of the population was fully vaccinated as of mid-March, according to the Johns Hopkins Coronavirus Resource Center.

Challenging Economic Outlook

Mexico’s economic recovery is largely confined to its manufacturing sector, which is filling production orders from its northern neighbor. Manufacturing has dealt with comparatively few restrictions and largely avoided disruption in North American supply chains, a situation unlikely to change.

By comparison, a service sector recovery is hindered by suppressed domestic demand, social-distancing measures and little government assistance. The lack of fiscal stimulus has left many households and businesses with significant income loss that will remain a headwind to the recovery.

The consensus forecast compiled by Banco de México for 2021 GDP growth is 3.9 percent, with a projected exchange rate of 20.3 pesos per dollar and year-end inflation of 3.9 percent.[4] However, the pandemic remains far from controlled, and supply and logistical issues have slowed vaccination progress. Additionally, the dearth of testing will complicate the timely detection of future COVID-19 incidents, impeding an economic recovery.

Notes

- GDP growth is calculated comparing fourth quarter 2020 with fourth quarter 2019. If the estimation is computed as Mexico’s National Institute of Statistics and Geography (INEGI) officially calculates growth—the averaging of year-over-year quarterly growth throughout the year—GDP fell 8.7 percent.

- For a more complete Mexico economic update, see www.dallasfed.org/research/update/mex.

- “Intra-Industry Trade with Mexico May Aid U.S. Global Competitiveness,” by Jesus Cañas, Aldo Heffner and Jorge Herrera Hernández, Federal Reserve Bank of Dallas Southwest Economy, Second Quarter, 2017.

- Communiqué on Economic Expectations, Banco de México, February 2021. The survey period was Feb. 24–26, 2021.

About the Authors

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: www.dallasfed.org/research/swe/2021/swe2101.