Texas reclaims jobs lost in pandemic; some metros still trying to catch up

As of December 2021, Texas had finally regained the 1.4 million jobs lost in the initial months of the pandemic. But many jobs in the latest count were not the same as the ones lost—and they were not in the same places either.

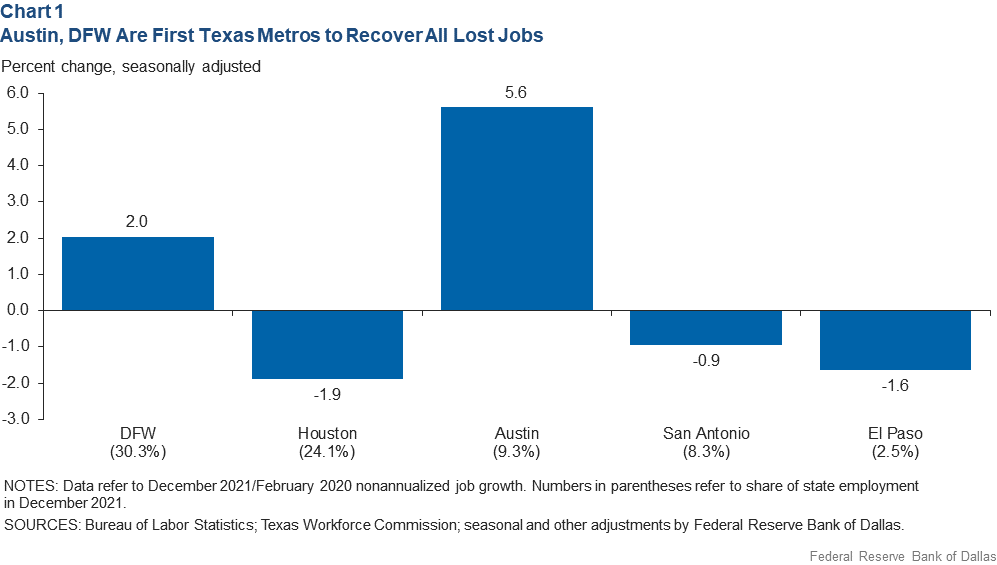

The recovery from the pandemic recession ushered in a massive reallocation of employment between industries with repercussions for different areas of the state. Austin and Dallas–Fort Worth are already well above their prepandemic levels of employment, but Houston, San Antonio and El Paso are not (Chart 1).

In May 2021, Austin became the first Texas metro to regain all jobs lost at the onset of the pandemic. The DFW region reached prepandemic employment levels in July. The boom in high-tech, financial activities, and professional and business services helped Austin and DFW come back sooner than their counterparts along the Gulf Coast and the border.

Employment in professional and business services in Austin is 18.0 percent higher than prepandemic levels, and financial activity employment has risen 10.9 percent. Across the state, these two sectors did not experience the same magnitude of growth as they did in Austin. Statewide employment is up 7.0 percent in professional and business services and 4.8 percent in financial activities. In many Texas cities, including El Paso, these sectors have yet to return to February 2020 employment levels.

Houston employment declined with the fallout in the energy industry in 2020 when the state’s mining sector lost 28.3 percent of its jobs in seven months. At the end of 2021, energy still trailed other industries statewide and was down 20.3 percent (roughly 45,000 jobs) from prepandemic levels. San Antonio, with its outsized dependence on tourism and business travel, has also been slower to come back, reflecting the later-to-recover leisure and hospitality sector.

El Paso faced a series of obstacles starting with the U.S.–Mexico border shutdown beginning in March 2020. The 20-month closure led to steep declines in trade and the number of cross-border shoppers.

Overall, Texas job growth over the past two years has been robust, and the state is one of only four (including Arizona, Idaho and Utah) to have regained all jobs lost during the pandemic. Part of Texas’ employment growth can be attributed to a large inmigration increase.

Migrants Flocked to Texas

Relocation to Texas accelerated during the pandemic. Net migration was up 60 percent compared with prepandemic levels, increasing from 109,000 in the five quarters preceding the pandemic’s onset in February 2020 to 174,000 people in the five quarters after the pandemic began.[1]

Austin and Dallas–Fort Worth were the two most popular destinations.

Dallas–Fort Worth drew 64,000 new residents, while Austin picked up roughly 48,000. The large gains in migration likely bolstered job growth in these metros, which have sizable high-tech sectors.

In Austin, the number of migrants from Silicon Valley (San Jose, California) and San Francisco doubled since the pandemic began. Combined, the two Bay Area metros were the largest source of Austin’s newcomers.

In Houston, in-migration increased substantially over the course of the pandemic. Net in-migration to Houston was almost five times prepandemic levels, increasing from 4,000 people in the five-month prepandemic period to roughly 25,000 people during the pandemic. However, these numbers are quite small relative to the metro’s population of roughly 7 million people.

Notes

- “Largest Texas Metros Lure Big-City, Coastal Migrants During Pandemic,” by Wenli Li and Yichen Su, Federal Reserve Bank of Dallas Southwest Economy, Fourth Quarter, 2021, www.dallasfed.org/research/swe/2021/swe2104/swe2104b.aspx.

About the Authors

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: www.dallasfed.org/research/swe/2022/swe2201.