Texas economy softens amid uncertain outlook

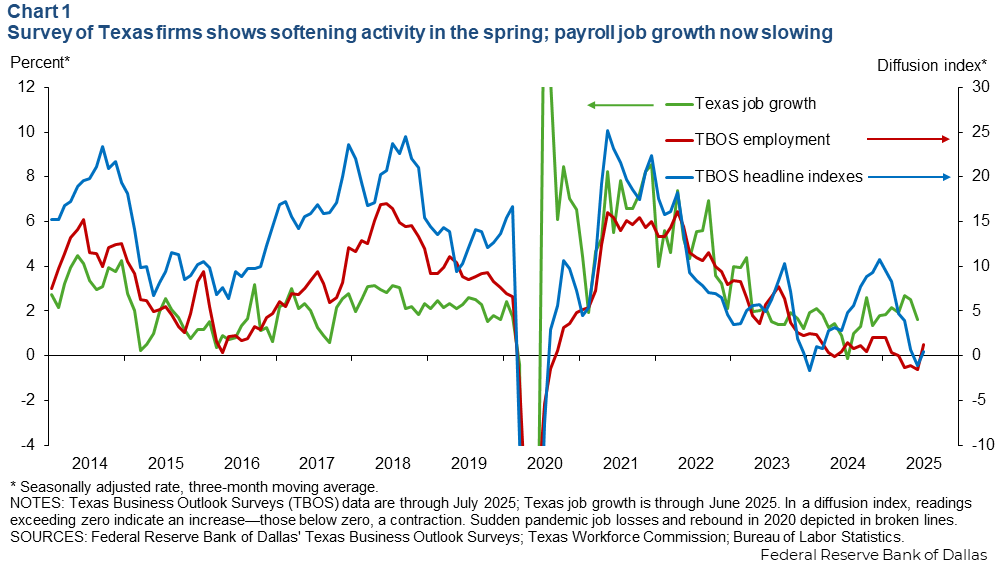

Texas’ overall pace of economic growth is trending lower, with payroll employment declining in June, a marked turn from robust job gains earlier in 2025. Despite slower employment growth, the unemployment rate declined and wage growth remained strong.

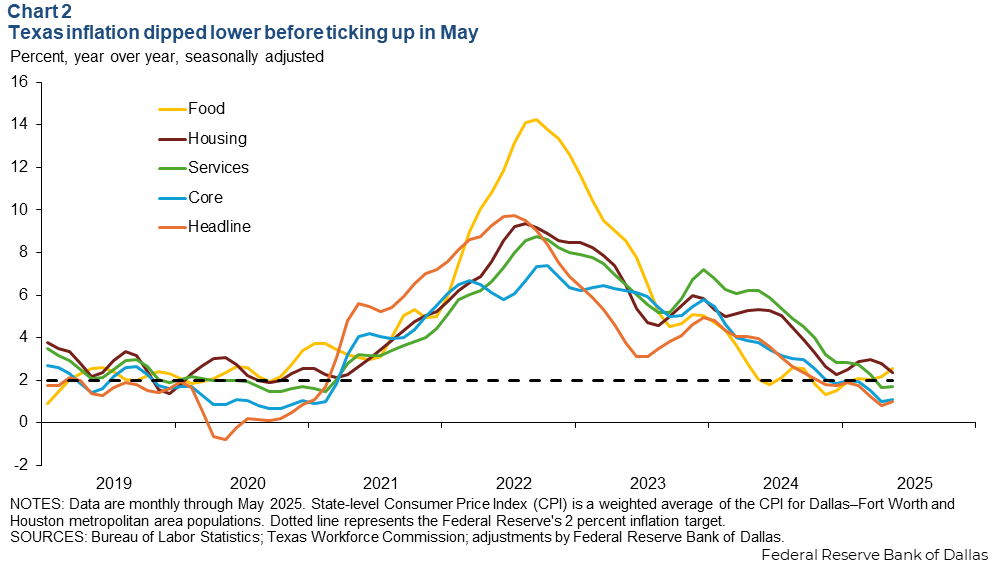

The Texas Business Outlook Surveys (TBOS) headline indexes of production and revenue picked up in July, after growing little in the intervening months since April. Texas inflation, which had been receding, turned up in May and is expected to further increase in June when data for that month are released.

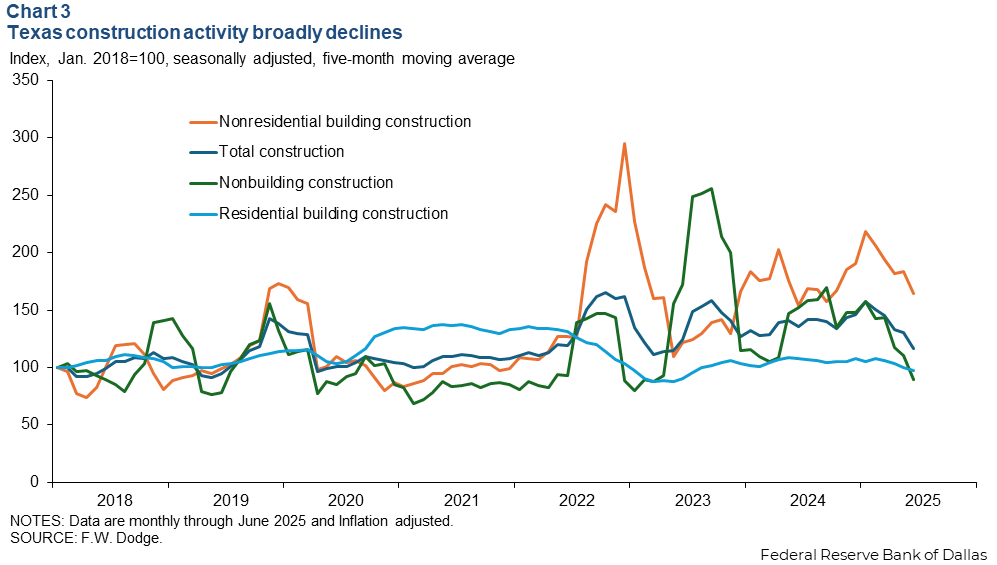

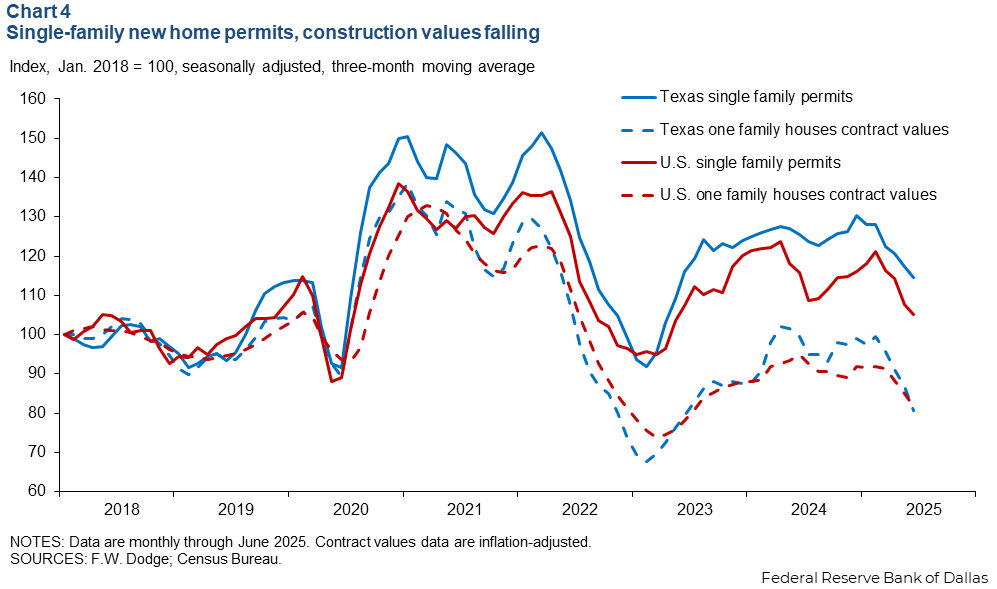

Recent policy changes and economic conditions have especially affected some sectors. All categories of construction in the state have declined. Housing market weakness is impacting residential construction. The number of single-family construction permits slipped in May and June.

Job growth falls abruptly in June

Texas employment contracted 1.3 percent month-over-month in June, while year-to-date job growth slowed to 1.8 percent. Texas’ pace of growth is still higher than the 0.7 percent rise nationwide. Apart from the decline in state employment in June, data for the previous two months was revised lower. The latest data suggest a slower growth trajectory for the second half of the year.

Other labor market indicators have remained healthy. The Texas unemployment rate declined to 4.0 percent, and average hourly earnings increased 4.9 percent year-over-year in June.

The TBOS employment indexes had indicated little, if any, employment growth in May and June, although the indexes picked up in July (Chart 1). TBOS output indexes (manufacturing production and service sector revenue) also rose in July, but the smoothed series suggest a modest expansion with below-average growth. An additional concern is that the soft survey data may signal upcoming downward revisions to Texas employment.

TBOS participants’ comments from the June and July surveys suggest tariff uncertainty and immigration policy are posing challenges for their businesses. A chemical manufacturer said tariff uncertainty “has substantially impacted the 2025 business outlook.” A professional, scientific and technical services firm said: “The firms I consult with are limiting investment due to the uncertain future of tariffs.”

Immigration enforcement actions are also affecting the ability of some firms to recruit and retain workers. Based on special questions in the July TBOS, the inability to hire qualified workers because they lack work permits or legal status was the most widespread impact noted among firms experiencing workforce disruption from changes to immigration policy. A machine manufacturer said: “Foreign-born laborers get the work done. We need them, we use them, and we like them.”

Texas inflation inches up in May

The Texas consumer price index (CPI), a weighted average of prices in the Dallas−Fort Worth and Houston metropolitan areas, ticked up in May after falling last year and through the start of 2025. Year over year, headline Texas CPI rose 1.0 percent, while core CPI (excluding food and energy) increased 1.1 percent—the lowest inflation readings since 2021 (Chart 2). The moderate price growth was broad based, with only housing and food showing a 12-month change exceeding 2 percent.

These low inflation readings are concerning and puzzling. They could reflect softer consumer and business demand and easing consumption growth. The recent slowing of consumer inflation aligns with the slower growth in output and employment that TBOS surveys indicated through June. Texas firms responding to TBOS special questions in June reported moderating price-growth expectations relative to when the question was last asked in March.

When queried about outlook concerns, nearly half of survey participants said the level of demand and potential recession remained the most widespread worries. Geopolitical uncertainty was the No. 2 concern, possibly because the survey was in the field during the Israel-Iran hostilities.

A lack of tariff impact is part of the Texas CPI puzzle. The effective tariff rate has risen nationally from 2.4 percent to 17.5 percent and should be trickling through to prices. While businesses may not pass on the full cost of tariffs to customers, they will likely pass on some. The May uptick in the Texas CPI may be tariff-related, suggesting what could be the beginning of tariff pass-through.

The delayed tariff impact on selling prices could reflect a buildup of inventories and the ability for businesses to absorb higher costs in the short run. Tariff effects on inflation will likely also be observed in June data, suggesting Texas inflation may tick up further.

TBOS participants expressed unease about tariff pass-through. “Tariff costs are starting to flow through to us from our international suppliers as we purchase replacement parts and bring them into our inventory,” a computer and electronic product manufacturing firm said. A real estate firm said: “Suppliers appear to be raising prices in anticipation of higher tariffs.”

Construction activity falls broadly across categories

In another reversal, Texas construction activity has declined since January across all sectors (Chart 3).

The five-month moving average for overall construction contract values declined 26 percent from its most recent peak in January, with nonbuilding construction (bridges, roads, plants) down 43 percent, residential construction lower by 7 percent and nonresidential construction off 25 percent. The completion of infrastructure projects led to some of the decline in nonbuilding construction.

In addition to completion of ongoing projects, uncertainty about future economic conditions—including tariffs and trade disputes—is causing postponement or cancellation of new projects, according to the Association of General Contractors of America. Relatively high interest rates and rising costs of construction also weigh on real estate projects.

“High interest rates continue to chill the commercial real estate market and lending,” a TBOS firm from the administrative and support services sector said.

The One Big Beautiful Bill Act, signed into law July 4, could jump-start some construction projects through various provisions aimed at boosting the economy and incentivizing new manufacturing and production facilities. But overall, the law is expected to have a small direct impact on construction.

The decline in residential construction contract values can be partially attributed to builder pullback in new single-family construction, a sign of weakness in the housing market. Single-family construction permits are falling. The three-month moving average for single-family construction values in Texas slid 7 percent in June, while the number of single-family permits fell 2 percent (Chart 4).

In contrast, multifamily construction values in Texas increased 4 percent in June, while multifamily permits rose 1 percent, a slowdown from 7 percent in May and 16 percent in April.

Outlook for below-trend growth amid high uncertainty

The Dallas Fed’s Texas Employment Forecast suggests employment will increase 1.7 percent in 2025, below the 2 percent long-run trend. Through the first half of the year, the Dallas Fed’s Texas employment forecast for 2025 has ranged from 1.6 percent to 2.0 percent.

Looking forward, Texas businesses must continue to navigate an uncertain climate. As one TBOS contact noted: “The tariff matters continue to cause major uncertainty. It is impossible to plan.”

About the authors