COVID-19’s unprecedented impact alters U.S. labor market

A staggering 22.03 million initial claims for unemployment benefits were filed from mid-March to mid-April as the COVID-19 pandemic and ensuing stay-at-home policies took hold across the country. Just a month earlier, in February, new claims fell to 211,000 on average per week, the lowest level since November 1969.

For additional perspective, 9.07 million new claims were filed during all of the Great Recession, from December 2007 to June 2009.

Among policymakers and economic analysts, an important question is what the response of the labor market will look like in the short and medium terms.

Pandemic captured by job separation rate shock

A simple but useful way to model the effects of the pandemic on the labor market is through an increase in the job separation rate—defined as total separations/total employment—where the shock is calibrated to match the unemployment claims data over the first month of the pandemic. We elaborate on this in our recent paper.

Based on data available in mid-April, there were 5.56 million total employment separations in February 2020, of which 1.76 million were either layoffs or discharges. A total 152.49 million people were employed in the U.S., leading to a 3.7 percent job separation rate.

Using the increase in initial unemployment claims data from mid-March to mid-April as a proxy for the increase in layoffs, the first month of the pandemic is estimated to have increased the job separation rate to 17.0 percent (100 x (3,805,000+22,034,000)/ 152,487,000), an unprecedented 13.3-percentage-point increase from February 2020.

One way to view the labor market responses to such a shock is through the lens of a theoretical model. The model, commonly used in economics literature, includes equations that describe the evolution of the unemployment rate and how firms make hiring decisions. Using this model, it is possible to trace the responses of the unemployment rate and vacancy postings to the increase in job separations caused by the virus and containment policies. It also helps identify underlying mechanisms driving the deterioration and eventual recovery of the labor market.

Unemployment rate responses driven by firms’ vacancy posting decisions

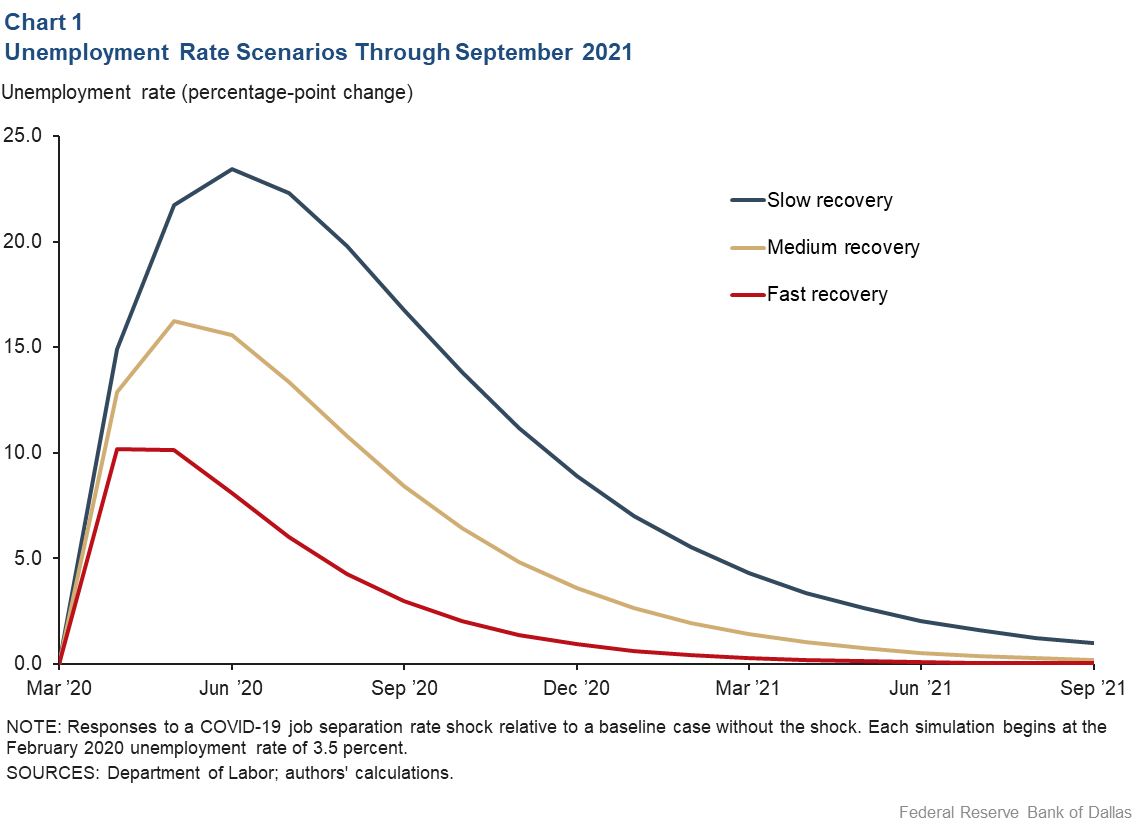

Charts 1 and 2 plot the model-generated responses of the unemployment rate and vacancy postings, respectively, based on employment data over the first month of the pandemic in the U.S. The severity of the responses depends on the persistence of the separation rate—the duration of the COVID-19 shock on the labor market—which determines the speed of the economic recovery. The charts show responses to a fast recovery (red line), a slow recovery (blue line) and a baseline or expected speed of recovery (beige line), since this information is highly uncertain.

In the baseline simulation, the unemployment rate increases by 16.4 percentage points and peaks about two months after the initial shock. Given that the unemployment rate was 3.5 percent in February before the shock hit, the unemployment rate was expected to peak at 19.7 percent in mid-May. The Bureau of Labor Statistics (BLS) has reported the April rate at 14.7 percent and the May rate at 13.3 percent. At the same time, BLS noted that some workers were misclassified. If all workers who were recorded as "employed but absent from work because of the coronavirus" were classified as unemployed, then the April unemployment rate would have been close to 20.0 percent.

After this peak, the economy begins recovering, but slowly. The unemployment rate remains slightly above 7.0 percent at the end of the year. For comparison, the unemployment rate peaked at 10.0 percent during the Great Recession.

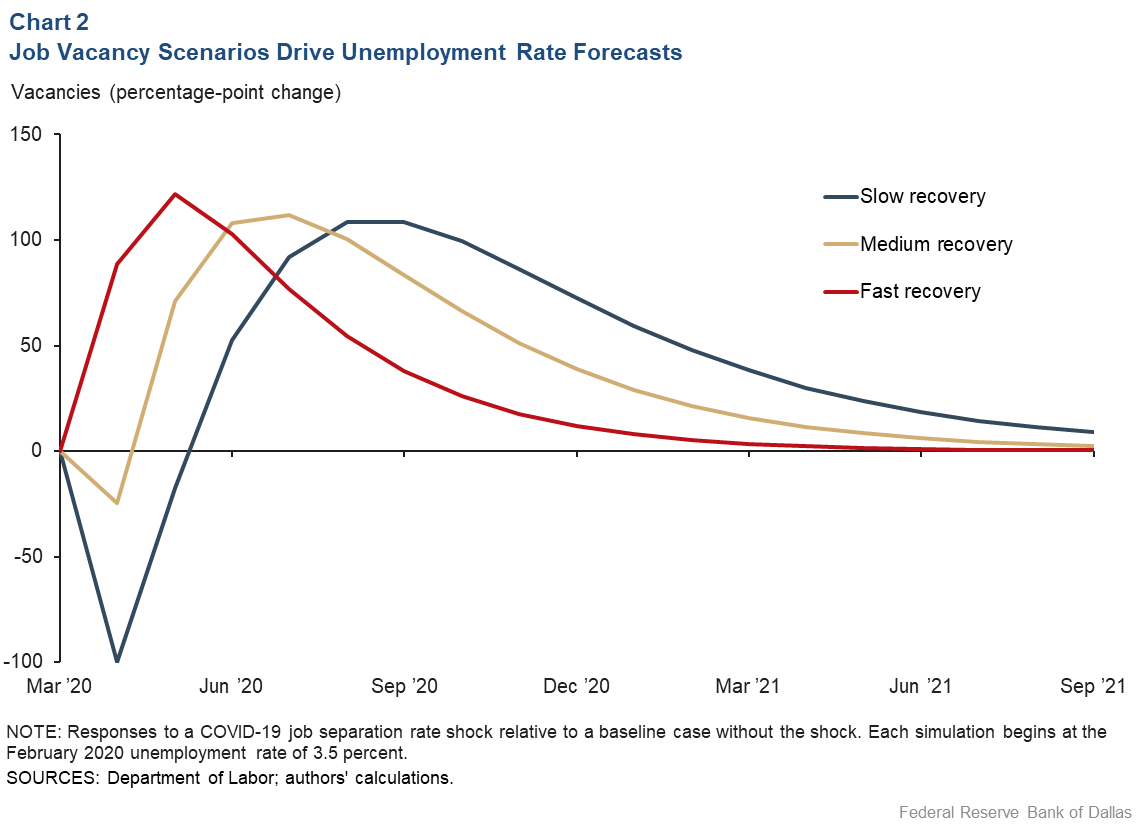

The dynamics of unemployment are driven by firms’ hiring decisions. The more vacancies firms post, the quicker the unemployment rate decreases. The theoretical model highlights how the persistence of pandemic-caused job separations affects the rate at which firms post vacancies. When firms expect the spike in job separations to continue for multiple months, their willingness to create new jobs decreases because they see a smaller benefit to hiring. The drop in vacancy creation pushes up the unemployment rate and slows economic recovery.

This effect is shown in Chart 2, which plots the path of vacancies in response to the initial shock.

In the baseline simulation (beige line), the increase in job separations is persistent enough to cause firms to post fewer vacancies, since they do not expect new jobs will be sufficiently profitable. Eventually, however, firms choose to post more vacancies, since a higher number of unemployed individuals searching for work increases the likelihood of filling the position. The increase in vacancies drives the eventual decline in unemployment and subsequent economic recovery.

If the economic recovery is slower (blue line), the unemployment rate peaks at 26.9 percent three months after the initial shock and remains above 12.0 percent at the end of the year. In contrast, if the shock quickly dissipates (red line), then the unemployment rate peaks at 13.5 percent almost immediately before normalizing within the year. In this counterfactual scenario, firms never reduce their hiring since they believe the decline in economic activity is short lived.

Labor market responses fuel uncertainty

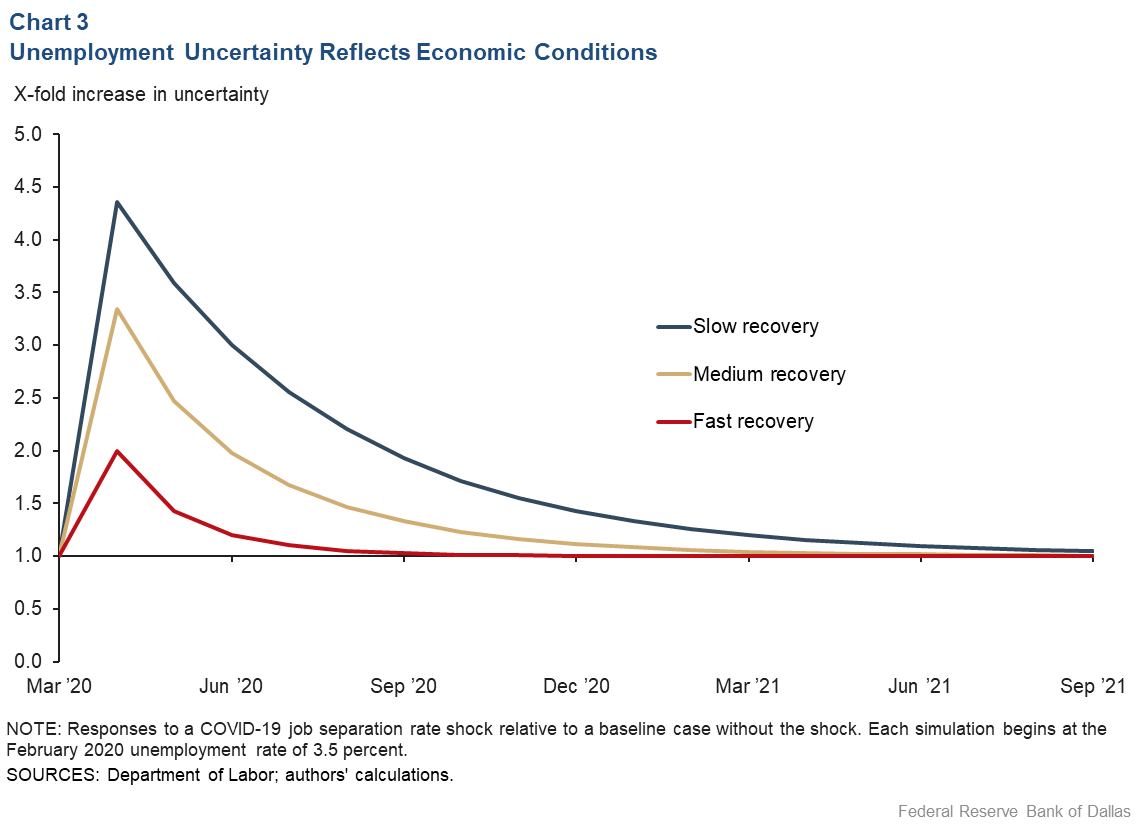

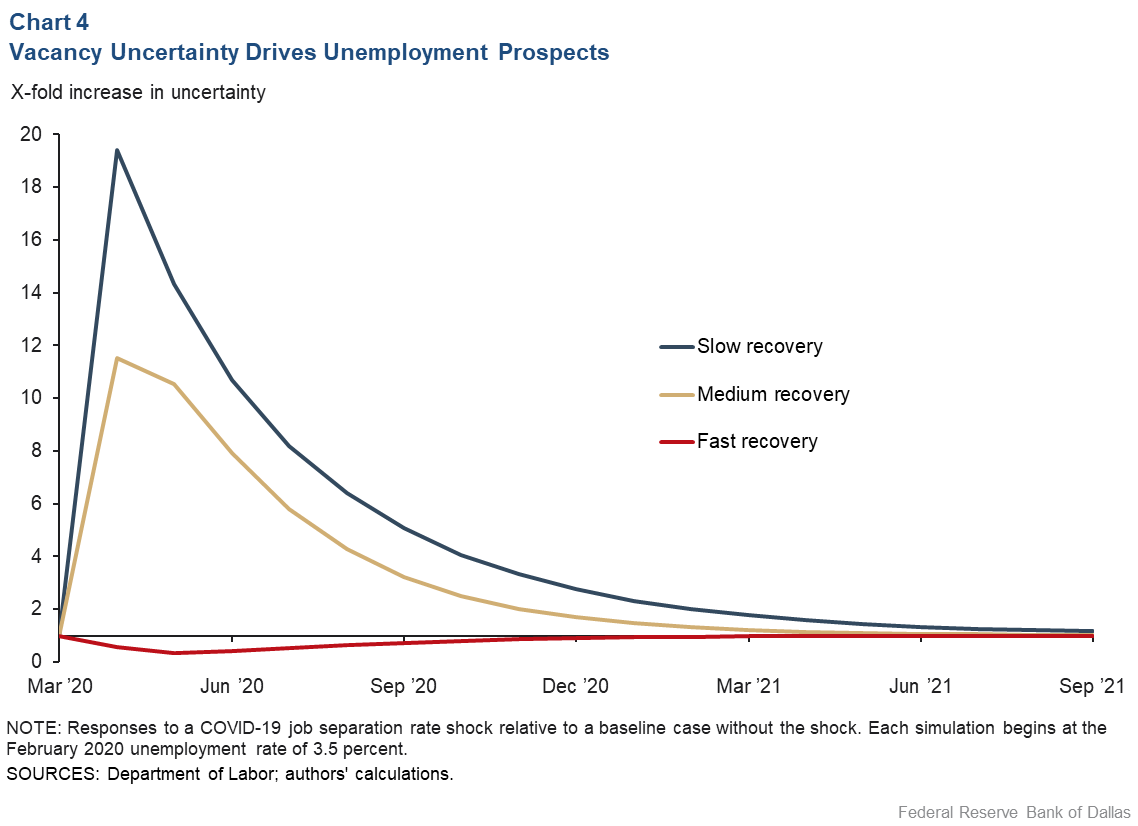

Charts 3 and 4 show that when unemployment is elevated, there is more uncertainty about the future labor market. In other words, the increase in uncertainty is a reflection of economic conditions and should not necessarily be thought of as a driver of economic activity.

This situation occurs because firms’ vacancy creation decisions are more sensitive to additional shocks to the economy when unemployment is already high. Since vacancy creation drives the evolution of unemployment, this extra sensitivity creates still more uncertainty about future unemployment and vacancy postings.

COVID-19’s unprecedented, persistent impact

These simulations suggest that the COVID-19 pandemic will likely have an unprecedented and persistent impact on the functioning of the U.S. labor market.

They also provide valuable insights into the mechanisms behind the impact of COVID-19, a key ingredient for any policy that seeks to alter the longer-run evolution of the labor market in the post-pandemic world.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.