Record global GDP contraction indicative of COVID-19’s cross-country effect

The COVID-19 shock—the combination of government-mandated lockdowns and voluntary social distancing by businesses and households in response to the global spread of the SARS CoV-2 virus—led to a record economic contraction.

The response to the virus has been notable across the world. In the United Kingdom, gross domestic product (GDP) declined at a 59.8 percent annual rate in the second quarter—the largest drop of any advanced economy this year. In India, GDP slid at a 69.4 percent annual rate—the greatest drop among emerging-market economies

In its June World Economic Outlook update, the International Monetary Fund (IMF) projected that global GDP would decline 4.9 percent in 2020, the largest drop on record. (Global GDP was essentially flat during the global financial crisis a decade ago.) Moreover, a number of studies have shown that individual households and businesses voluntarily scaling back social interactions as they learned about the risks associated with COVID-19 have probably played a more important role in damping economic activity than government mandates.

Observing varying impact across countries

The COVID-19 pandemic has affected countries differently. As is now well-documented, the disease first emerged in Wuhan in Hubei province, China, toward the end of 2019, with the first reported case outside of China in mid-January. The Chinese government imposed a lockdown on Wuhan and several other cities in Hubei to try to control the outbreak. On Jan. 30, the World Health Organization declared a pandemic. By the end of March, almost every country in the world had recorded cases.

While the pandemic began to weigh on economic activity in the first quarter, most of the economic damage was apparent in the second quarter. The exception was China, where the disease was first recorded. China experienced a 36.5 percent decline in GDP at an annual rate in the first quarter, followed by a 59.9 percent increase in GDP at an annual rate in the second quarter—a more or less perfect “V-shaped” recovery in aggregate activity.

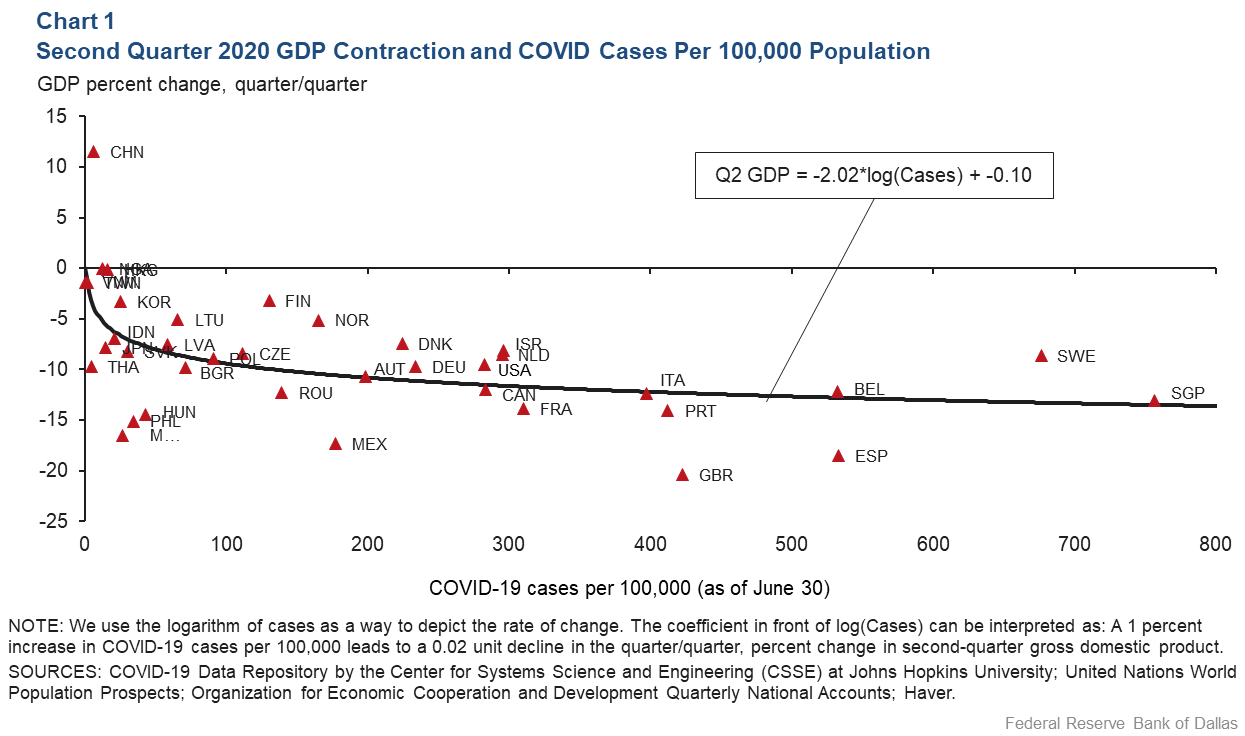

The severity of the second-quarter GDP contraction in different countries was directly correlated with the severity of the COVID-19 outbreak, as measured by cumulative cases through June 30 (Chart 1). The countries with the most severe outbreaks tended to have the largest GDP declines.

Chart 1 also includes a regression line showing the nonlinear relationship between each country’s GDP growth in the second quarter and cumulative COVID-19 cases through June 30. We note that growth in the second quarter was likely influenced by a wider range of factors than just the incidence of COVID-19.

Some countries—such as Spain, the U.K. and Mexico—contracted by more than would be predicted based on the simple regression relationship. Others—Sweden, Norway and Denmark—contracted by less. These differences were due to differences in economic structure (greater or lesser importance of economic activities requiring a high degree of face-to-face interaction); differences in how governments, households and businesses responded to the outbreaks; and differences in the fiscal and monetary responses.

Continuing impact beyond initial outbreak

The adverse economic effects of the pandemic seem likely to persist beyond the second quarter and will influence growth for all of 2020. In many countries, lockdowns that were imposed in the spring were relaxed over the summer, and economic activity began to recover.

Given the IMF’s prediction of a record contraction in global GDP this year, it will be difficult for growth in the third and fourth quarters of 2020 to offset the output losses in the second quarter. There is still a lot of uncertainty about the course of the disease and the prospects for a vaccine. Many countries in western Europe seem to be experiencing a second round of cases.

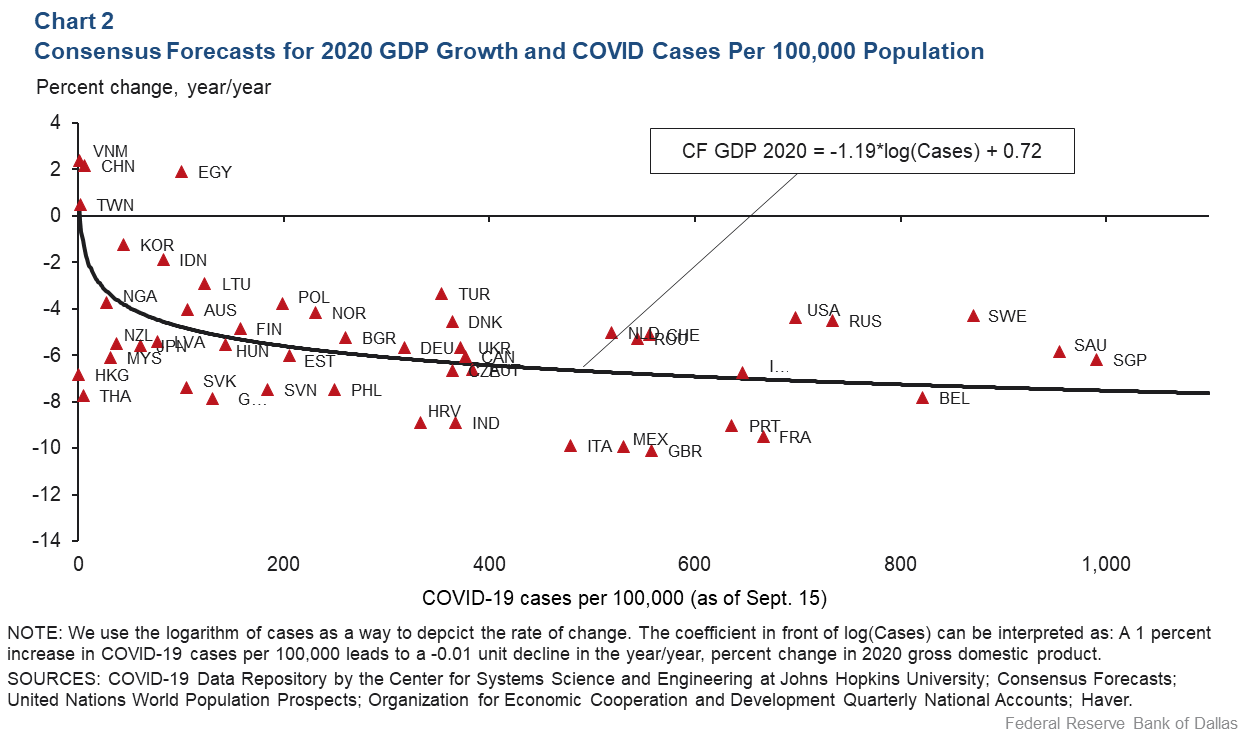

Chart 2 shows how the severity of the COVID-19 outbreak as measured by cumulative cases per 100,000 of population through Sept. 15 correlates with the September release of Consensus Forecasts of year-over-year GDP growth for 2020. Among the countries covered by Consensus Forecasts, only China, Egypt and Vietnam are expected to grow in 2020. All three have had relatively small numbers of COVID-19 cases compared with other industrialized or industrializing countries.

Looking toward 2021, almost all of the countries expected to experience COVID-19-related contractions this year will expand on a year-over-year basis next year.

Pandemic reaches all countries’ GDP

The massive mandated and voluntary scaling back of economic activity in response to COVID-19 has adversely affected countries everywhere, with indications that voluntary measures were at least as powerful a restraint on GDP as mandated ones.

A crude but imperfect measure of how well countries have handled the public health crisis is cumulative cases per 100,000 of population. Countries with fewer cases did better in the second quarter in terms of GDP growth than countries with many cases. The same will likely be true for 2020 as a whole.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.