Better Vehicle Batteries Needed to Power Energy Transition

A large-scale conversion to electric vehicles (EVs), necessary for a successful transition from fossil fuels, has yet to occur despite dramatic improvements in battery costs and performance over the past decade.

So far, consumers have been hesitant to switch; EVs have accounted for about 2 percent of U.S. auto sales in recent years. This hesitancy is due, in part, to still-high upfront costs and anxiety over vehicle range—concerns that persist despite improvements in lithium-ion (Li-ion) batteries, the power source of choice for EVs.

However, many companies are working on a battery of the future that might overcome these issues.

What’s in a battery and why it matters

A battery’s properties are determined in large part by the materials used to produce its four main components: the anode (the source of the electrons that provide power); the cathode (which stores ions generated when the battery is used); the electrolyte (which allows ions to move through the battery); and the separator (the barrier preventing the anode and the cathode from directly interacting).

Key properties include the amount of energy a battery stores, the number of times it can be recharged before becoming inoperable and the conditions under which it can safely operate. A battery’s cost is also important. If the materials used to produce it are too expensive or if the battery cannot be manufactured at scale, it may at best have limited commercial use.

The Li-ion battery, introduced in 1991, represents the fruits of more than 200 years of research and development. Li-ion batteries can be charged many times before failure and pack more energy than other commercially available rechargeable batteries. However, they are expensive compared with other, lower-performance batteries.

There are many variants of Li-ion batteries, but only three types are commonly used in EVs. Lithium is the common denominator in all of them, playing a key role in the chemical reactions that produce electricity. The anode is almost always made of graphite; the cathode varies across types.

More than 80 percent of EV sales in recent years use Li-ion batteries whose cathode is made of nickel, cobalt and either manganese or aluminum. Nickel and cobalt provide high-energy density but increase costs. There are additional concerns about the future availability of both metals. These batteries can also overheat, leading to potential safety issues because their electrolyte is flammable.

The lithium-iron-phosphate battery is another Li-ion battery found in some EVs. It has lower energy density and, therefore, shorter driving ranges. But it can be recharged more times and doesn’t have the supply concerns or overheating issues of the nickel/cobalt cathode.

Innovation increases energy density, drives down prices

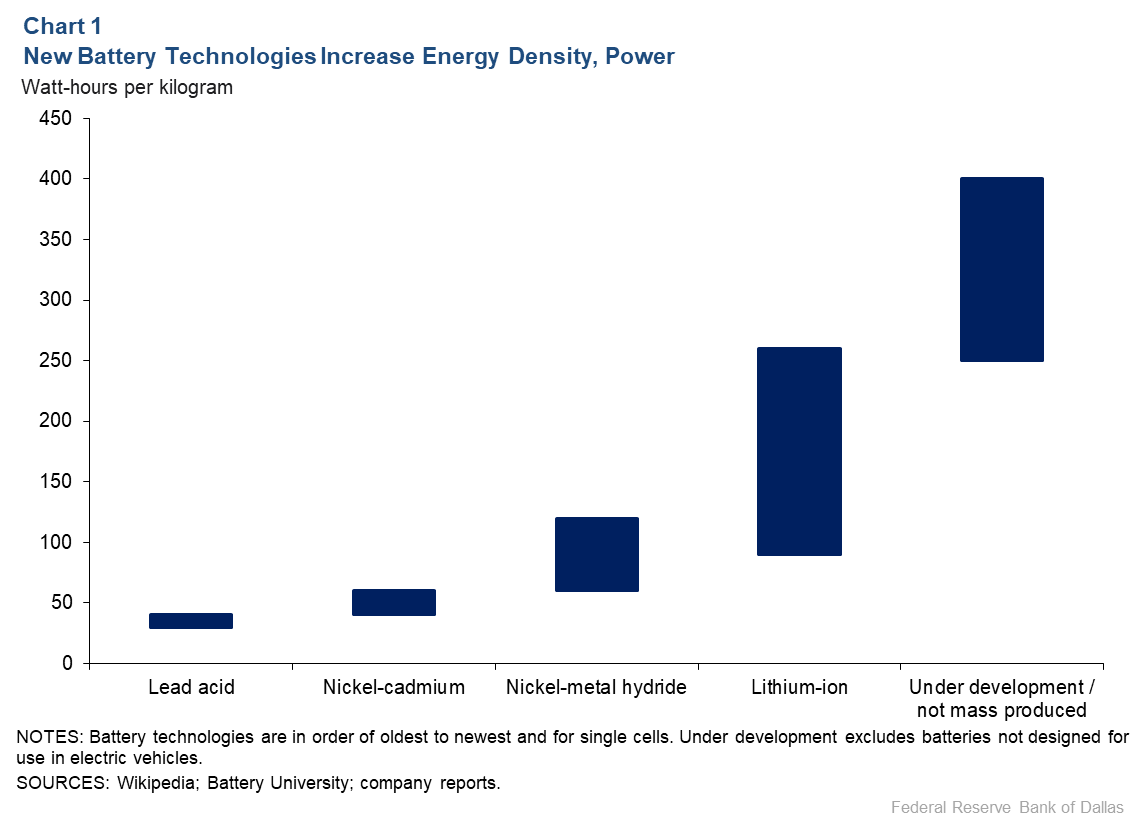

New chemistries have increased the amount of power a battery stores per unit of mass—the gravimetric energy density (Chart 1). There is an inherent economic motive to boost energy density since that means smaller, lighter batteries with more power.

The energy density of Li-ion batteries varies depending upon the type but, generally, it is much higher than earlier renewable batteries—such as lead acid, nickel-cadmium and nickel-metal hydride batteries—and reflects the cumulative impact of 30 years of research and development. Improvements upon the original design—including new cathode materials—have increased energy density and safety.

Chart 1 depicts the energy density for a single battery, technically called a “cell.” An electric vehicle battery is composed of many individual cells, which are grouped together to form modules and then combined to form a battery pack. Another option for enhancing performance and driving down costs, particularly for electric vehicles, has been improving the design of the battery pack.

The battery pack can be viewed as standalone piece of equipment, one that includes other components besides the individual batteries. To the extent that manufacturers can improve upon these designs, they can reduce the price of the battery and, therefore, the potential price of electric vehicles.

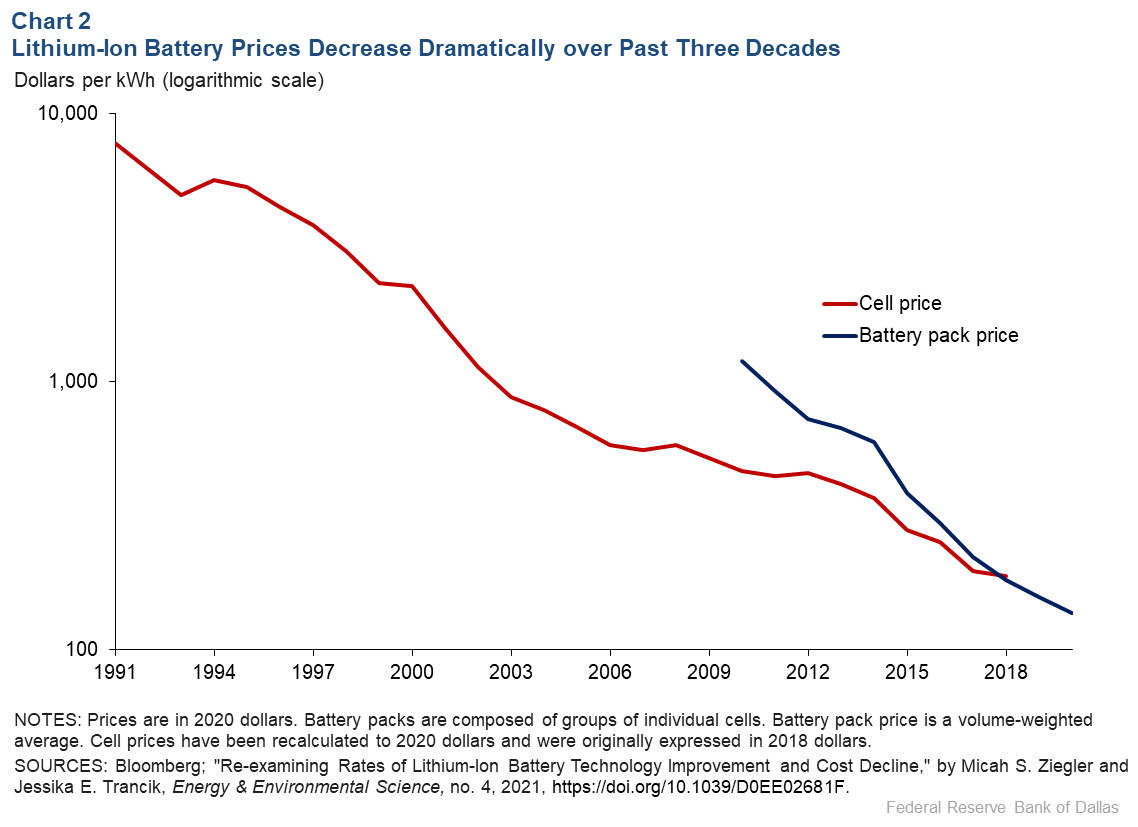

These improvements, along with growing economies of scale, have dramatically reduced the price of Li-ion batteries over time (Chart 2). The price of individual cells has fallen almost 98 percent since 1991, and battery pack prices have also decreased dramatically over the past decade.

The future is silicon … or perhaps something else

Many in the industry believe that, despite significant improvements, the current generation of Li-ion batteries remains too expensive relative to its performance. Given the stakes, many companies are trying to develop a commercially viable battery with a higher energy density.

Some researchers are focusing on the anode. It has been known for many decades that silicon can store greater amounts of lithium than graphite, and small amounts of silicon have, in fact, boosted the performance of some Li-ion batteries. However, technical challenges have so far prevented the full-scale replacement of graphite with silicon-based anodes.

Another broad area of research focuses on solid-state batteries, which replace the liquid electrolyte in Li-ion batteries with a solid material. Solid-state batteries for use in electric vehicles remain, for the most part, in the development phase. Prototype vehicles have been introduced, with companies targeting larger-scale deployment later this decade.

Other approaches also under consideration include replacing lithium ions with sodium ions, using graphene (highly conductive carbon that is extremely light and thin) to boost performance, and using sulfur-based cathodes.

Long, risky development process

Whatever the approach, history has shown that the development process for batteries is often long and risky—even in the best of cases—so progress may take time. For example, initial research on the Li-ion occurred in the 1970s, but the first prototype wasn’t introduced until 1986, and it took another five years for a commercial product to emerge.

Decades of improvement on the original design followed. Along the way, there were many successes but also many commercial failures and bankruptcies. Automakers also have a long and detailed qualification process to vet new battery technology, which slows the pace of adoption.

Besides the inherent risks in developing a new battery, newcomers also face a formidable challenge in the existing economies of scale of Li-ion production. More than a decade has been spent assembling supply chains and understanding how to best manufacture Li-ion batteries and packs for use in EVs. These economies could increase if predictions about future EV adoption are correct. Some companies, but not all, are looking to sidestep these issues by developing batteries that can take advantage of existing production processes.

Still, past developments suggest that we should expect to see further battery improvement. But exactly what that looks like, when it occurs and which developers will reap the spoils from that success are difficult to predict.

About the Author

Michael D. Plante

Plante is a senior economist and adviser in the Research Department at the Federal Reserve Bank of Dallas.

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.