Location, location, location: Mortgage rate impact varies by metro

The housing and real estate sectors attract outsized attention during a period of quickly escalating interest rates such as the Fed’s ongoing tightening cycle that began in March 2022.

Housing and real estate, because of their rate sensitivity, are among the first influenced by interest rate changes because the sectors are a primary transmission channel for monetary policy throughout the economy. Moreover, home equity is a significant share of Americans’ wealth and an important source of collateral.

Further, declining house prices can lead to decreased consumption as individuals’ net worth falls and their ability to borrow becomes constrained. Related sectors, such as construction, also likely experience downturns, which in turn can broadly affect employment. Thus, the role of individual housing markets and their sensitivity to mortgage rate changes play an important part in understanding the impact of higher rates.

Mortgage rates influence house-price movement

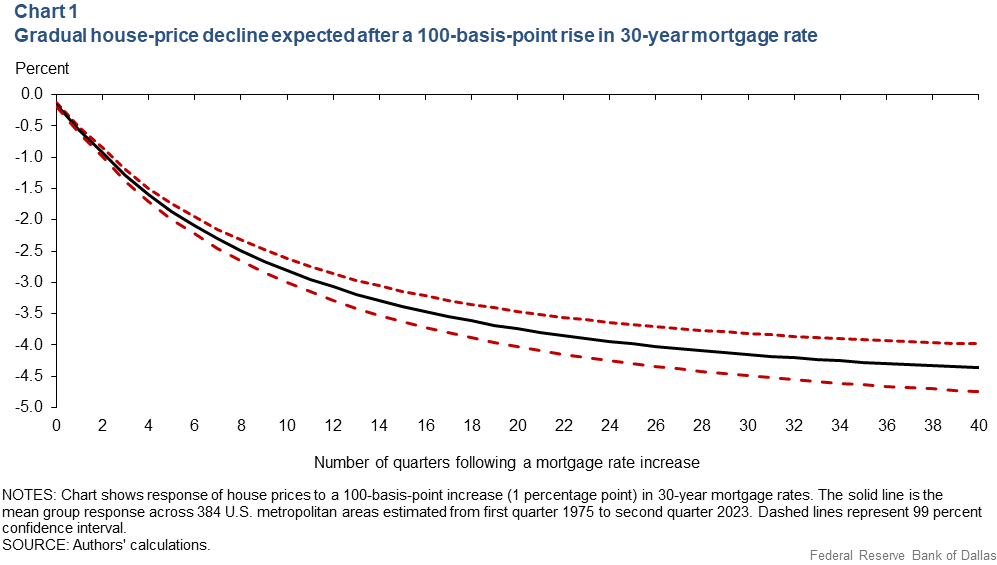

Mortgage rate changes can help predict house-price movements, based on quarterly data covering 384 U.S. metropolitan areas from first quarter 1975 to second quarter 2023. For every 1-percentage-point (100-basis-point) increase in 30-year fixed-rate mortgage rates, a -1.6 percent adjustment in house prices on average is expected in the following year (Chart 1).

This response seems remarkably persistent, becoming a 2.5 percent decline in two years and a 3.1 percent drop in three years. Over a 10-year period, the cumulative effect is considerable, amounting to about a 4.4 percent fall in house prices.

These estimates, based on historical data over the past five decades, are subject to a great deal of uncertainty. Besides the usual statistical sampling uncertainty, the estimates depend on the house-price model chosen as well as the nature of the shock causing the mortgage rate increase.

Evolving house-price sensitivities emerge in recent period

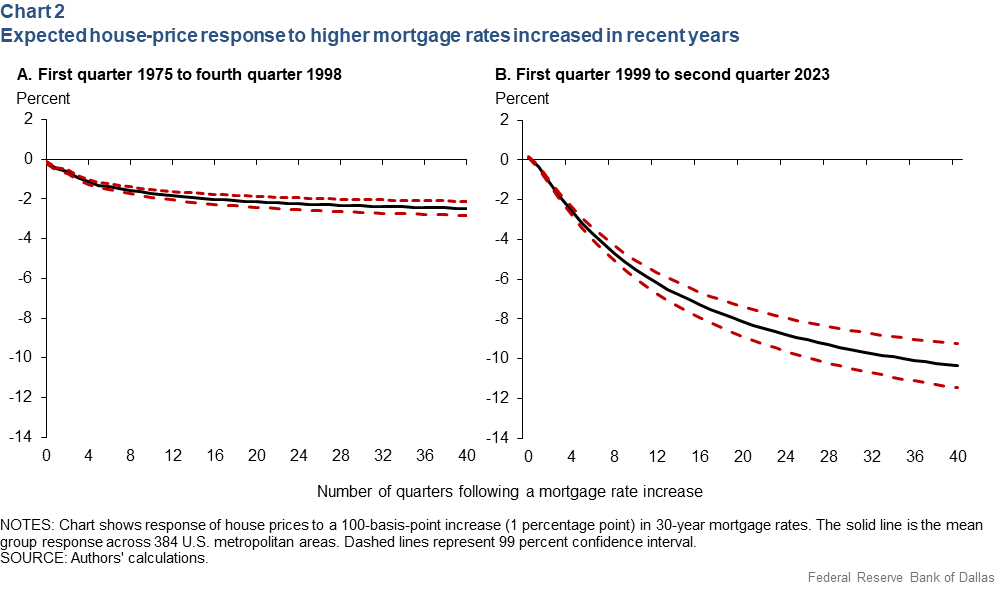

One notable concern is that historical relationships could have changed over such a long time. Splitting the estimation sample in two halves reveals that the expected response of house prices has likely increased in magnitude in the more recent period (Chart 2).

House-price sensitivity to mortgage rates has likely risen because of multiple factors. First, the 2000s housing bubble, along with a sharp decline in mortgage rates, produced a period of elevated house-price sensitivity. Secondly, a long-term increase in the investor share of home purchases may have further contributed to the increased sensitivity of housing demand to changes in mortgage rates.

Lastly, previous research shows that housing supply elasticity has decreased over time due to tighter state and local land-use requirements. When the housing supply is limited, fluctuating demand because of mortgage rate changes leads to larger swings in house prices.

These findings align closely with those from prior research, which has revealed a considerable range in the estimated responses of house prices to changes in mortgage rates.

Some recent research suggests that the amount potential homeowners are willing to pay for a house decreases by 5 percent if mortgage rates rise from 4.5 percent to 6.5 percent. However, other studies indicate a range of effects, with some finding a 1-percentage-point increase in mortgage rates can lead to house-price reductions of between 1 percent and 9 percent, and others suggesting impacts as large as 20 percent.

Regional factors contribute to varying interest rate sensitivities

Importantly, regions within the U.S. differ widely in their sensitivities to interest rates. This differential sensitivity can arise from a multitude of factors. For example, states with a larger manufacturing sector may be more sensitive given manufacturing’s particular vulnerability to interest rate changes.

Additionally, the distribution of firm sizes and bank sizes can also influence sensitivity, as credit availability typically more intensely affects smaller firms and exerts a relatively larger impact on small banks.

The regional distribution of housing market sensitivity to mortgage rate changes, which often track general interest rate changes, is another crucial consideration. These regional disparities of interest rate sensitivity influence the aggregated effect of monetary policy. While discussions often focus on the overall impact of monetary policy, various regions’ reaction to monetary policy changes will shape the aggregated outcome. Thus, regional differences can have macroeconomic implications.

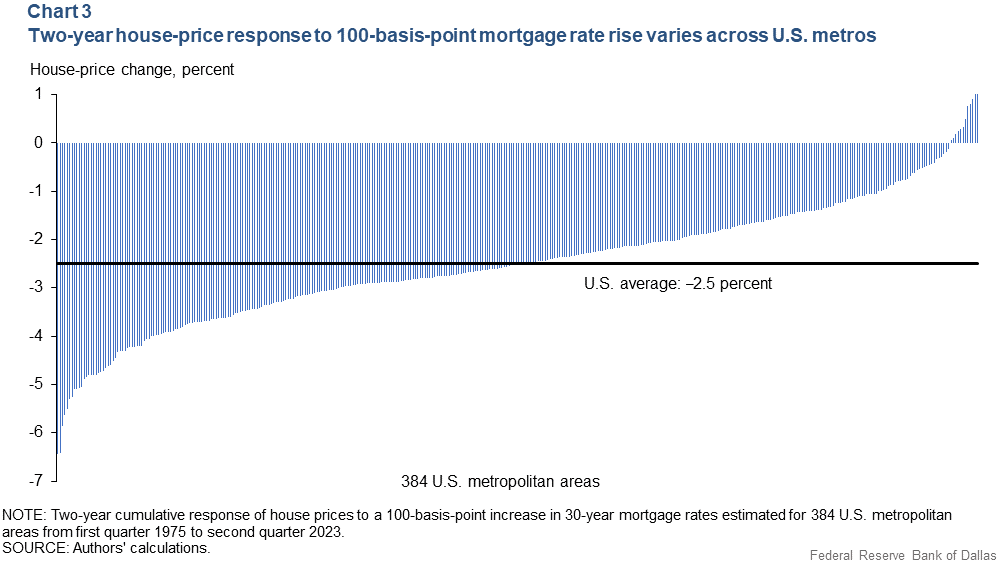

Data suggest significant variations in how regional house prices react to mortgage rate changes, demonstrating a notable heterogeneity (Chart 3).

To be sure, the variability in mortgage rate sensitivity might also partially reflect disparities in regional economic conditions, such as job growth, GDP growth, inflation and unemployment, which simultaneously evolve with changing mortgage rates. Differences in regional housing supply elasticity also play a role in the disparities.

It's worth noting that these estimates do not account for other factors affecting house prices when mortgage rates fluctuate. Mortgage rates, while a significant determinant of housing demand, are just one component of the overall cost of homeownership. Other factors such as down payment requirements, the discount rate, property taxes, maintenance and insurance costs, expected house-price appreciation and mobility also shape the user cost of housing and, hence, house-price growth.

Still other considerations, such as changing mortgage credit standards, might also be at play. After controlling for some of these, previous research has found that mortgage rates may have a relatively restrained effect on house prices.Monetary policy transmission affected

Differences in how regional house prices respond to mortgage rate changes have implications for the impact of monetary policy across regions. When monetary policy tightens and mortgage rates increase, differing regional house-price declines will result in unequal changes in home equity.

The disparities in home equity changes directly affect the refinancing transmission channel of monetary policy. Regions more sensitive to mortgage rate changes will experience larger declines in house prices and home equity, reducing their borrowing capacity in the face of an economic slowdown.

On the other hand, less-sensitive regions will experience smaller impacts. This differential sensitivity thus contributes to an uneven distribution of economic slowdown, and regions with greater mortgage rate sensitivity are likely to suffer more adverse effects.

About the authors

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.