Austin Economic Indicators

| Austin economy dashboard (June 2024) | |||

| Job growth (annualized) March–June '24 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 2.0% | 3.4% | $34.62 | 2.7% |

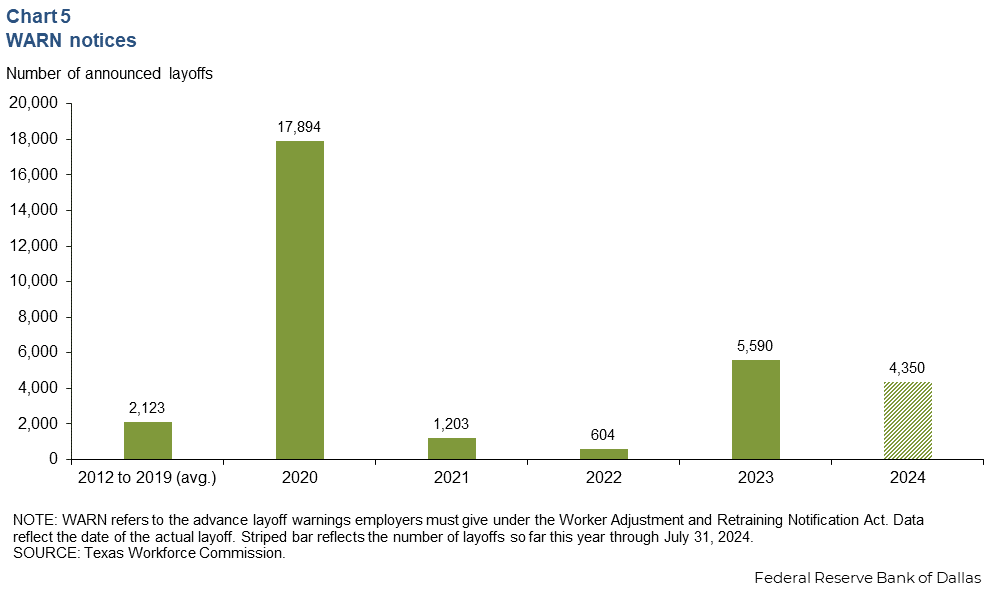

Austin employment fell in June, while the unemployment rate remained the same. The median house price declined, and home inventories fell. Worker Adjustment and Retraining Notification (WARN) notices given indicated an elevated number of layoffs so far in 2024.

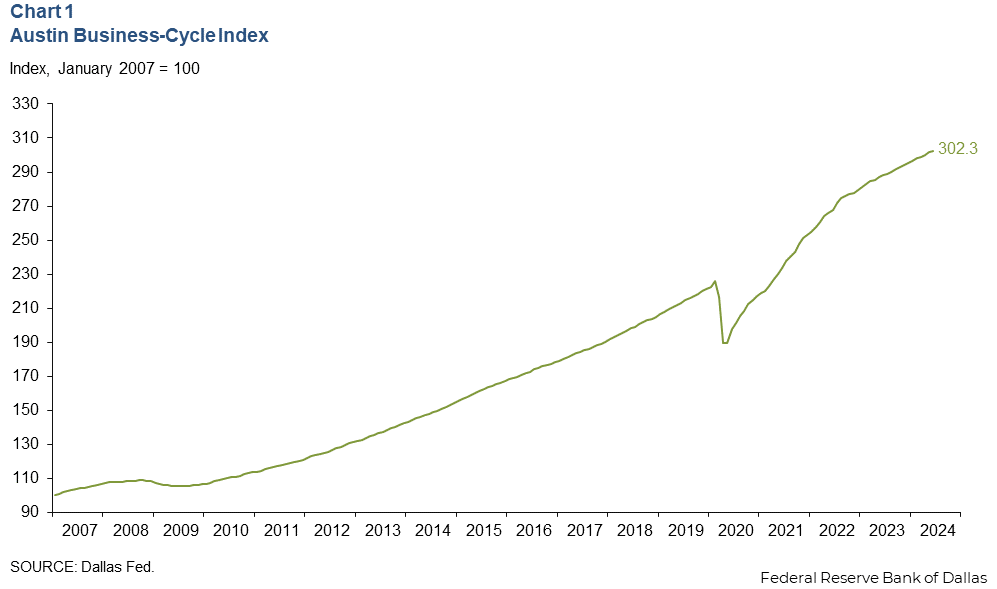

Business-cycle index

The Austin Business-Cycle Index, a broad measure of economic activity, grew an annualized 2.9 percent in June, slower than the 6.1 percent gain in May (Chart 1).

Labor market

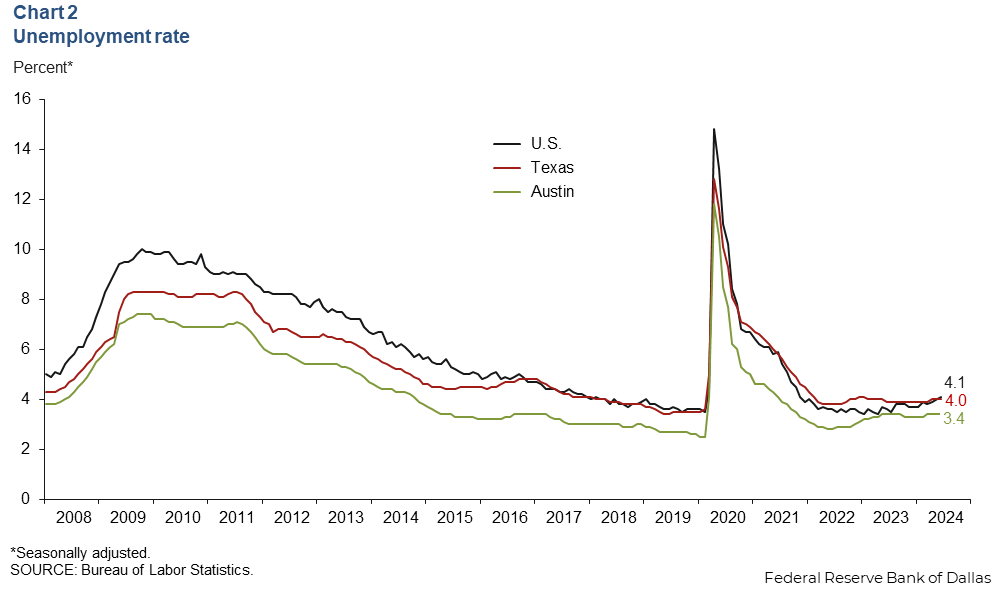

Unemployment rate stabilizes

Austin’s unemployment rate remained at 3.4 percent in June—below the state’s and nation’s rates of 4.0 and 4.1 percent, respectively (Chart 2). In June, the local labor force increased an annualized 5.1 percent, while the state’s increased 3.9 percent, and the nation’s grew 2.0 percent.

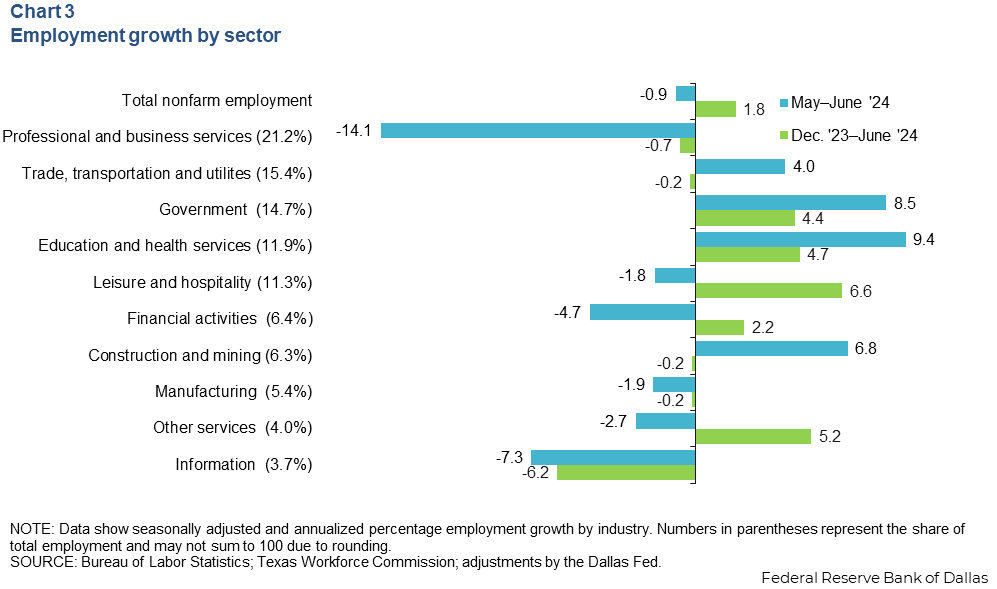

Employment falls

Austin employment fell 0.9 percent in June after increasing 3.4 percent in May (Chart 3). Sectors with the most growth were government (1,363 jobs) and education and health services (1,209 jobs). Sectors that saw a decline included professional and business services (-3,61- jobs) and financial activities (-350 jobs). Year to date, Austin employment growth was 1.8 percent, below the state’s 2.3 percent gains and above the nation’s 1.7 percent increase.

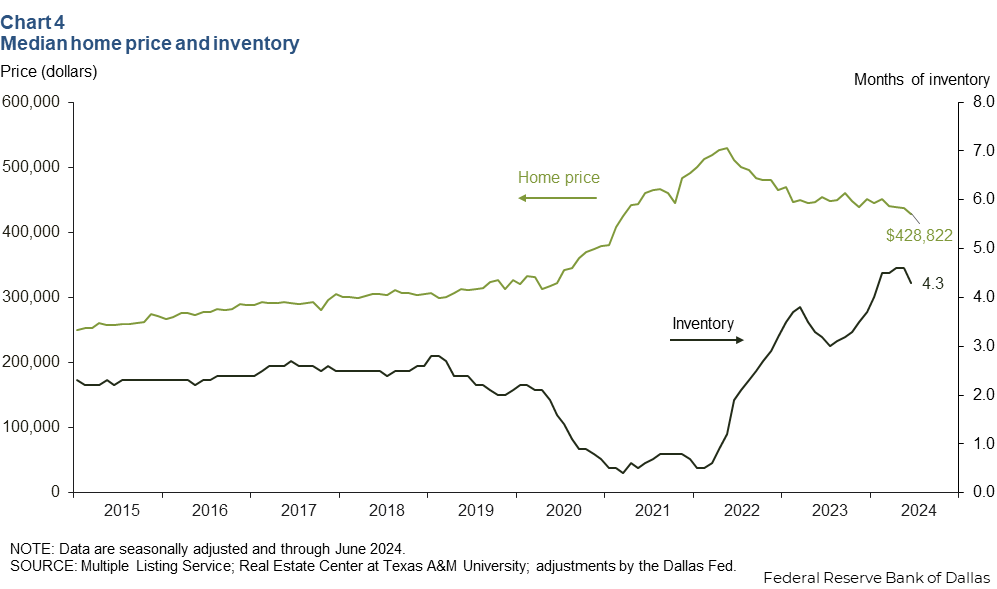

Housing

Austin’s median home price declined 1.9 percent in June to $428,822 (Chart 4). Year over year, home prices trended down—falling 5.6 percent in the metro and 3.7 percent in the state. Austin home inventories declined to 4.3 months in June, remaining below six months, which is generally considered a balanced housing market. A year ago, home inventory levels in Austin were 3.2 months, while they were 3.0 months in Texas and 2.9 months in the U.S.

Mass layoffs (WARN)

Mass layoff notices (WARN) have been given to 4,350 employees in the Austin metropolitan statistical area so far in 2024, double the annual average from 2012 to 2019 and more than double the number of layoff notices for 2021 and 2022 combined (Chart 5). Most of these losses are due to Tesla layoffs announced in April, accounting for 60 percent of the layoffs so far in 2024.

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions or suggestions can be addressed to Isabel Dhillon at Isabel.Dhillon@dal.frb.org.

Austin Economic Indicators is released on the first Thursday of every month.