Austin Economic Indicators

| Austin economy dashboard (December 2025) | |||

| Job growth (annualized) Sept.–Dec. '25 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 1.3% | 3.6% | $36.62 | 3.2% |

Austin employment ticked up in December, and high-tech jobs decreased, while the unemployment rate declined and wages rose.

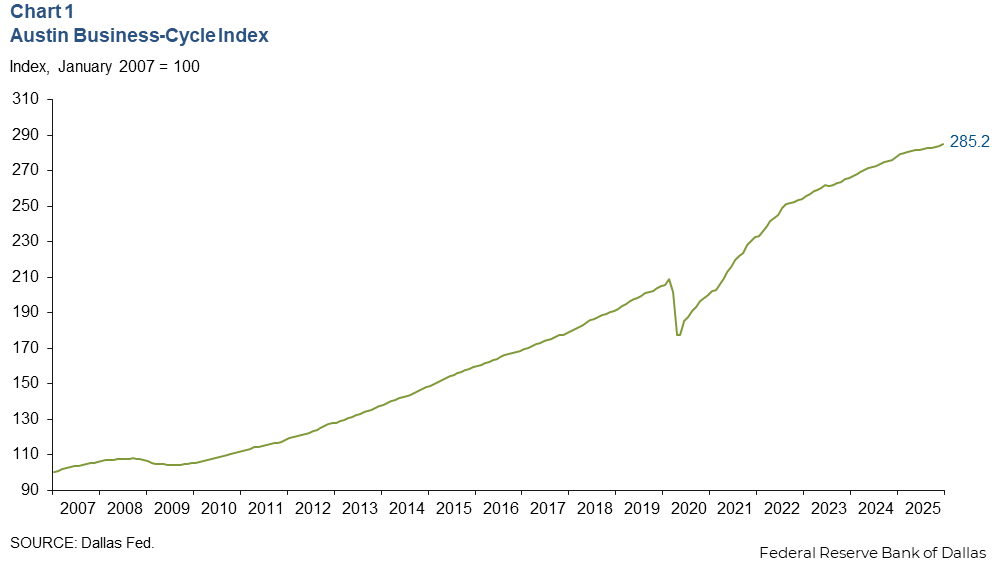

Business-cycle index

The Austin Business-Cycle Index, a broad measure of economic activity, grew an annualized 4.7 percent in December, quicker than the 4.1 percent gain in November (Chart 1).

Labor market

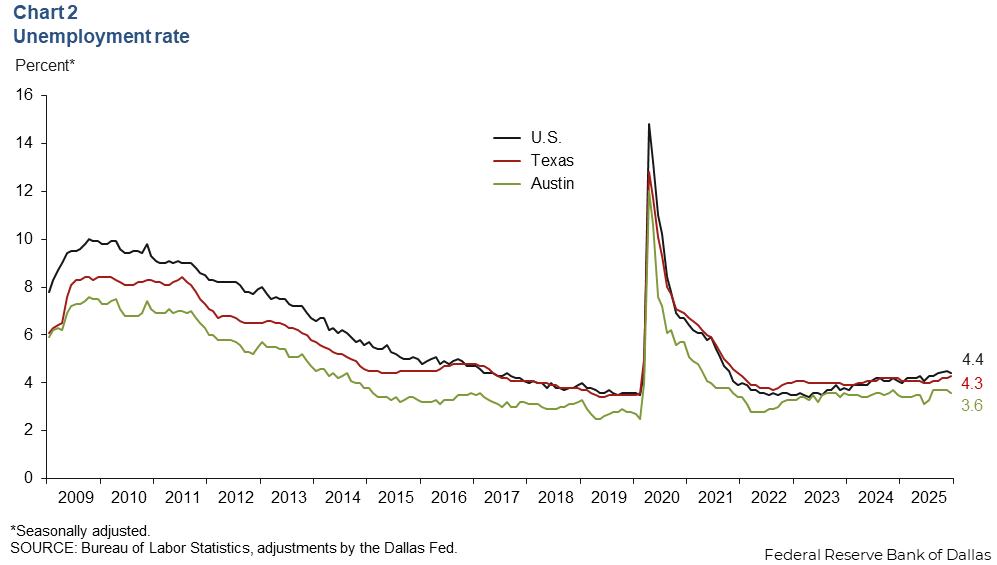

Unemployment falls

Austin’s unemployment rate fell to 3.6 percent in December, below the state rate of 4.3 percent and the national rate of 4.4 percent (Chart 2). The number of unemployed decreased 31.8 percent, while the size of the labor force rose, by 0.3 percent.

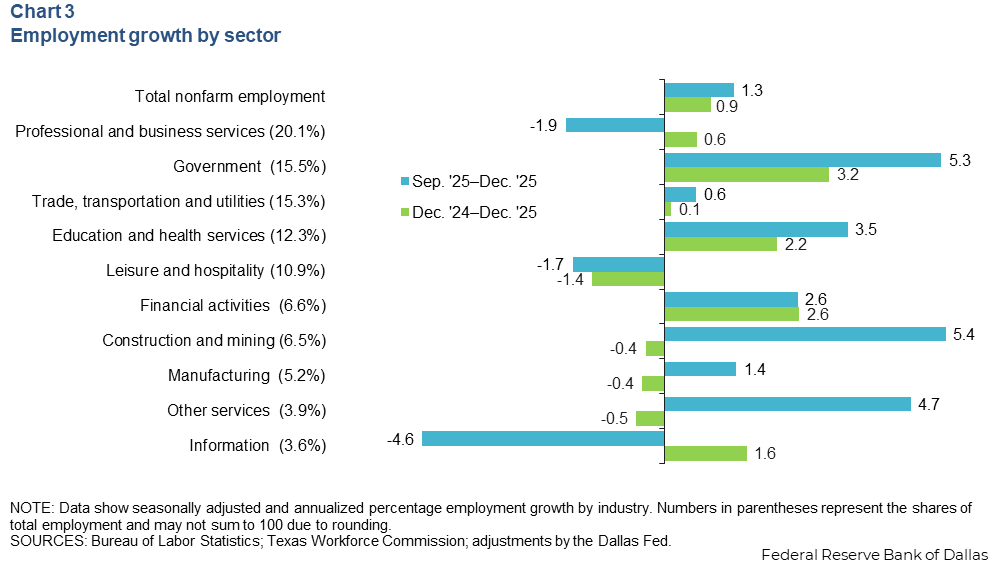

Jobs increase

Austin employment increased an annualized 1.0 percent in December. In the three months ending in December, employment increased an annualized 1.3 percent (Chart 3). The greatest gains were in government (2,800 jobs), education and health services (1,500 jobs) and construction and mining (1,200 jobs). Sectors that declined include professional and business services (-1,300 jobs) and leisure and hospitality (-700 jobs). Austin’s employment grew 0.9 percent from December to December, quicker than for Texas, which rose 0.1 percent. National employment rose 0.4 percent.

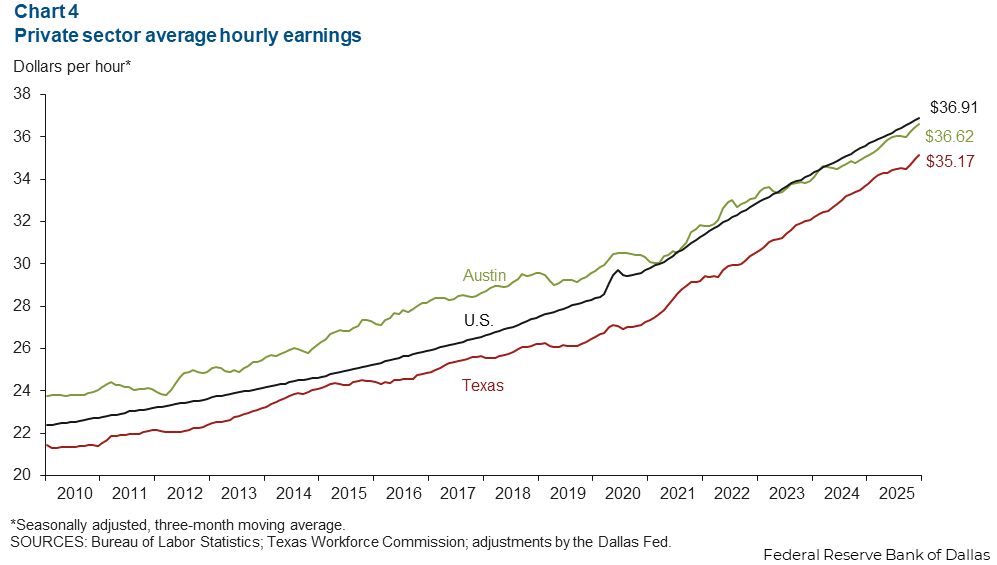

Earnings growth decelerates

Austin’s average hourly wage increased to $36.43 in December. The three-month moving average for wages increased an annualized 5.6 percent in December to $36.62, lower than the nation’s average of $36.91 but higher than the state’s average of $35.17 (Chart 4). Year over year, Austin’s 3.2 percent wage growth slowed from 5.1 percent in November, and wage growth was slower than Texas’ gains of 3.9 percent and the nation’s gains of 3.8 percent.

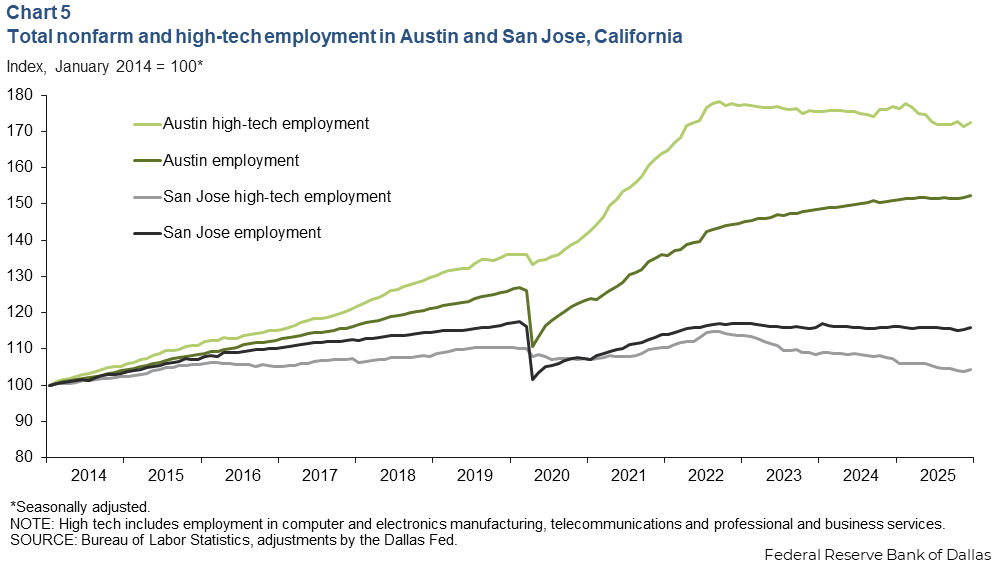

High-tech employment outperforms

Employment in electronics manufacturing, telecommunications, and professional and business services in Austin grew out of the pandemic at a much faster clip than in San Jose, California, a traditional high-tech hub (Chart 5). However, high-tech employment in Austin fell 2.5 percent year over year, slightly less than the 2.7 percent decline in San Jose.

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions or suggestions can be addressed to Ethan Dixon at Ethan.Dixon@dal.frb.org.

Austin Economic Indicators is published every month after state and metro employment data are released.