El Paso Economic Indicators

El Paso's economy continued to expand in October. Existing-home sales remained near all-time highs, while home-price appreciation was moderate. Slow price gains, coupled with increases in household income, have maintained El Paso's home affordability. While employment growth in the metro continues, maquiladora employment in Ciudad Juárez has steadied.

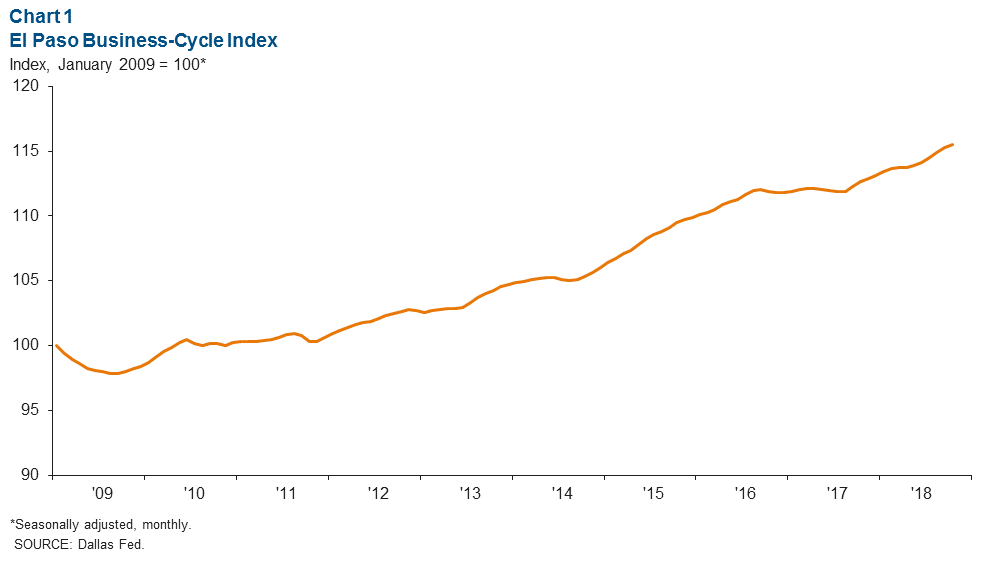

Business-Cycle Index

The El Paso Business-Cycle Index advanced at a 2.9 percent annualized rate in October (Chart 1). Gains in the index continue to be attributed to the payroll expansion.

Labor Market

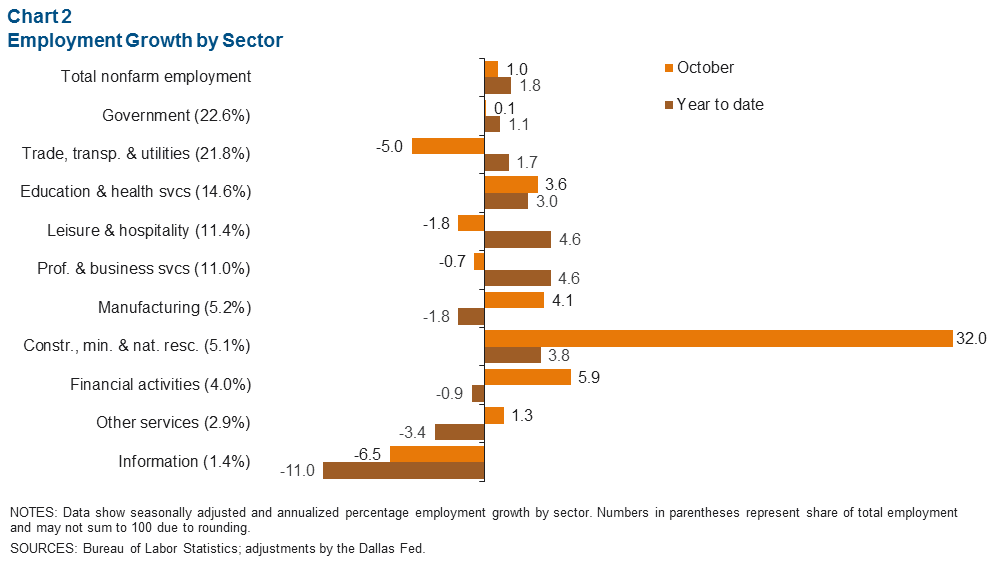

Year to date, El Paso payrolls have grown at an annualized rate of 1.8 percent (Chart 2), adding over 4,800 jobs. Growth has been centered in El Paso's largest employment sectors.

The strongest year-to-date growth is in leisure and hospitality and professional and business services, which are both rising at a 4.6 percent annualized rate and have together added over 2,600 jobs this year. Infrastructure improvements, school-bond projects and new commercial developments are boosting construction employment. Year to date, construction, mining and natural resources has expanded at an annualized rate of 3.8 percent, making it the third-fastest-growing sector.

The jobless rate in El Paso inched lower to 4.1 percent in October from 4.3 percent in September. The El Paso unemployment rate stands slightly above the 3.7 percent rate for both the state and U.S.

Housing

Existing-Home Sales Remain Near All-Time Highs

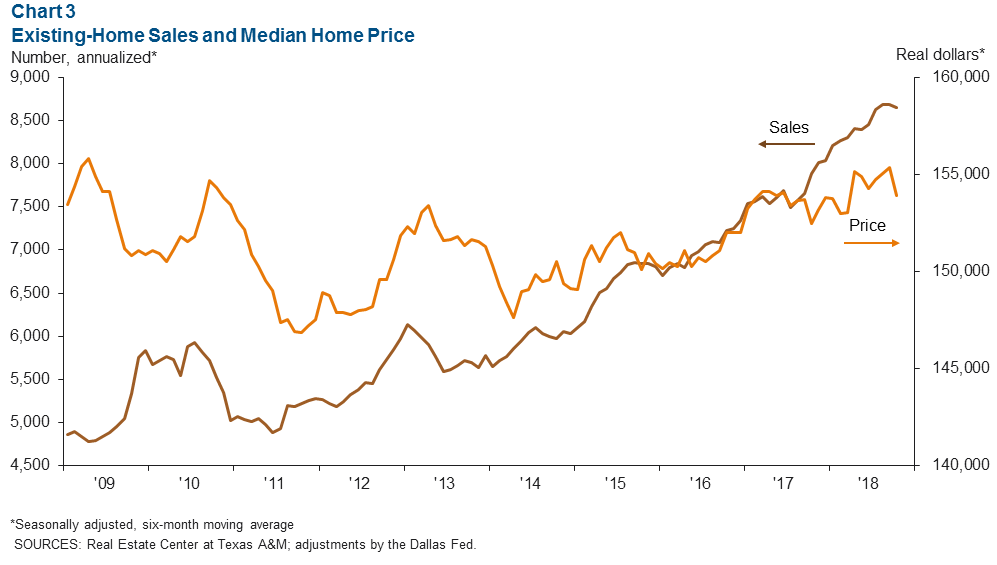

In October, sales totaled 8,702—9.7 percent above year-ago levels (Chart 3). Strong sales have placed downward pressure on home inventories. In October, inventories stood at 4.4 months, below the six months' supply associated with a balanced market.

The median home price dipped in October to $153,918, from September's price of $155,365. However, compared with a year ago, the price is up 1 percent.

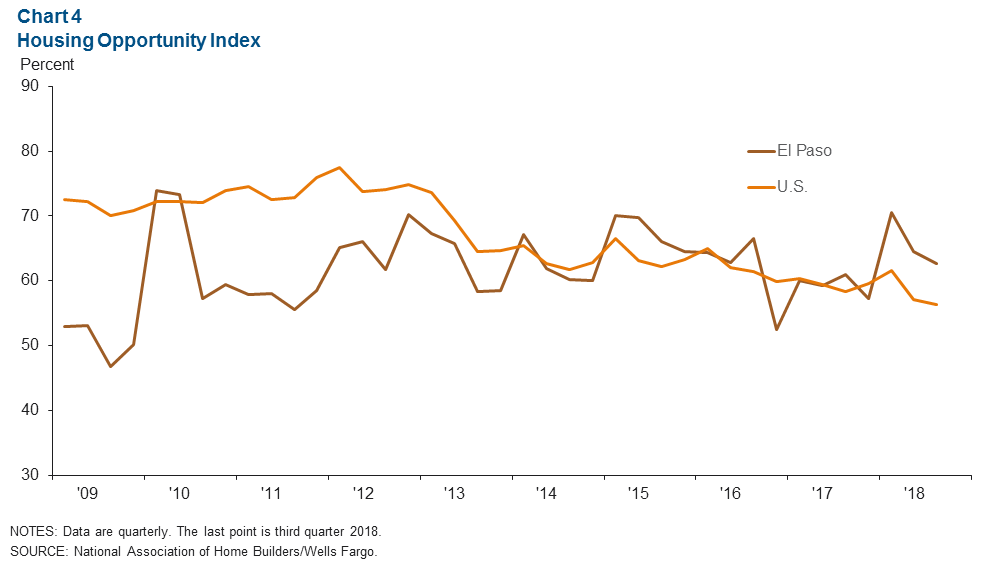

El Paso Housing Affordability Higher than U.S. Average

The National Association of Home Builders Housing Opportunity Index represents the share of homes sold that are considered affordable to a family earning the median income. The El Paso reading of 62.6 percent in third quarter 2018 was well above the U.S. reading of 56.4 percent (Chart 4). El Paso's greater affordability is due to the slow gain in home prices and faster gain in incomes.

Industrial Production and Maquiladora Activity

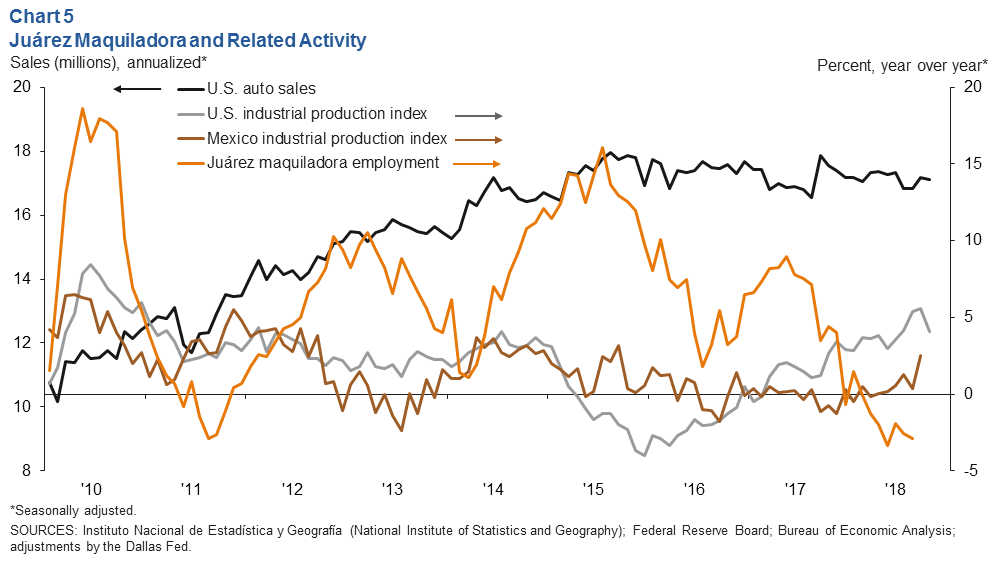

U.S. industrial production rose 4.1 percent year over year in October (Chart 5), and the Institute for Supply Management manufacturing index stood at 57.7 in October, well above 50, which signals expansion. U.S. manufacturing conditions remain solid. U.S. and Mexican production and manufacturing trends are important to the local economy because of cross-border manufacturing relationships.

Across the border from El Paso, Juárez manufacturing employment has steadied. This is likely due in part to a tight labor market there. According to Mexico's official series, Juárez maquiladora jobs totaled about 267,800 in the most recent count in August. Employment remains little changed from July but is down 2.9 percent from a year earlier.

U.S. auto and light-truck production was 10.7 million in October, on par with the units produced a year earlier. Meanwhile, monthly auto sales fell to 17.1 million, below the 17.6 million sold a year earlier. Auto sales are closely linked to the local economy because roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Marycruz De León at marycruz.deleon@dal.frb.org. El Paso Economic Indicators is released on the fourth Wednesday of every month.