El Paso Economic Indicators

June 1, 2020

El Paso’s economy contracted further in April as COVID-19 pandemic measures took hold. El Paso’s business-cycle index and payrolls witnessed historical declines, and trade volumes fell sharply. U.S. and Mexico industrial and manufacturing conditions worsened considerably, with U.S. auto sales and production figures in deep decline.

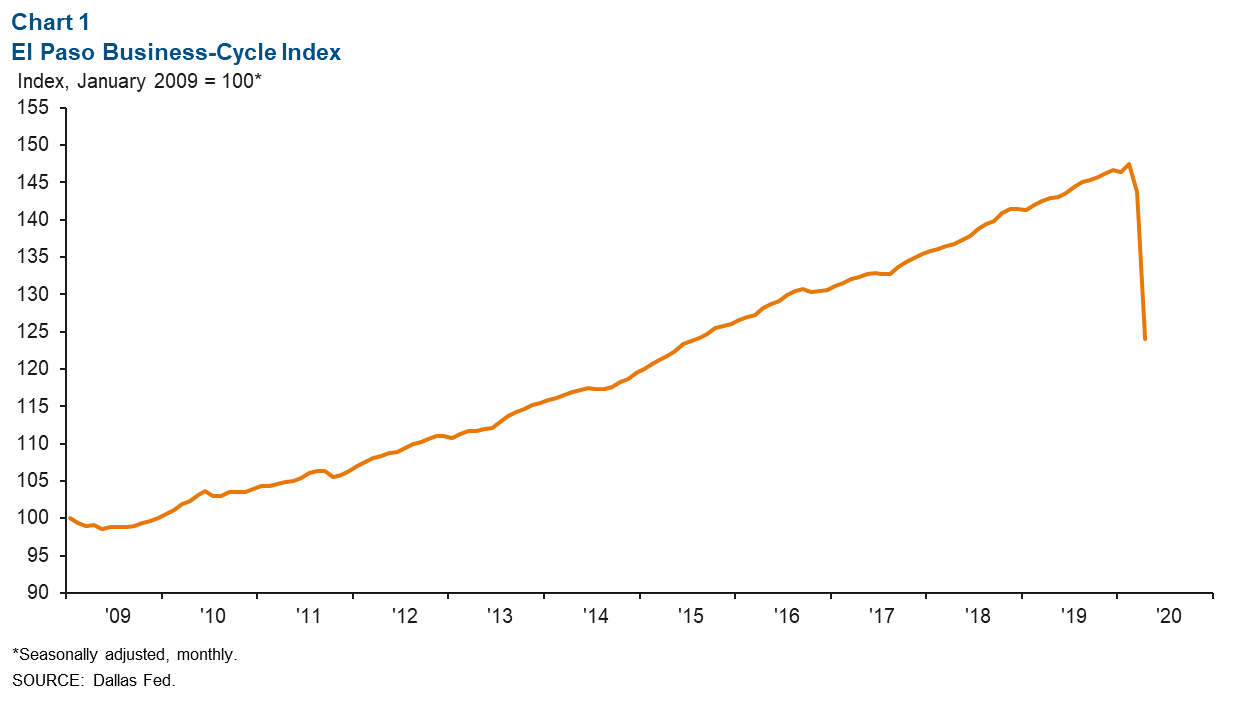

Business-Cycle Index

The El Paso Business-Cycle Index contracted an annualized 82.9 percent (13.7 percent nonannualized) from March to April (Chart 1). Weakness in the index was attributed to a spike in the unemployment rate and extensive jobs losses.

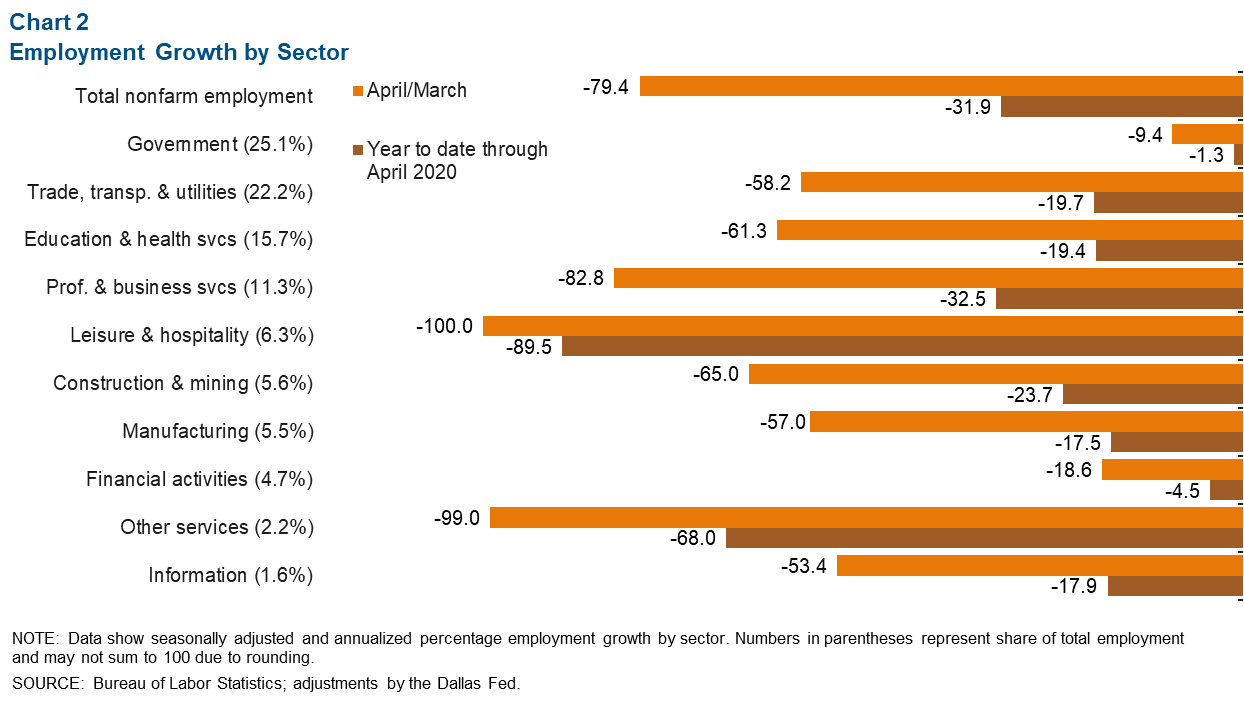

Labor Market

The El Paso labor market shrank an annualized 79.4 percent in April, a loss of 40,413 jobs on a nonannualized basis (Chart 2). Jobs losses were widespread, with declines led by leisure and hospitality (-20,064 nonannualized), professional and business services (-5,123) and trade, transportation and utilities (-4,803). Since the beginning of 2020, El Paso has lost 39,285 jobs, a reduction of 31.9 percent on an annualized basis (12 percent nonannualized).

In April, El Paso’s unemployment rate rose to 13.9 percent—above the Texas figure of 12.8 but below the U.S. figure of 14.7 percent.

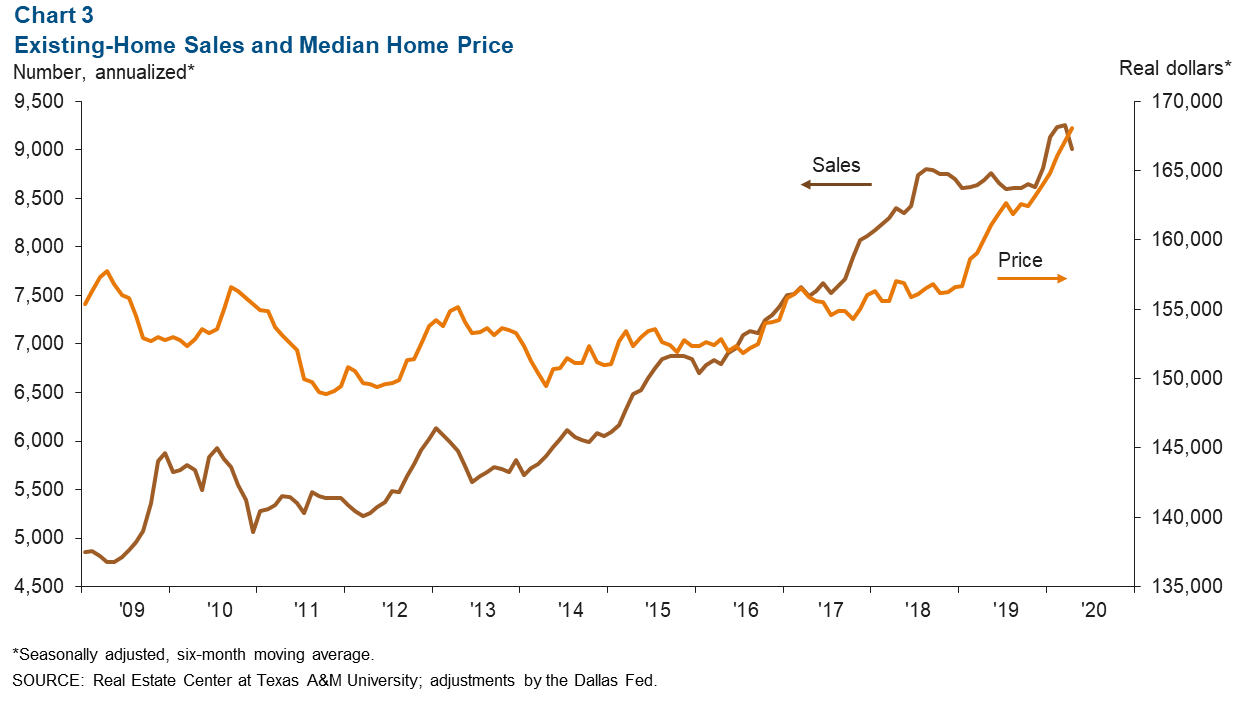

Housing Market

Annualized existing-home sales in the metro weakened 2.6 percent to 9,010 in April (Chart 3). The median price of homes sold in El Paso reached a 15-year high at $168,059, or a year-over-year increase of 5.0 percent. The existing-home inventories value was 2.9 months in April, well below the six months of supply associated with a balanced market.

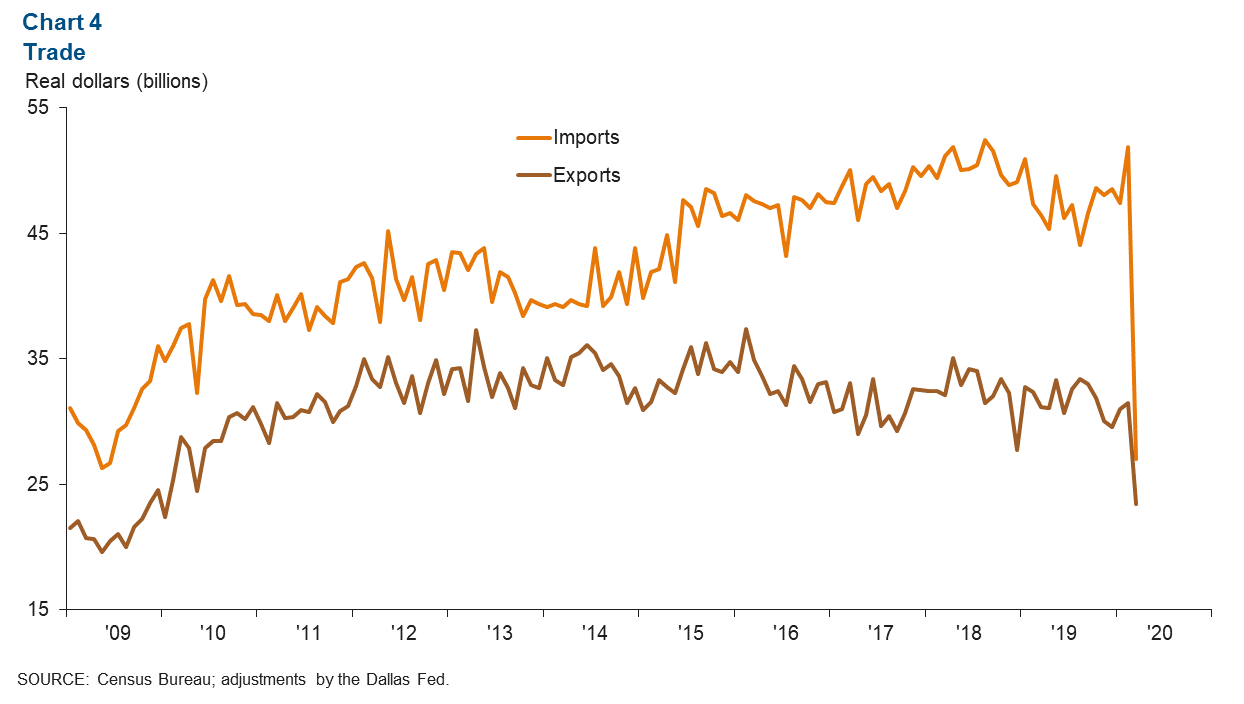

Trade

Annualized total trade in El Paso was $50.4 billion in March, down 35.0 percent from a year prior—the sharpest year-over-year decline seen in 13 years. The drop in total trade was driven by declines of 41.9 percent in imports and 24.8 percent in exports (Chart 4). Imports totaled an annualized $27.0 billion in March, while exports equaled $23.4 billion.

Industrial Production and Maquiladora Activity

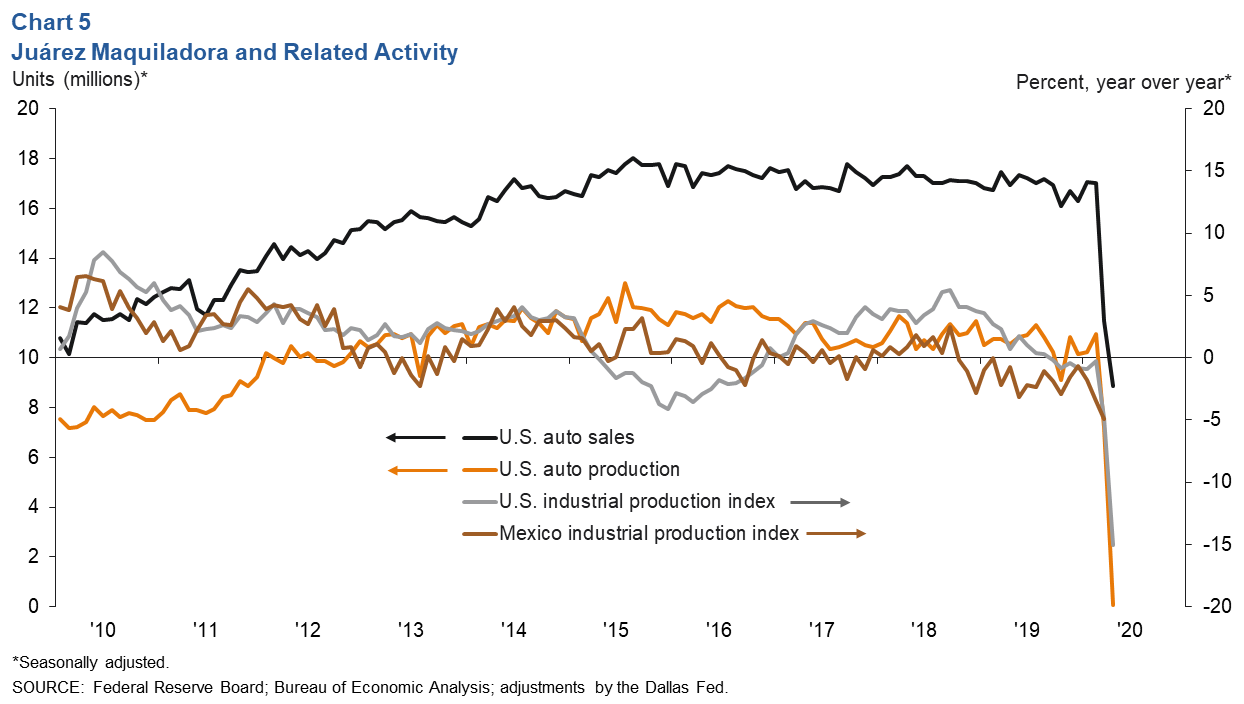

U.S. industrial production (IP) decreased 15.0 percent year over year in April, and Mexico IP fell 4.9 percent in March from a year prior (Chart 5). The Institute for Supply Management’s U.S. manufacturing index was down from 49.1 in March to 41.5 in April. The index fell to its lowest level since December 2008, when the U.S. economy was in a recession. Panelists’ near-term outlooks were negative due to the COVID-19 pandemic and energy market downturn. U.S. and Mexican production and manufacturing trends are important to the local economy because of cross-border manufacturing relationships.

U.S. auto and light-truck production totaled 74,800 units in April, the lowest figure on record. Meanwhile, monthly U.S. auto sales totaled 8.8 million, the lowest number since the early 1970s and 47.8 percent below sales of 16.9 million a year prior. Auto sales are closely linked to the local economy because roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Keighton Allen at keighton.allen@dal.frb.org. El Paso Economic Indicators is released on the fourth Wednesday of every month.