El Paso Economic Indicators

August 24, 2022

El Paso continued to experience strong economic growth in July. The metro’s business-cycle index rose, unemployment remained low, U.S. auto production and sales increased, and the labor market finally recovered the jobs lost due to the pandemic. However, El Paso’s housing market cooled.

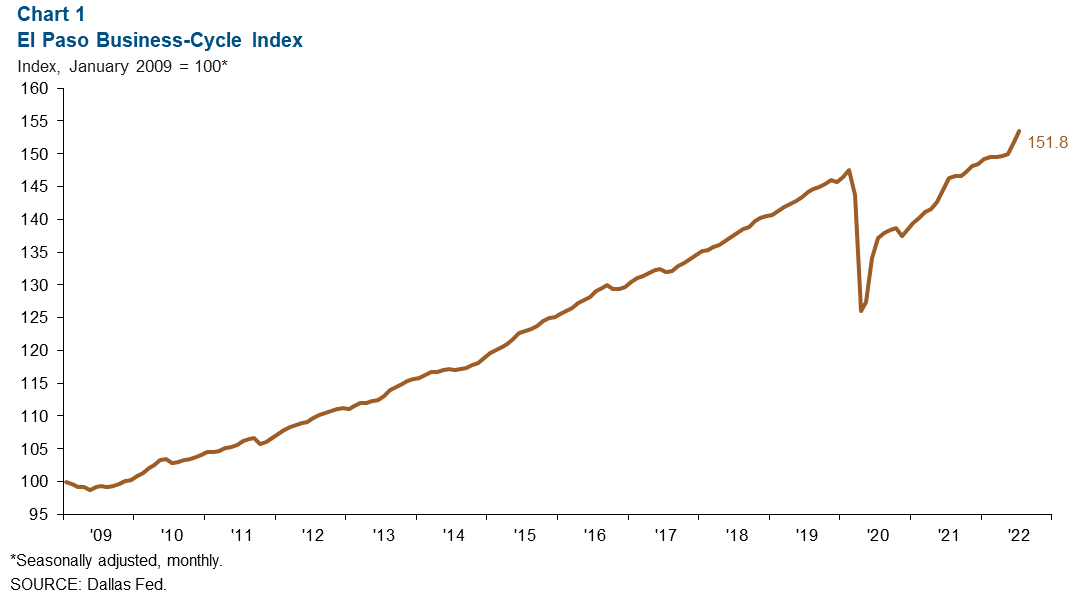

Business-cycle index

The El Paso Business-Cycle Index rose an annualized 13.1 percent in July, slower than June’s 16.5 percent increase but a still-notable gain (Chart 1). The year-to-date growth rate of 4.9 percent reflects strong economic activity in the border region.

Labor market

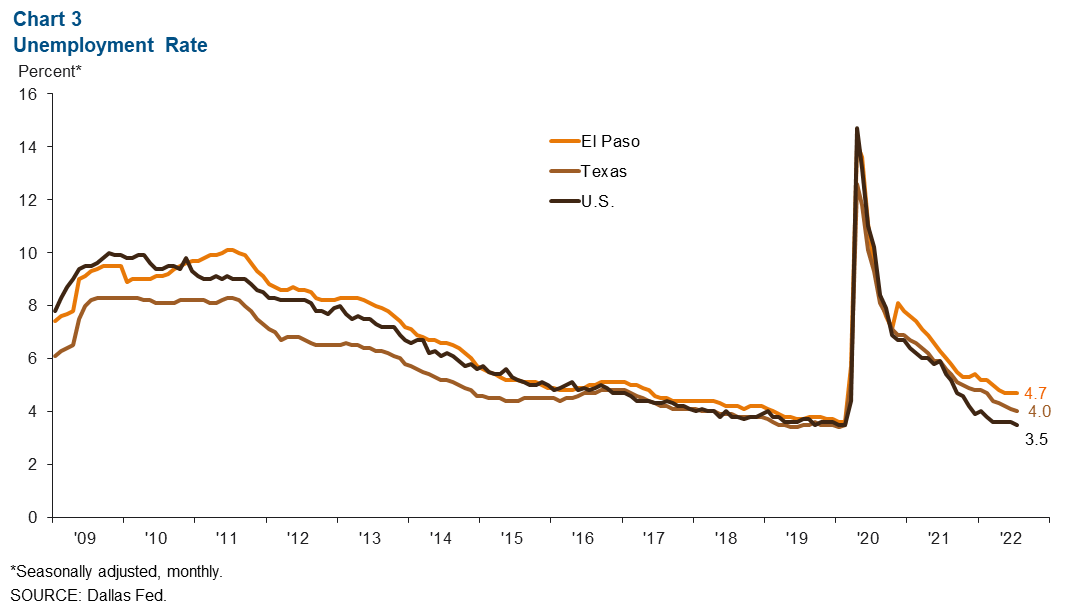

Unemployment remains above prepandemic levels

El Paso’s unemployment rate came in at 4.7 percent for both June and July 2022 (Chart 2). The metro unemployment rate remains above prepandemic levels and is greater than the Texas (4.0 percent) and U.S. (3.5 percent) rates.

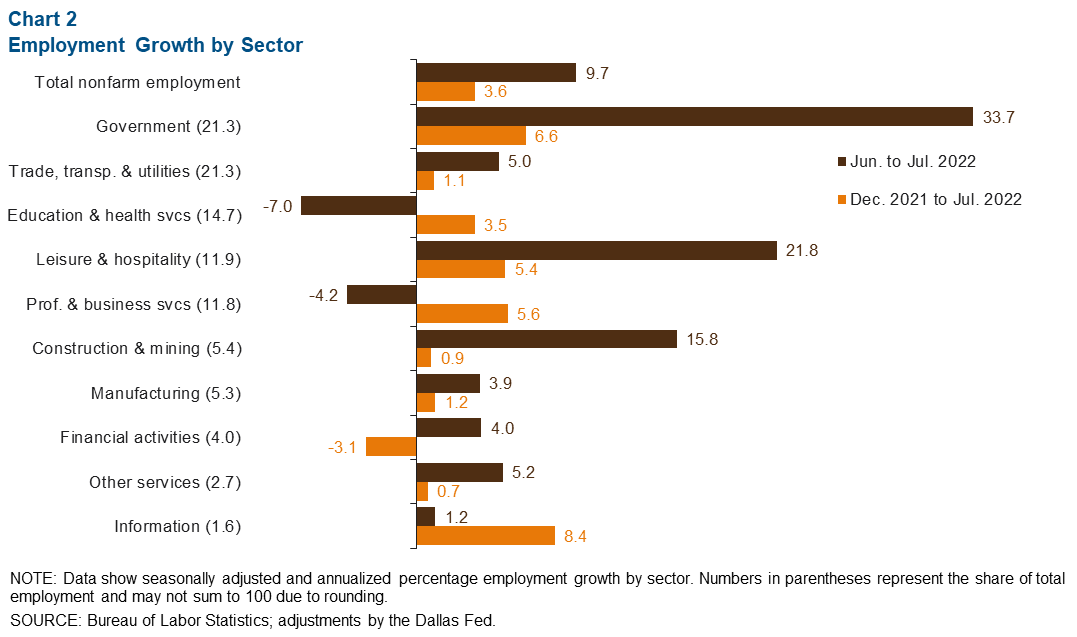

Employment back to prepandemic levels

Nonfarm employment was up 9.7 percent (2,535 jobs) in July, led by growth in the government sector (33.7 percent, or 1,683 jobs), leisure and hospitality (21.8 percent, or 643 jobs) and construction and mining (15.8 percent, or 215 jobs) (Chart 3). Education and health services declined 7.0 percent (293 jobs) and professional and business services fell 4.2 percent (139 jobs). El Paso has finally recovered all the jobs it lost due to the pandemic.

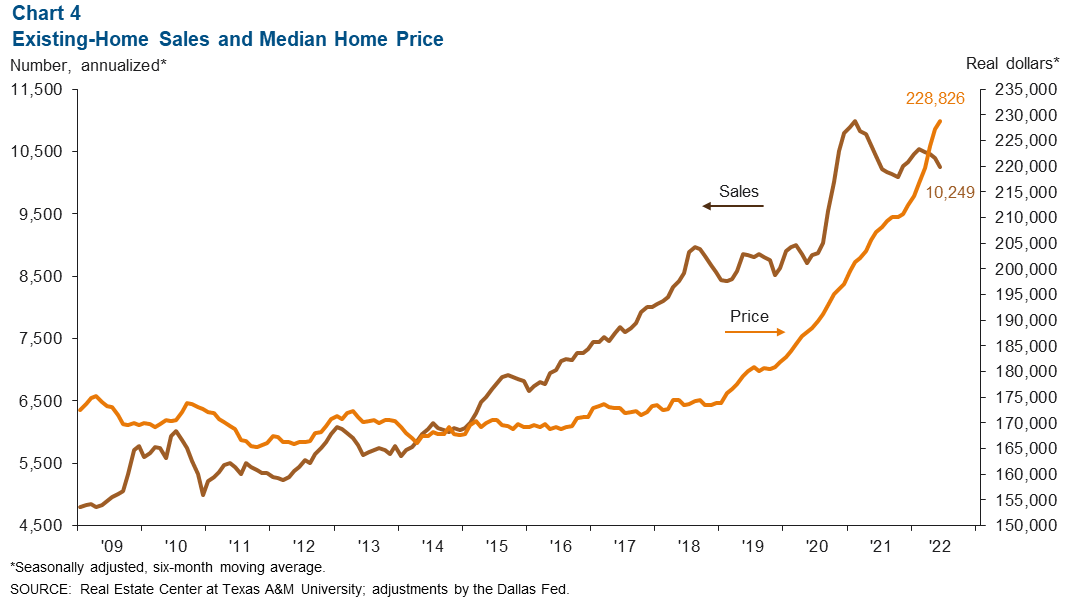

Housing

In July, El Paso’s home sales fell 1.4 percent—a steeper drop than June’s decline of 0.6 percent—as the median home price increased at an annualized rate of 20.1 percent (Chart 4). However, the price gain was smaller than the previous month’s annualized increase of 30.8 percent.

Industrial production and maquiladora-related activities

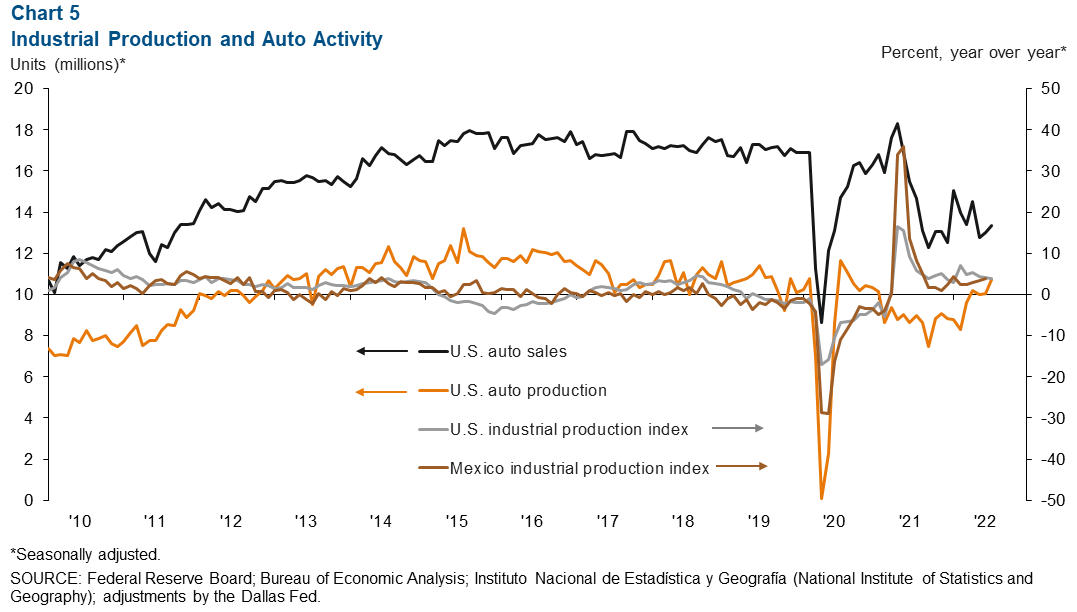

The U.S. Industrial Production (IP) Index fell 0.1 percent in July but is up 3.9 percent from one year ago (Chart 5). Mexico’s IP index grew 0.5 percent in June; it is 3.8 percent higher than in June 2021. The Institute for Supply Management (ISM) manufacturing index declined slightly to 52.8 in June and is down 7.1 percent from a year ago. However, ISM readings above 50 signal continued expansion in the manufacturing sector. Meanwhile, U.S. auto sales rose to a seasonally adjusted 13.3 million units in July from 13.0 million in June as auto production ramped up to 10.7 million units from 10.0 million in June. U.S. and Mexico production trends are important to the El Paso economy because of cross-border manufacturing relationships.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Aparna Jayashankar at Aparna.Jayashankar@dal.frb.org. El Paso Economic Indicators is published every month after state and metro employment data are released.