Houston Economic Indicators

January 9, 2020

The Houston Business-Cycle Index suggests the local economy continued to expand through November despite weakness in energy. Service-providing industries led job growth in both the broader economy and mining-related sectors, and unemployment remains low. However, forward-looking data point to a tepid near-term outlook for Houston employment and oilfield activity in 2020.

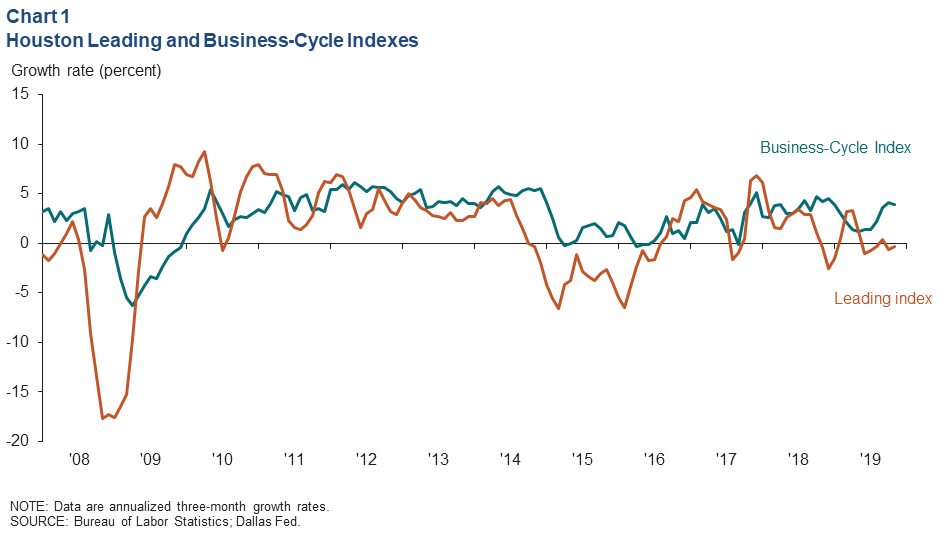

Business-Cycle and Leading Indexes

The Houston Business-Cycle Index’s three-month pace slowed modestly to 3.9 percent in November but remained higher than its historical pace of 3.5 percent, indicating that the region’s economy continues to expand (Chart 1). A separate index of 11 leading indicators for Houston continues to suggest moderate growth ahead. Growth in that index was -0.3 percent over the three months ending in November, well below the average rate of 1.8 percent.

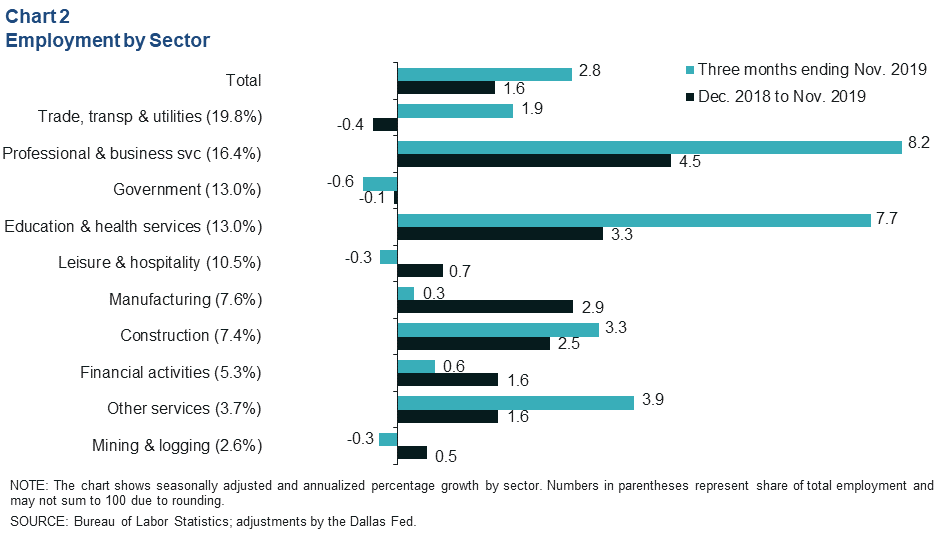

Employment

Initial estimates of job growth in the latter months of 2019 continue to outstrip growth in the first half of the year. Employment rose 2.8 percent (22,200 jobs) over the three months ending in November, led by strong increases in professional and business services (10,200) and education and health services (7,600) (Chart 2). Government saw the largest net loss at 600 jobs.

For the 11 months ending in November, Houston employment grew a modest 1.6 percent (45,500), below its historical average of 2.1 percent. Growth over that longer time frame was also led by professional and business services (20,300) and education and health services (12,200).

Unemployment remained near historic lows. The unemployment rate in Houston was 3.8 percent in November 2019, up from 3.7 percent the prior month. For context, the unemployment rate was 3.4 percent in Texas and 3.5 percent in the U.S.

Energy

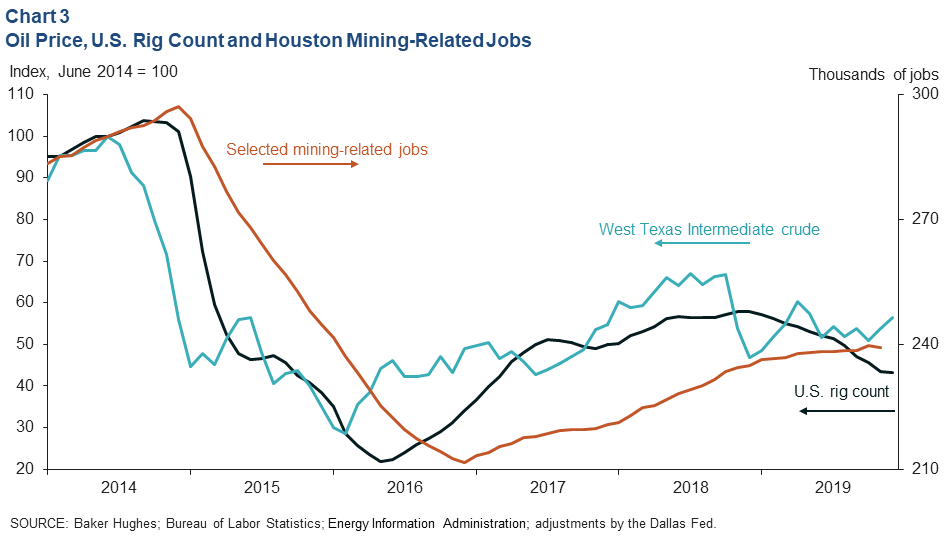

WTI Crude Price Range Bound; Rig Count Falls

The monthly average price of West Texas Intermediate crude oil (WTI) ticked up to nearly $60 in December from nearly $57 in November. The increase was in part due to the announcement of deeper production cuts from OPEC and an increase in optimism that the U.S.–China trade war would not escalate further.

Changes in monthly oil prices tend to precede changes in oilfield activity. WTI spent much of 2019 in the mid-to-high $50 range, but that was not enough to forestall steady erosion in drilling activity (Chart 3). The monthly rig count fell 25 percent over 2019, but most firms believe that drilling activity will stabilize in the first half of 2020.

Changes in oilfield activity tend to lead changes in Houston’s mining-related job sectors. In aggregate, mining-related jobs leveled off in 2019, though the employment data since June has yet to be revised and can change substantially. Ongoing declines in drilling activity likely presage a decline in payrolls, particularly for support activities for mining (mostly oilfield services).

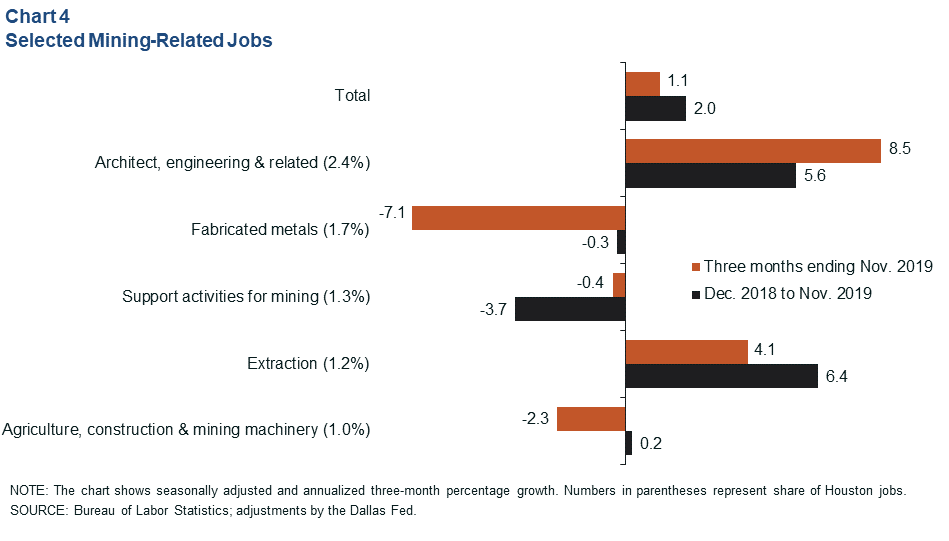

Mining-Related Jobs Grow

Mining-related jobs logged a positive 1.1 percent annual growth rate (700 jobs) for the three months ending in November, led by architecture, engineering and related professional services (1,500) (Chart 4). However, this growth was in part related to pipeline, storage, export infrastructure, and petrochemical activity and in part due to support from some nonenergy sectors. Extraction jobs (400; mostly exploration and production firms) also saw growth over that time, according to initial estimates. Job losses were concentrated in fabricated metals manufacturing (-1000).

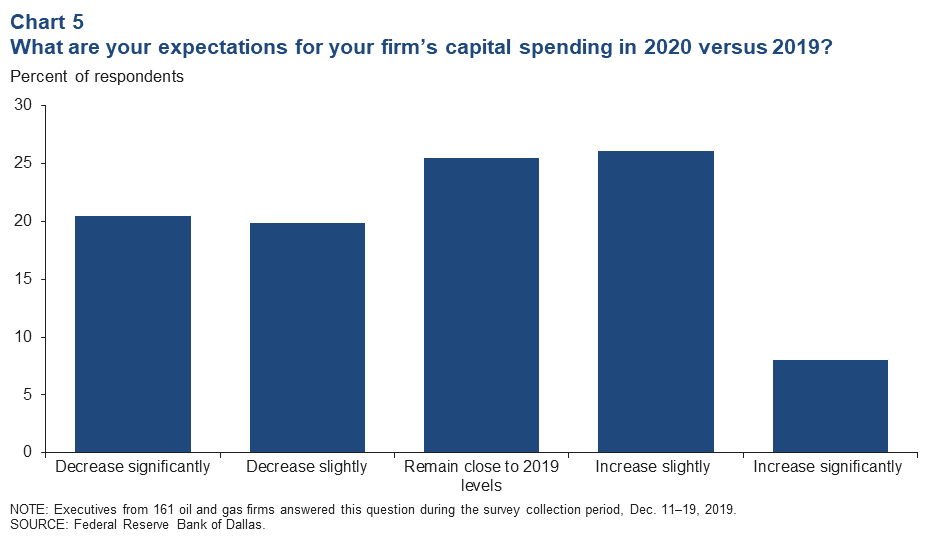

Most Energy Firms Expect to Spend the Same or Less

Results of the fourth-quarter Dallas Fed Energy Survey indicated that nearly two-thirds of respondents expect their firm’s capital spending to decline or remain unchanged in 2020 compared with 2019 (Chart 5). With the need to fund operations out of cash flow, monthly oil prices will likely need to firm substantially for oilfield activity—and related labor demand—to materially increase.

NOTE: Data may not match previously published numbers due to revisions.

About Houston Economic Indicators

Questions can be addressed to Jesse Thompson at jesse.thompson@dal.frb.org. Houston Economic Indicators is posted on the second Monday after monthly Houston-area employment data are released.