Houston Economic Indicators

November 17, 2022

| Houston Economy Dashboard (September 2022) | |||

| Job growth (annualized) July–September |

Unemployment rate |

Avg. hourly wages |

Avg. hourly wage growth y/y |

| 6.0% | 4.4% | $30.88 | 3.1% |

Houston is showing more signs of slowing growth as the metro’s payrolls recover to trend. Oilfield activity is flattening, export volumes are softening and economic data for Houston’s largest export markets are weakening. Overall, however, the region has momentum and the outlook remains positive.

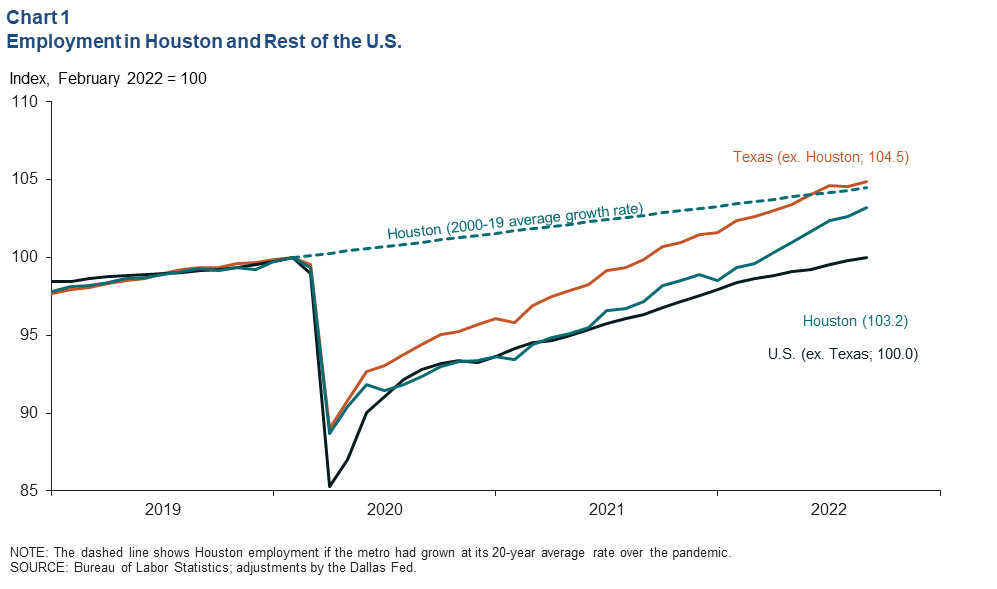

Employment

Houston payrolls were 3.2 percent above prepandemic levels in September 2022 and on pace to close the gap with the metro’s 21st century trend growth rate (1.7 percent per year) in the first quarter of 2023 (Chart 1). Employment for the rest of Texas is 4.5 percent above prepandemic levels and has already recovered to its trend. While still robust, Texas job growth slowed over the summer. However, this year’s payroll data are still subject to potentially substantial revision over the next few months. Job growth in the nation outside of Texas has been relatively steady, albeit slower than in Texas. September 2022 marked the full return to prepandemic payroll jobs levels in the rest of the U.S.

Energy

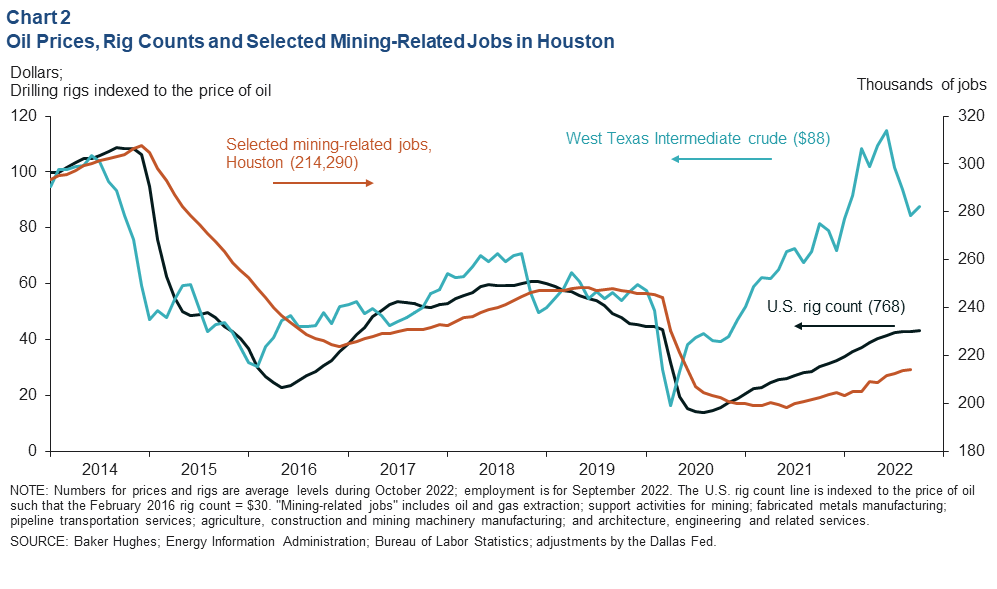

Drilling activity Is flattening

The price of West Texas Intermediate crude oil averaged $88 per barrel in October 2022, a slight increase from September but still down sharply from June (Chart 2). The U.S. rig count leveled off near 770 the past three months as falling prices met with surging oilfield costs. Historically, the monthly average rig count tends to follow the price of oil up and down with a lag of about three months, though the magnitude of the response varies over time. In the past two years, strict adherence to capital budget and production plans, as well as a marked increase in drilling efficiencies compared with the year prior to the prepandemic, seems to have muted this relationship.

Houston’s mining-related jobs—which make up 6.5 percent of total Houston payrolls—are still rising, led by support activities for mining (mostly oilfield services firms). For perspective, that puts the mining-related job count 12.7 percent below prepandemic levels, 30.3 percent below the peak prior to the 2015–16 oil bust and on par with payroll levels in 2006.

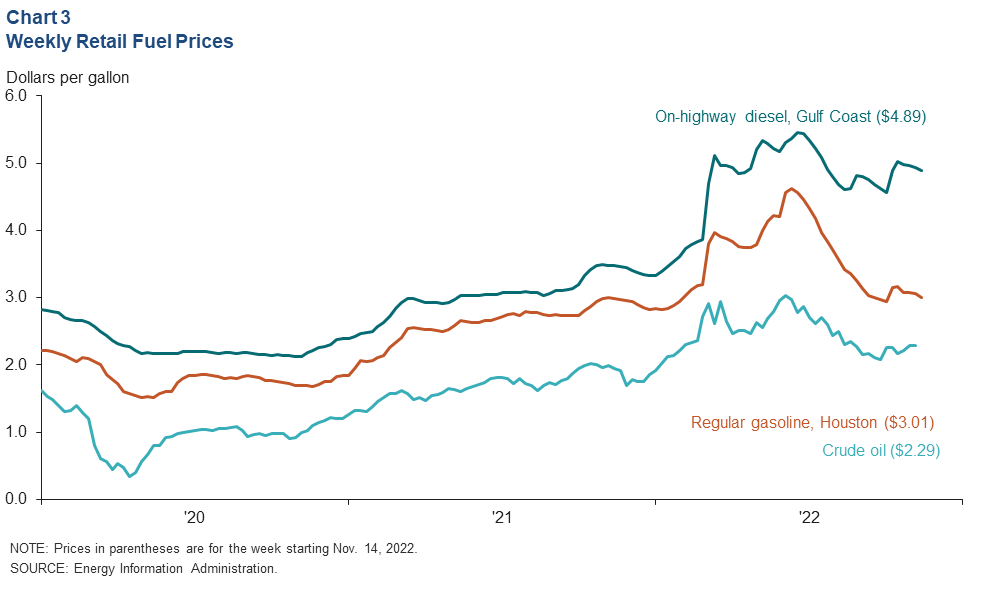

Retail diesel holding near $5 per gallon

The retail price of gasoline fell from a high of $4.62 in early summer to just over $3.00 per gallon by mid-November (Chart 3). This tracked the slide in global benchmark Brent crude from $3.00 per gallon to a low of $2.08 in September and the rise to $2.29 on Nov 14. In contrast, diesel prices remain highly elevated at $4.89 per gallon. Strong demand, narrow inventories and disruptions in supply related to the Russia–Ukraine war are all contributing factors.

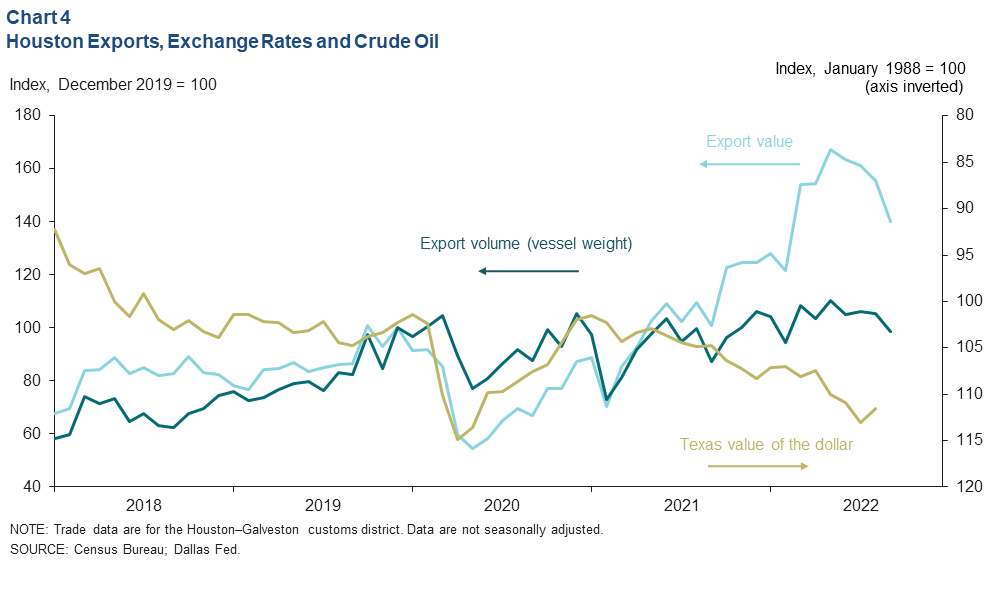

Exports

The value of exports from the Houston–Galveston customs district fell with the price of oil and natural gas from June to September (Chart 4). Oil and gas, petroleum and coal products, chemicals, and plastics and rubber products make up over three quarters of the total value of regional exports. However, the decline was not entirely driven by a fall in prices. The total tonnage of exports fell slightly in September, capping off a record-setting 12 months for total tonnage (and total container trade).

The value of the dollar fell in September relative to the currencies of Texas’ export partners (data are inverted in the chart) but remains higher than in most of the past two years. Typically, a falling trade-weighted value of the dollar yields an increase in the relative competitiveness of Texas exports on the global market and is a boon to export-driven manufacturing output like plastics, machinery and energy. A rising value of the dollar has the opposite effect.

Manufacturing

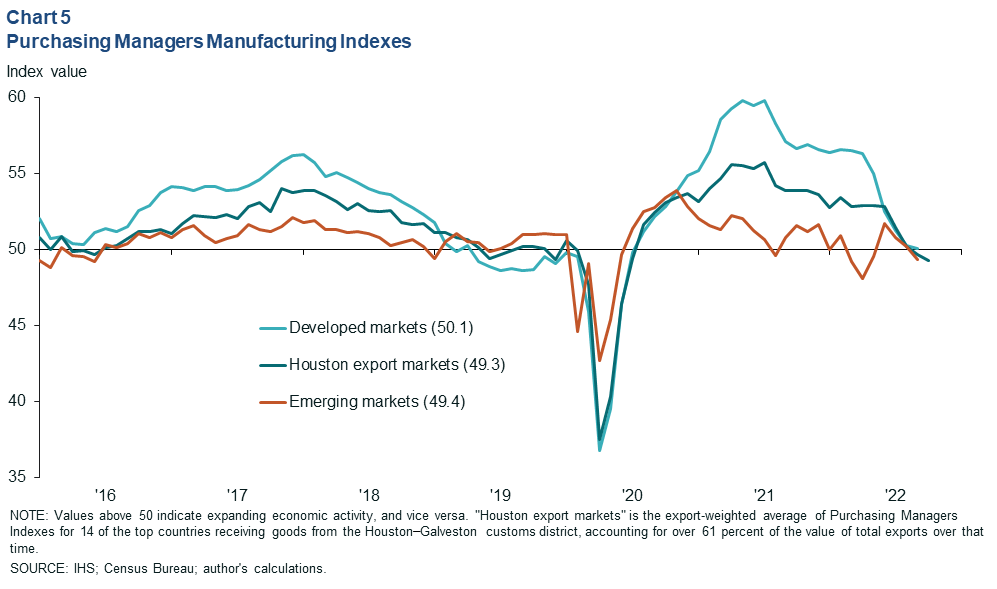

Indicators of manufacturing activity suggest global manufacturing is slowing (Chart 5). Most of the goods exported through Houston-area ports are intermediate goods needed for further processing in the global supply chain (like plastics and truck parts). Demand for fuel and other energy exports, particularly diesel, are highly correlated with industrial activity abroad.

Global purchasing managers indexes (PMIs) indicate a substantial slowing of manufacturing output. Developed market indexes have slipped to near 50, indicating an even split between companies reporting an expansion and companies reporting a contraction in activity. European producers beleaguered by high energy prices have led the decline, but the U.S. index has slowed as well.

Emerging economies have slipped to 49, signaling modest a contraction in manufacturing. Houston’s largest trading partners are also showing contraction. Houston’s export-weighted PMI is signaling modest contraction in manufacturing sectors and may point to slowing demand for exports ahead.

NOTE: Data may not match previously published numbers due to revisions.

About Houston Economic Indicators

Questions or suggestions can be addressed to Jesse Thompson at jesse.thompson@dal.frb.org. Houston Economic Indicators is posted on the second Monday after monthly Houston-area employment data are released.