Permian Basin Economic Indicators

Recent data were mixed for the Permian Basin region in 2019. Job growth, Midland wages, housing permits and weekly oil prices softened. However, oil prices and stock returns were up year to date, the outstanding value of loans at local banks has improved, and Odessa saw strong real-wage growth year over year.

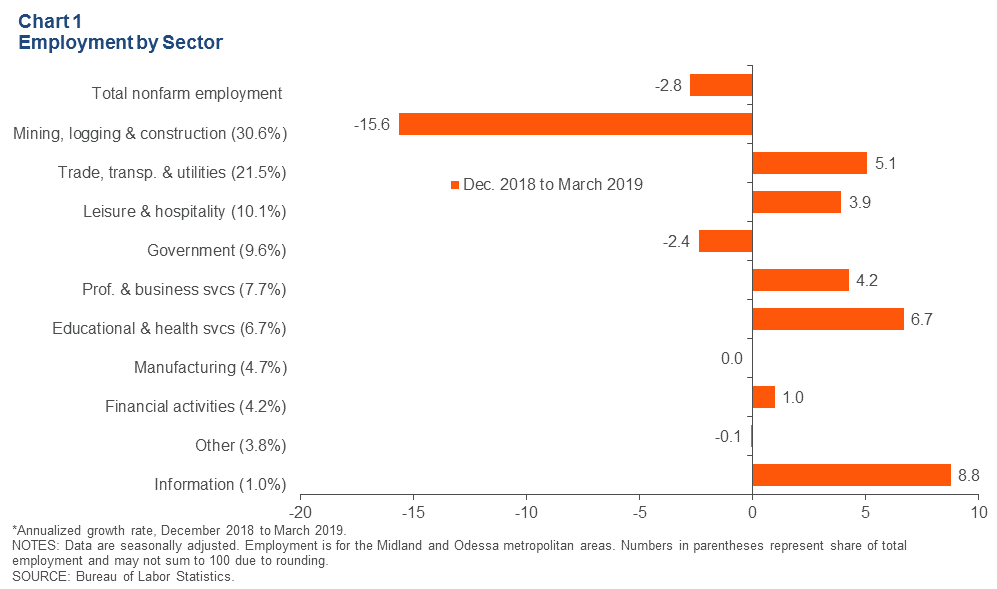

Employment by Sector

Employment in the Midland and Odessa metropolitan areas slipped at an annual rate of 2.8 percent over the three months ending in March (-1,400 jobs), a reversal from the positive 4.8 percent growth rate over the prior three-month period (Chart 1). Job losses were concentrated in mining, logging and construction (-2,600), which highly correlates to drilling activity in the Permian Basin. Trade, transportation and utilities (500), education and health services (200), and leisure and hospitality (200) added the most jobs; the fastest-growing sector was the small information services industry.

The Midland and Odessa metros have an exceptionally tight labor market by any measure. The unemployment rate in these metros fell to 2.3 percent in March. By comparison, Texas and the U.S. both had 3.8 percent unemployment. However, looking at trends may be more informative for West Texas, given the small sample size in the survey that produces unemployment statistics. On a three-month moving average basis, the unemployment rate in Midland and Odessa was less than 2.4 percent in March, up only slightly from the nearly 2.3 percent rates in the third and fourth quarters of 2018.

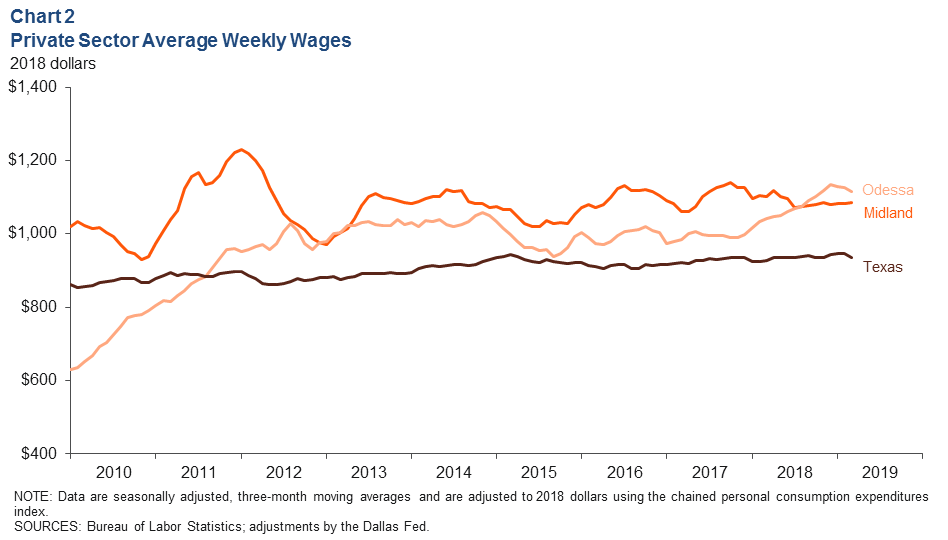

Private Sector Real Wages

Aggregate real weekly wages in West Texas remain substantially above the rest of the state due to exceptionally low unemployment rates and the dominance of the relatively well-paying mining and mining-related industries. For the first three months of 2019, real wages in Midland and Odessa—in 2018 dollars—averaged $1,084 and $1,115 per week, respectively (Chart 2). By comparison, the average real weekly wage in Texas was $937 per week. Compared with a year ago, real wages in Odessa grew 7 percent, handily outpacing both the state, which saw 1.1 percent growth, and Midland, where real wages actually slipped 1.7 percent.

Energy

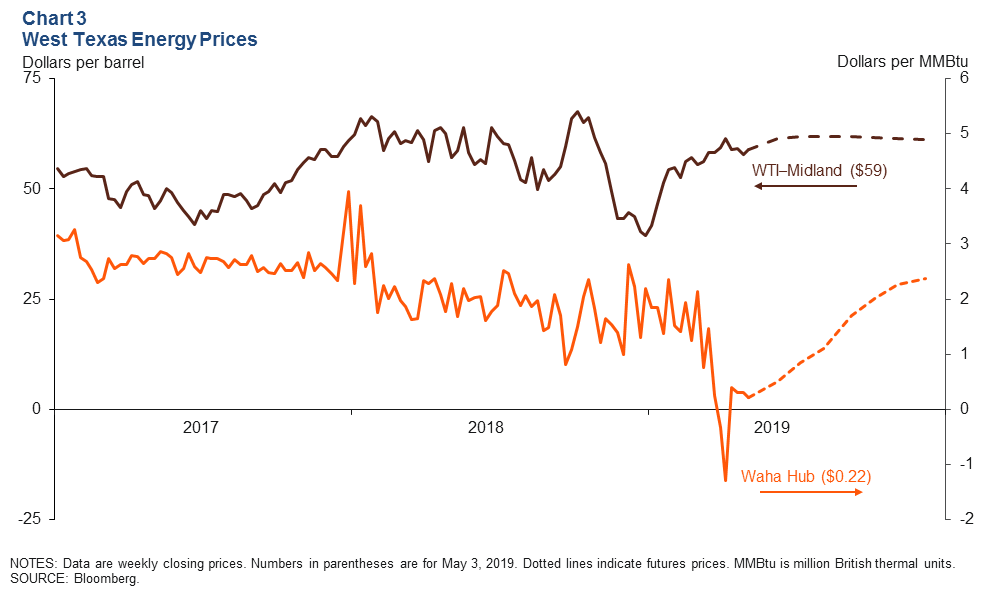

Oil Prices Up While Natural Gas Languishes

West Texas Intermediate (WTI) crude oil priced in Midland slipped from a high of $62 in early April to $59 the first week of May (Chart 3). Futures traders on Friday, May 3, were expecting further price appreciation by midyear before prices flattened out.

The Waha hub benchmark for West Texas natural gas remained in the doldrums near zero in April and early May as gas production in the region continued to strain takeaway capacity, which has also suffered from unplanned outages. Traders indicate they expect in-basin gas prices to recover as new oil and gas pipelines are completed and filled in second half 2019.

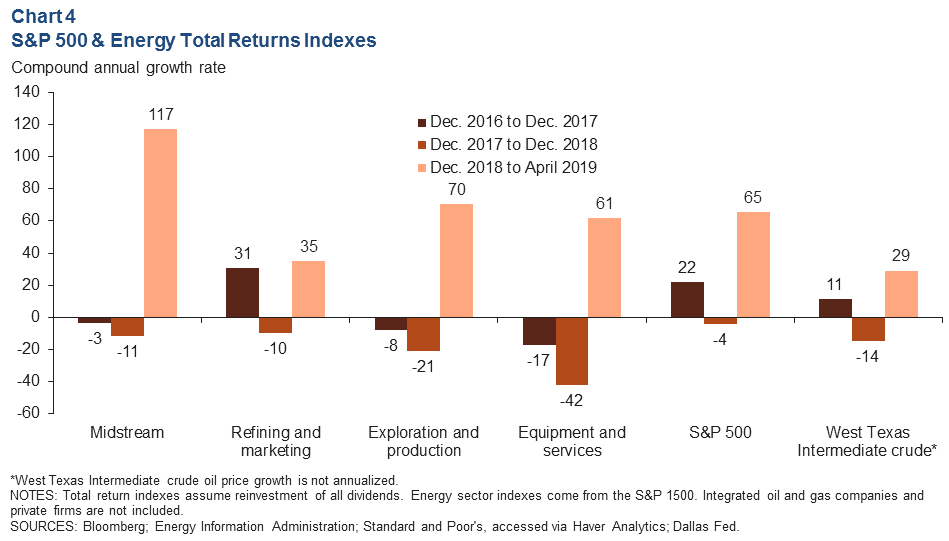

Energy Industry Total Returns Improve in 2019

Total returns for publicly traded energy companies grew sharply over the first four months of 2019 (Chart 4). Exploration and production and midstream firms outperformed the S&P 500 index. Fluctuations in energy stocks are driven in part by oil price volatility, and the average monthly price of WTI crude was up 29 percent year to date in April.

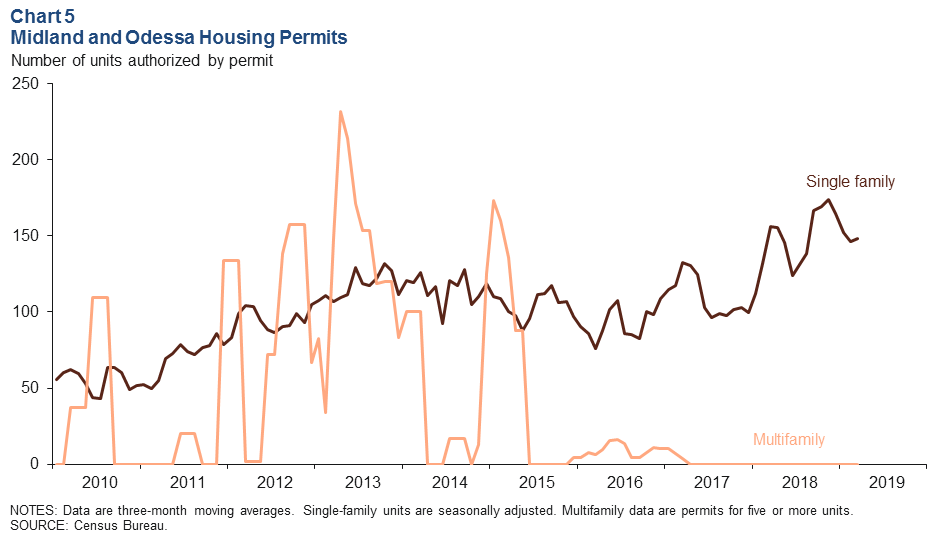

Midland and Odessa Metro Area Housing Permits

Permits for the construction of single-family housing units in the Midland and Odessa metropolitan areas slipped from a record 174 in November 2018—on a three-month moving average basis—to 149 in March 2019 (Chart 5). Single-family permits, have been trending up since the end of the 2015–16 oil bust.

The same cannot be said of multifamily permits, which are far more volatile. March 2019 marked the 24th consecutive month where no permits were issued for five or more units. The last time a significant number of units were authorized in Midland–Odessa was early 2015, before the depths of the most recent oil bust. These numbers do not include temporary housing such as motels or so-called “man camps” that have been erected in support of oilfield services workers whose home addresses are often elsewhere.

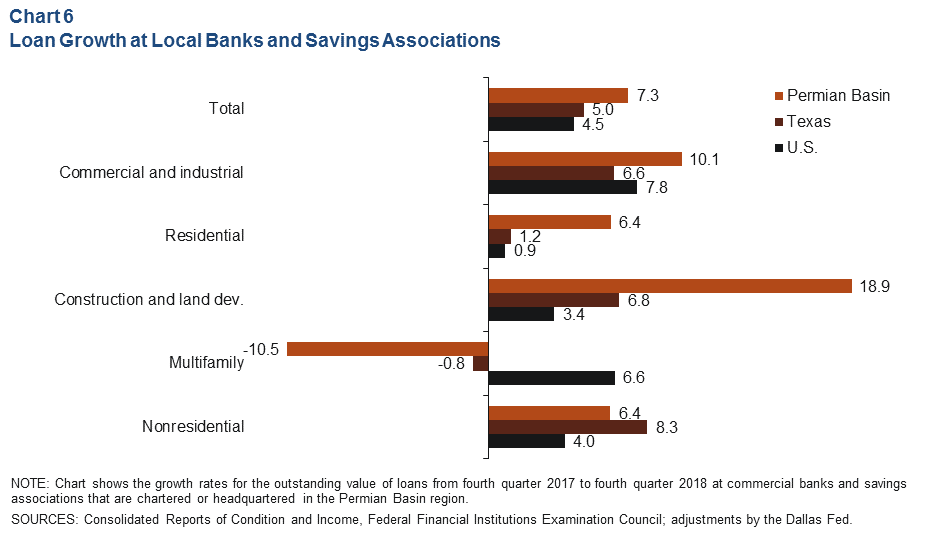

Bank Lending

The outstanding value of loans at 66 banks and savings associations chartered or headquartered in the Permian Basin region substantially outpaced the U.S. from fourth quarter 2017 to fourth quarter 2018 (Chart 6). In particular, the outstanding value of construction and land development loans was up 18.9 percent, and the value of commercial and industrial loans (generally loans to businesses for investment or working capital) was up 10.1 percent. Limited permit activity in the Midland–Odessa area over the past four years likely contributed to the 10.5 percent decline in outstanding multifamily loan values.

NOTES: Employment data are for the Midland–Odessa metropolitan statistical area (Martin, Midland and Ector counties), unless otherwise specified. Energy data includes the 55 counties in West Texas and southern New Mexico that make up the Permian Basin region. Data may not match previously published numbers due to revisions.

About Permian Basin Economic Indicators

Questions can be addressed to Jesse Thompson at jesse.thompson@dal.frb.org. Permian Basin Economic Indicators is released monthly.