Permian Basin Economic Indicators

| Midland–Odessa economy dashboard (December 2025) | |||||

| Job growth (annualized) Sept. '25–Dec. '25 |

Unemployment rate |

Avg. hourly earnings | Avg. hourly earnings growth y/y | ||

| Midland–Odessa | 1.2% | 3.5% | $32.64 | -9.3% | |

| Midland | 0.7% | 3.3% | $33.26 | -11.8% | |

| Odessa | 1.9% | 3.9% | $31.73 | -5.3% | |

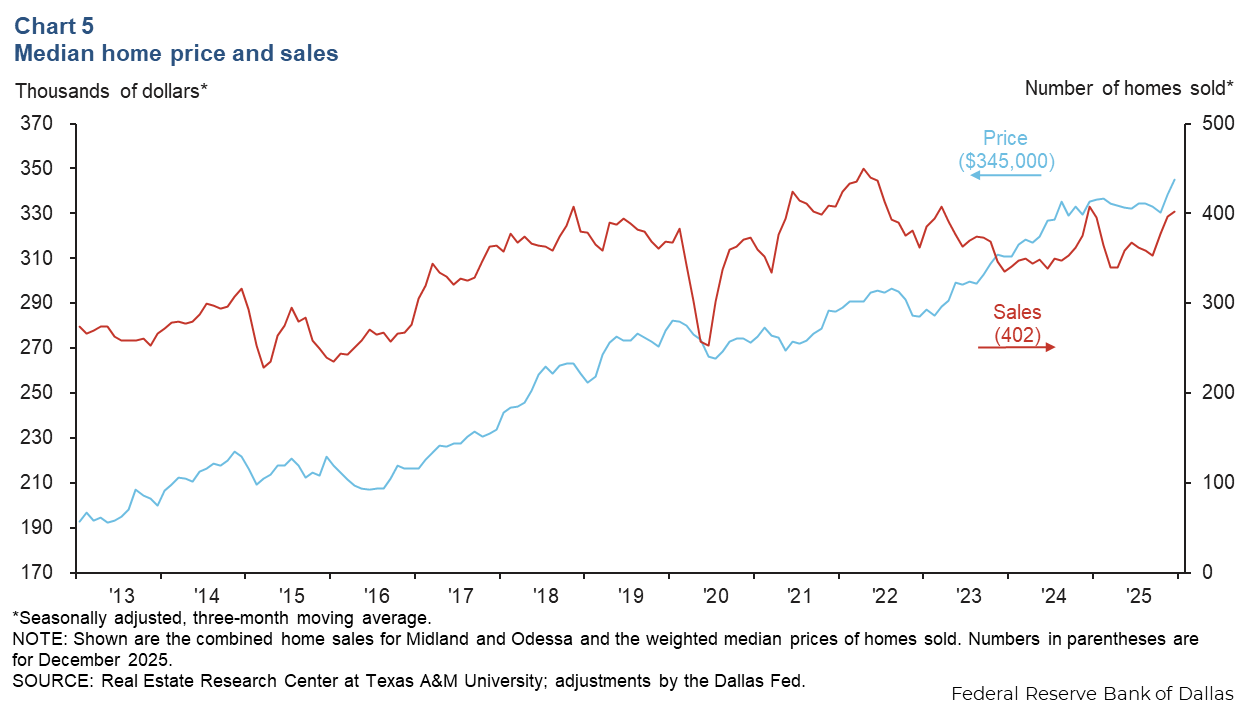

Employment in the Texas Permian Basin grew in the three months ending in December, and the unemployment rates were unchanged. Both home sales and the median price of homes sold increased. Oil production remained flat despite the small decline in the number of new wells drilled and the number of active rigs.

Energy

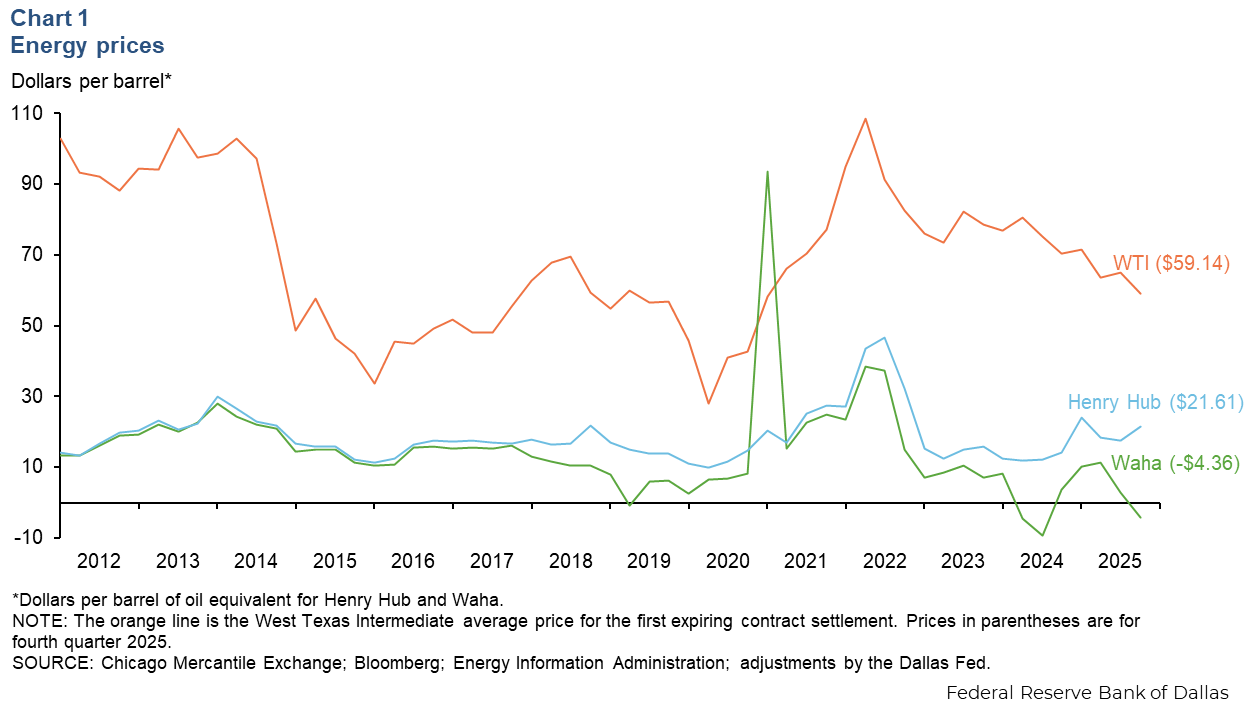

Natural gas prices fall in fourth quarter

Natural gas prices in the Permian Basin (Waha) fell while national benchmark natural gas prices (Henry Hub) rose in the fourth quarter (Chart 1). Henry Hub’s average price increased to $21.61 per barrel of oil equivalent (BOE) in the fourth quarter from $17.59 in the third quarter, while Waha, the hub in West Texas close to the producing wells of the Permian Basin, decreased to -$4.36 from $2.91 per BOE over the same period. Natural gas in the Permian has frequently seen negative pricing the past few years because the growth in supply has largely been a byproduct of oil production. When gas production approaches the physical limits of transportation and storage infrastructure, producers pay to have the natural gas removed to avoid shutting down oil production.

The price of West Texas Intermediate crude averaged $59.14 per barrel in the fourth quarter, down 9 percent from the third quarter. Prices fell to a daily average of $58.96 in January.

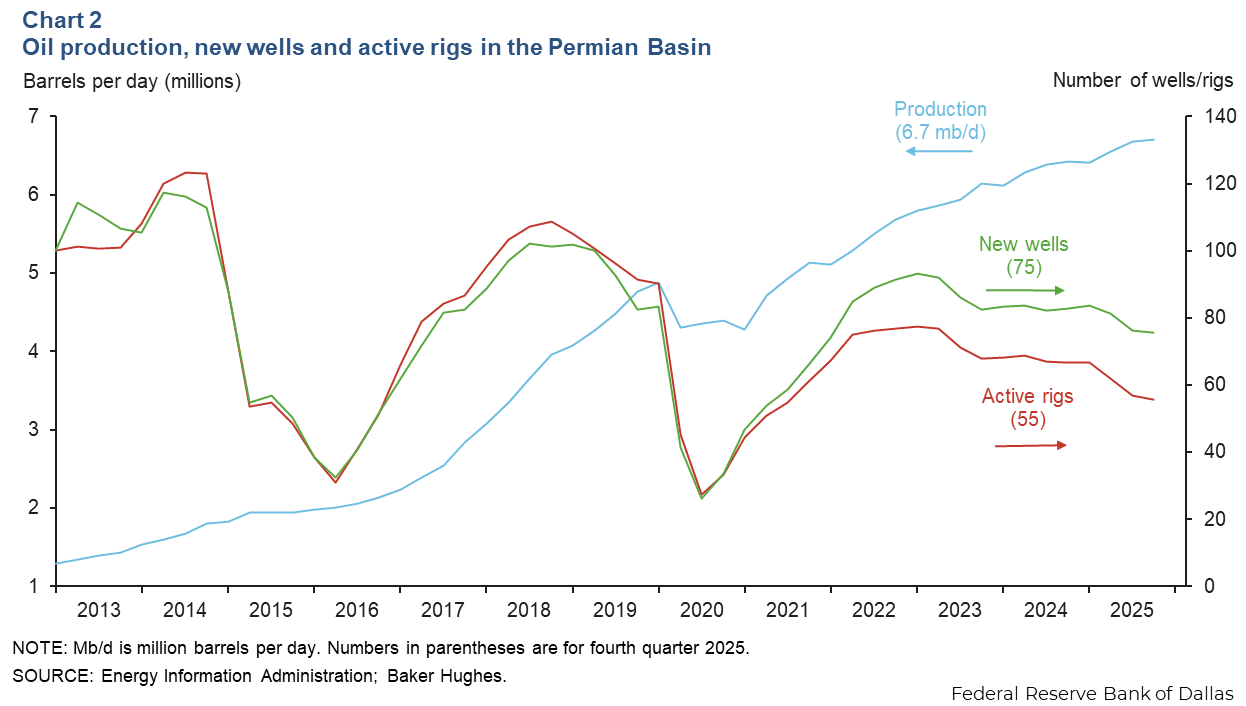

Oil production remains flat

Oil production in the Permian Basin remained at 6.7 million barrels per day in the fourth quarter. New wells and active rigs decreased slightly over the same period (Chart 2). The number of new wells drilled decreased 0.8 percent from the third quarter, and the number of active rigs decreased 2.1 percent over the same period. Despite the decline in new wells drilled and the number of active drilling rigs, oil production held up due to increases in well productivity.

Labor market

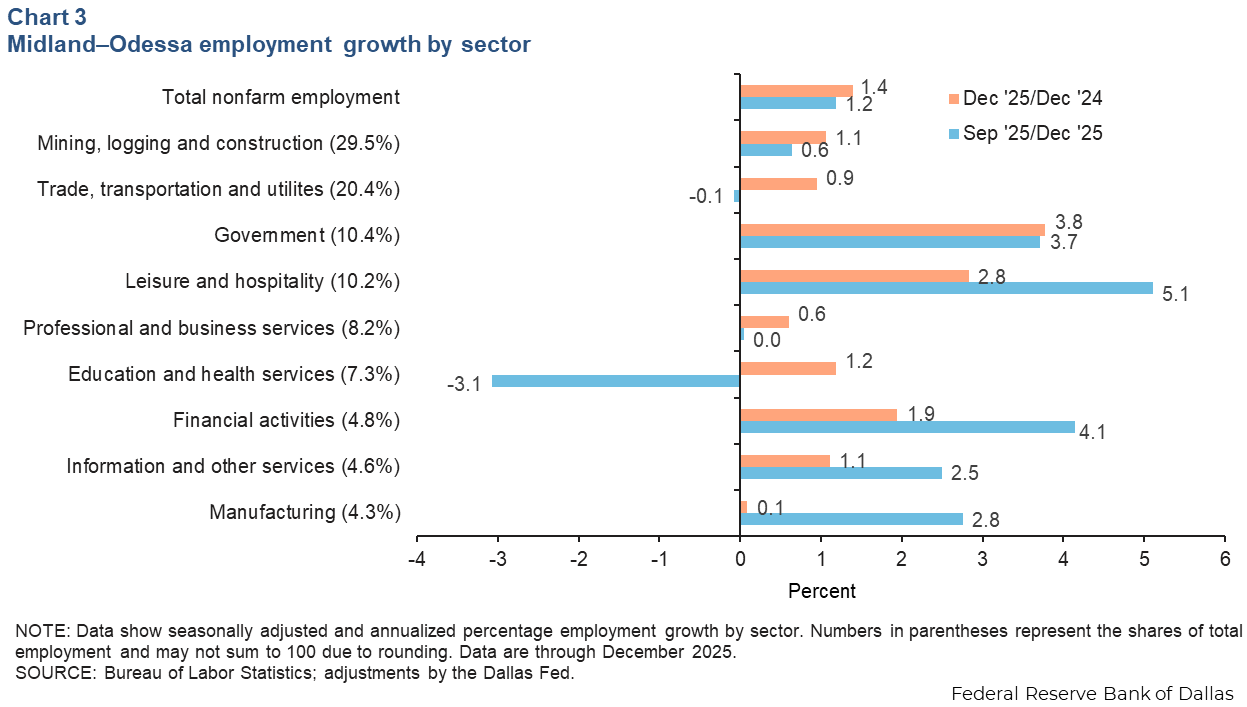

Employment increases in Midland–Odessa region

Total nonfarm employment in Midland-Odessa increased 1.2 percent from September through December (Chart 3). Texas nonfarm employment increased 0.2 percent over the same period. From September to December most sectors grew in Midland-Odessa with the exception of the education and health services and trade, transportation and utilities sectors, which contracted.

Year over year, employment in Midland–Odessa grew 1.4 percent in December. Employment for the year increased across all sectors.

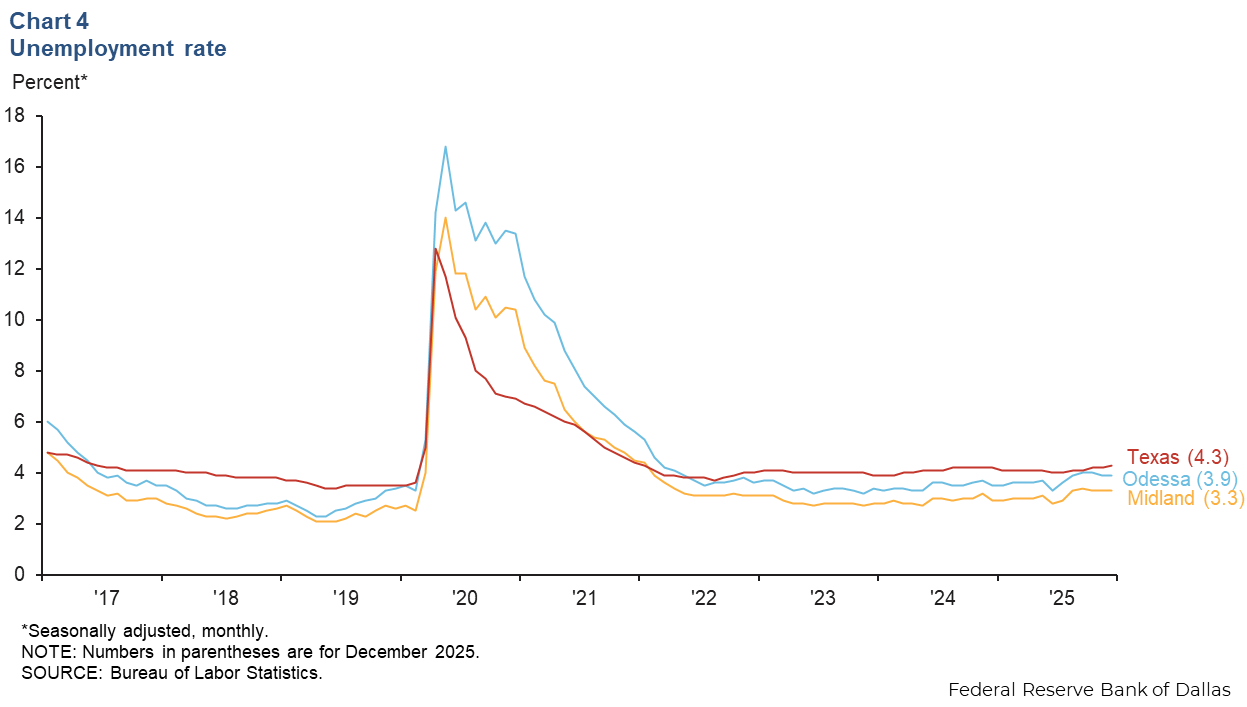

Unemployment rates tick down

The unemployment rates in both Midland and Odessa were slightly lower in December compared with September (Chart 4). Midland’s unemployment rate decreased to 3.3 percent in December from 3.4 percent in September, while Odessa’s jobless rate decreased to 3.9 percent from 4.0 percent over the same period. Meanwhile, Texas’ unemployment rate increased to 4.3 from 4.1 percent.

Housing

Home sales and prices increase

Home sales in the Permian Basin were up 13.6 percent in December compared with September (Chart 5). However, home sales in the region were down 1.4 percent on a year-over-year basis. The median home sales price increased 3.5 percent from September to December and was up 2.9 percent compared with December 2024. The median home sales price in the Permian Basin was $345,000 in December, 3.2 percent higher than the state figure.

NOTES: Employment data are for the Midland–Odessa metropolitan statistical area (Martin, Midland and Ector counties), unless otherwise specified. Energy data include the 55 counties in West Texas and southern New Mexico that make up the Permian Basin region. Data may not match previously published numbers due to revisions.

About Permian Basin Economic Indicators

Questions or suggestions can be addressed to Adefemi Abimbola at adefemi.abimbola@dal.frb.org. Permian Basin Economic Indicators is released quarterly.