San Antonio Economic Indicators

October 29, 2021

Broad measures of the San Antonio economy were largely positive in September. Payrolls surged in the month, though jobs in the third quarter posted tepid growth. The unemployment rate was steady. The San Antonio Business-Cycle Index increased in September after declining in August. Recent consumer spending remained above pre-COVID-19 levels. Home sales improved after three months of contraction, and COVID-19 hospitalizations continued to decline after peaking in late August.

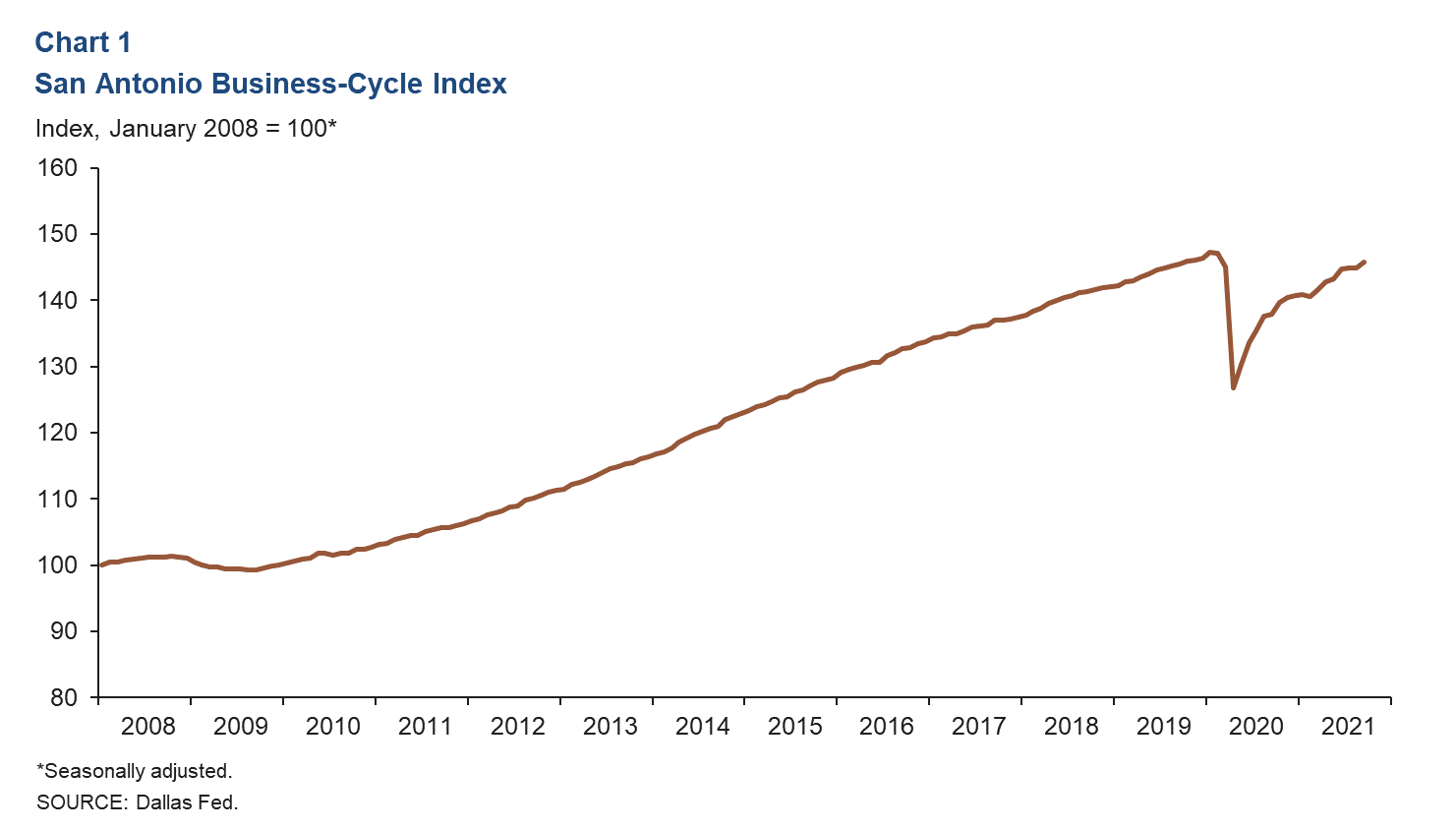

Business-Cycle Index

Growth in the San Antonio Business-Cycle Index—a broad measure of economic activity in the metro—expanded an annualized 7.4 percent in September after declining 0.2 percent in August (Chart 1). Recent strength in the index can be attributed to robust net job gains in the metro area in September.

Labor Market

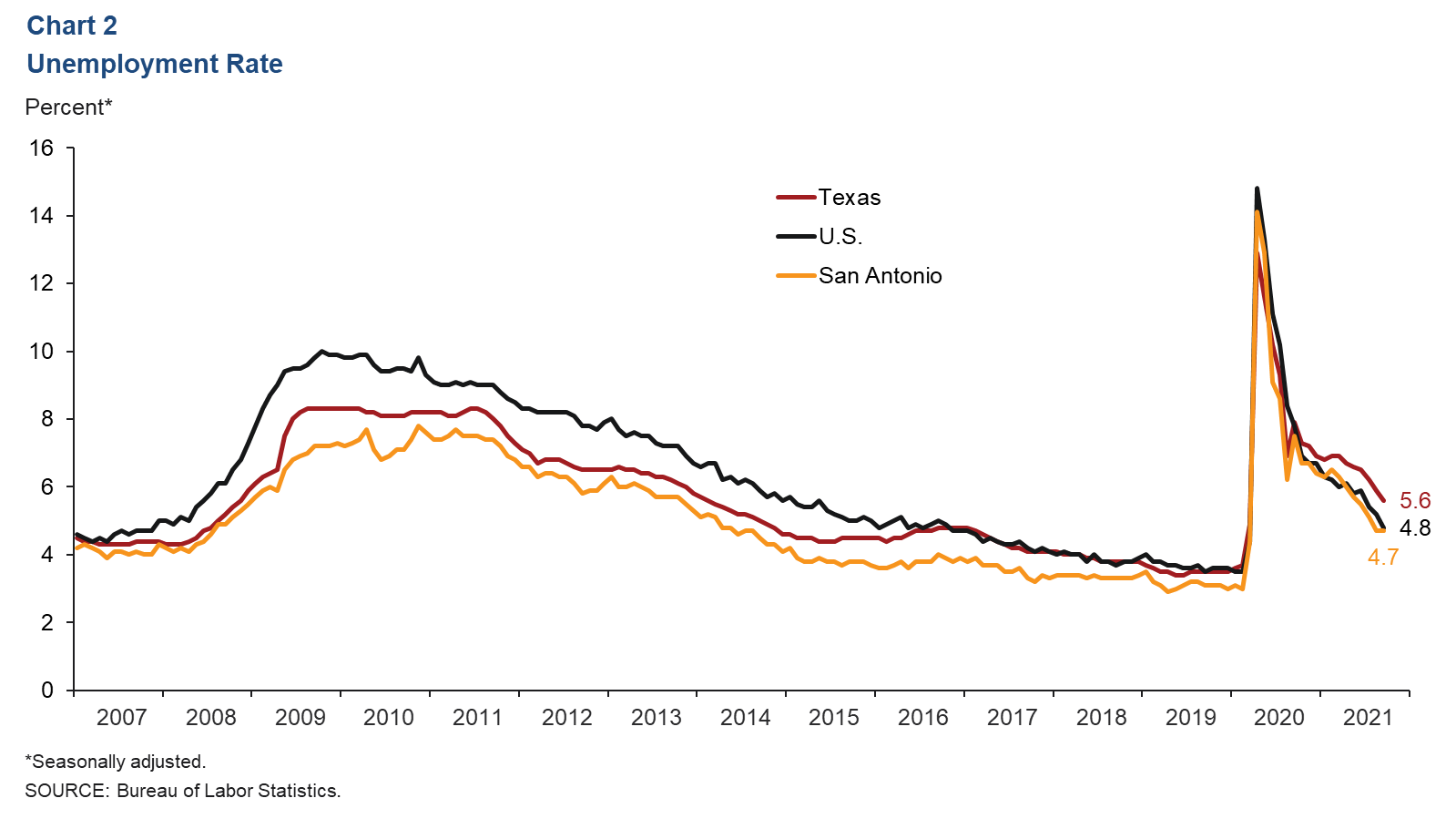

Unemployment Rate Steady

The metro’s unemployment rate was unchanged from its August rate at 4.7 percent in September (Chart 2). The state’s jobless rate declined slightly to 5.6 percent, and the nation’s rate fell to 4.8 percent, the lowest since March 2020.

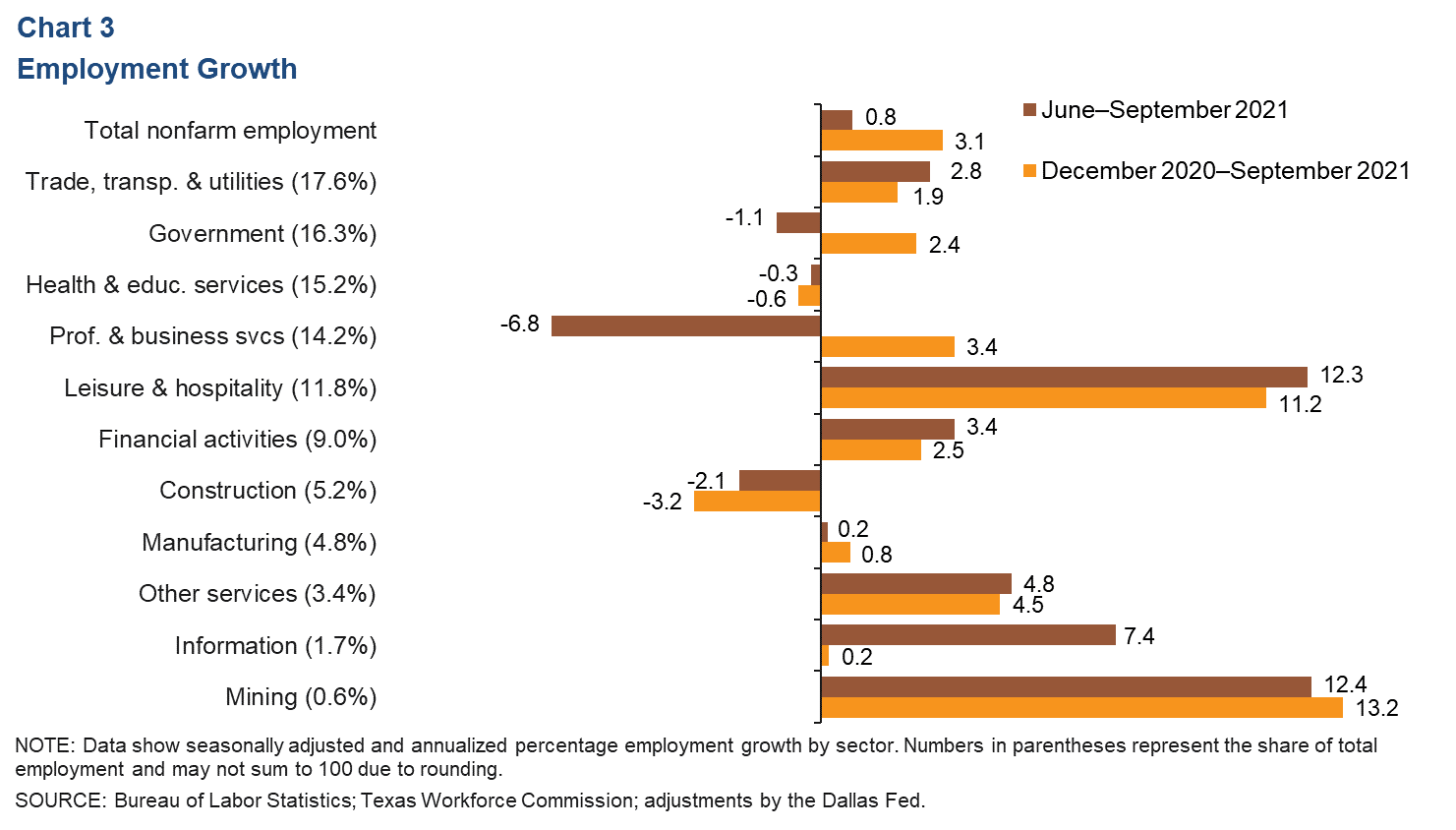

Third-Quarter Payroll Gains Mixed

While net payrolls grew from August to September, San Antonio jobs expanded a sluggish 0.8 percent (2,127 jobs) in the third quarter on an annualized basis (Chart 3). Mining led growth in the quarter (12.4 percent, or 200 jobs) and was followed by leisure and hospitality (12.3 percent, or 3,595 jobs), information (7.4 percent, or 320 jobs) and other services (4.8 percent, or 425 jobs). Industries that posted net declines were professional and business services (-6.8 percent, or 2,685 jobs), construction (-2.1 percent, or 295 jobs), government (-1.1 percent, or 490 jobs) and health and private education services (-0.3 percent, or 110 jobs). In March and April 2020 combined, 136,764 jobs were lost as the pandemic hit. As of September 2021, 82.9 percent of those jobs had been recovered.

Consumer Spending

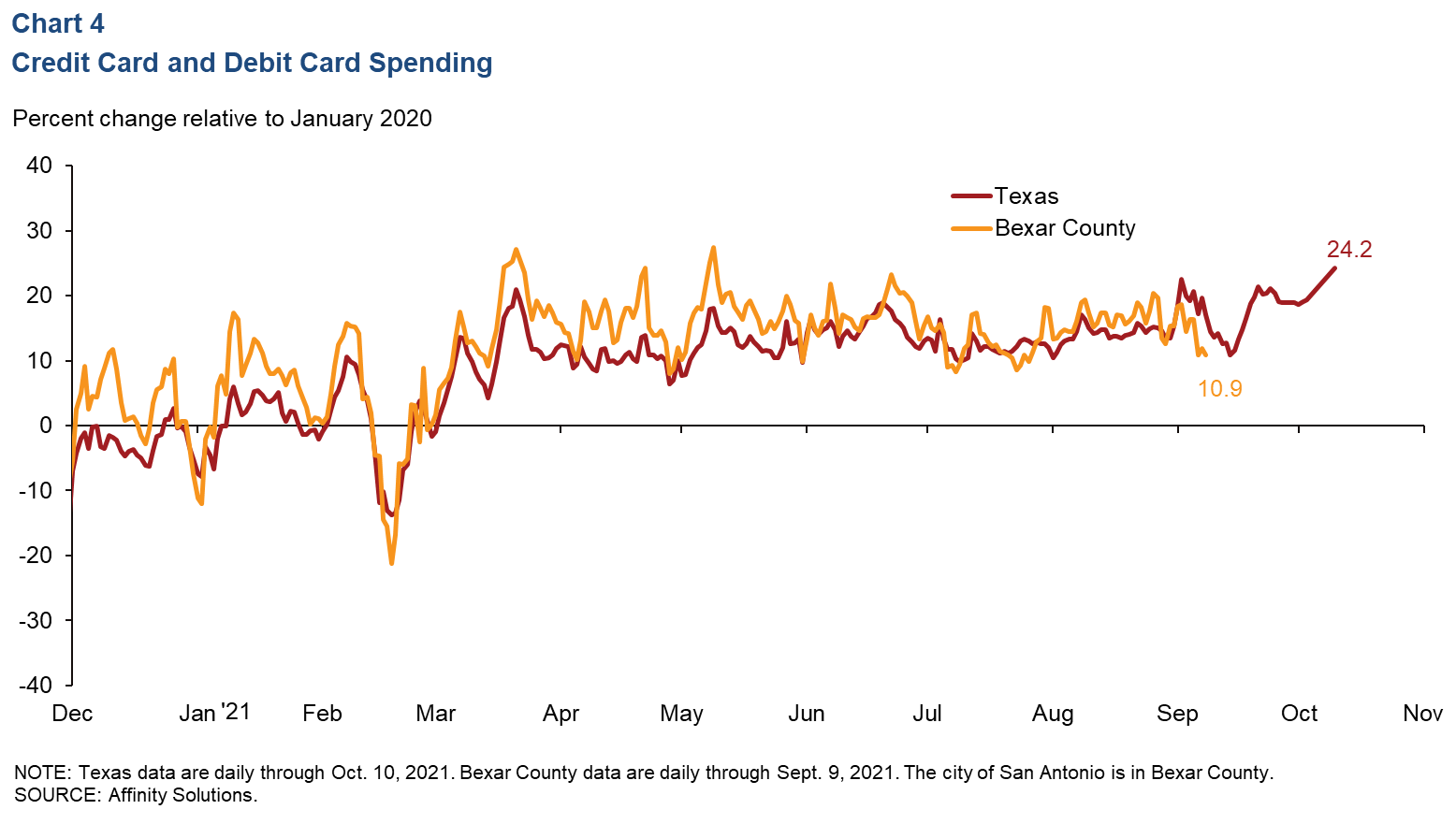

Since early February 2021, consumer spending in Bexar County has remained generally above January 2020 levels, except for a brief dip to below prepandemic levels during the week of Winter Storm Uri in mid-February. Spending (as measured by debit and credit card activity) declined in the county in early September but, as of Sept. 9, was 10.9 percent higher relative to January 2020 levels (Chart 4). In Texas, spending dipped in the first half of September before recovering in late September and early October. As of Oct. 10, it was 24.2 percent higher relative to January 2020.

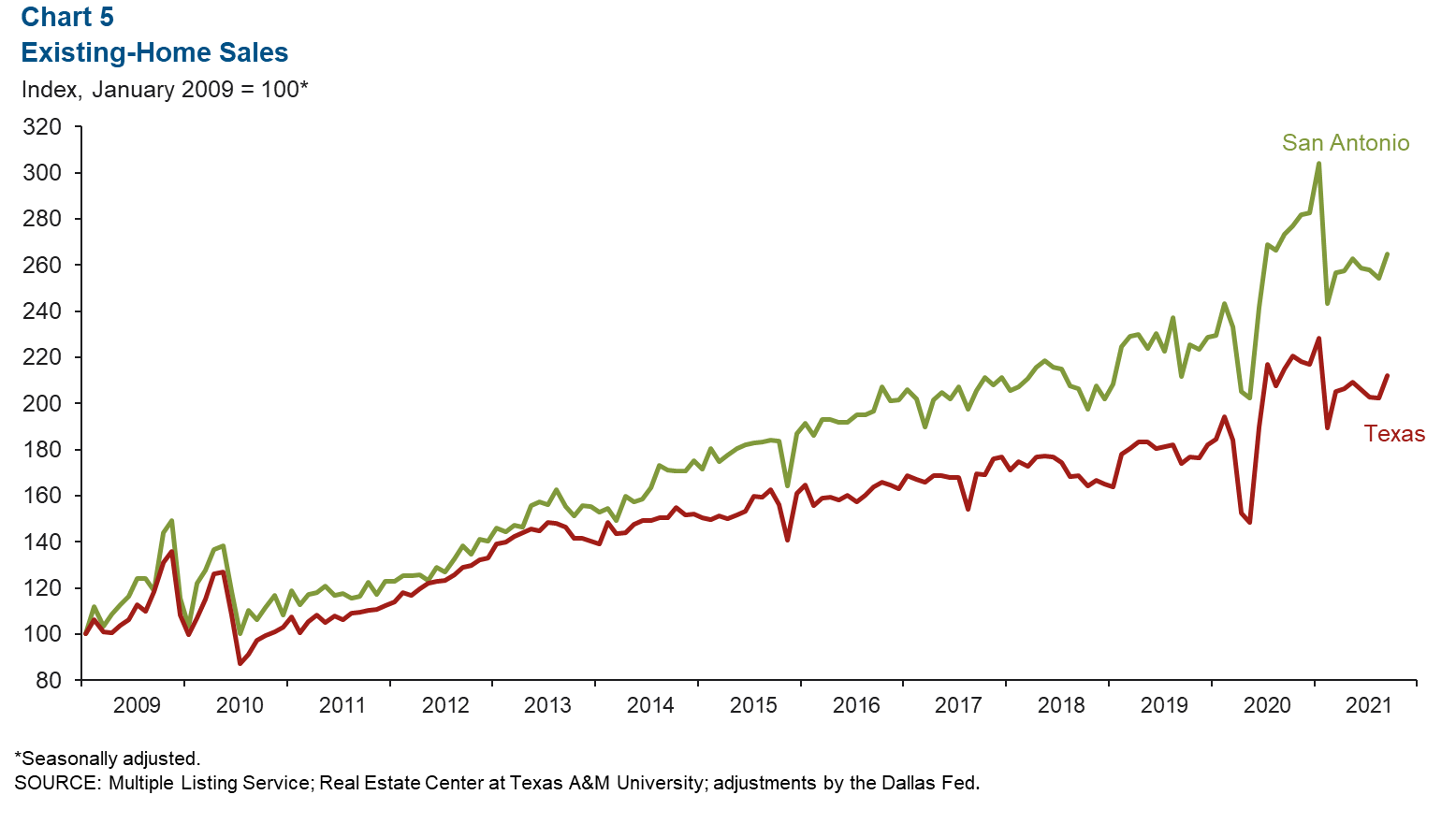

Real Estate

San Antonio existing-home sales increased 4.1 percent in September after posting declines in the prior three months (Chart 5). Statewide, sales grew 4.9 percent in September. In the first nine months of the year, the metro’s home sales were up 9.1 percent compared with the same period in 2020—slightly below the state’s 10.0 percent increase. The median price of homes sold in San Antonio in September was $292,432—a 9.1 percent gain year over year. In the state, the median home price was $309,625, a 10.6 percent jump.

COVID-19 Statistics

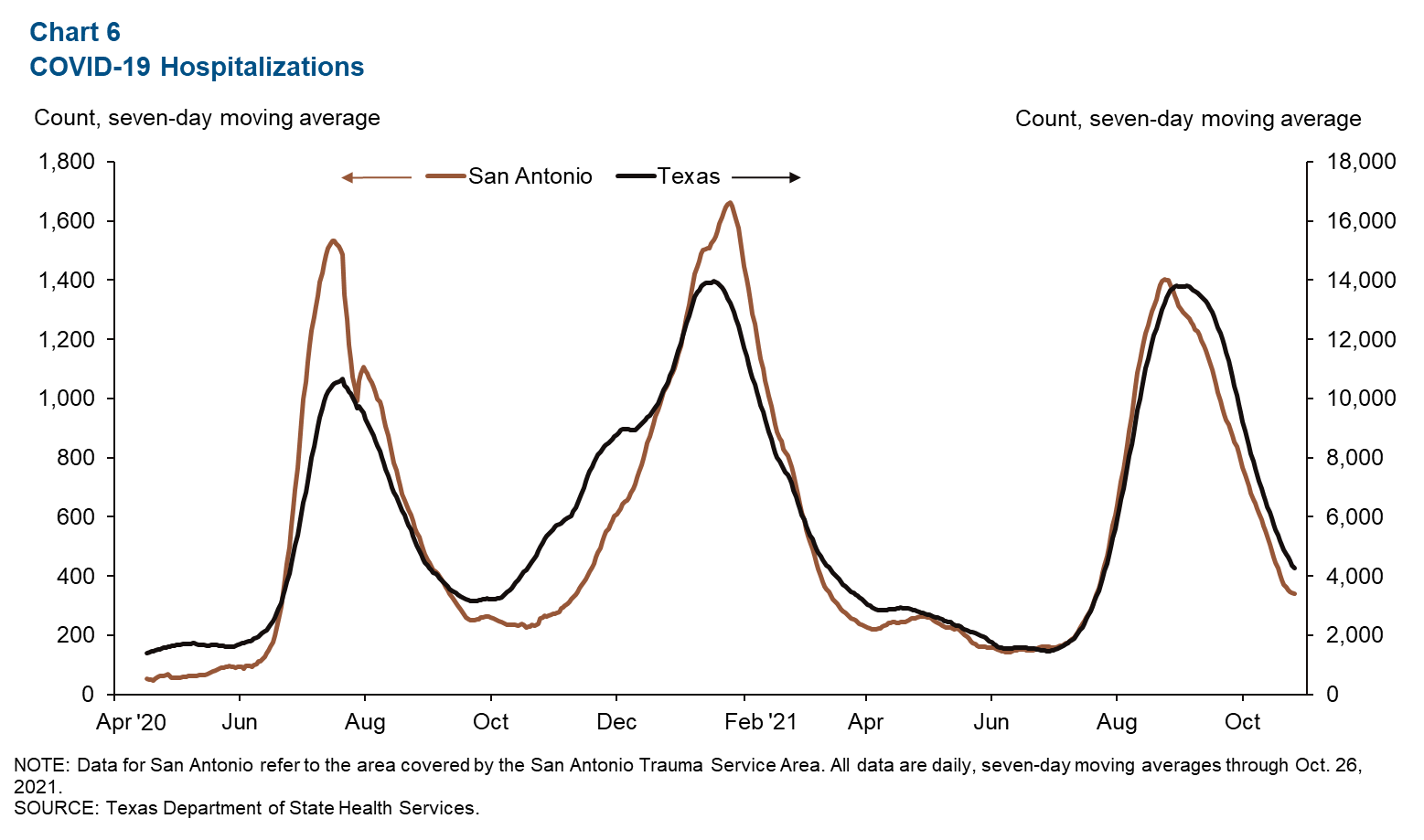

The number of people currently hospitalized with COVID-19 in San Antonio has continued to decline since the most recent peak in late August (Chart 6). As of Oct. 26, 340 people were hospitalized with COVID-19 in San Antonio, while 4,272 people were hospitalized in the state.

NOTE: Data may not match previously published numbers due to revisions.

About San Antonio Economic Indicators

Questions can be addressed to Judy Teng at judy.teng@dal.frb.org. San Antonio Economic Indicators is published every month during the week after state and metro employment data are released.