Texas Economic Indicators

The Texas economy grew at a moderate pace in September. The state added jobs at a slower pace than in August, and unemployment dipped to a record low. Firms remained optimistic about the future, but uncertainty among manufacturing firms heightened. Daily oil production, construction contract values and existing-home sales are higher so far this year than in 2017.

Labor Market

Employment Growth Moderates in September

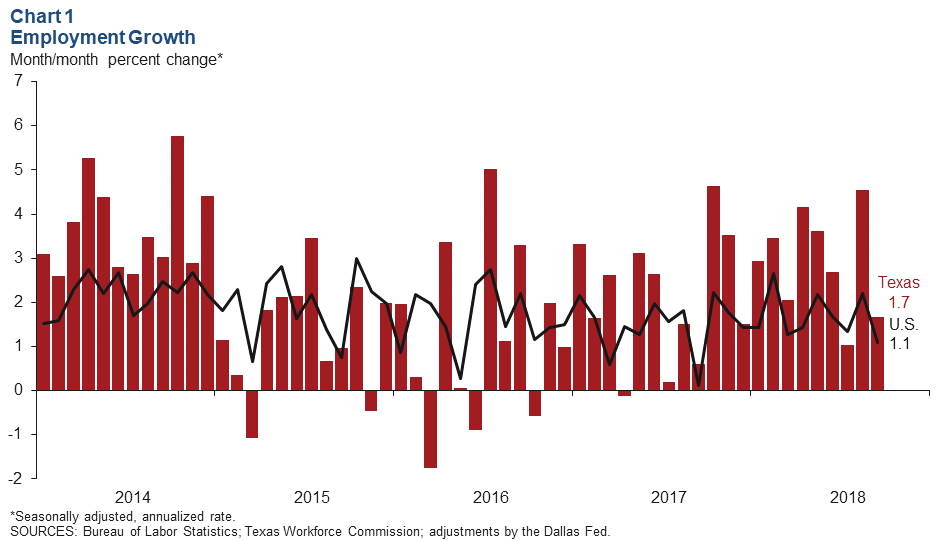

Texas employment expanded 1.7 percent in September, following August’s growth of 4.5 percent (Chart 1). Year to date, the state has added jobs at a 2.9 percent annualized rate—above its long-run average of 2.0 percent. The Dallas Fed’s Texas Employment Forecast predicts 2.7 percent job growth in 2018 (December/December), with an 80 percent confidence band of 2.2 to 3.2 percent.

Payrolls in the financial activities sector swelled 10.7 percent in September, outpacing growth in other major sectors. The government, education and health, professional and business services and information sectors all shed jobs in the month. The oil and gas sector has expanded the fastest this year through September, and only information employment has contracted.

All the major metros added jobs both in September and year to date. Houston payrolls advanced an annualized 3.6 percent this year through September—the fastest among the major metros, while San Antonio payrolls inched up 0.6 percent—the slowest among the major metros.

Unemployment Drops to Record Low

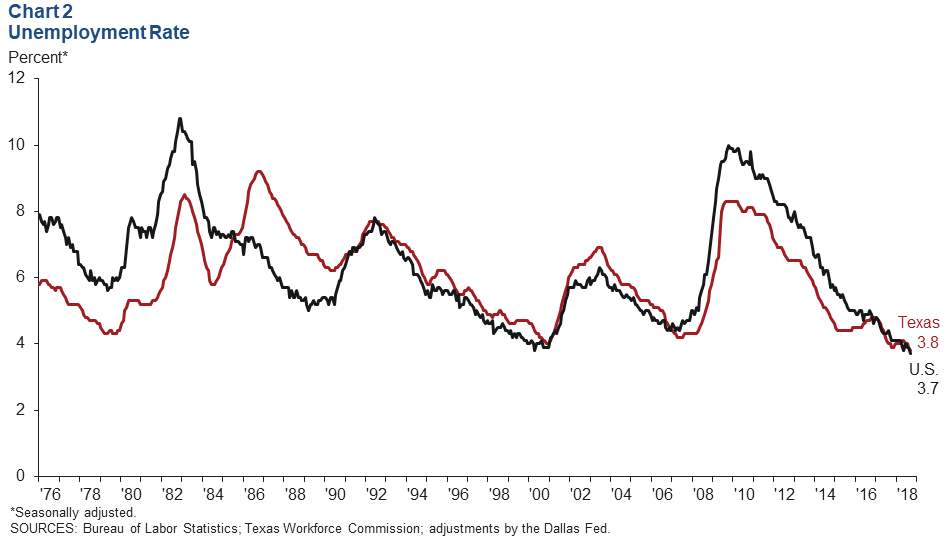

The Texas unemployment rate ticked down to 3.8 percent in September, setting a new record low for the series, which dates back to 1976 (Chart 2). The U.S. unemployment rate dipped to 3.7 percent in the month, its lowest point since December 1969.

El Paso’s unemployment rate edged up, Houston’s rate declined, and the rate for other major Texas metros held steady in September. Unemployment rates were well below their postrecession (January 2010–December 2017) averages in all major metros, with Houston and McAllen posting their lowest rates since 2008.

Texas Business Outlook Surveys

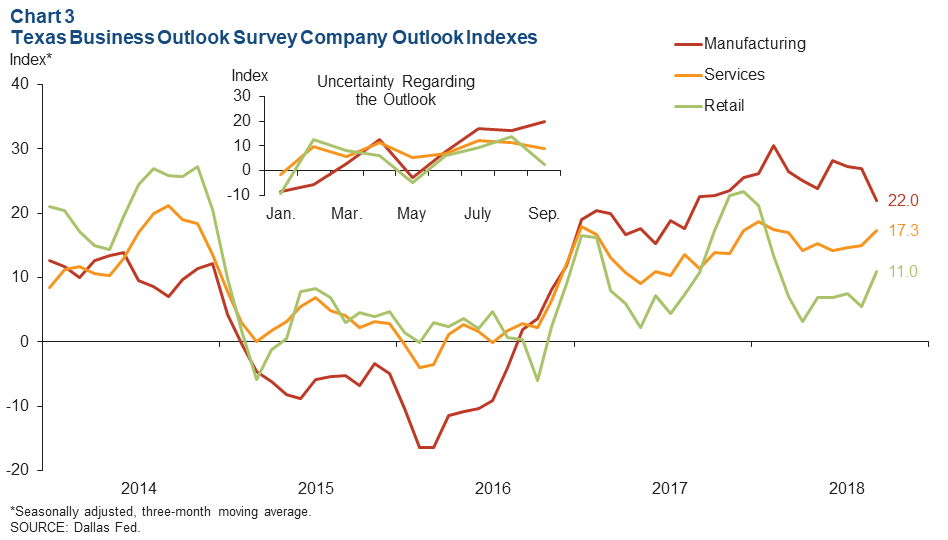

The three-month moving averages of the Texas Business Outlook Surveys’ company outlook indexes indicated continued optimism in September (Chart 3). The services and retail indexes rose, indicating improved outlooks, while the manufacturing index fell but remained positive. The manufacturing and service sector outlook indexes were above their postrecession averages, while the retail index was below its postrecession average.

The uncertainty indexes, which debuted in January 2018, gauge uncertainty regarding the outlook. The manufacturing uncertainty index reached its highest point in the nine months of data, signaling rising uncertainty in future expectations. Meanwhile, the services and retail uncertainty indexes dropped, suggesting lower uncertainty in expectations.

Energy Sector Activity

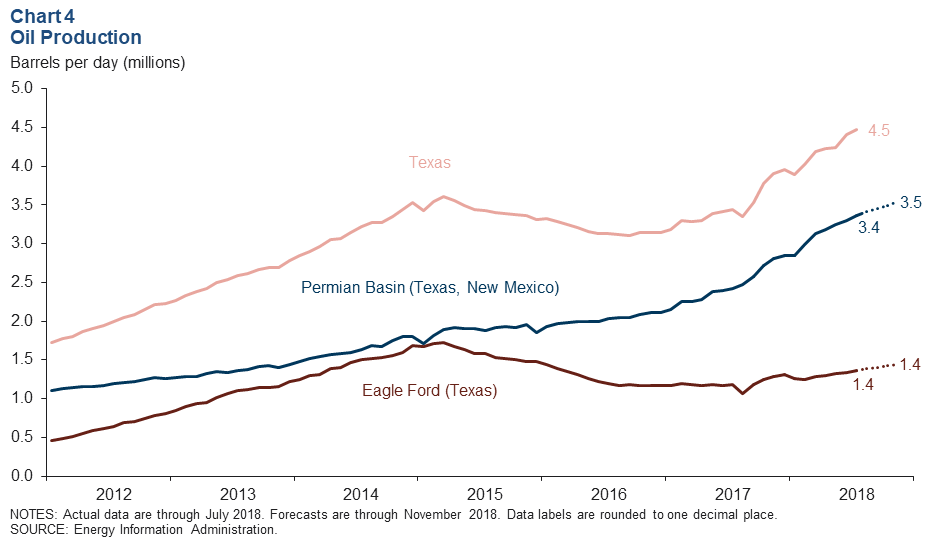

Texas daily crude oil production increased 1.3 percent in July to 4.5 million barrels per day—once again setting a new record for the series, which dates back to January 1981 (Chart 4). The state represents 40.8 percent of all U.S. production. Texas’ average daily production this year through July was 26.3 percent above its average production during the same period last year.

Daily oil production in the Permian Basin, representing 30.7 percent of U.S. production, picked up 1.8 percent in July, and the Energy Information Administration (EIA) estimates that production will reach 3.5 million barrels per day in November. The Permian Basin’s average daily production in the first seven months of the year was 36.8 percent higher than average production during the first seven months of 2017.

Daily production in the Eagle Ford, representing 12.4 percent of U.S. oil production, rose 1.6 percent in July, and the EIA estimates that production will reach 1.4 million barrels per day in November. The Eagle Ford’s average daily production in the first half of the year was 10.6 percent above average production during the same period last year.

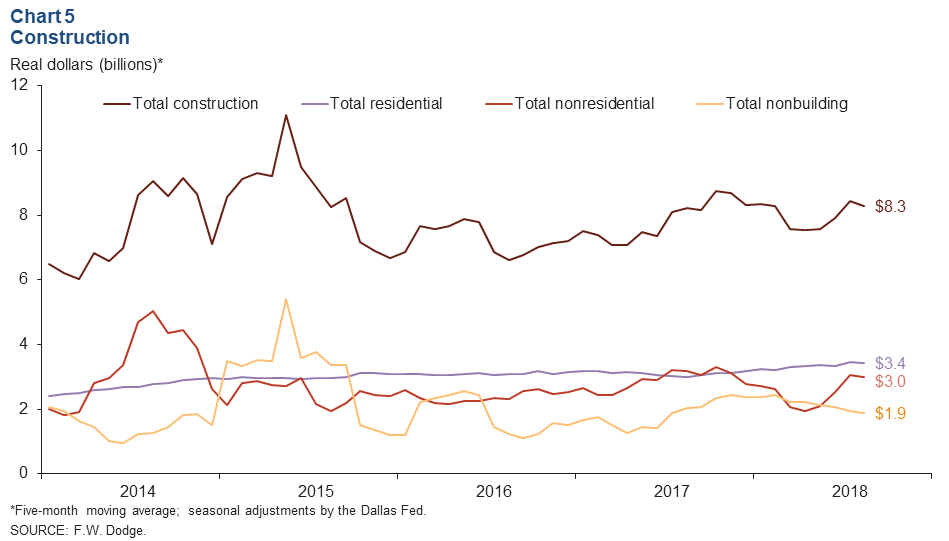

Construction

The five-month moving average of total Texas construction contracts fell 1.7 percent in August to $8.3 billion after a 6.5 percent increase in July (Chart 5). The decline was broad based, with the five-month moving average of Texas nonresidential construction contracts slipping 1.3 percent, nonbuilding construction declining 3.6 percent and residential construction dipping 0.8 percent.

Year to date through August, the value of Texas total construction contracts was 1.9 percent higher than the same period last year. While nonresidential construction contract values slipped 10.5 percent in the first eight months of 2018 compared with the same period in 2017, nonbuilding construction contract values expanded 7.4 percent, and residential construction contract values rose 10.8 percent.

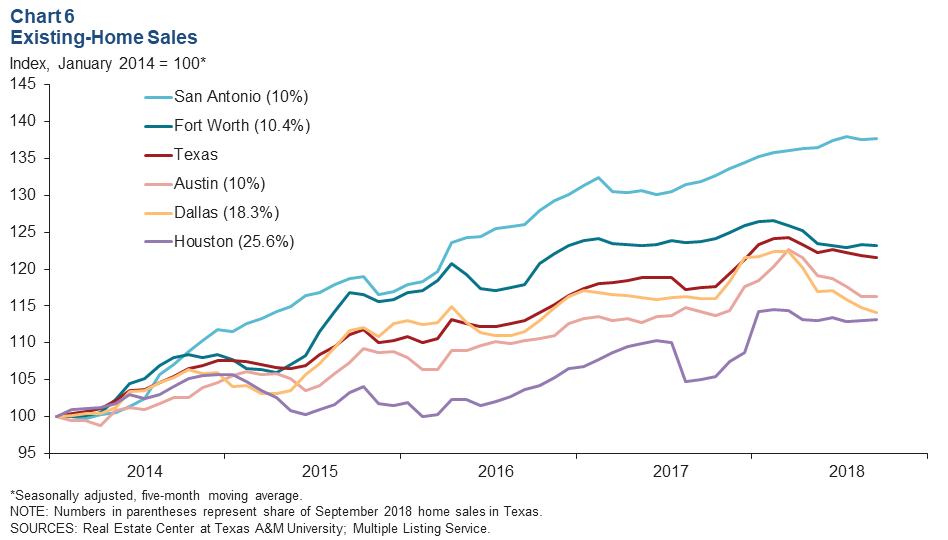

Housing

Texas’ existing-home sales grew 1.3 percent in September, but the five-month moving average inched down 0.2 percent in the month (Chart 6). The five-month moving average of existing-home sales edged down in Dallas and Fort Worth as well but ticked up in Austin, Houston and San Antonio. This year through September, existing-home sales climbed 3.2 percent in Texas compared with the same period in 2017. Austin, San Antonio and Houston existing-home sales were higher in the first nine months of 2018 than in the same period in 2017, but Fort Worth and Dallas existing-home sales were lower.

The inflation-adjusted median home sales price in Texas ticked up 0.3 percent in September and is up 1.1 percent year over year. Home inventories in the state inched up to 3.7 months, remaining well below the six months of supply considered balanced. Housing starts, which include multifamily construction, and building permits for single-family housing both slumped 0.8 percent in August.

NOTE: Data may not match previously published numbers due to revisions.

About Texas Economic Indicators

Questions can be addressed to Stephanie Gullo at stephanie.gullo@dal.frb.org. Texas Economic Indicators is published every month on the Monday after Texas employment data are released.