Texas Economic Indicators

| Texas economy dashboard (December 2023) | |||

| Job growth (annualized) Sept.–Dec. '23 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 3.2% | 4.0% | $32.37 | 5.9% |

The Texas economy expanded at a robust pace last year. Payrolls expanded in December, and the unemployment rate dropped. Initial unemployment claims ticked down in mid-January. The January Texas Business Outlook Surveys (TBOS) showed declines in both manufacturing and service sectors. Oil prices dipped, natural gas prices increased, and rig counts in Texas were steady in mid-January. Texas exports dipped in November, and construction contract values rose in December.

Labor market

Job gains moderate in December

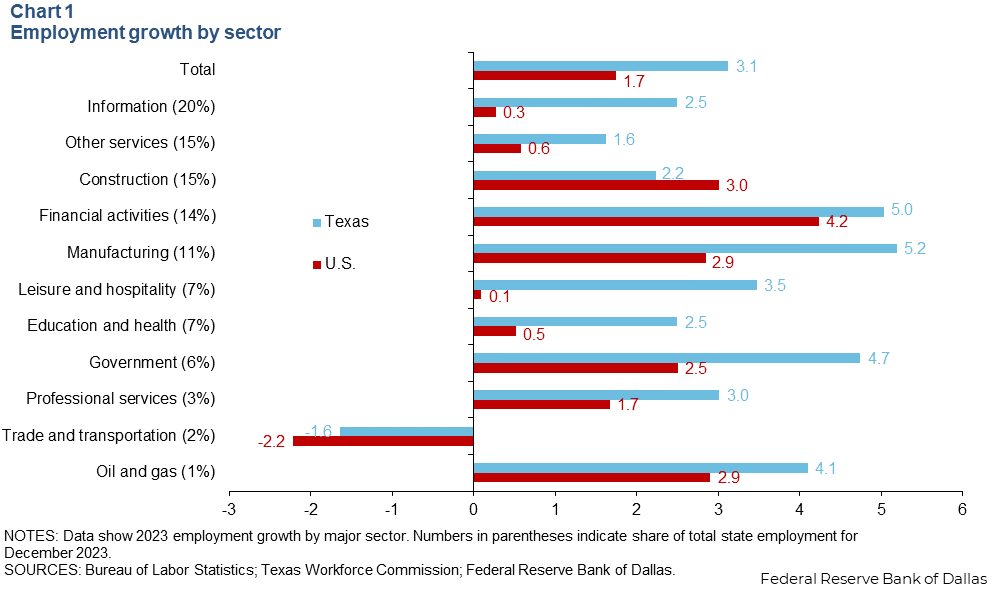

Texas employment expanded 3.1 percent in 2023, above the nation’s 1.7 percent (Chart 1). The expansion was slower than 2022’s increase of 4.3 percent. Job gains were widespread, outpacing the U.S. in all sectors except construction. Texas’ strongest gains were in manufacturing, financial activities, government and oil and gas, which all grew more than 4 percent.

New unemployment claims drop

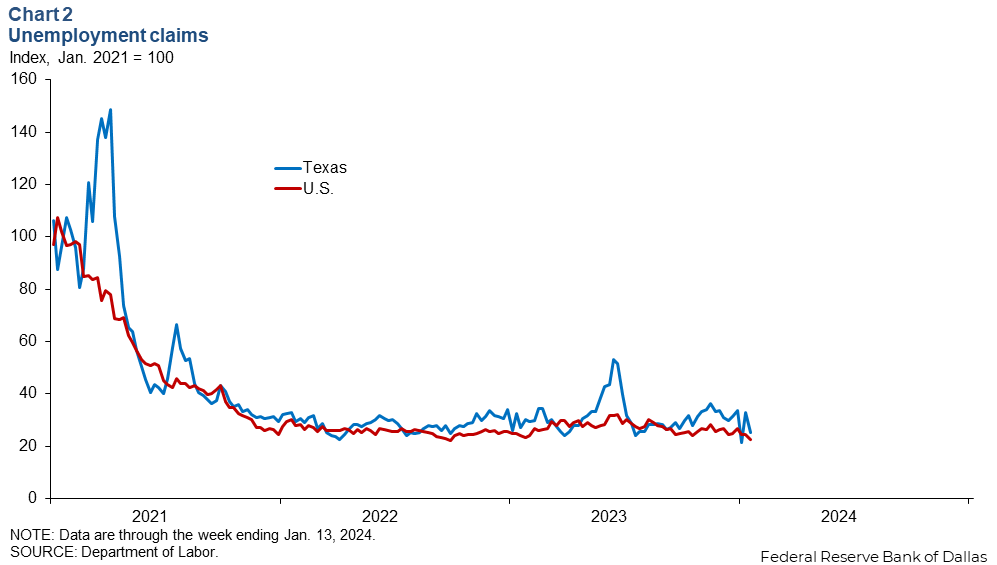

Weekly initial unemployment claims decreased in Texas in mid-January and remained significantly below January 2021 levels (Chart 2). New unemployment claims trended down to 12,854 in Texas and to 187,000 in the U.S. The Texas unemployment rate ticked down to 4.0 percent in December, while U.S. unemployment was 3.7 percent.

Texas Business Outlook Surveys

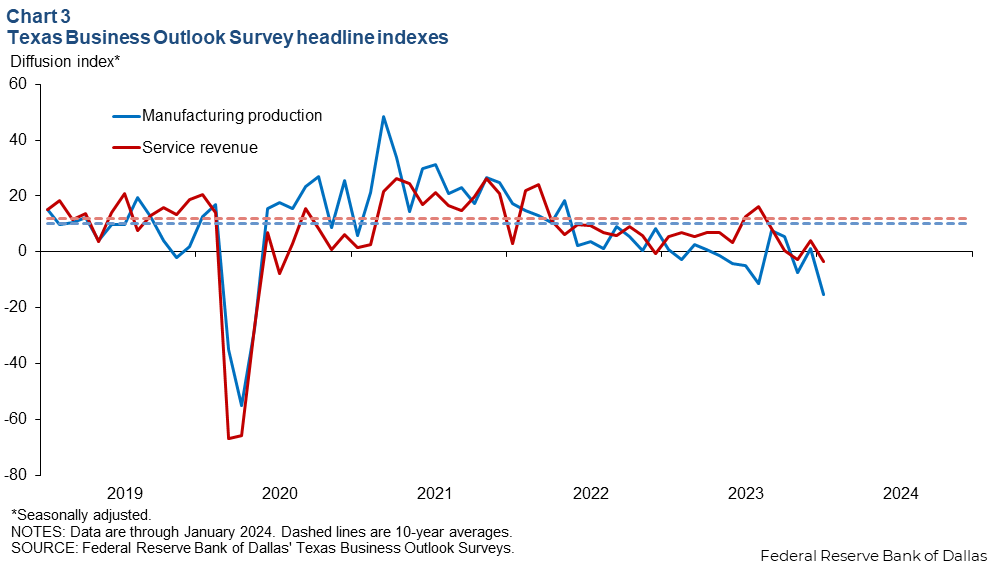

The January Texas Business Outlook Surveys reflected declines into contractionary territory in both manufacturing output and service sector activity (Chart 3). Both indexes were below their 10-year averages for most of 2023, and the outlook for both sectors remained pessimistic.

Energy

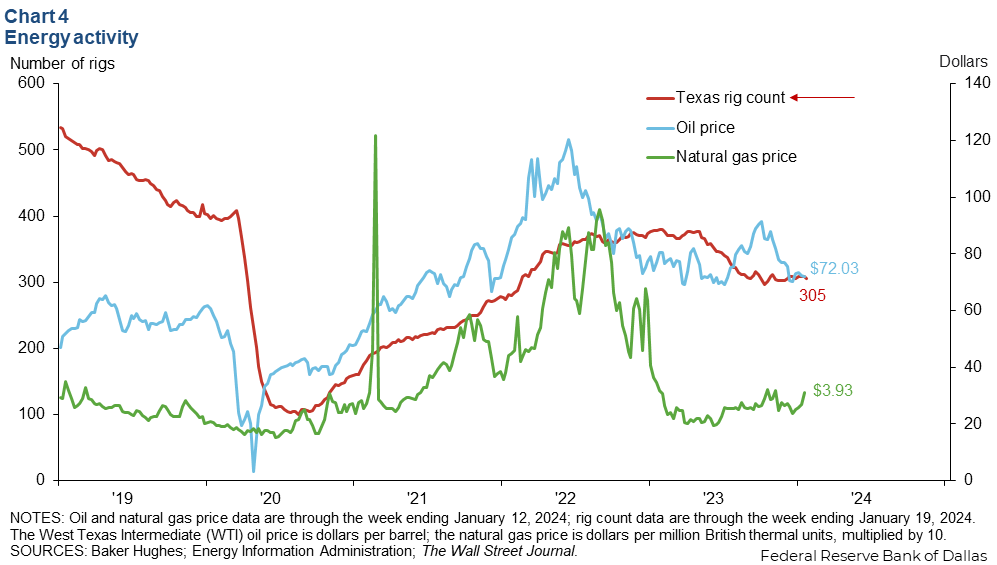

Oil prices ticked down in mid-January (Chart 4). As of the week ending January 12, West Texas Intermediate crude was $72.03 per barrel, $1.49 lower than the end of December. Natural gas (Henry Hub) increased $0.42 to $3.93 per million British thermal units. The number of active rigs in Texas was little changed at 305 during the same period.

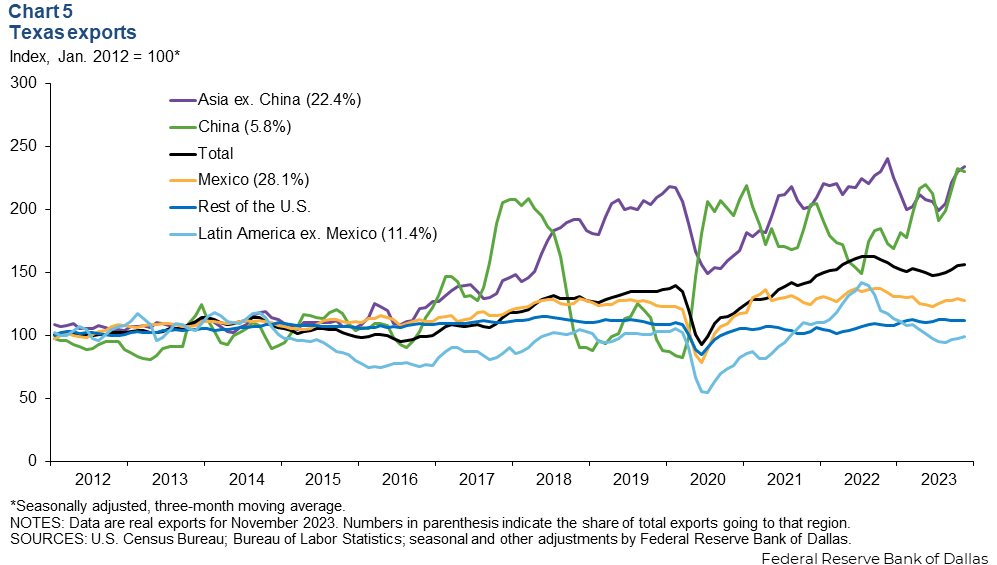

Exports

In November Texas exports dipped, but the three-month moving average edged up 0.4 percent (Chart 5). Exports from the rest of the U.S. contracted 0.1 percent. Over the same period, the three-month average of Texas exports to China ticked down 1.1 percent, while exports to the rest of Asia were up 1.7 percent. Texas exports to Mexico, the state’s largest trading partner, contracted 1.3 percent, but exports to the rest of Latin America rose 1.4 percent.

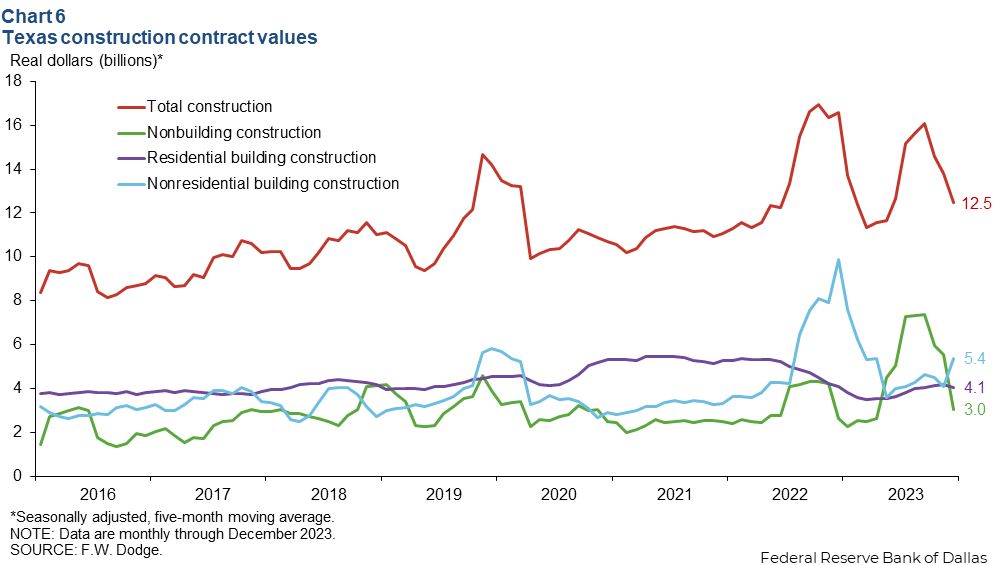

Construction

Construction contract values in Texas increased 68.4 percent in December, while the five-month moving average edged down 9.7 percent. The decline was concentrated in nonbuilding contract values, which dropped 6.4 percent in December, and the five-month moving average was down 45.1 percent. On a smoothed basis, nonresidential building construction rose 31.5 percent to $5.4 billion, and residential building construction dropped 3.0 percent to $4.1 billion (Chart 6).

NOTE: Data may not match previously published numbers due to revisions.

About Texas Economic Indicators

Questions or suggestions can be addressed to Diego Morales-Burnett at diego.morales-burnett@dal.frb.org. Texas Economic Indicators is published every month during the week after state and metro employment data are released.