Agricultural Survey

First Quarter 2019

Survey Highlights

Bankers responding to the first-quarter survey reported overall weaker conditions across most regions of the Eleventh District. Many noted that volatile weather conditions have caused issues with crop harvesting and livestock health. Prices were generally reported as being weak, particularly for cotton, although livestock prices were more mixed.

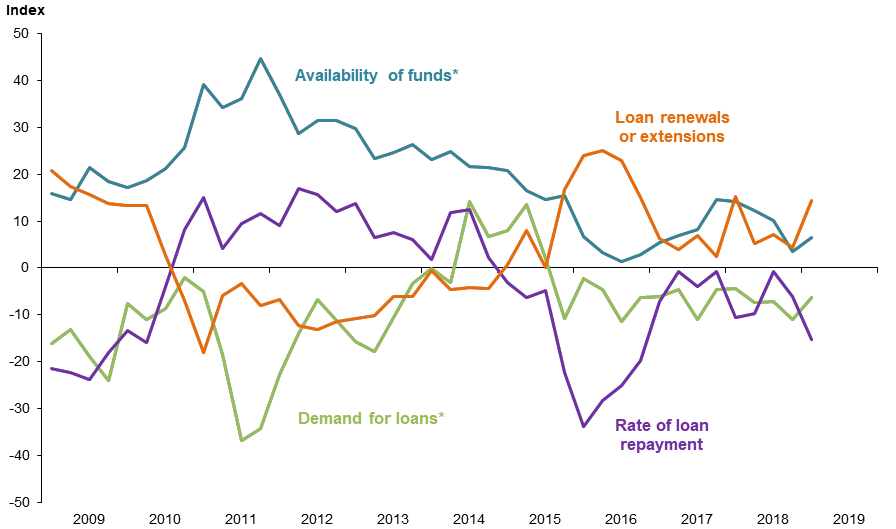

Demand for agricultural loans overall declined for a 14th consecutive quarter. Loan renewals and extensions increased, and the rate of loan repayment declined to its lowest pace since the end of 2016. Loan volume fell across all major categories compared with a year ago, with the sharpest declines in dairy, farm machinery and farm real estate loans (Figure 1).

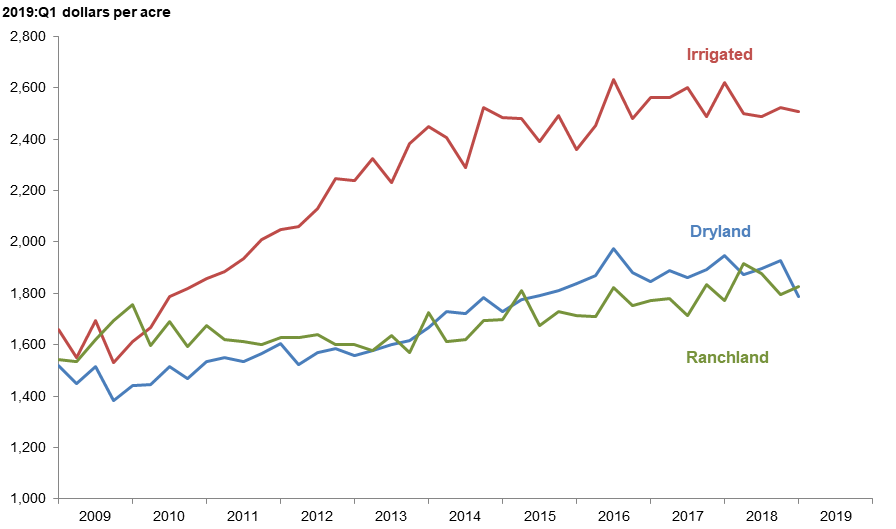

District ranchland values ticked up this quarter, while irrigated cropland values slipped modestly, and dryland values fell to a four-year low (Figure 2). According to bankers who responded in both this quarter and first quarter 2018, Texas nominal cropland and ranchland values increased year over year (Table 1). Southern New Mexico respondents also indicated an increase in cropland and ranchland values, while northern Louisiana respondents reported a decrease in cropland and ranchland values.

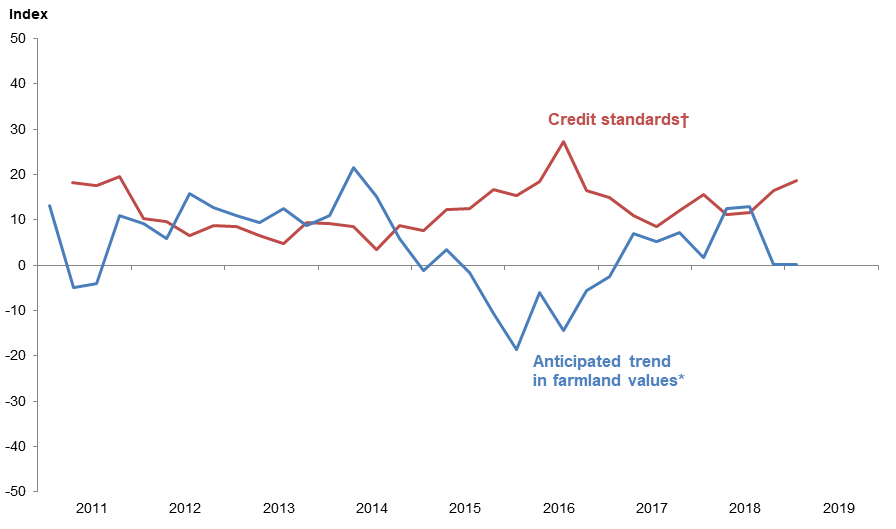

The anticipated trend in the farmland values index was flat for a second consecutive quarter, suggesting respondents expect farmland values to hold steady in the upcoming months. The credit standards index rose to a two-year high, indicating further tightening of standards on net (Figure 4).

Quarterly Comments

District bankers were asked for additional comments concerning agricultural land values and credit conditions. These comments have been edited for publication.

Region 1—Northern High Plains

- Extremely dry conditions exist with little measureable rainfall/snow in the past four months. Trade issues resulting in low prices are of continuous concern.

- The Panhandle has received a normal amount of moisture this winter. Our cattle feeders are benefiting from a strong price on live cattle due to the very poor weather in Kansas and Nebraska. We are hearing of (feedlot) cost of gains over $1 per pound from many of the Midwest feedlots. Look for 2019 cotton acres to be up again in the Panhandle with two new gins coming online.

- Conditions are very dry in the Panhandle. This is not good for the cattle’s health due to the dry and dusty conditions.

Region 2—Southern High Plains

- 2018 irrigated cotton had a good yield. Most dryland was lost early in the year due to drought or hail. If the cotton was sold late 2018 or early 2019, producers received a good price. Those that held their cotton are now facing a drop in market prices. Overall, 2018 was a good year in our area with most producers being able to pay their operating loans in full and make all term debt payments.

- We need rain and frost-free weather to get planted and provide vegetation for livestock. Better prices and a safety net for cotton would also help.

- Results from 2018 are coming in. Lengthy harvest delays from prolonged wet weather this fall prevented timely harvesting and ginning of the cotton crop. Very little dryland cotton was harvested; most was abandoned for insurance. Irrigated yields were decent given how dry it was last summer. Soft prices have been a big drag, but market facilitation payments will help. Those growers astute enough to have elected Stacked Income Protection Program (STAX) coverage on dryland cotton will be rewarded. With a mostly disappointing crop and falling prices, we are pleased that there will be very little carryover debt to deal with. On the other hand, there has been a notable trend in shrinking working capital, which indicates a lack of profitability. The general outlook has become pessimistic with no rainfall since December, falling crop prices and no resolution in sight for tariff disputes. Amazingly enough, land prices remain high with little for sale and lots of willing buyers. The bright spot has been stocker and feeder cattle. Death loss was bad this early last fall, but cattle have been doing well since then, although wheat pasture needs rain soon. Markets have been strengthening, and closeouts have been mostly positive.

Region 4—Southern Low Plains

- It has been an extremely difficult year for agriculture, both for livestock and crop production. Volatility in weather and market conditions are contributing to a decline in farm incomes. Also, continued increases in expenses, seed chemicals and equipment are squeezing what little profits are left.

- Some cotton is still waiting for harvest due to wet fields. Wheat acreage is down due to wet fields at planting time. Low commodity prices and high input costs are the challenge.

Region 6—North Central Texas

- Commodity prices for local crops are poor. Year after year of weather instability is hurting crop yields and crop quality, which appears to be affecting demand for farmland in this area. Low commodity prices and weather instability, and its effect on yields and quality, are making farming in this area very risky.

- Net farm income amounts were reduced for the 2018 crop as a result of continued increases to cost of production, primarily on cotton. The concerning fact is that yields were average to above average and margins in most cases were still negative. As such, it appears that the risk associated with cotton and other row crops in the South Plains of Texas appears to have drastically increased.

- The continued unprecedented wet weather pattern that Hunt County has experienced since the middle of September 2018 through today’s date, with no projected relief in sight, is becoming a very significant detriment to the overall agriculture environment for Hunt County and our surrounding area.

- The rain since September has damaged everybody in our area in agriculture. Numerous customers have lost calves due to sickness because of the rain and the damp and cold conditions. It ruined several cuttings of hay in late summer/early fall. Thus, we see $90 per roll for below-average hay, if you can find any. The weather has ruined numerous soybean and cotton crops and has helped keep the cattle market prices lower than normal.

Region 7—East Texas

- Cattle prices are lower than our borrowers would like. Very wet conditions continue, which may cause delays in farmers being able to gear up for hay production.

- Farm lending activity is down due to the weather.

- The extremely wet fall/winter continues to cause problems in the row crop area. Land prep is still several weeks behind, and normal planting dates have moved back almost a month. Pastureland is in good shape moisture wise, but all hay inventories were depleted, so hay production is paramount this year.

Region 8—Central Texas

- Everyone is moaning about the wet conditions and how long it will last, but we hope they don’t forget what a drought is. Corn farmers have been delayed, with only about 20 percent of corn acreage planted. Cattle people are still feeding hay daily, hoping that winter will be over soon. Winter oats and rye have been excellent this year, with good gains by cattle on winter pasture. Oil and gas is still doing well, with several rigs in the area, and fracking jobs are still going strong on older wells. Spring prospects look good if we don’t get any more late freezes.

Region 11—Trans-Pecos and Edwards Plateau

- Livestock prices are strong across the board. Range conditions should be very good going into the late spring and early summer due to the good fourth quarter rain in 2018. However, most producers are always looking expectantly toward that next rain. Given a normal year of rainfall, it should be a good ag year.

Region 12—Southern New Mexico

- Spring farming is underway. Weather conditions have been dry and windy. We need rain for dryland winter wheat crop to have a chance at harvest. Crop stands remain good despite a dry winter. The dairy industry continues to struggle with low milk prices and marginal returns. Livestock returns are mixed. There is good demand and strong prices for stocker steer and heifers to meet summer grazing needs. The feeder market struggles with lower prices as area feedlots are at or near capacity. The yards in the northern U.S. dealing with harsh, wet conditions have pretty much been out of the market for additional purchases for most of January and February. Yearling steer and heifer prices keep trending lower despite good feedlot returns on the inventory being harvested at this time.

Region 13—Northern Louisiana

- Grain farmers are not doing as well as they have in past years.

Eleventh District Agricultural Data

Figures

|

Figure 1 Farm Lending Trends |

|||||

|---|---|---|---|---|---|

| What changes occurred in non-real-estate farm loans at your bank in the past three months compared with a year earlier? | |||||

| Index | Percent reporting, Q1 | ||||

| 2018:Q4 | 2019:Q1 | Greater | Same | Less | |

| Demand for loans* | -11.0 | -6.3 | 11.6 | 70.5 | 17.9 |

| Availability of funds* | 3.6 | 6.5 | 13.0 | 80.5 | 6.5 |

| Rate of loan repayment | -6.1 | -15.2 | 5.4 | 74.1 | 20.5 |

| Loan renewals or extensions | 4.4 | 14.4 | 20.7 | 73.0 | 6.3 |

| What changes occurred in the volume of farm loans made by your bank in the past three months compared with a year earlier? | |||||

| Index | Percent reporting, Q1 | ||||

| 2018:Q4 | 2019:Q1 | Greater | Same | Less | |

| Non-real-estate farm loans | -13.8 | -9.1 | 10.9 | 69.1 | 20.0 |

| Feeder cattle loans* | -19.4 | -4.0 | 14.2 | 67.6 | 18.2 |

| Dairy loans* | -21.0 | -22.4 | 1.8 | 74.0 | 24.2 |

| Crop storage loans* | -6.8 | -9.9 | 7.6 | 74.9 | 17.5 |

| Operating loans | -7.1 | -1.8 | 12.8 | 72.5 | 14.7 |

| Farm machinery loans* | -19.5 | -21.5 | 4.4 | 69.7 | 25.9 |

| Farm real estate loans* | -13.0 | -12.5 | 8.0 | 71.5 | 20.5 |

| *Seasonally adjusted. NOTES: Survey responses are used to calculate an index for each item by subtracting the percentage of bankers reporting less from the percentage reporting greater. Positive index readings generally indicate an increase, while negative index readings generally indicate a decrease. |

|||||

| Figure 2 Real Land Values |

|---|

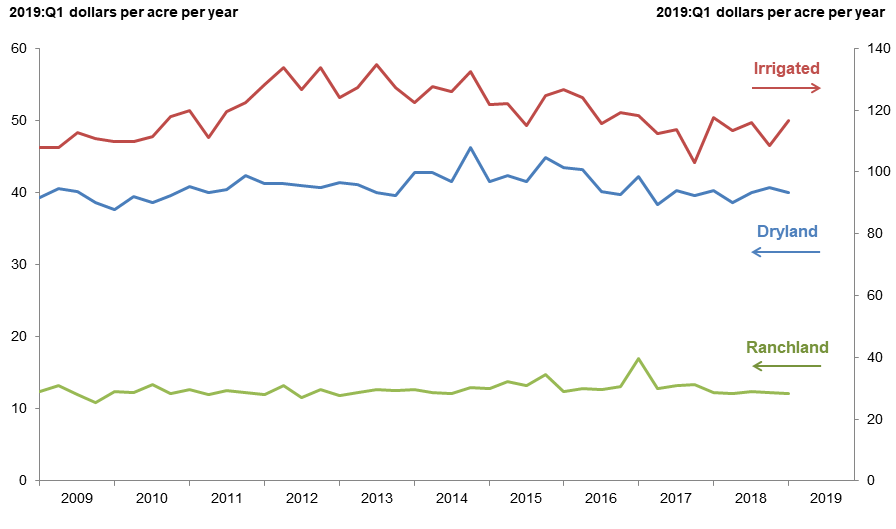

| Figure 3 Real Cash Rents |

|---|

NOTES: All values have been seasonally adjusted. Real values are created by deflating the nominal values using the implicit price deflator for U.S. gross domestic product.

|

Figure 4 Anticipated Farmland Values and Credit Standards |

|||||

|---|---|---|---|---|---|

| What trend in farmland values do you expect in your area in the next three months? | |||||

| Index | Percent reporting, Q1 | ||||

| Anticipated trend in farmland values* | 2018:Q4 | 2019:Q1 | Up | Stable | Down |

| 0.1 | 0.1 | 6.8 | 86.5 | 6.7 | |

| What change occurred in credit standards for agricultural loans at your bank in the past three months compared with a year earlier?† | |||||

| Credit standards | 2018:Q4 | 2019:Q1 | Tightened | Same | Loosened |

| 16.4 | 18.6 | 18.6 | 81.4 | 0.0 | |

†Added to survey in second quarter 2011.

NOTES: Survey responses are used to calculate an index for each item by subtracting the percentage of bankers reporting less from the percentage reporting greater. Positive index readings generally indicate an increase, while negative index readings generally indicate a decrease.

Tables

Tables |

||||

| Table 1 Rural Real Estate Values—First Quarter 2019 |

||||

|---|---|---|---|---|

| Banks1 | Average value2 | Percent change in value from previous year3 | ||

| Cropland—Dryland | ||||

| District* | 87 | 1,812 | 2.3 | |

| Texas* | 77 | 1,830 | 3.0 | |

| 1 | Northern High Plains | 11 | 880 | 4.2 |

| 2 | Southern High Plains | 9 | 794 | -2.0 |

| 3 | Northern Low Plains* | 3 | 825 | 2.1 |

| 4 | Southern Low Plains* | 7 | 1,141 | -4.6 |

| 5 | Cross Timbers | 5 | 1,670 | 2.5 |

| 6 | North Central Texas | 13 | 2,881 | 3.5 |

| 7 | East Texas* | 5 | 2,573 | 19.4 |

| 8 | Central Texas | 10 | 3,605 | -3.4 |

| 9 | Coastal Texas | N/A | N/A | N/A |

| 10 | South Texas | 5 | 2,000 | -6.4 |

| 11 | Trans-Pecos and Edwards Plateau | 7 | 2,607 | 23.9 |

| 12 | Southern New Mexico | 4 | 438 | 6.1 |

| 13 | Northern Louisiana | 6 | 2,567 | -11.9 |

| Cropland—Irrigated | ||||

| District* | 71 | 2,541 | 5.9 | |

| Texas* | 60 | 2,246 | 8.9 | |

| 1 | Northern High Plains | 11 | 2,059 | 7.4 |

| 2 | Southern High Plains | 9 | 1,700 | 19.6 |

| 3 | Northern Low Plains* | N/A | N/A | N/A |

| 4 | Southern Low Plains | 6 | 1,717 | -3.5 |

| 5 | Cross Timbers | 3 | 2,000 | 11.1 |

| 6 | North Central Texas | 6 | 2,908 | -6.0 |

| 7 | East Texas | 4 | 2,850 | 8.5 |

| 8 | Central Texas | 6 | 4,183 | -1.8 |

| 9 | Coastal Texas | N/A | N/A | N/A |

| 10 | South Texas | 5 | 3,440 | 8.5 |

| 11 | Trans-Pecos and Edwards Plateau | 7 | 4,036 | 13.6 |

| 12 | Southern New Mexico | 6 | 4,458 | 3.4 |

| 13 | Northern Louisiana | 5 | 3,460 | -8.3 |

| Ranchland | ||||

| District* | 96 | 1,851 | 3.9 | |

| Texas* | 85 | 2,208 | 3.8 | |

| 1 | Northern High Plains | 10 | 698 | 9.2 |

| 2 | Southern High Plains | 3 | 883 | 3.9 |

| 3 | Northern Low Plains | 3 | 800 | -5.9 |

| 4 | Southern Low Plains* | 7 | 1,264 | -1.8 |

| 5 | Cross Timbers | 6 | 1,950 | 5.7 |

| 6 | North Central Texas | 15 | 2,933 | 0.9 |

| 7 | East Texas | 11 | 2,705 | 5.1 |

| 8 | Central Texas | 10 | 5,935 | 7.5 |

| 9 | Coastal Texas | N/A | N/A | N/A |

| 10 | South Texas | 5 | 2,740 | -1.0 |

| 11 | Trans-Pecos and Edwards Plateau | 13 | 1,969 | 6.7 |

| 12 | Southern New Mexico | 5 | 305 | 9.5 |

| 13 | Northern Louisiana | 6 | 2,317 | -3.0 |

| *Seasonally adjusted. 1 Number of banks reporting land values. 2 Prices are dollars per acre, not adjusted for inflation. 3 Not adjusted for inflation and calculated using responses only from those banks reporting in both the past and current quarter. |

||||

| Table 2 Interest Rates by Loan Type |

|||||

|---|---|---|---|---|---|

| Feeder cattle | Other farm operating | Intermediate term | Long-term farm real estate | ||

| Fixed (average rate, percent) | |||||

| 2018:Q1 | 6.41 | 6.51 | 6.28 | 6.10 | |

| Q2 | 6.55 | 6.57 | 6.50 | 6.24 | |

| Q3 | 6.74 | 6.84 | 6.64 | 6.36 | |

| Q4 | 6.88 | 6.95 | 6.78 | 6.58 | |

| 2019:Q1 | 7.01 | 7.11 | 6.88 | 6.58 | |

| Variable (average rate, percent) | |||||

| 2018:Q1 | 6.18 | 6.17 | 6.04 | 5.75 | |

| Q2 | 6.25 | 6.28 | 6.23 | 5.90 | |

| Q3 | 6.48 | 6.48 | 6.43 | 6.02 | |

| Q4 | 6.70 | 6.69 | 6.66 | 6.26 | |

| 2019:Q1 | 6.81 | 6.83 | 6.75 | 6.44 | |

Back issues of Agricultural Survey »

For More Information

Questions regarding the Agricultural Survey can be addressed to Christopher Slijk at christopher.slijk@dal.frb.org.