Texas Service Sector Outlook Survey

Texas service sector activity weakens further

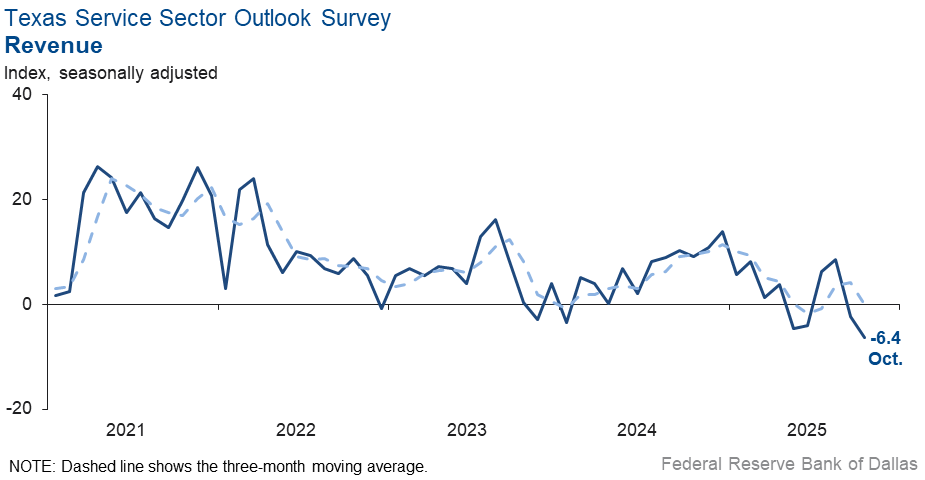

Texas service sector activity contracted further in October, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, fell four points to -6.4, its lowest reading since July 2020.

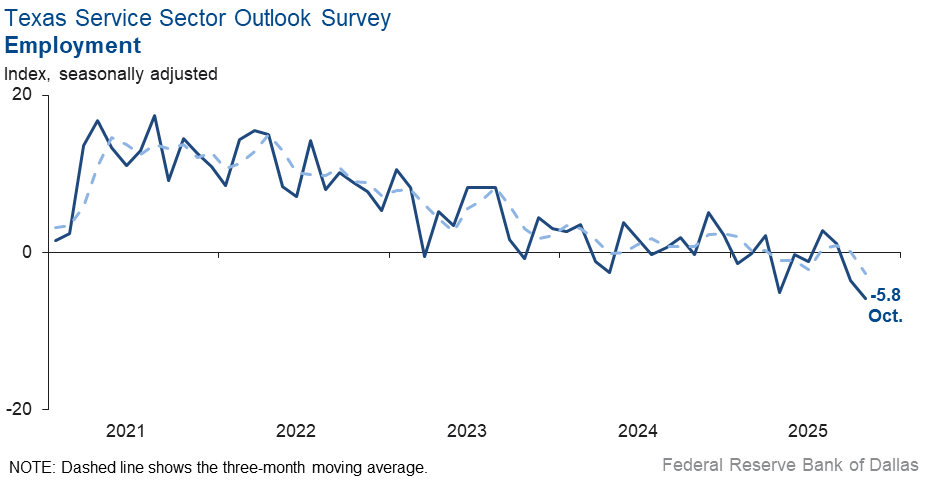

Labor market measures suggested further declines in employment, though hours worked were largely unchanged this month. The employment index fell slightly to -5.8 from -3.6 in September. Both the part-time employment index and the hours worked index held steady, registering -0.1 and -1.4 respectively. These near-zero readings suggest little change in part-time employment or the length of workweeks in October.

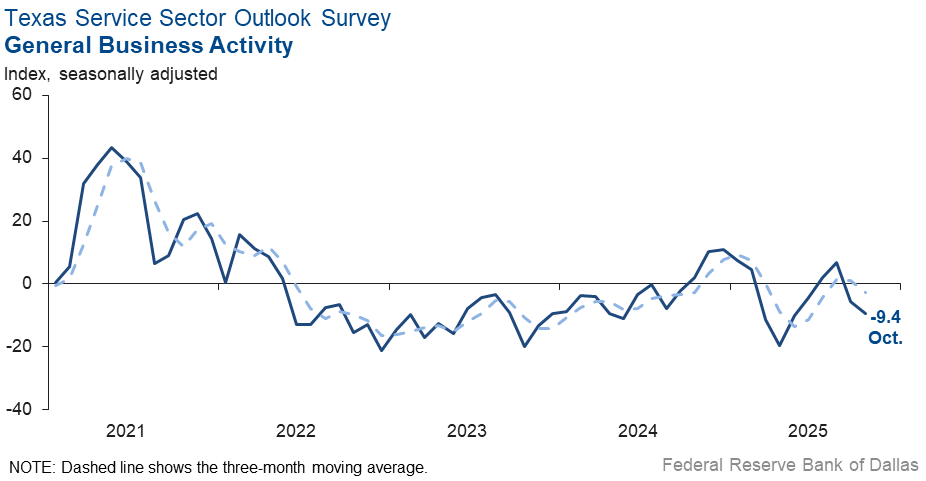

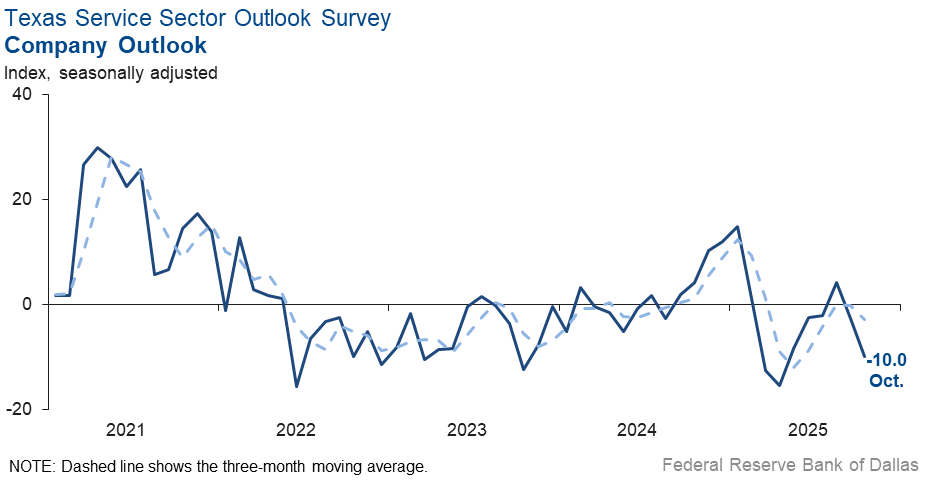

Perceptions of broader business conditions worsened in October while uncertainty increased at about the same pace as in September. The general business activity index pushed further negative, falling four points to -9.4. The company outlook index also dropped to -10 from -2.6 in September. The outlook uncertainty index was little changed at 22.2, though it remains well above the series average of 13.8.

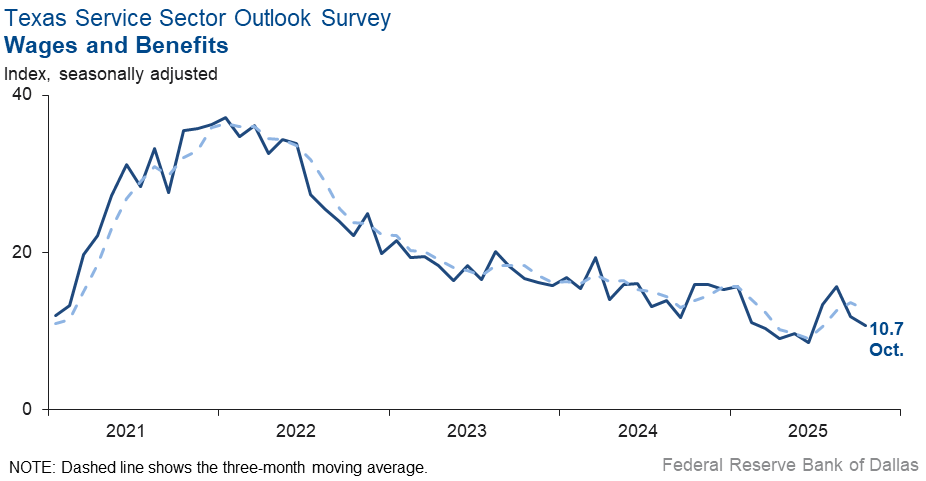

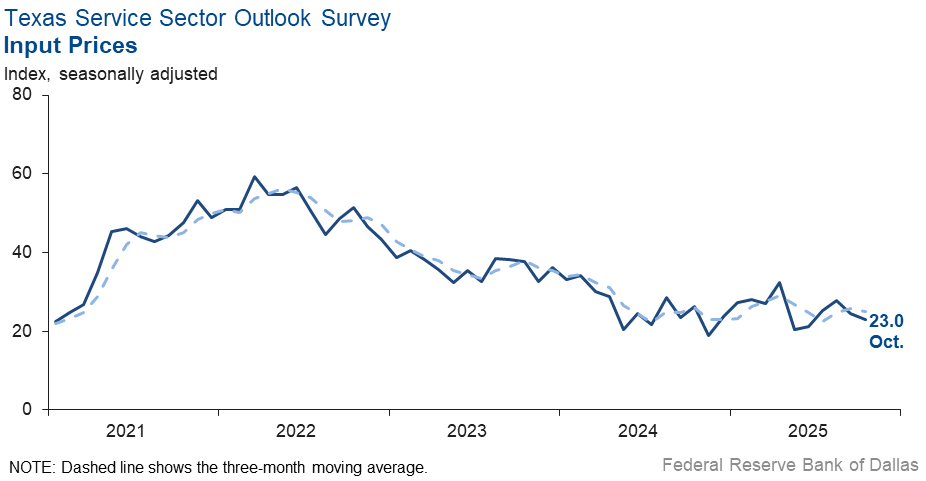

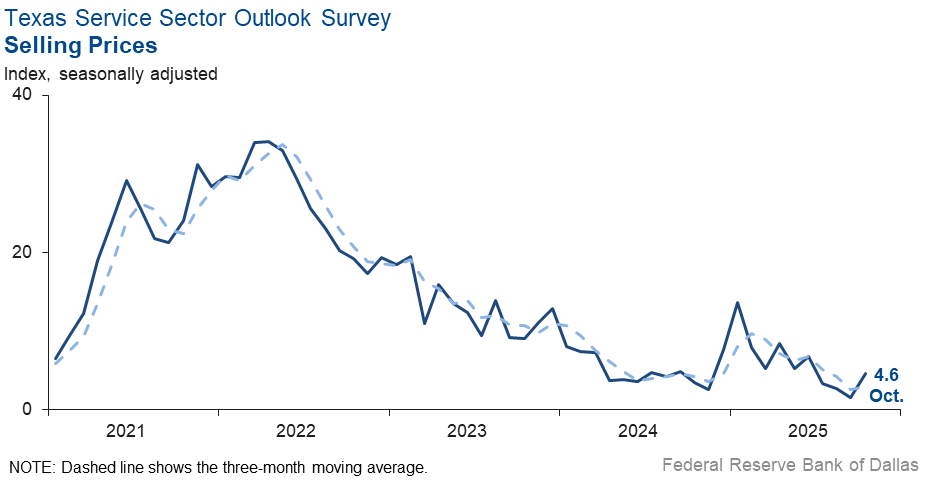

Input price and wage pressures held steady while selling prices edged up. The input prices index came in at a reading of 23.0, similar to September. The wages and benefits index was also little changed at 10.7. Meanwhile, the selling prices index ticked up three points to 4.6.

Respondents’ expectations regarding future service sector activity remained positive, though October readings were below average. The future revenue index was little changed at 33.7 while the future general business activity index dipped six points to 5.7. Other future service sector activity indexes, such as employment and capital expenditures, remained in positive territory but moved down from their September readings.

Texas Retail Outlook Survey

Texas retail sales contract further

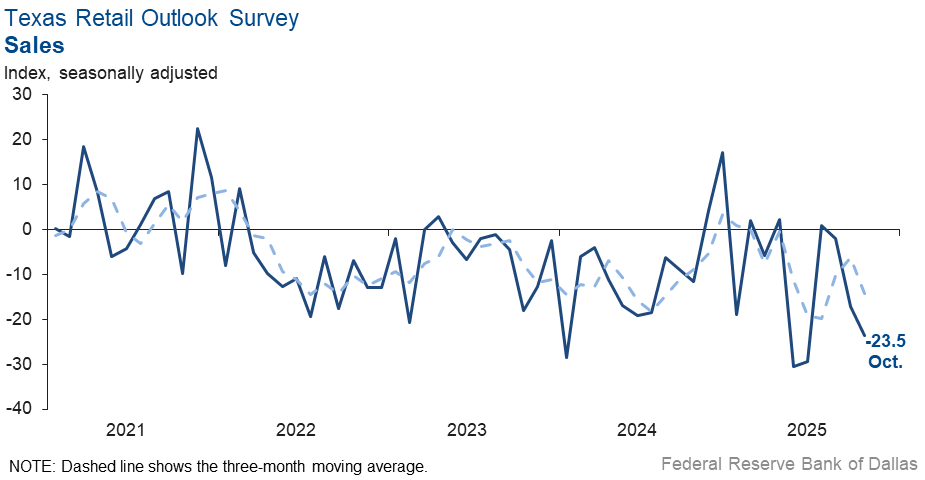

Retail sales fell further in October, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, fell to -23.5 from -17.2 in September. Retailers’ inventories remained unchanged, with an index reading of zero signaling little change in inventories in October.

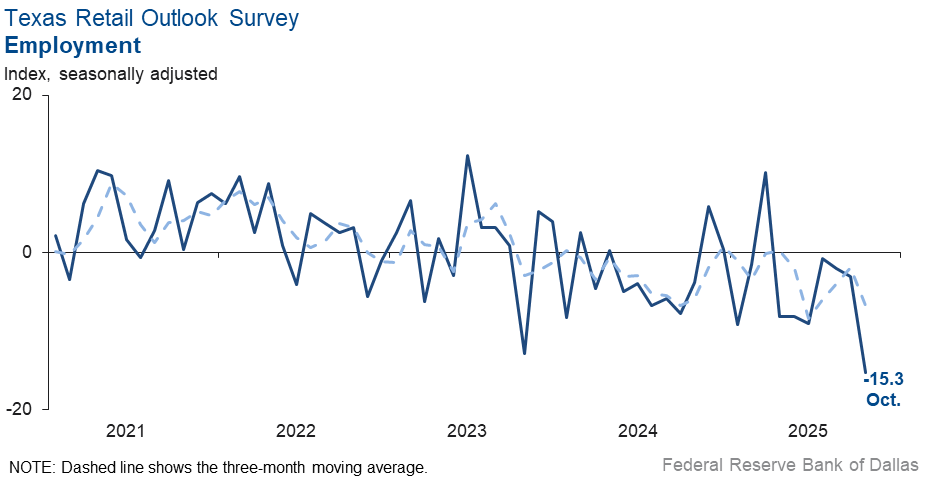

Labor market indicators reflected a further contraction in retail employment and hours worked. The employment index plunged to -15.3 from -3.0, while the part-time employment index was little changed at -3.2. The hours worked index also held steady with a reading of -6.8, suggesting a similar contraction in hours worked as last month.

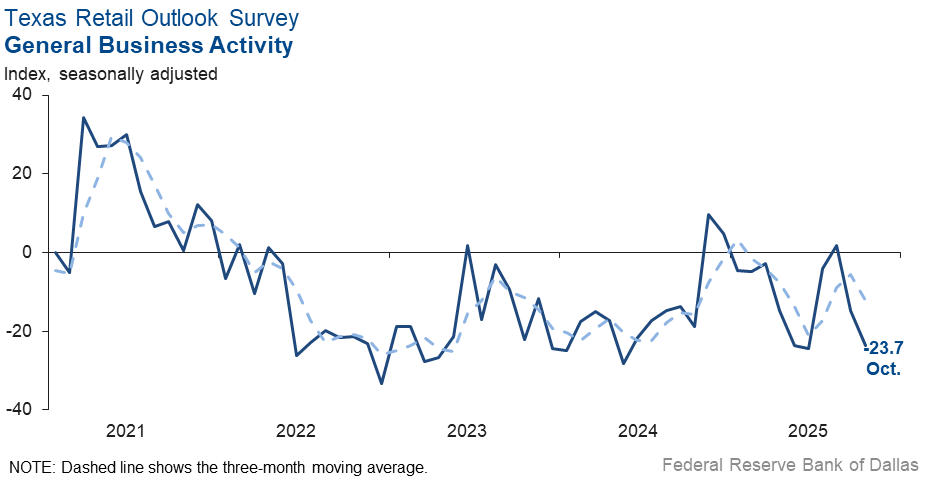

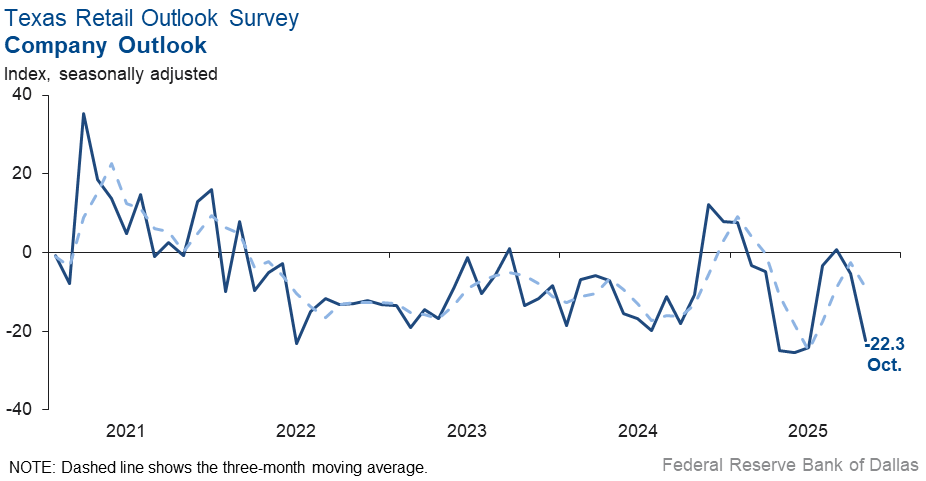

Perceptions of broader business conditions deteriorated further in October and uncertainty in outlooks increased, though at a slower pace than in September. The general business activity index fell nine points to -23.7, while the company outlook index fell 17 points to -22.3. The outlook uncertainty index fell nine points to 17.3 but remained above its series average.

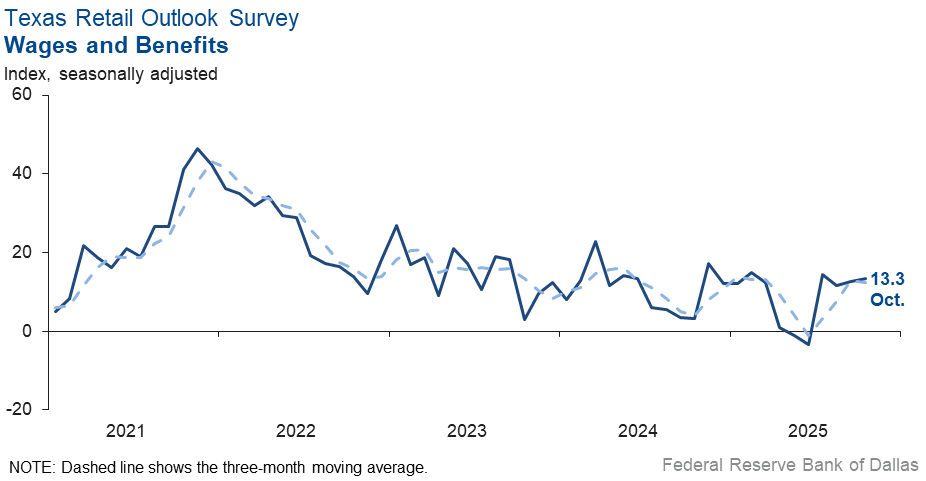

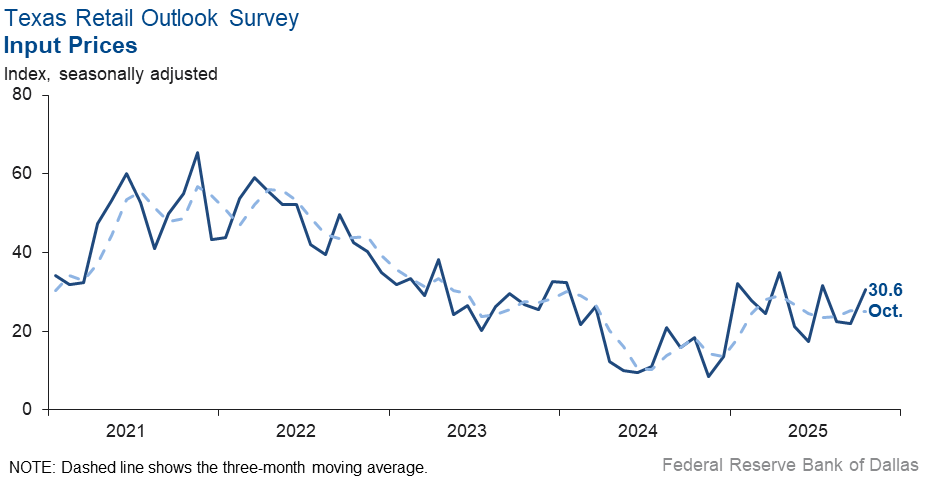

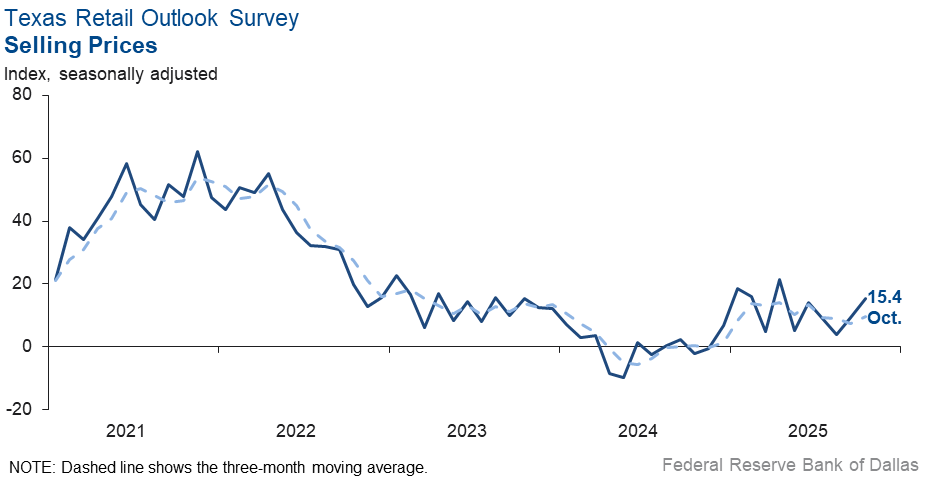

Input and selling price pressures increased while wage pressures held steady this month. The selling prices index moved up six points to 15.4, while the input prices index rose nine points to 30.6, surpassing the series average of 22.6. The wages and benefits index was little changed at 13.3.

Expectations for future retail activity remained positive in October. The future sales index fell three points to 23.2, remaining in solidly positive territory. Meanwhile, the future general business activity index came in at 3.2, similar to September. Other future retail activity indexes, such as employment and capital expenditures also remained in positive territory, though the future employment index was down notably from its September reading.

Next release: November 25, 2025

Data were collected Oct. 14–22, and 242 of the 350 Texas service sector business executives surveyed submitted responses. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | –6.4 | –2.4 | –4.0 | 10.2 | 2(–) | 20.7 | 52.2 | 27.1 |

Employment | –5.8 | –3.6 | –2.2 | 5.9 | 2(–) | 12.2 | 69.8 | 18.0 |

Part–Time Employment | –0.1 | –0.6 | +0.5 | 1.2 | 8(–) | 6.2 | 87.5 | 6.3 |

Hours Worked | –1.4 | –1.0 | –0.4 | 2.5 | 2(–) | 6.7 | 85.2 | 8.1 |

Wages and Benefits | 10.7 | 11.9 | –1.2 | 15.6 | 65(+) | 15.4 | 79.9 | 4.7 |

Input Prices | 23.0 | 24.4 | –1.4 | 27.7 | 66(+) | 27.9 | 67.2 | 4.9 |

Selling Prices | 4.6 | 1.6 | +3.0 | 7.5 | 63(+) | 13.4 | 77.8 | 8.8 |

Capital Expenditures | 5.8 | 7.3 | –1.5 | 9.8 | 63(+) | 12.6 | 80.6 | 6.8 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –10.0 | –2.6 | –7.4 | 4.0 | 2(–) | 12.8 | 64.4 | 22.8 |

General Business Activity | –9.4 | –5.6 | –3.8 | 2.1 | 2(–) | 13.0 | 64.6 | 22.4 |

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 22.2 | 22.5 | –0.3 | 13.8 | 53(+) | 32.5 | 57.2 | 10.3 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 33.7 | 35.3 | –1.6 | 37.3 | 66(+) | 48.9 | 36.0 | 15.2 |

Employment | 20.1 | 25.4 | –5.3 | 23.0 | 66(+) | 30.2 | 59.7 | 10.1 |

Part–Time Employment | 3.7 | 6.8 | –3.1 | 6.5 | 4(+) | 9.6 | 84.5 | 5.9 |

Hours Worked | 3.9 | 2.9 | +1.0 | 5.9 | 6(+) | 9.4 | 85.1 | 5.5 |

Wages and Benefits | 38.1 | 39.5 | –1.4 | 37.4 | 66(+) | 42.3 | 53.5 | 4.2 |

Input Prices | 38.6 | 42.9 | –4.3 | 44.2 | 226(+) | 45.3 | 47.9 | 6.7 |

Selling Prices | 22.2 | 26.8 | –4.6 | 24.4 | 66(+) | 31.3 | 59.6 | 9.1 |

Capital Expenditures | 17.7 | 20.5 | –2.8 | 22.5 | 65(+) | 26.8 | 64.0 | 9.1 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 8.7 | 13.1 | –4.4 | 15.3 | 6(+) | 27.4 | 53.9 | 18.7 |

General Business Activity | 5.7 | 11.6 | –5.9 | 11.9 | 5(+) | 25.9 | 53.9 | 20.2 |

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | –23.5 | –17.2 | –6.3 | 2.6 | 3(–) | 15.7 | 45.0 | 39.2 |

Employment | –15.3 | –3.0 | –12.3 | 1.3 | 7(–) | 9.4 | 65.9 | 24.7 |

Part–Time Employment | –3.2 | –3.9 | +0.7 | –1.6 | 3(–) | 6.6 | 83.6 | 9.8 |

Hours Worked | –6.8 | –8.2 | +1.4 | –2.3 | 3(–) | 5.9 | 81.4 | 12.7 |

Wages and Benefits | 13.3 | 12.6 | +0.7 | 11.1 | 4(+) | 19.4 | 74.5 | 6.1 |

Input Prices | 30.6 | 22.0 | +8.6 | 22.6 | 66(+) | 38.2 | 54.2 | 7.6 |

Selling Prices | 15.4 | 9.2 | +6.2 | 13.0 | 11(+) | 27.2 | 61.0 | 11.8 |

Capital Expenditures | 15.7 | 13.7 | +2.0 | 7.5 | 2(+) | 18.0 | 79.7 | 2.3 |

Inventories | 0.1 | –0.3 | +0.4 | 2.6 | 1(+) | 21.3 | 57.5 | 21.2 |

| Companywide Retail Activity | ||||||||

Companywide Sales | –19.2 | –8.2 | –11.0 | 3.8 | 6(–) | 20.3 | 40.3 | 39.5 |

Companywide Internet Sales | –15.7 | –1.9 | –13.8 | 3.4 | 8(–) | 13.5 | 57.3 | 29.2 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –22.3 | –5.4 | –16.9 | 0.9 | 2(–) | 7.6 | 62.5 | 29.9 |

General Business Activity | –23.7 | –14.7 | –9.0 | –3.0 | 2(–) | 10.5 | 55.3 | 34.2 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 17.3 | 26.6 | –9.3 | 11.7 | 15(+) | 31.1 | 55.1 | 13.8 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 23.2 | 26.6 | –3.4 | 30.1 | 29(+) | 37.7 | 47.8 | 14.5 |

Employment | 8.7 | 26.1 | –17.4 | 12.8 | 6(+) | 21.4 | 65.9 | 12.7 |

Part–Time Employment | 6.9 | 1.7 | +5.2 | 1.5 | 2(+) | 11.7 | 83.5 | 4.8 |

Hours Worked | –2.1 | 2.5 | –4.6 | 2.2 | 1(–) | 8.8 | 80.3 | 10.9 |

Wages and Benefits | 35.9 | 40.9 | –5.0 | 29.1 | 66(+) | 37.0 | 61.9 | 1.1 |

Input Prices | 38.6 | 52.3 | –13.7 | 34.1 | 66(+) | 45.3 | 47.9 | 6.7 |

Selling Prices | 17.7 | 40.5 | –22.8 | 28.2 | 66(+) | 26.8 | 64.0 | 9.1 |

Capital Expenditures | 19.1 | 19.2 | –0.1 | 16.4 | 6(+) | 26.1 | 66.9 | 7.0 |

Inventories | 23.7 | 20.8 | +2.9 | 10.7 | 6(+) | 33.0 | 57.7 | 9.3 |

| Companywide Retail Activity | ||||||||

Companywide Sales | 20.1 | 20.7 | –0.6 | 28.4 | 6(+) | 37.1 | 45.9 | 17.0 |

Companywide Internet Sales | 22.2 | 10.8 | +11.4 | 20.9 | 21(+) | 32.5 | 57.2 | 10.3 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Oct Index | Sep Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 9.3 | 5.7 | +3.6 | 14.6 | 5(+) | 24.7 | 59.9 | 15.4 |

General Business Activity | 3.2 | 4.7 | –1.5 | 10.2 | 4(+) | 23.6 | 56.0 | 20.4 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Texas Retail Outlook Survey

Texas Service Sector Outlook Survey

Comments from survey respondents

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- The government shutdown and economic malaise are taking a toll on hotel and travel demand.

- It feels impossible to predict what the hiring and employment market will be in six months. This year has been the most challenging in 15 years of search and staffing. Candidates have failed background checks. Employers have delayed hiring, candidates have accepted counter offers, others have continued interviewing after accepting a new role. These events used to be uncommon and rare. Now they're happening on a regular basis. Revenue swings month to month are drastic. We are trying to budget and forecast, but it is impossible, and I'm on the edge of laying off an employee now. Business has felt recessionary for over a year—no wonder we knew the jobs numbers were off and kept saying there was no way they were as good as reported, and we were correct. These are very tough times for small and midsized businesses.

- The level of uncertainty has increased in the face of higher interest rates and borrowing costs. Layoffs in the energy sector are just now being felt, and the federal shutdown will have a compounding impact.

- The government shutdown [is an issue impacting our business].

- Most of our customers are federal agencies. If there is a shutdown, our business suffers.

- We are seeing major price escalation resistance.

- There are numerous factors affecting our outlook and current performance. A general downturn in the economy and economic outlook coupled with increased layoffs and significant increases in prices for day-to-day commodities have reduced demand for those seeking our pediatric urgent care services. Healthcare fatigue is also a factor post-COVID. Couple that with the frankly baseless guidance that the Department of Health and Human Services is providing, there is also a lot of confusion among potential patients of ours of sound medical judgement.

- With continued angst over secured overnight financing rate, federal funds rate and prime

Pundits are debating whether “it is different this time.”

Federal Reserve keeps tracking,

but economic data’s still lacking.

Historians will laugh or cry at this rhyme!

- Some of our long-term clients are beginning to show interest in buying and selling properties again, and others are asking about their ability to replace short-term, bank-type loans with long-term, fixed-rate debt capital.

- There are many moving parts to the economic environment, and the disruptions are resulting in an increase of destabilizing factors: the government shutdown, political instability, the anticipated impact of tariffs and the interest rate markets. Cybersecurity is still a priority, especially with the accelerating expansion of artificial intelligence. The cattle market is extremely elevated, and the price of beef over the counter and on the plate continues to be high. The race to expand the electrical grid is heating up. Nuclear-powered sources are back in the news as an alternative source of electrical power generation.

- Uncertainty about visa approval rates and H1-B visa fees will have a potentially significant negative impact.

- I am concerned about the government shutdown.

- Lower oil prices impact producer activity and uncertainty.

- We're seeing significant uncertainty among our oil and gas service company clients. Commodity prices are down, and there is no real cause to anticipate an upturn in drilling activities.

- The residential market has continued its decline due to the uncertainty of the economy. Homebuilders are having a difficult time selling homes, even with the incentives they are offering, and existing homes are just sitting. The commercial market is a little better but is being held up by energy and data center transactions. We need a major adjustment in the pricing of homes or a significant reduction in the interest rate to get this market moving again.

- Interest rates are still too high. Reduction in regulations is improving optimism. The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act will open new opportunities.

- We have seen an upturn in work flowing from clients in October in consulting engineering.

- All of our customers are scaling back on technology spending.

- I feel like our clients are more apprehensive. We are writing a lot of proposals, but they are just sitting. Projects are still being planned, but the execution is being delayed.

- I work globally with international companies, so uncertainty is inherently high, and it will likely increase in the coming months. Four new governments in Latin America will be decided within the next six months, and such political transitions always contribute to greater economic and business uncertainty.

- Commodity prices adversely affecting upstream oil and gas companies coupled with potential increased costs from renewed China tariffs creates an uncertain or negative outlook.

- We are pitching to more small businesses and nonprofits on our marketing and advertising services than we have since founding the company 14 years ago. More than 80 percent of responses from business owners indicate they are not spending money on marketing and additional items until 2026 because of economic uncertainty.

- Trump administration volatility causes clients to stall new purchases.

- The industrial sector appears to be gaining momentum.

- Tariffs [are an issue impacting our business].

- We aren't getting the larger requests that we saw at the end of fourth quarter 2024. That makes me nervous as we work on our 2026 pipeline and prospects.

- A high level of uncertainty is still there. I think we have become somewhat accustomed to it. The stock market is going to bounce 1,000 points (Dow) either up or down with every pronouncement or retraction.

- The slowdown in the use of consultant services by the Texas Department of Transportation is having a significant impact on the business outlook for engineering consulting firms serving the transportation marketplace.

- There is significant inflation in regular goods prices.

- We continue to be concerned about compounding effects of tariffs, government shutdown, reduced federal spending, wavering consumer confidence and the levels of credit card usage and delinquency (which we expect to increase), as well as the generally antibusiness policies being championed by Republican lawmakers and the Trump administration.

- The sentiment we see from apartment residents, owners, vendors, employees and others is neither optimism nor excessive worry. Folks are getting by OK, reallocating spending to compensate for high food prices, and they seem resigned to their fate. Immigration and Customs Enforcement (ICE) continues to terrify immigrants, and they are keeping their heads down. Few people are moving, changing jobs or expecting more. The economy feels like it's in the doldrums, and all the outrageous politics just feels like noise. Our company is doing well enough to throw a couple of big events and make improvements to properties we own. Being conservative, focusing on fundamentals and conserving cash have paid off for us. Others see us doing well, so more prospects are coming our way.

- We are always hopeful things are going to move forward and upward. Our goal is to survive the next six months.

- I don't know that any geopolitical or political conditions have changed our business outlook. The fourth quarter is typically when we do 27 percent to 29 percent of our volume. The first two quarters of the year are typically slow due to weather and manufacturers trying to manage their budgets. Tax-incentive buying pulls purchases ahead into fourth quarter 2025.

- We are a naturally seasonal business. Our outlook for the future is bright.

- Uncertainty remains uncertain.

- I wish we would get clarity on tariffs. We have been slow to sign new clients.

- Big projects are boosting construction. Fear of ICE raids is hurting retail sales and employment reporting.

- Government shutdown, federal employee firings, tariffs, ICE raids, international turmoil and higher cost of living are creating general business uncertainty and increasing downside risks to our businesses.

- We are waiting on final appropriations bills.

- Volatility—including interest rates, stock market fluctuations, geopolitical issues and the government shutdown—is creating poor confidence.

- With the current administration taking meaningful action to address foreign labor issues, the outlook for the trucking and logistics industry has improved considerably. The decline faced in recent years has been attributable to violations of federal laws, most notably allowing those not legally authorized and without English proficiency to saturate the market and to violate cabotage restrictions. We are encouraged by the renewed emphasis on enforcement and compliance. As these measures take effect and below-market labor practices are curtailed, American motor carriers will once again be able to begin breaking even and then to profit.

- Too much funding (private equity combined with the Broadband Equity, Access and Deployment program) is flowing into the broadband industry as evident by the number of broadband providers in any given area. While it has naturally increased competition, resulting in lower pricing, it is also driving irrational investment decisions. These decisions will have consequences once the broadband market begins a correction in the next three to five years.

- Our business has died.

- I feel better about business activity, but the threatened tariffs do not help with the business situation.

- General economic conditions appear to be worsening, though it's hard to put a finger on exactly where or why. We're working through 2026 budget and are expecting revenue to either stay flat or dip. We are eliminating a small number of heads, roughly 4 percent of our workforce. We expect inflation to continue to impact the cost to provide services and will be adjusting revenue in response.

- [Business activity is] very slow now.

- The impact of tariffs has begun to weigh on margins and profitability. The Brazil coffee tariff has pushed the green coffee spot price up by about 60 percent since October 2024. Specialty coffee is generally priced on a spread over the spot, so we are now paying much higher prices for green coffee than we were a year ago, and we will eventually be forced to pass that increase on to the customer in the form of higher prices. We lost 2 percent of gross margin in September over prior year same period, for example. So, increased input costs due to tariffs are the most significant factor affecting performance today. We are also expecting an increase of around 5 percent in labor costs for 2026. Prices will need to be raised in January 2026.

- The federal government shutdown is affecting our patients. We are seeing a decrease in volumes since patients cannot afford their medications. We are hoping there will be a resolution soon.

- Recent tariff announcements increased the level of business uncertainty, which will cause businesses to be cautious and potentially delay expansion plans and projects.

- The government shutdown is killing us.

- We are onboarding two new clients internationally. We are the No. 2 supplier to our new Ecuador customer, with a goal of becoming the No. 1 supplier in first quarter 2026. Current [sales] to Hawaii and Latin America continue to be steady to slightly increasing. Puerto Rico business is steady to slightly decreasing. As we move into the fourth quarter, seasonal sales increase, so it's hard to discern what is seasonally expected versus an overall trend.

- There is continued softening in consumer demand and sensitivity to perceived high interest rates. Inventories continue to build, putting increased demand on pricing cuts.

- It seems like things have slowed down compared with one year ago. We are not getting as many new customers. I am wondering if the influx of new people from out of state has slowed down.

- I am hoping with a tad cooler weather, people will start thinking about fall and the holidays.

Special questions

For this month’s survey, Texas business executives were asked supplemental questions on credit conditions. Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey. View individual survey results.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Isabel Brizuela.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.