Texas Service Sector Outlook Survey

Growth resumes in Texas service sector activity

Starting with the January 2026 data release, the Texas Retail Outlook Survey results will no longer be published. The retail sector will continue to be included in the Texas Service Sector Outlook Survey results. For questions, please contact the Regional Survey Team at Dal.Fed.Research@dal.frb.org.

This month’s data release also includes annual seasonal factor revisions. Once per year, the Federal Reserve Bank of Dallas revises the historical data for the Texas Service Sector Outlook Survey after calculating new seasonal adjustment factors. Annual seasonal revisions result in slight changes in the seasonally adjusted series. Read more information on seasonal adjustment.

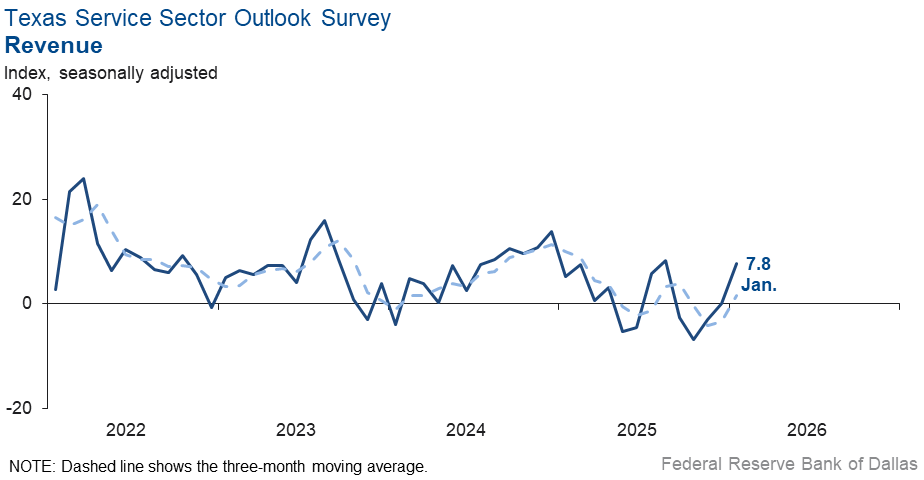

Texas service sector activity grew in January, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, rose from 0 to 7.8.

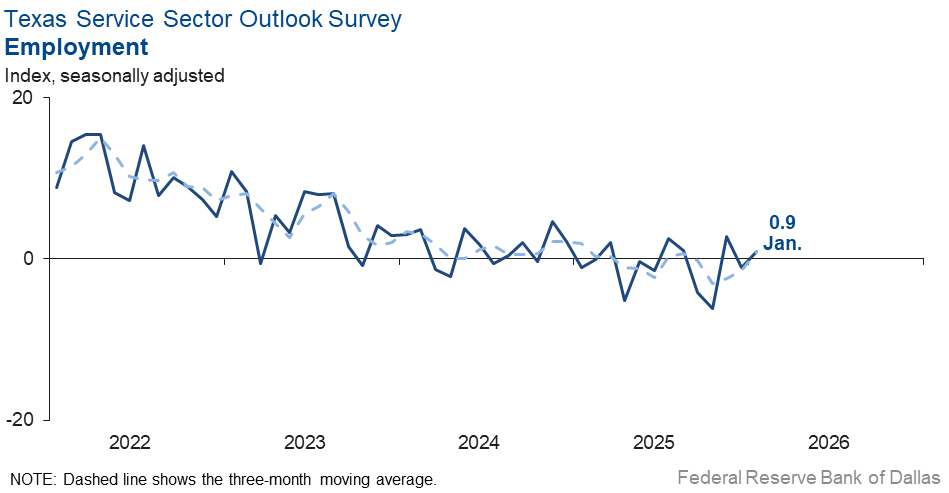

Labor market measures suggested stable employment and hours worked this month, as both indexes registered near-zero readings. Meanwhile, the part-time employment index rose nearly six points to 5.5.

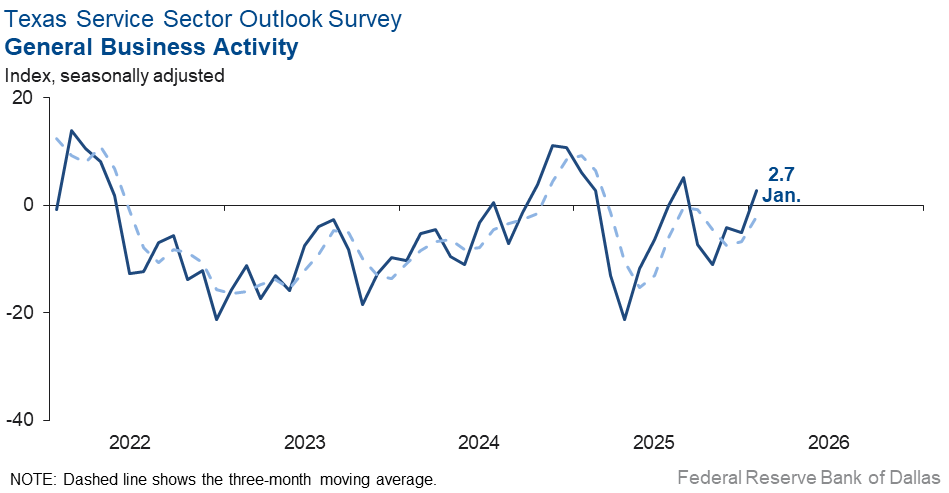

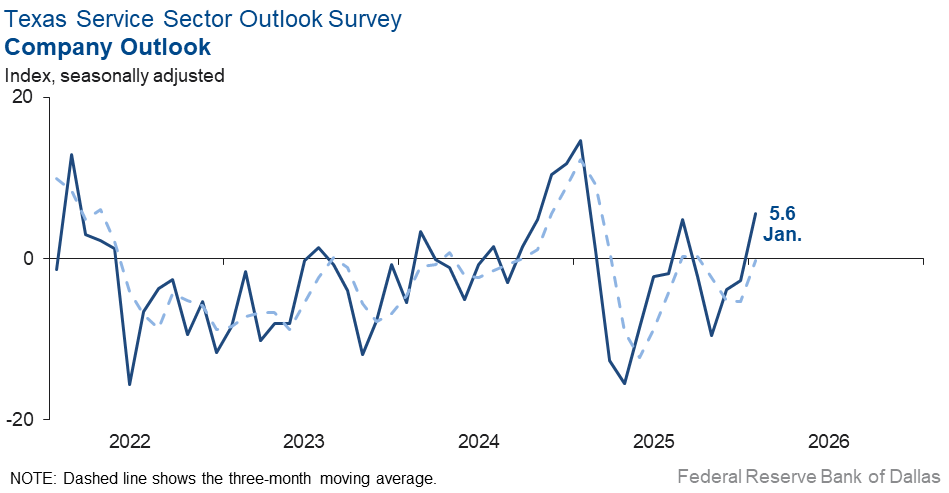

Perceptions of broader business conditions improved. The general business activity index moved up eight points to 2.7 after four consecutive months of negative readings. The company outlook index also moved into positive territory, increasing from -2.7 to 5.6. The outlook uncertainty index was little changed at 16.5.

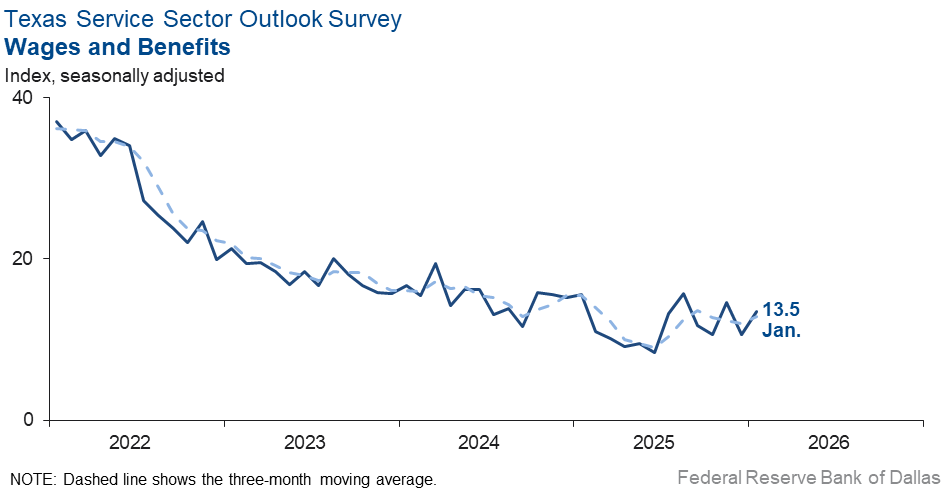

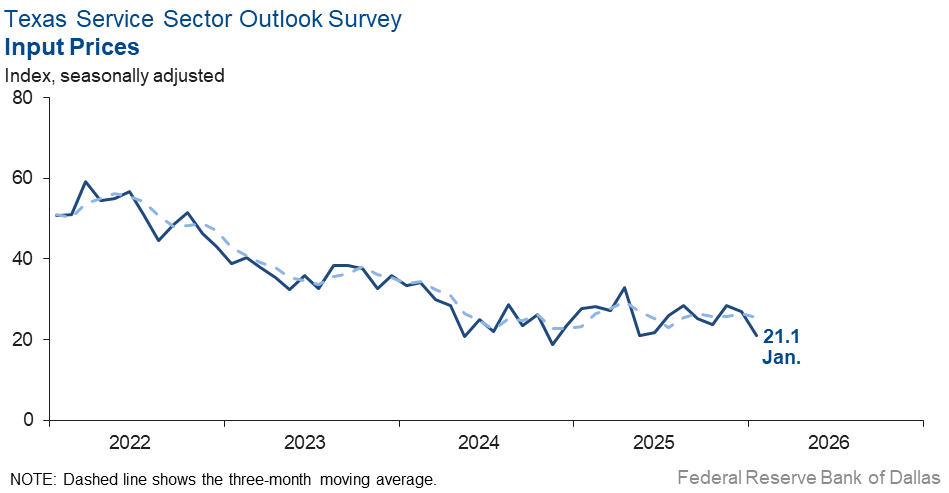

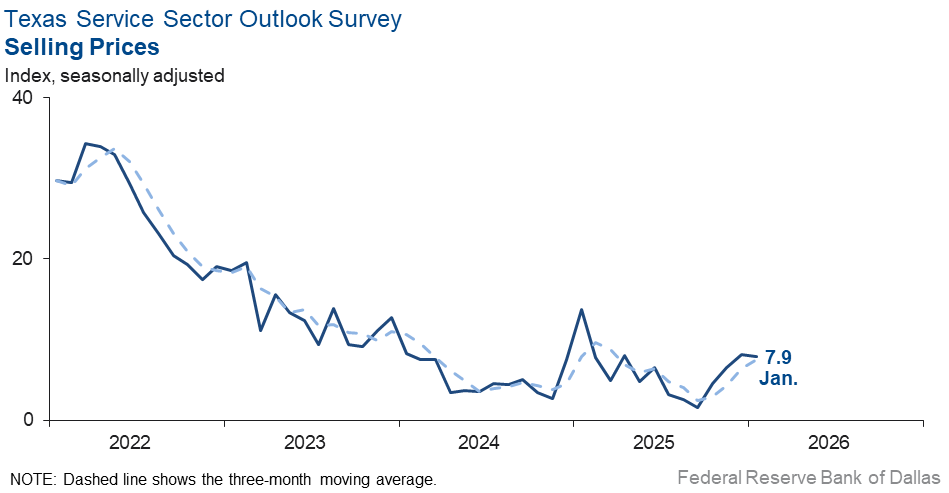

Input price pressures eased while selling prices rose at about the same pace as in December. The input prices index ticked down six points to 21.1, and the selling price index was little changed at 7.9. The wages and benefits index edged up three points to 13.5.

Respondents’ expectations regarding future service sector activity improved. The future revenue index ticked up six points to 41.0, surpassing the series average of 37.2. The future general business activity index edged up three points to 14.7. Other future service sector activity indexes, such as employment and capital expenditures, remained in solidly positive territory.

Next release: February 25, 2026

Data were collected Jan. 13–21, and 244 of the 347 Texas service sector business executives surveyed submitted responses. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease.

Data have been seasonally adjusted as necessary.

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Jan Index | Dec Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 7.8 | 0.0 | +7.8 | 10.1 | 1(+) | 27.0 | 53.8 | 19.2 |

Employment | 0.9 | –1.1 | +2.0 | 5.8 | 1(+) | 10.1 | 80.7 | 9.2 |

Part–Time Employment | 5.5 | –0.1 | +5.6 | 1.2 | 1(+) | 7.9 | 89.7 | 2.4 |

Hours Worked | 1.1 | –2.6 | +3.7 | 2.5 | 1(+) | 6.0 | 89.0 | 4.9 |

Wages and Benefits | 13.5 | 10.6 | +2.9 | 15.5 | 68(+) | 16.8 | 80.0 | 3.3 |

Input Prices | 21.1 | 27.1 | –6.0 | 27.8 | 69(+) | 25.8 | 69.6 | 4.7 |

Selling Prices | 7.9 | 8.2 | –0.3 | 7.4 | 66(+) | 15.5 | 77.0 | 7.6 |

Capital Expenditures | 6.8 | 10.5 | –3.7 | 9.7 | 66(+) | 13.6 | 79.7 | 6.8 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Jan Index | Dec Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 5.6 | –2.7 | +8.3 | 3.9 | 1(+) | 17.5 | 70.5 | 11.9 |

General Business Activity | 2.7 | –5.0 | +7.7 | 1.9 | 1(+) | 18.0 | 66.6 | 15.3 |

| Indicator | Jan Index | Dec Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 16.5 | 16.1 | +0.4 | 13.9 | 56(+) | 24.2 | 68.0 | 7.7 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Jan Index | Dec Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 41.0 | 34.6 | +6.4 | 37.2 | 69(+) | 51.9 | 37.1 | 10.9 |

Employment | 22.0 | 19.8 | +2.2 | 22.9 | 69(+) | 31.2 | 59.6 | 9.2 |

Part–Time Employment | 7.1 | 3.7 | +3.4 | 6.4 | 7(+) | 12.1 | 82.9 | 5.0 |

Hours Worked | 9.1 | 6.6 | +2.5 | 5.9 | 7(+) | 12.7 | 83.7 | 3.6 |

Wages and Benefits | 40.1 | 32.7 | +7.4 | 37.5 | 69(+) | 43.8 | 52.6 | 3.7 |

Input Prices | 37.5 | 40.2 | –2.7 | 44.2 | 229(+) | 42.7 | 52.1 | 5.2 |

Selling Prices | 27.0 | 24.6 | +2.4 | 24.5 | 69(+) | 34.2 | 58.5 | 7.2 |

Capital Expenditures | 18.4 | 23.5 | –5.1 | 22.5 | 68(+) | 25.7 | 66.8 | 7.3 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Jan Index | Dec Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 18.7 | 16.5 | +2.2 | 15.4 | 9(+) | 31.1 | 56.6 | 12.4 |

General Business Activity | 14.7 | 11.5 | +3.2 | 11.9 | 8(+) | 27.1 | 60.4 | 12.4 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Comments from survey respondents

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- I was hopeful the lowering of interest rates and acceptance of tariffs would allow companies and candidates to feel more certain and stable. That has not happened. Candidates are still reluctant to discuss changing jobs, preferring to stay with the “devil that they know,” and clients are holding tight on hiring and preferring not to backfill open roles. It's a double-edged sword; clients are slow and reluctant to hire, and good candidates don't want to leave the jobs they have, even if they are not happy. It's not changing, sadly.

- All sectors have decreased RFQ (request for quotation) submittals. There is no seasonal rationality to it. There are no late payments by clients, and things seem to be in stock with the vendors. It is just an odd time, possibly because of tariff threats, [geopolitical risks] or [attempts to] take over the Federal Reserve Board. We all know the reason for all this turmoil, but no one is stating it out loud. I am hoping the midterm elections will set the rudder in a neutral position on policy.

- There has been a significant decline in consumer sentiment. Federal policy uncertainty, high long-term rates and concerns over consumer prices are all representing headwinds.

- We are government contractors, and we have been awarded a rather large subcontract and expect more in the next two or three months.

- The first month of the year is always slow for us.

- There are several legislative issues concerning regulatory changes that could impact the outlook for the company. The Genesis Act and its treatment of incentives allows for stablecoin that might be offered by nonbank entities. Fintech companies are expanding and becoming more competitive in the financial markets. Interest rates continue to be a concern as they relate to future revenue and the impact on liquidity, primarily deposit migration.

- Uncertainty about international mobility, federal grant funding and political decisions continue to complicate our outlook.

- The cost of goods has slightly increased, but our selling price cannot increase because we are at our highest price point. Increasing pricing may decrease our number of customers.

- While general business volume has remained fairly steady, my expectation is that the chaotic political and geopolitical environment will eventually take its toll on economic activity. That said, I remain bullish on the resilience of the American economy and governing model Therefore, I intend to continue to invest in our successful business model, albeit in a very measured and lightly to moderately leveraged way. In my opinion, chaos is restraining what could otherwise be even stronger growth, and I am opposed to loosening credit in the face of this strength of performance. I would encourage the chairman and members of the FOMC to remain strong and independent.

- There is nothing going on that seems to be changing the current environment. Maybe if the Federal Reserve cuts rates, the economy will improve.

- Seasonal customer demand peaks and valleys are becoming more and more pronounced. The cost of everything has been increasing for multiple years now, with some ebb and flow but always trending up, while customers are becoming more and more sensitive to price increases. The main drivers of our regular business remain negatively impacted (the oil industry and business travel).

- I’m very concerned with the actions of our government leadership, which appear to be having an adverse economic impact on our economy.

- The January lull seems to have kicked in in Northeast Texas. We have noticed fewer people in local restaurants. Insurance policies for new property purchases seem slower lately. Just seems like lots of people are keeping the status quo until spring gets closer.

- New-vehicle inventory is lower than normal which caused net sales to be unseasonably low.

- What's going on with stocks is giving many people a false sense of security; we are still being buoyed up by the top 10%. But at some point, we need a wider customer base, and many of those entry-level customers are in big trouble.

- Extraordinarily warm weather this winter has significantly decreased sales in our propane business, so our employees have less of the seasonal overtime.

- The key issue for upstream producers is a desire for $50 per barrel of oil with a “Drill, baby, drill” policy.

- There is all kinds of political uncertainty. Local institutions (school districts) that are a strong source of business are shrinking and in debt.

- While there are still some economic headwinds (wars, tariffs, Greenland, etc.), it feels as if the economy is gaining traction. I see it at my company and at the majority of my clients’ companies.

- We have seen an increase in commercial and residential orders since the beginning of the year, which should relate to an increase in real estate transactions for the first quarter. If interest rates trend down slightly, we should see a significant increase in home sales as well as commercial transactions in 2026.

- We continue to see a little more activity in the real estate market.

- The president's support for AI, cryptocurrency and U.S.-made products has contributed favorably to our clients and will benefit our company.

- Things are not looking great in the automotive industry, so demand for our services has been wavering a bit.

- The president’s actions are random, and he creates uncertainty.

- In December we started to get busier with more requests to help fill positions. January increased slightly from December.

- Higher cost for December versus November is associated with general and professional liability insurance. Despite no insurance claims on either policy, premiums have increased 8 to 10 percent.

- We do not build projects directly but design them. Several of our projects have been disrupted and delayed and have experienced cost increases due to Immigration and Customs Enforcement picking up laborers, contractors, etc. This does not financially impact us, but it does negatively impact our clients, who are generally public units of government.

- The price we can charge is regulated by the state, which is cutting how much we are able to collect. While it is not a huge percentage decrease, it will impact our ability to raise wages as our costs to operate our business and process transactions will increase.

- It seems like some sectors of the construction and real estate markets are overbuilt, and we are seeing some adjustments. I think it will take six months to a year to level back out.

- Conflicts between the Trump administration and the Federal Reserve could threaten the U.S. and world economies for years if the administration is successful in removing the Federal Reserve chair and putting in a person beholden only to the president. The Federal Reserve should remain completely independent in order to satisfy its goals of low inflation and maximum employment.

- Immigration enforcement tactics and excessive use of force will stifle new projects due to lack of labor, especially labor support services.

- Given that most of our clients are foreign investors, the current outlook has become more uncertain due to fluctuations in the value of the U.S. dollar and heightened geopolitical risks.

- We are seeing a lot of queries and RFP (requests for proposals) out, indicating increases in design and construction activities in both private and public sectors. Finding qualified workers is still a big challenge.

- Budgets are tight for capital improvement projects in the public sector, particularly the Texas Department of Transportation.

- Uncertainty continues, particularly with federal budgets in the Department of Defense and related areas. Strategies need to evolve as the focus continues to change.

- Tariffs are creating scares on international payments. The IRS being slow to issue tax forms (i.e., treaty-based double-taxation forms) has increased ARs (amended returns) by over $500,000.

- Revenue is expected to decrease next month and for the foreseeable future due to continued financial pressure on consumers, which will reduce their discretionary spending. We expect costs will increase. Businesses have been in a wait-and-see mode, and that is not a state that can be maintained. At some point, continued investments need to be made, and they will be at higher prices that will be passed onto consumers.

- This year will be slow for the multifamily real estate industry. Until genuine economic prosperity returns, rents, values and profits will lag. Moving fast and breaking things will help a few get rich but does little to develop the economic engines necessary to raise all boats. We are entering a period where our residents and employees are keeping their heads down and just getting by. They are increasingly ignoring the political and economic noise. Commercial property owners and investors have either found new modicums of stability or are at the end of their ropes. Many are coming to grips with the fact that their equity is gone. The ball is mostly in the hands of debtholders now. Most of them remain loathe to take losses and are instead electing to carry REO (real estate owned) or at least seize control. Cash that was going to interest payments is now being used to support operations and recover from deferred maintenance and operational declines. It will be a year or two before they can recover their capital, but at least they can claim it is still intact. Also, rent control elsewhere means more businesses, people and investors are fleeing to Texas, so we're good with it.

- As a capital goods dealer selling construction machinery, we thought the benefits of the One Big Beautiful Bill Act and the return of 100% bonus depreciation would make for a big year last year. It did not happen. We were up 1.9% over 2024, which was down 7.4% from 2023, so not very outstanding growth. We are very much a growth company, but our real growth over the last decade has been a miserable 2.74%. So, we are disappointed. However, we think our enthusiasm got ahead of itself, as so often happens in business. We do think 2026 will be a better year, and we mean to get back on our 10%+ growth per year (in real dollars) we have realized for the last 25 years.

- Finding the right private capital partners and banks isn’t easy. Most bank vice presidents are very busy, and it’s hard to build new relationships or get your requests looked at. This is one of the main issues I see in the lending industry.

- It is somewhat uncertain what the impact of Venezuela dialogues and activities will be on mergers and acquisitions and capital formation within the upstream and midstream industries in the U.S. and Texas. Our business activities typically tie into the volume of transactions in mergers and acquisitions and capital formation in 2- to 3-month arrears.

- It is hard to get a read on activity right now, though it seems to be in equilibrium.

- Health insurance premiums are largely responsible for increases in costs to provide services.

- We are still seeing a pause in spending. We are climate-dependent; mild temperatures for the past year have hurt us.

- While still a high level of uncertainty, the continued removal of unqualified commercial drivers from the market has provided more optimism and stability for the trucking industry.

- The new discussions on tariffs again introduce a lot of uncertainty

- I believe that the economy is improving. This is anecdotic.

- The beginning of the new year involved an increase of 5% in our selling prices to offset prior-year inflation, and we also provided a roughly 5% increase in employee compensation. We did reduce our headcount by 11 positions, all currently unfilled.

Special questions

For this month’s survey, Texas business executives were asked supplemental questions on labor market conditions and capital expenditures. Results below include responses from participants from both the Texas Manufacturing Outlook Survey and Texas Service Sector Outlook Survey. View individual survey results.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Isabel Brizuela.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.