Oil patch productivity rises; jobs vanish

The oil and gas industry’s shale revolution, a product of technical breakthroughs and high oil prices more than a decade ago, transformed global energy markets and sparked an economic boom in parts of Texas and New Mexico.

But after major oil price busts in 2014 and 2020, the same engineering prowess that helped the industry thrive has been driven to find efficiencies to lower operating costs. The result: Fewer workers are needed to produce the same oil and gas output.

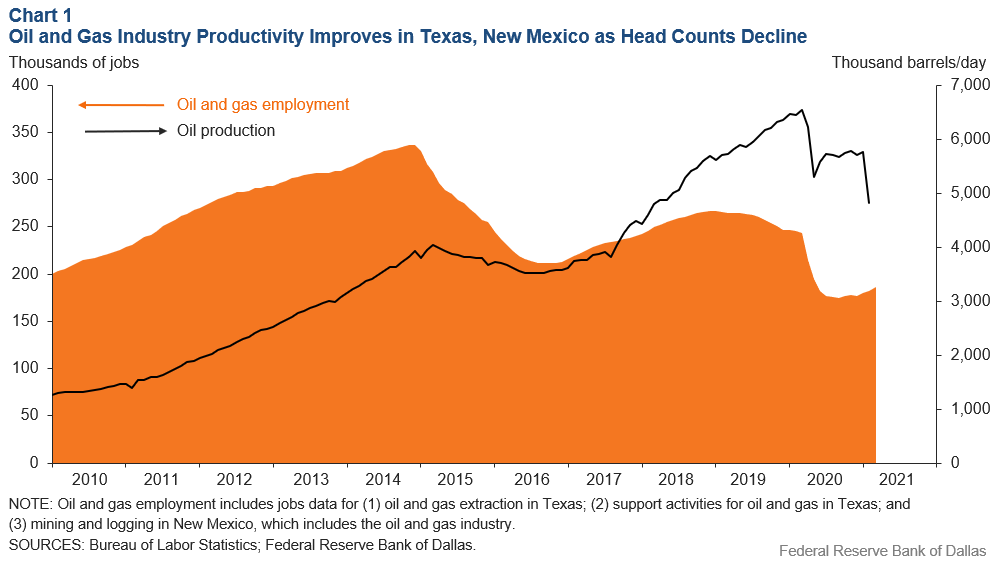

The region’s oil and gas firms employ fewer people today than at the beginning of the shale oil boom 11 years ago, even as oil production quadrupled (Chart 1).

Boom Years Growth

As domestic oil production surged between 2010 and 2014, so did hiring. More than 900 rigs operated across Texas and New Mexico during the first half of 2014 when the benchmark West Texas Intermediate oil price held above $100 per barrel.

Companies in the two states employed more than 330,000 people at the time. Prices crashed in the second half of that year, and by 2015, drilling activity and capital spending collapsed—289 oil production and service companies went bankrupt, and 120,000 energy jobs were lost. The rig count plummeted below 200 by mid-2016.

Companies unleashed a series of improvements to make wells more productive and cut costs starting in 2015.[1] This lowered the breakeven prices for shale wells and allowed production to recover quickly after the downturn. Texas and New Mexico oil production grew 14 percent between December 2014 and December 2017, while industry employment dropped 29 percent.

These developments were apparently insufficient to satisfy investor demands to improve free cash flow and to return capital.[2] Company payrolls shrank again, the rig count declined throughout 2019 and, counterintuitively, oil production surged.

Further Belt Tightening

Oil prices crashed again last year, as a price war erupted between Saudi Arabia and Russia, and demand slumped because of COVID-19. A wave of industry consolidation swept the sector and led to more cost cutting.

Technology is redefining operational roles. Though automation is in the early stages of deployment on drilling rigs, it is decreasing personnel requirements. Remote monitoring of wells and other facilities, which proliferated with COVID-19 workplace restrictions, further lessened employment needs.

These kinds of adaptations have shifted the workforce and cost structure of oil and gas companies. In an analysis of 14 independent exploration and production companies, general and administrative costs fell from $2.96 per barrel of oil equivalent on average in 2018 to $2.10 in 2020. These expenses on average exceeded $4 among these companies at the start of the decade.

Job opportunities in the oil patch face a compounding squeeze. Companies require fewer employees for more output while a slower pace of field activity takes hold.

However, since most companies are as lean as they have ever been, another period of low prices is unlikely to yield further widespread job losses. Conversely, if prices surge higher, few operators are expected to act as aggressively as they would have in the past and drill more wells and hire more workers.

Notes

- “Spotlight: Permian’s Shale-Era Oil Production Rises Even as Rig Count Falls,” by Emma Marshall and Jesse Thompson, Federal Reserve Bank of Dallas Southwest Economy, First Quarter, 2020.

- “Shale Firms Pump Up Dividends as Industry Focus on Returns Grows,” by Ernest Scheyder, Reuters, March 25, 2018.

About the Authors

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: https://www.dallasfed.org/research/swe/2021/swe2102.