Texas home prices rose at record pace in 2021

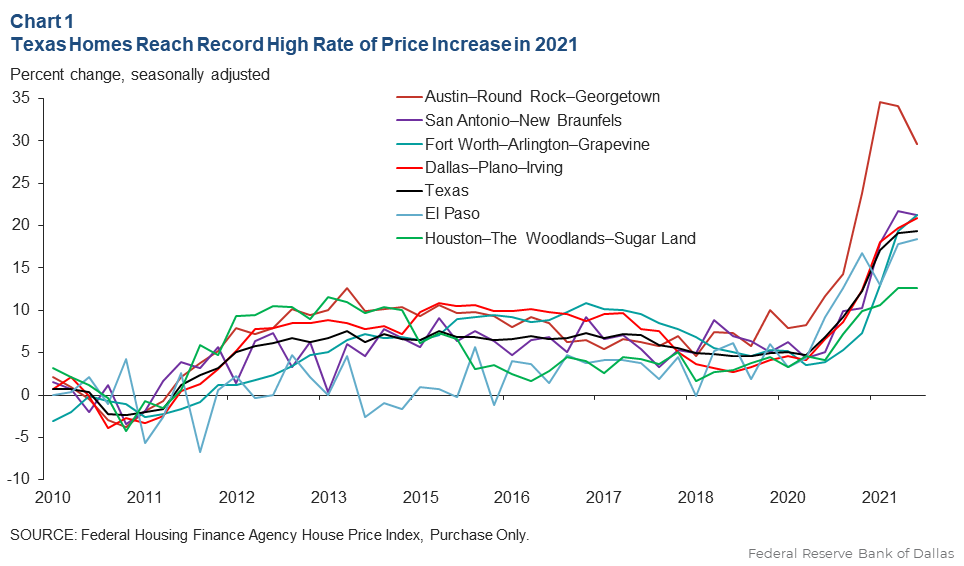

House prices in Texas metropolitan areas recorded historic year-over-year increases in 2021. Austin registered the highest growth rate, with an average annual home price increase of 30 percent in fourth quarter 2021 (Chart 1). Fort Worth, San Antonio and Dallas home prices jumped 21 percent.

Home price growth also accelerated in El Paso, up an annualized 18 percent at year-end 2021. By comparison, Houston’s rate of increase was the lowest among major metros at a healthy and still-elevated 13 percent. The buyer frenzy in Texas housing markets began in summer 2020, just months after COVID-19 shut down the economy in March and April. Several factors contributed to the surge, including low mortgage rates, more people working from home, federal stimulus payments and unemployment benefits, a federal student loan payment pause, a surging stock market and accelerating domestic migration to the state.[1]

Slow Inventory Growth

The inventory of homes was low even before the pandemic, further straining the marketplace. Texas homebuilders were slow to build back inventory after the Great Recession a decade earlier, and by some measures, construction had lagged demand for years, especially for lower-priced “starter” homes—those priced below $250,000.

The pandemic demand boom further depleted the inventory of homes available for sale, propelling prices higher.

The difference in price pressures among Texas metros can be explained by each area’s industry mix and the resulting pace of economic growth, which is highly correlated with the number of people moving to an area and its subsequent housing demand. Austin home prices soared as the high-tech industry boomed during the pandemic and in-migration accelerated. The high-tech industry was also quick to adopt remote work arrangements, which aided worker mobility and relocation.

Lofty Price Rises

The large price increases in Texas housing markets prompted discussion of a speculative housing bubble.”[2] However, rapid home price growth does not necessarily indicate a bubble. Bubbles arise when there is a persistent misalignment of home prices with economic conditions and housing market fundamentals—which doesn’t appear to be the case in the pandemic recovery.

Texas’ months of inventory of homes for both existing and new homes have reached historical lows across all price categories, according to the Texas Real Estate Research Center at Texas A&M University.[3]

For example, there was less than one month’s inventory in Austin and Dallas–Fort Worth in February 2022 and only a little more than one month in El Paso, Houston and San Antonio. Six months of inventory is typically considered a balanced housing market.

A scarcity of available homes—reflected in the low months of inventory—is a significant reason why housing prices rose so abruptly and make it difficult to claim a housing bubble exists.

Still, identifying bubbles is no easy task. It requires extraordinary insight that even the savviest market participants sometimes lack. For example, unlike Arizona, California, Florida and Nevada, the Texas housing market did not experience explosive price growth during the mid-2000s’ boom (and subsequent collapse). Texas’ price growth was more aligned with fundamentals, including employment, income, new-home construction and population growth.

Notes

- “Largest Texas Metros Lure Big-City, Coastal Migrants During Pandemic,” by Wenli Li and Yichen Su, Federal Reserve Bank of Dallas Southwest Economy, Fourth Quarter, 2021.

- “Real-Time Market Monitoring Finds Signs of Brewing U.S. Housing Bubble,” by Jarod Coulter, Valerie Grossman, Enrique Martinez-Garcia, Peter C.B. Phillips and Shuping Shi, Federal Reserve Bank of Dallas Dallas Fed Economics, March 29, 2022.

- See “Texas Housing Insight,” Texas Real Estate Research Center at Texas A&M University, April 2022.

About the Author

Luis Torres

Torres is a senior business economist in the San Antonio Branch of the Federal Reserve Bank of Dallas.

Southwest Economy is published quarterly by the Federal Reserve Bank of Dallas. The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.

Articles may be reprinted on the condition that the source is credited to the Federal Reserve Bank of Dallas.

Full publication is available online: www.dallasfed.org/research/swe/2022/swe2202.